Ukraine’s Grain Exports Get Spooked

Grain markets finished the last full week of October mostly in the red as profit-taking and healthy rains put a softer tone on the complex. That changed over the weekend though, as Russian navy ships in a Crimean port were attacked. Moscow said that it was pulling out of the grain export deal, which had allowed safe passage of food-carrying ships through the Black Sea since late July. Traders are also watching just how much moisture is actually helping U.S. winter wheat that was planted into “bone-dry” ground in the Southern Plains, as well as ongoing harvest activity in the southern hemisphere. As we flip the calendar to November this week though, the biggest factor impacting wheat markets will be what happens with Ukrainian grain exports.

While a dozen ships did finally get cleared to leave Ukrainian ports to start the week, Russia has officially left the UN-backed agreement to let Ukrainian grain access world markets. The Kremlin said over the weekend that Ukrainian sea and air drones attacked on Russian boats in the Black Sea, and responded by bombing Ukrainian energy and other utility infrastructure in multiple cities, including the capital of Kyiv. At the ports though, the U.N., with support from both Ukraine and Turkey, who brokered the grain deal, has agreed to let ships sail, potentially testing the waters a bit as to whether or not Putin will indeed continue to allow safe passage or not. Quite literally, Ukrainian grain exports are back in murky waters.

We’ve heard from Putin and other Russian officials about their disdain for Ukrainian grain not going to poorer countries. However, this comes against the reality that Russian grain exports haven’t be going very well so far in the 2022/23 crop year. That said, after a slow start, more private analysts, including SovEcon, expect Russian grain shipments to pick up pace, although they admit that available railcars do remain a bottleneck for in-country movement.

A similar type of transportation bottleneck remains in the U.S. as slower barge traffic have slowed exports, which figuratively translates to a cap on grain prices. Corn and soybeans are also both under pressure from the potential of a large Brazilian harvest, but lower-than-expected yields and strong ethanol and soybean crush demand are keeping prices elevated.

For wheat, the strong U.S. Dollar is certainly not helping American wheat exports, but the bigger issue is the dry conditions across the continental United States. As of last week, more than 6 out of every 10 acres are now facing some level of drought, on par with the geographical sprawl of 2012’s dry conditions. Thanks to the dry start, the emergence of the recently-planted U.S. winter wheat crop is behind normal, but some good rains last week across the bottom half of the country could help. Therein, with combined inventories of American HRW and HRS wheat sitting at their lowest since the 2008/09 crop year, Harvest 2023 prospects – and therefore new crop bids – may get more attention earlier than usual.

Heading north, final yield estimates from provincial governments suggest a smaller wheat crop than what Statistics Canada has tabulated. In their September publication, StatsCan pegged a spring wheat harvest of just over 26 MMT and a durum crop of 6.1 MMT, but most private estimates I follow now suggest a Canadian spring wheat harvest that’s below this, by around 300,000 – 500,000 MT for both classes. On the flipside, demand expectations for Canadian durum remains strong, especially for North Africa and the U.S., two regions that did not see as big of a harvest as first thought. Therein, the spread between durum and spring wheat bids has strengthened considerably over the last 2 months, from basically nil in early September to the $1.60 - $1.70 CAD/bushel range today.

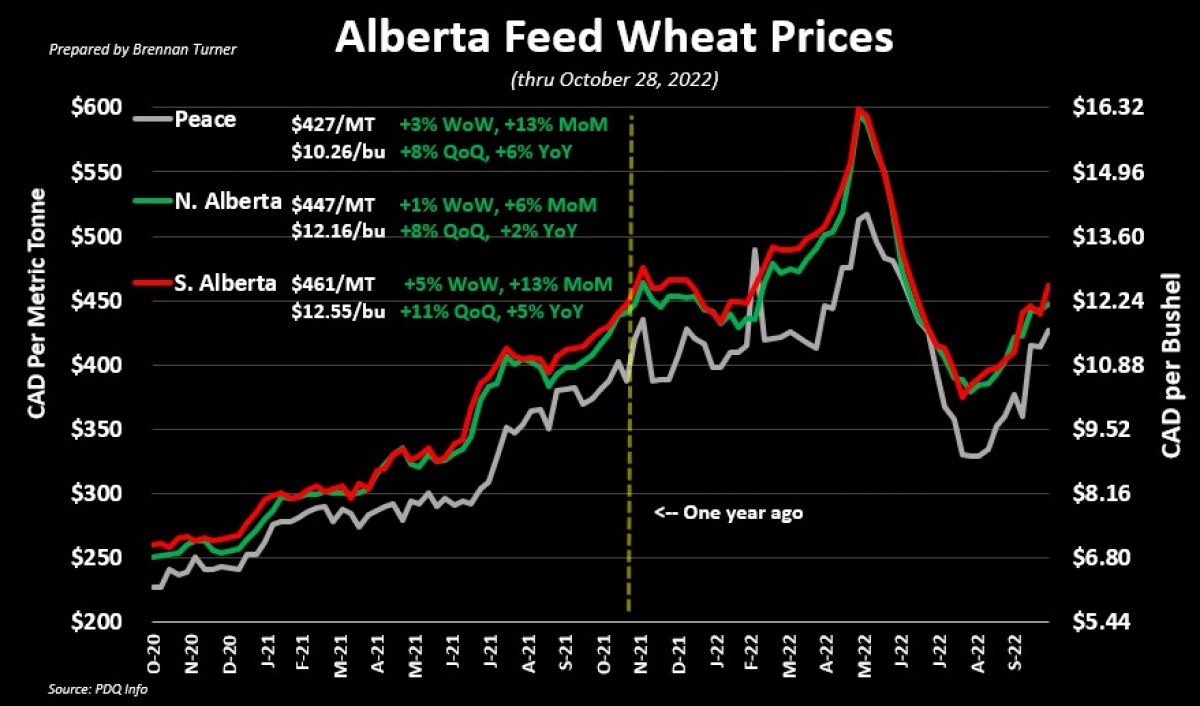

Now that many farmers know their harvest’s quality, while some are waiting to make their next milling wheat sale, I’m getting more questions about feed markets and how to approach sales after last year’s record highs. For starters, we’re still in a relatively tight carryout scenario for most feed crops, and so perhaps that’s why we’re already seeing some corn make its way over to Lethbridge. While that may pressure the market psychologically, in the long-term, the demand for feedstuffs appears to be strong, be it at the domestic or international window. Nonethless, as the chart below suggests, we traded relatively sideways in November the last 2 years. So if you’re looking for some cash ahead of winter, now may be the time to part with a few loads.

To growth,

Brennan Turner

Founder | Combyne Ag