U.S. Plant 2021 Estimates Gives Fresh Bullish Boost

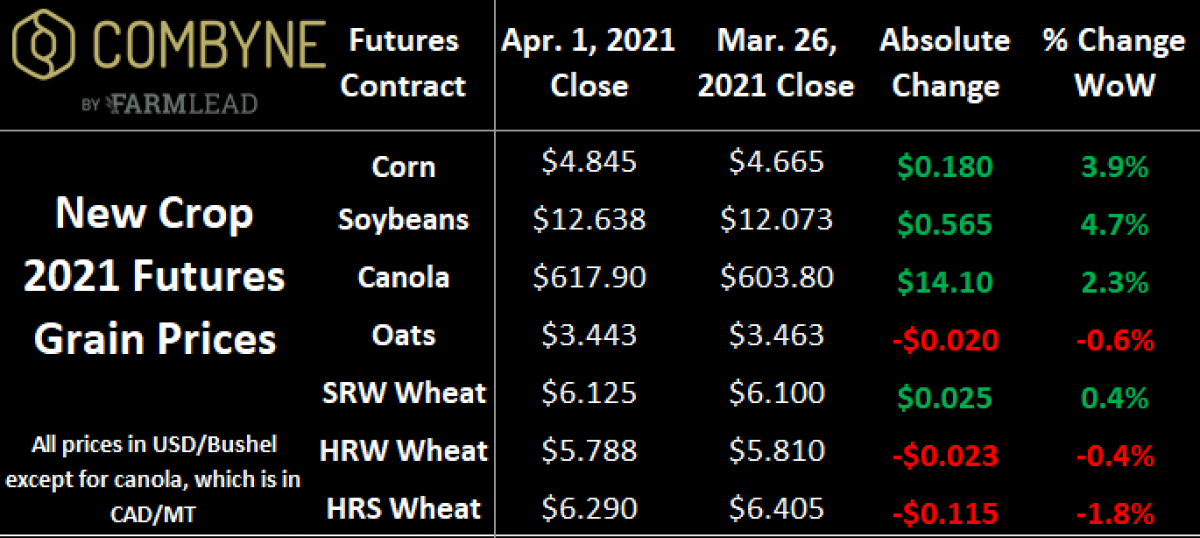

Last week, we flipped the calendar into April, but not before the USDA threw a doozy of a Prospective Plantings report at the grain markets. On Wednesday, March 31st, the USDA said that American farmers will plant way less corn and soybeans than what the market was expecting, propelling a rally that was led by corn going limit up for the trading day. Wheat futures tried to follow corn and oilseeds complex higher, but that proved difficult to do so, especially for winter wheat varieties, as acreage came in larger than expected. While front-month spot futures pulled back on Thursday, for new crop grain prices, corn, soybeans, and canola all saw some impressive gains for the week.

Digging into the report, the USDA said that American farmers would plant 91.1M acres of corn and 87.6M acres of soybeans. For the latter, this was well below the pre-report average guesstimate of 90M acres, but still about 5% more than Plant 2020. Accounting for current demand, available American inventories seems to be inadequate, and unless Brazil starts ramping up its exports, soybean prices could climb higher yet.

For corn, the USDA’s estimate is a slight increase from last year’s 90.8M acres, but it was also well below the 93.2M acres that the market was expecting to see. That said, at 91.1M acres, this would still be the largest area of corn planted in the U.S. since Plant 2016! However, the USDA suggested 4.7M acres of Prevent Plant in the Dakotas (3M in North Dakota, 1.7M in South Dakota), and many analysts think that, with current corn prices, many of these acres will eventually be seeded with the coarse grain this spring.

For wheat, total acres came in at 46.4M, which is up about 4% from Plant 2020, but is still the 4th-smallest area in the last century. For winter wheat, the total area is suggested to be 33.1M acres, which would be up 3% from the previous estimate and 9% higher than last year’s area. Therein, it was no surprise to see hedge funds flip to a net-short in Chicago-traded SRW wheat futures, while also reducing their net-long in Kansas City-traded HRW wheat futures.

For spring wheat, HRS acres were pegged by the USDA at 10.9M, a drop of about 4% or 510,000 acres from 2020. Montana saw the biggest drop year-over-year in HRS wheat acres – 400,000 less – while North Dakota is expected to see 100,000 less and Minnesota HRS acres are expected to drop by just 50,000 acres. As I mentioned in last week’s wheat Market Insider column, a survey by Farm Futures suggested more spring wheat than what the USDA said. We’ll need to a keep close eye on new crop prices for HRS, relative to corn and soybeans, as if prices for the latter two remain elevated, more fields could be substituted out of spring wheat in the coming weeks. Should we start to see reports that back up this theory, it would support higher HRS wheat prices, both in the U.S. and Canada.

Finally, that Farm Futures survey suggested 2.2M acres of durum would get planted by U.S. farmers in Plant 2021, but the USDA printed 1.54M! This is a drop of about 150,000 acres, or 9% lower year-over-year, and surprised everyone (including yours truly) as we were expecting to see an increase. Montana’s durum acres are expected to be marginally bigger than last year at 710,000, but North Dakota’s area is expected to drop 160,000 acres to 750,000.

Like HRS wheat, this smaller U.S. durum area is also a positive for Canadian durum growers, albeit I’m cognizant of the decent crop conditions in Europe, especially in France. That said, it’s worth noting that CGC data through February 2021 shows European and North African countries have been big buyers of Canadian durum this year: Italy: +90% year-over-year to 1.085 MMT, Algeria: +400% to 362,000 MT, Morocco: +72% to 741,000 MT, and Tunisia: +144% to 216,400 MT. However, for this export interest to continue into the 2021/22 crop year, it will largely be depended on how that European crop fares over the next 2 months.

Note that Statistics Canada will come out with its own version of Plant 2021 acreage estimates for Canada in about 3 weeks, on Tuesday, April 27th. 10 days later, on May 7th, StatsCan will report grain stocks as of March 31, 2021.

To growth,

Brennan Turner

CEO | Combyne Ag