USDA Helps the Bulls (Finally?)

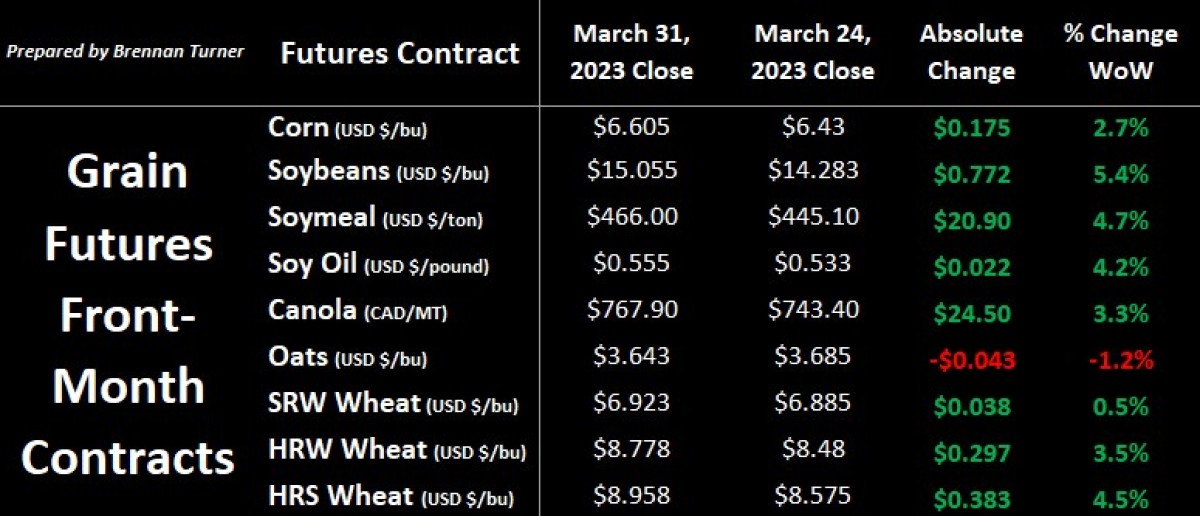

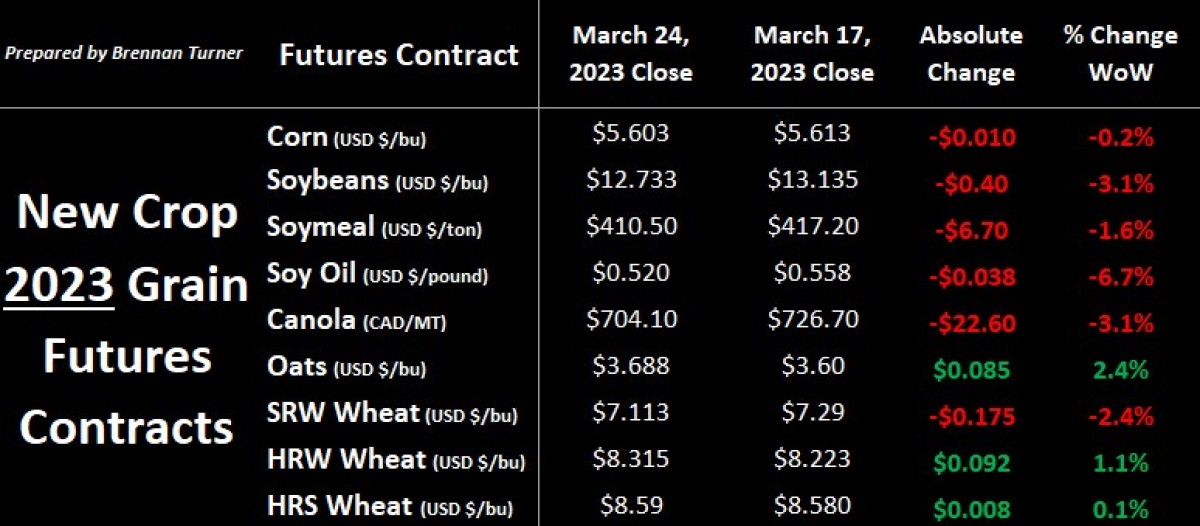

Grain markets flipped the calendar to April with a bullish last day of trading for March, thanks to some USDA stocks and acreage numbers surprising the market a bit. We’ll dig into the numbers, but other factors moving grain markets is more snow in the U.S. Northern Plains creating some anxiety about a late start to Plant 2023. Therein, more attention from the market is being paid to weather at this time of year, which includes Argentina, whose expected to get some heavy rains this week and while it won’t help corn and soybeans that are just starting to get harvested, it would rebuild the soil moisture profile for wheat that will be planted soon. Overall, while we got some green on the screen this past week, almost all grain futures are below where they started the 2023 calendar year, be it old or new crop.

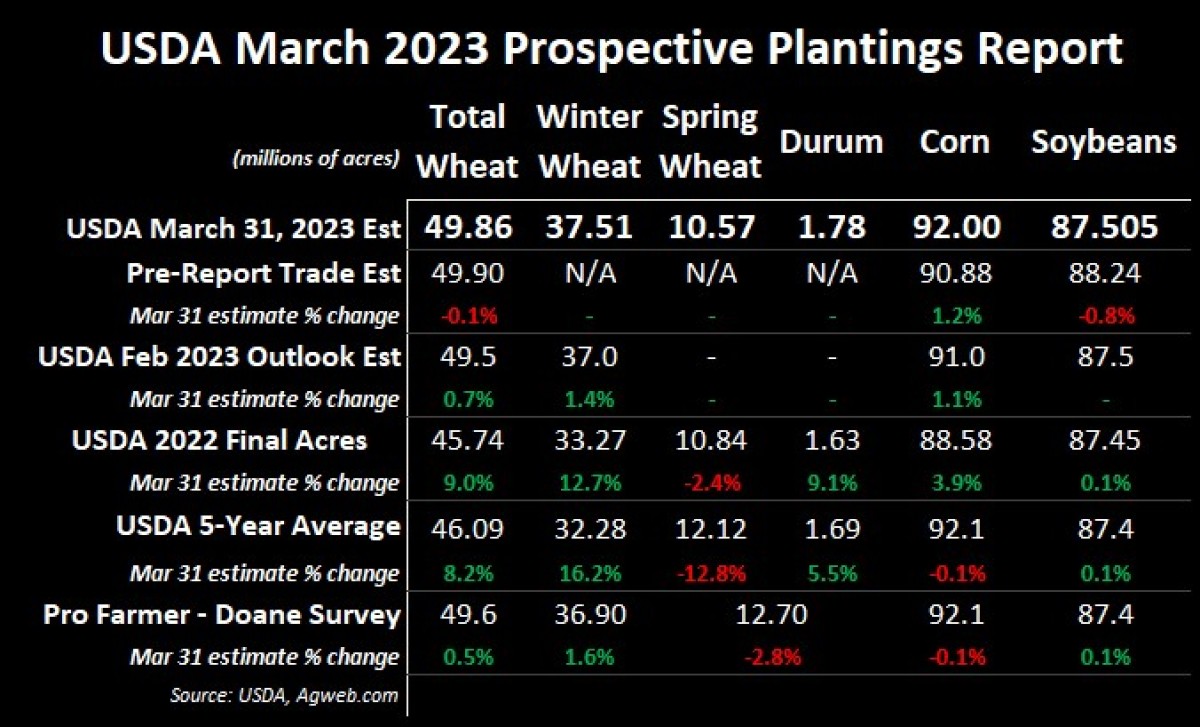

As a reminder, we won’t get the first official Plant 2023 estimates from Statistics Canada until Wednesday, April 26th. Staying on the southern side of the 49th parallel though, while the U.S. acreage numbers can and will change by the June USDA report, the soybean data suggests prices for the oilseed should stay elevated (albeit U.S. soybean values are trading at about a $1.50 USD / bushel premium to those from Brazil!). The smaller soybean acreage number surprised most, but everyone and their mother can agree that corn prices are favouring more acres for the coarse grain (not to mention crop insurance guarantees of nearly $6 USD / bushel being hard to ignore!) As for wheat, the fall seeded numbers continue to climb as the USDA raised their estimate of winter wheat acres by 500,000 to 37.5M, 16% higher than the 5-year average. Durum acres are expected to increase by 9% year-over-year to 1.78M, with almost all the increase attributed to North Dakota soil. Finally, spring wheat acres of 10.57M is a slight drop from last year but the lowest since 1972!

That said, almost no one expects all American winter wheat acres to be harvested given the drought impacting the U.S. Southern Plains. We will get the first official USDA crop progress report on Monday, April 3rd. The individual state reports, when compared to the end of February, suggest a mostly poorer winter wheat condition in states like Oklahoma, Texas, and Colorado, and slight improvements in Nebraska and Montana. As mentioned, a lot of buzz is already building for the Northern Plains which, in some places are going to be dealing with the wet / muddy fallout from a very heavy snowpack (including record levels in some areas) come spring. After all, 1.3M acres of corn are suggested by the USDA to be planted in the Dakotas and Minnesota but will that all get in, let alone the wheat?

On the grain stocks side of things, U.S. corn stocks as of March 1st were pegged at 7.4B bushels, down 5% year-over-year and a 9-year low, while soybean inventories totaled 1.69B bushels, a 13% decline year-over-year and a 2-year low. Thus, most attention from the USDA report was paid to soybeans, as with smaller acres in 2023, assuming trendline yields and consistent demand, the balance sheet could get pretty tight. On the flipside, the corn balance sheet will likely loosen up and bring prices down, but China is the wild card, as they’ve been heavy value buyers when U.S. prices have been low. For wheat, inventories of 946M bushels is a 8% drop from last March, and also the smallest number for this time of year in 15 years!

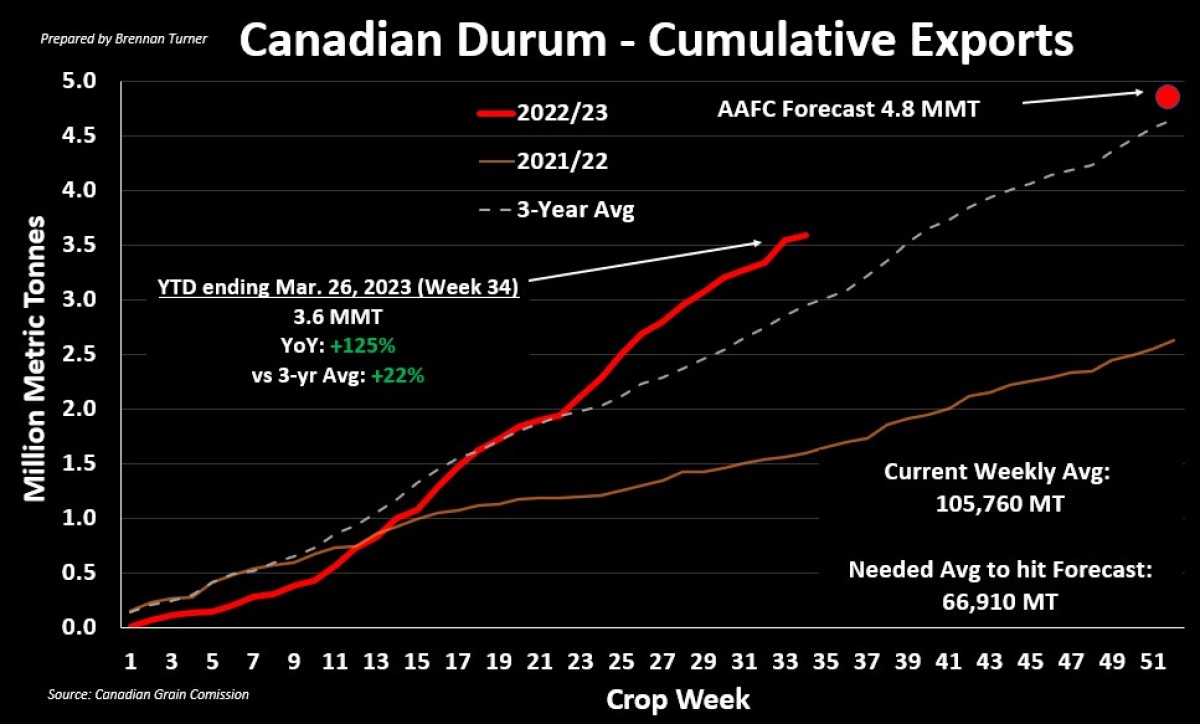

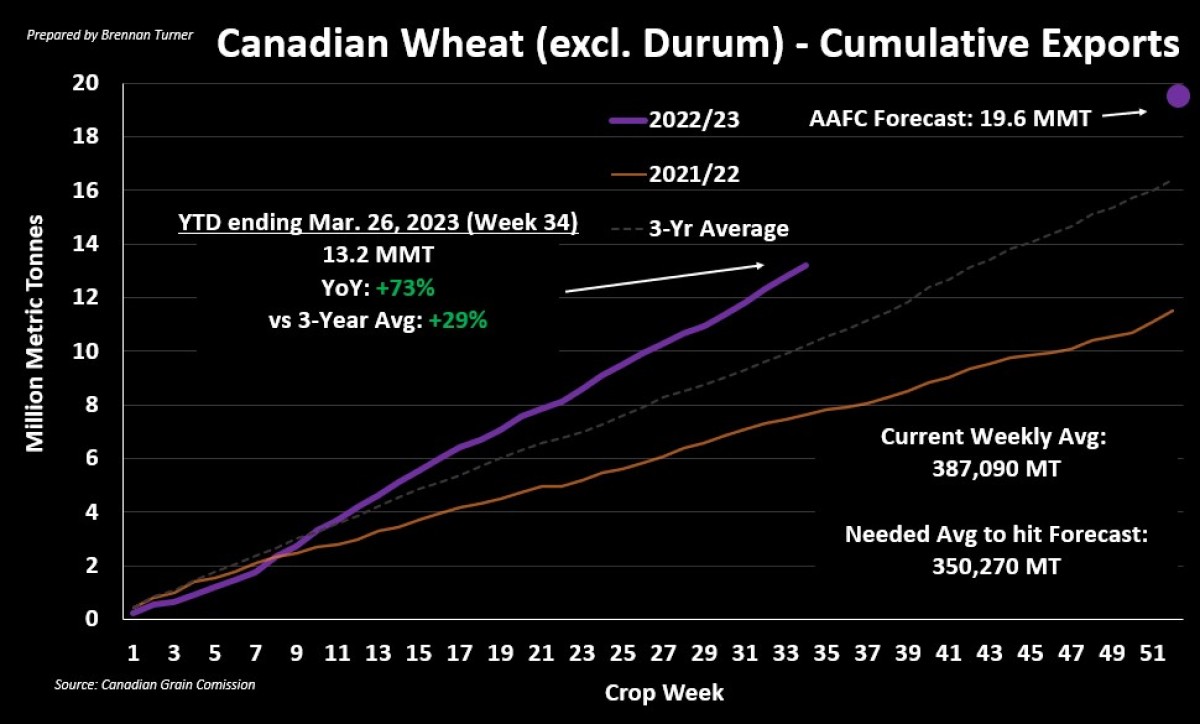

Speaking of smaller wheat inventories, North Africa is looking pretty dry again, and while some areas are better off than last year, the devastation of last year’s drought beat down water supplies in the likes of Morocco. That means that less area was planted and as the region starts its durum harvest in the coming weeks and months, we could start to see some more interest in old crop Canadian durum. That said, both non-durum and durum Canadian exports continue to perform very well, with little-to-no signs of slowing down. Assuming that the current pace is near equal for the last 4 months of the crop year, it would be one of the better years in terms of total wheat exports, and an impressive rebound after Canada’s own drought-impacted Harvest 2021.

To growth,

Brennan Turner

Independent Grain Market Analyst