Trade Shrugs Off Latest WASDE

Last week, grain markets took in Friday’s USDA August WASDE report, chewed it up, and spit it back out as the meal traders were hoping to eat had already been tasted. This is to say that due to the hot and dry summer weather in the U.S., the market knew the UDSA was going to lower yields, but the USDA published numbers that the trade basically interpreted as old news. Adding to the negative sentiment has been a few central banks raising interest rates the last few weeks, suggesting inflation and recession fears should not yet be moved on from. Overall, the complex considered the August WASDE for about an hour before going back to trade weather and the limits that are U.S. grain export demand.

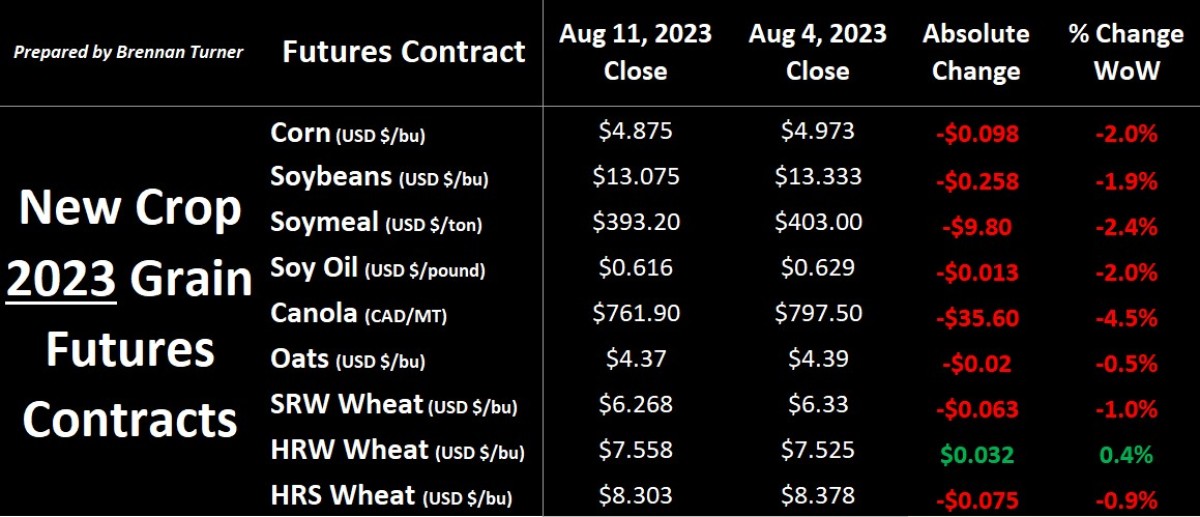

Leaning into the report, the biggest areas that traders were watching was U.S. yields and demand. With a lot of banter about whether or not the USDA would account for the late July / early August rain that most U.S. growing regions received, the USDA only dropped corn yields by 2.4 bushels per acre (bu/ac) to 175.1. This kept production above 15 billion bushels and 2023/24 carryout closer to 2.2 billion. For soybeans, average yields were lowered by 1.1 to 50.9 bu/ac but the trade shrugged this off as they know good August rains could support this number. Where the trade really sunk its teeth in was corn’s higher-than-expected ending stocks, thanks to demand not being cut as much as the market was expecting to see. With new crop corn trading comfortably below $5 USD/bushel and November soybeans toying with a $12 handle, we may see more international buyers start coming to the table now, which could be supportive of U.S. wheat futures.

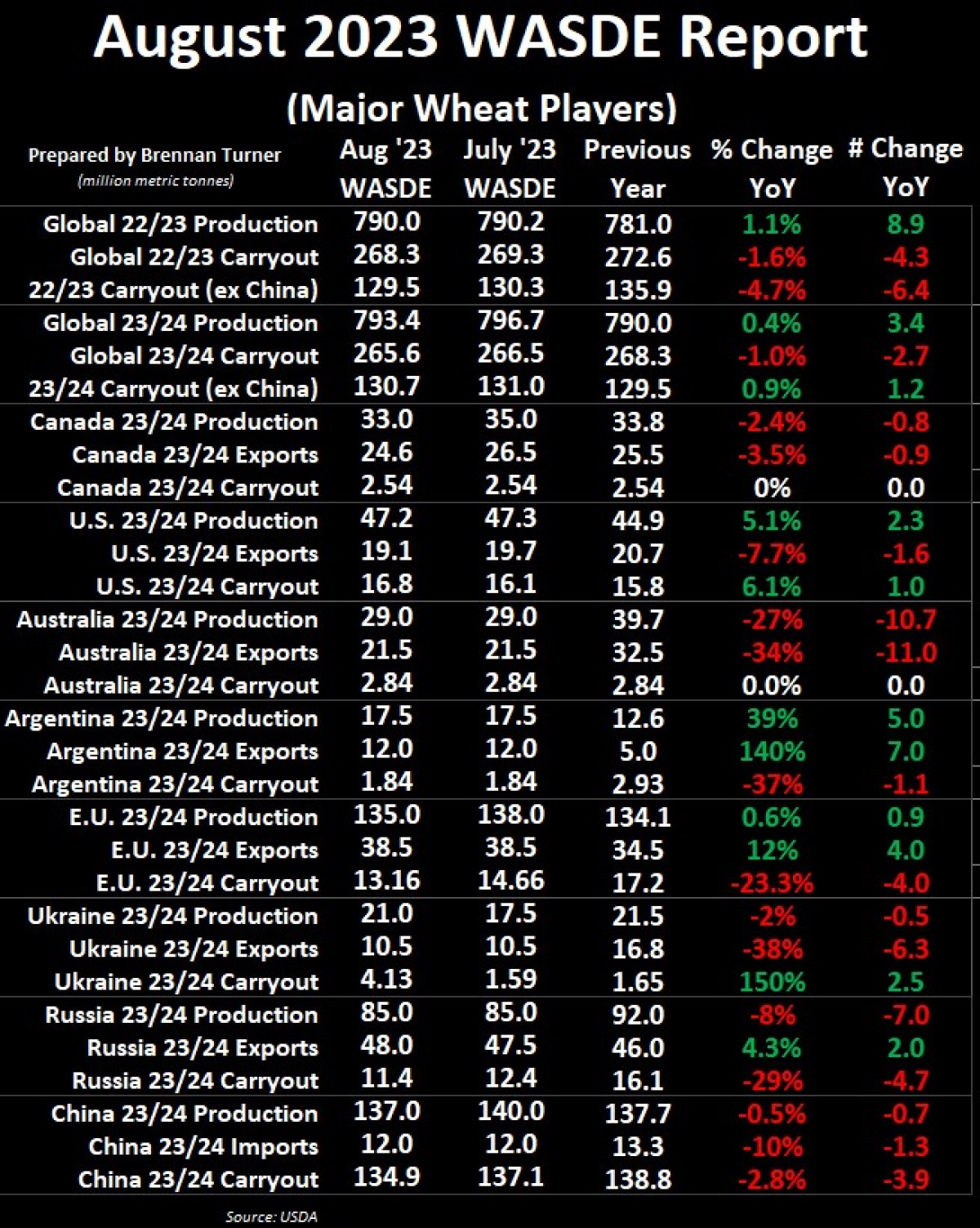

For the U.S. wheat complex, numbers printed basically mirrored what the trade was expecting with a note that American 2023/24 ending stocks of 16.75 MMT is still a far cry from the 5-year average of over 23 MMT. Total U.S. wheat production of 47.2 MMT was just 130,000 MT below July’s number, broken down by less spring wheat (-789,250) and white wheat (-163,300) but more winter wheat (+707,600 MT) and durum (+81,650 MT). As of the Aug. 7th USDA crop progress report, 87% of the winter wheat crop has been harvested (in-line with last year and 5-year average), while 11% of the spring wheat crop is now in the bin. For the latter, the portion of the U.S. spring wheat crop rated poor-to-very poor (P/VP) increased by 4 points week-over-week to 20% while 41% of the crop was rated G/E, down 1 point from last week. This is still much better than 2021 when, this same week, just 11% of the U.S. spring wheat crop was rated G/E, while 61% was rated P/VP.

The global old crop, 2022/23 balance sheet was largely unchanged, save for worldwide ending stocks being lowered by 1 MMT, mainly due to less imports by China as well as EU and Russian exports behind raised by 500,000 MT each. The bigger update was on the new crop 2023/24 balance sheet, where less-than-ideal conditions meant production declines in Canada (-2 MMT to 33 MMT), the EU (-3 MMT to 135 MMT), and China (-3 MMT to 137 MMT). China’s reduction wasn’t as big as some have been expecting while I think the market was a bit surprised by Europe’s wheat harvest being lowered by as much as it did, despite exports being stayed at 38.5 MMT. Conversely, Canadian exports were dropped by 1.9 MMT to 24.6 MMT, which, in my opinion, feels a bit high today given production woes in most of the Prairies (more on this later).

The biggest surprise to the global wheat balance sheet might have been Ukraine, where favourable weather has helped average grain yields of all crop types climb at least 5% year-over-year. Last week, the Ukrainian Ag Ministry suggested a total grain harvest of 56.4 MMT, or roughly 2% better than last year. Despite, in this August WASDE, the USDA suggesting a 3.5 MMT increase compared to Harvest 2022, 2023/24 Ukrainian exports were stayed at 10.5 MMT, due to the ongoing shipping issues in the militarized Black Sea. On that note, also last week, Ukraine announced a “humanitarian corridor” in the Black Sea and started registering cargo and other ships that have been stuck in ports. Traders, grain companies, and even insurance companies will likely be watching this closely as to whether or not the Russian Navy will intercept any of the vessels.

Coming back home, wheat Harvest 2023 has started in Western Canada with earliest-seeded crops starting to come off. Most of Manitoba’s wheat remains in the fair-to-good columns, but not very much is considered excellent. Saskatchewan continues to be hot with spotty rain showers, which at this point, likely won’t help a ton in terms of yield but could help recharge depleted soil moisture levels. In Alberta, just 45% of spring wheat and 32% of durum are in good-to-excellent (G/E) condition, which is still much better than this point of the drought of 2021 when just 20% of spring wheat and 19% of durum fields in Alberta were rated G/E. Suffice to say, no one is currently pricing in much of a 2021-type harvest and so we should temper any crystal ball coffee row talk of $20 durum and $16 spring wheat.

Supporting my bullish-wheat-but-not-too-bullish-wheat thesis is that last week, China officially took its 80% tariff off Australian barley. This will certainly mean reduced demand by the People’s Republic for Canadian feed and malt barley, likely pushing more feedstuffs into the Canadian pipeline and malt product into the U.S., Mexico, and maybe even Columbia. This also means more competition for feed wheat, which again, suggests any expectations for significantly higher feed grain prices might need to be dialed down a bit. What’s certain to be debated over the coming weeks though is what U.S. corn and soybean yields will turn out to be as, next Monday, August 21st, the annual ProFarmer crop tour will kick off, running from Ohio through South Dakota and Minnesota. Nonetheless, each day we do get closer to knowing exactly what sort of yields are out there.

To growth,

Brennan Turner

Independent Grain Markets Analyst