Trick or Treat: Wheat Markets at the Door

Grain markets had bearish tone to them last week, led by corn and Kansas City HRS wheat futures, as a soft start to Monday’s trading continued through the other fourtrading days. South American weather is being watched a little earlier than usual as El Nino rains may cause a few 100,000 soybean acres to re-planted. With that, the USDA is expecting a record harvest this crop year of over 160 MMT.

The same rain systems are bringing moisture to Argentina, which will benefit corn and wheat crops there, albeit possibly a bit too late for the latter. Rain is also falling in Australia, supporting the rationale behind some of the recent upgrades to their wheat production forecasts. Elsewhere, the European Union Commission raised their wheat harvest by 200,000 MT to a 125.5 MMT harvest, but they also raised their exports by 1 MMT to 31 MMT (offset by lower domestic use).

Weighing on domestic markets is the St. Lawrence Seaway being closed for the last week as seaway workers continue to strike . Broadly with the absence of any bullish headlines, the grain complex isn’t able to surge and sustain any rallies.

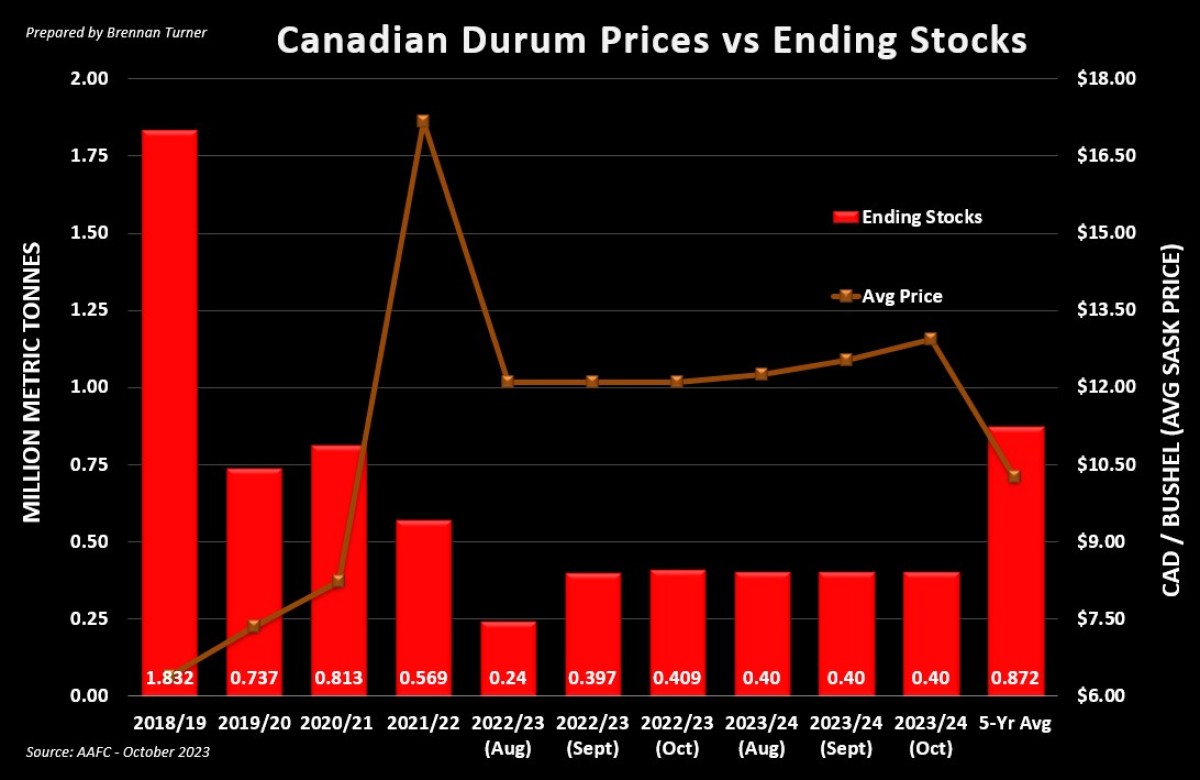

Last week, Agriculture Canada released its monthly updated supply and demand estimates and while there wasn’t much changed this month, AAFC did provide some other notes to be mindful of. Starting with durum, the Canadian Grain Council says that the drier growing conditions led to good quality with about 4/5s of the crop being a #2 or #1 quality, with an average protein content of 14.7%. While that would be attractive to most international buyers, Canadian durum is competing with Turkish supplies here in the earlier months of 2023/24.

The transcontinental country is expected to produce nearly 22 MMT of total wheat this year, up 10% year-over-year, and 3.1 MMT of that is allocated as durum exports, a 55% jump over the 2 MMT in shipments by Turkey last year. Most of this larger Turkish durum export program is finding its way into Europe and North Africa, notably the latter, as the region’s durum harvest was below 4 MMT for the first time in 8 years. Aggregately though, with a global durum harvest this year of 33.5 MMT, that’s the second-smallest haul in 2 decades, and with the robust global trade, the International Grain Council (IGC) is expecting 2023/24 to end with just 3.9 MMT of durum inventories, the tightest carryout in 30 years! Amidst, the Canadian durum balance sheet seeing its own record tight carryout, there’s not a lot of surprise in seeing AAFC continuing to raise its forecast for Canadian durum prices.

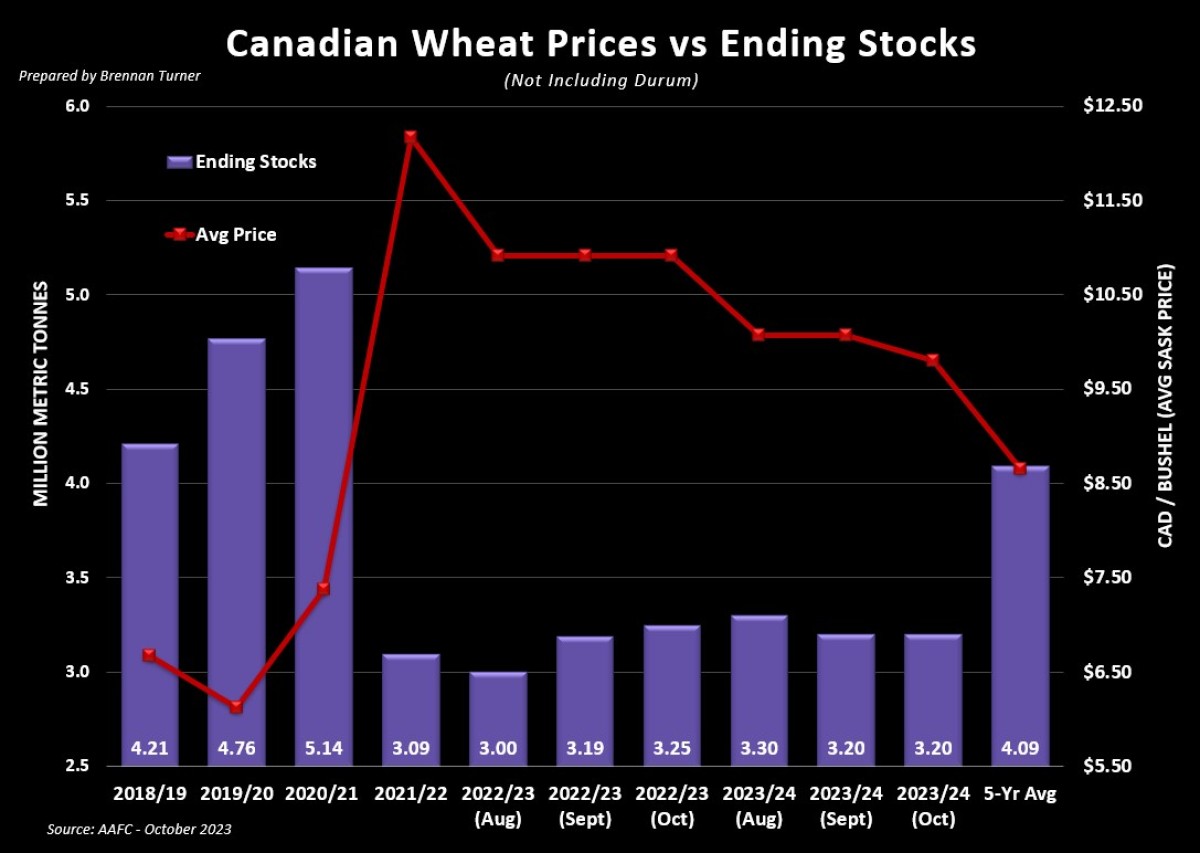

For non-durum wheat, about 3/4s of this year’s crop is coming in as a #1 quality, averaging 14.2% protein, with most of the remainder of the harvest grading a #2 with 13.1% average protein. Despite that sort of quality, Agriculture Canada remains relatively pessimistic on the price front, dropping their average forecast below $10 for the first time in 2 years, as they’re anticipating a decrease in demand and global trade. Is this really the case? Or perhaps just a function of the current market conditions and not reflective of the broader state of the wheat trade?

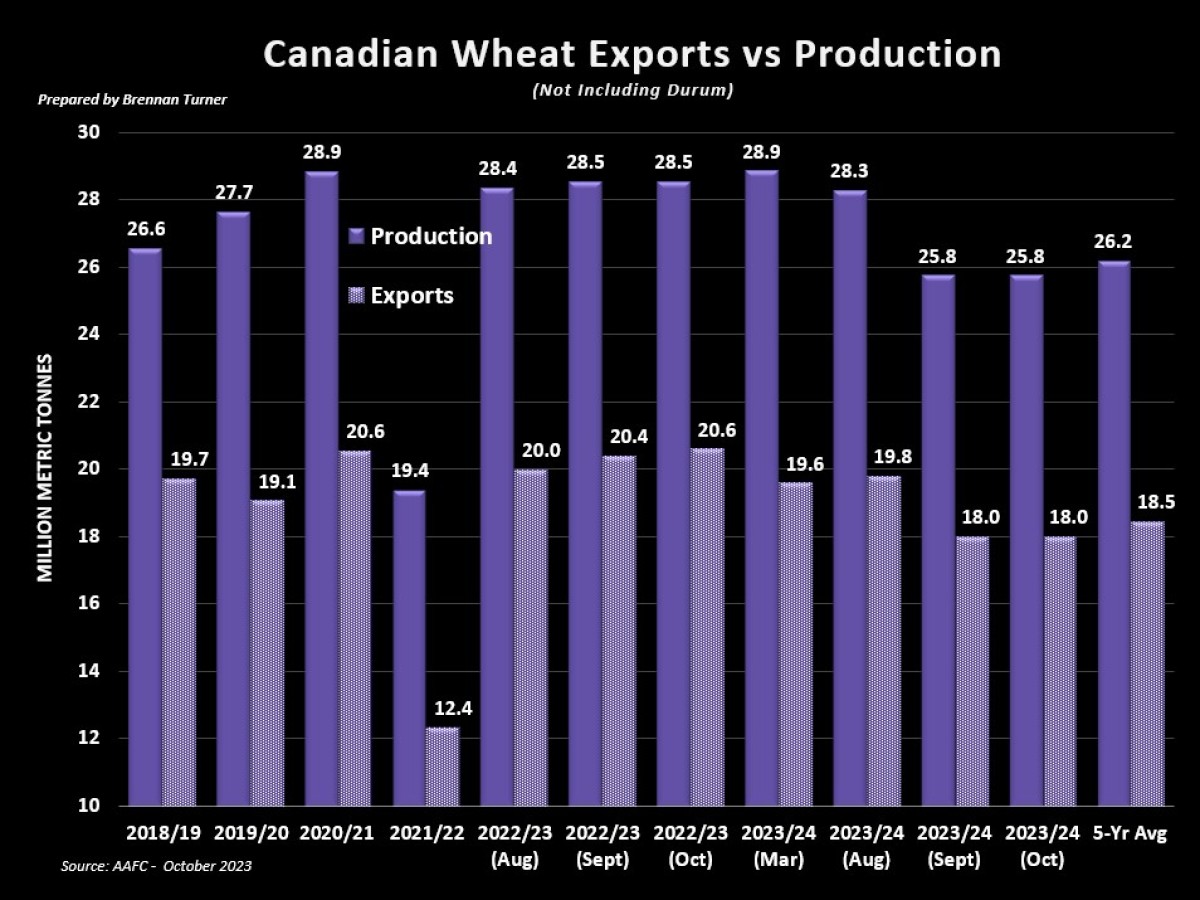

The team at MarketsFarm made some healthy arguments last week that the current price for Canadian wheat is likely undervalued, which I’d agree with. First, carryout of the world’s major wheat exporters is pegged at 53 MMT which would be down 14% or 8.3 MMT year-over-year, and the 2nd-lowest level in 15 years (specifically since 2007/08 – remember that year?) While the current pace of non-durum Canadian wheat exports points to a 20 MMT program, MarketsFarms thinks things will level out at 18.8 MMT, versus AAFC’s estimate of 18 MMT (unchanged from last month). I think that the AAFC will raise their forecast throughout the year to end up somewhere between 18.5 and 19 MMT.

Apart from the challenge of sustaining any rallies, it’s no secret that managed money continues to hold a record short position in the Minneapolis HRS wheat futures, while funds are also holding large-sized net short positions in Chicago and Kansas City wheat futures. What will be the catalyst for some of these holdings to be covered (AKA help spur a short-covering rally?)? In my opinion, it’s either going to be a slow trickle over the next 3 months, or a sudden burst because of a geopolitical event. For the latter, it’s most likely going to come from the Black Sea as this region has become a major player in wheat trade in the last 2 decades.

That said, the Ukrainian government is suggesting that their farmers will lose money for the first time in over 20 years. Apart from the reality that costs of inputs, fuel, seed, etc. have risen substantially in Ukraine (yes, much more than yours), combined with the challenge of getting their production to market, farming margins have turned negative. On the export front, with Russia still treating every vessel coming out of Ukraine as suspicious, most grain is being shipped out of Danube River ports, adding to transportation costs, and thus, a lower cut for Ukrainian farmers. When the Black Sea was “open” for Ukrainian grain to do business, only about ¼ of the country’s grain was going through the Danube River, but now, it’s closer to 2/3s of all exports. Further, because this infrastructure can only handle so much grain (i.e. there’s only 2 canals that barges can traverse), even with 2.5 MMT of grain moving per month through the river ports, it’s likely that Ukraine’s total grain exports will drop 30% – 40% compared to last year.

Perhaps this is a treat for Canadian, American, or European wheat to pick up the market share lost by Ukraine? Perhaps this is why Europe raised its wheat export forecast? Or is it a trick that Russia’s playing in trying to secure more market share for itself? For example, we do know that Russian and Chinese state organizations have signed agreements for the former to supply the latter with ~100 MMT of grain over the next 12 years. This is not just a function of the Chinese trying to diversify their origination options, but also a catalyst for Russia to try and develop its Siberian / Ural / eastern territories farmlands, which reportedly has about 20M acres of rich soil that hasn’t been touched in nearly a century. The reality is though, there’s little-to-no infrastructure out there to support the industry and/or trade.

Ultimately though, in today’s fast-paced news world, the Russian-Chino food agreement is likely just an attempt to control the narrative, as that amount of grain would likely drive up Russia’s domestic food prices, and China has a bad history of not fully executing said agreements (Remember when Beijing said they’d buy $200B more of U.S. goods and services when Trump was President? They only hit a little over half of that target). That said, Russia’s grain exports to China in the first nine months of 2023 did total 3.5 MMT, a healthy bump from the 2.2 MMT shipped to China in all of 2022!

Overall, it’s these types of headlines, and the general uncertainty in markets given the wars in Ukraine and now Israel/Gaza, that are currently pressuring traders. When they sit on the sidelines, this reduces total volume in the trade, and consequently, volatility of the markets (read: opportunities traders think they can take advantage of). Therein, the market is “tricked” to trade sideways, but sometimes the treat is worth waiting for!

Happy Halloween!

To growth,

Brennan Turner

Independent Grain Markets Analyst