USDA Says There’s Less Wheat (Finally)

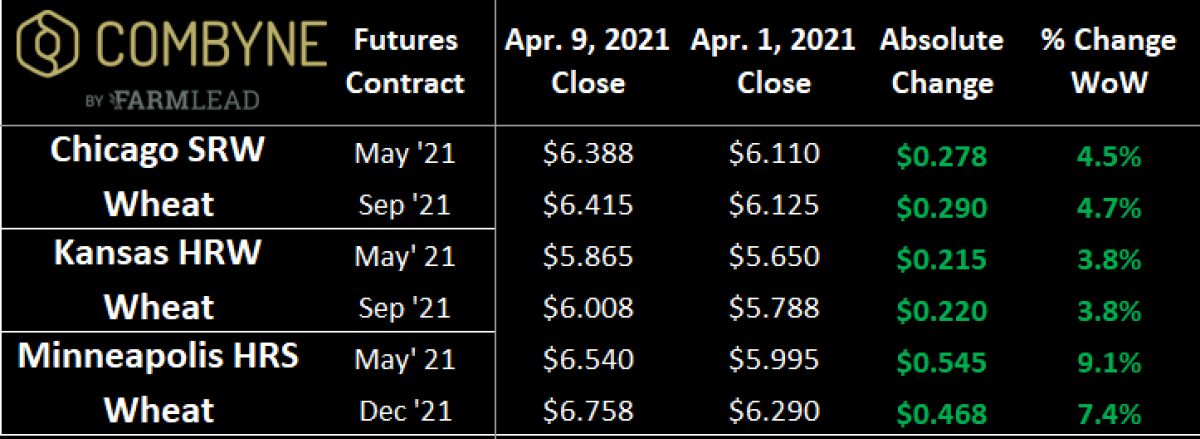

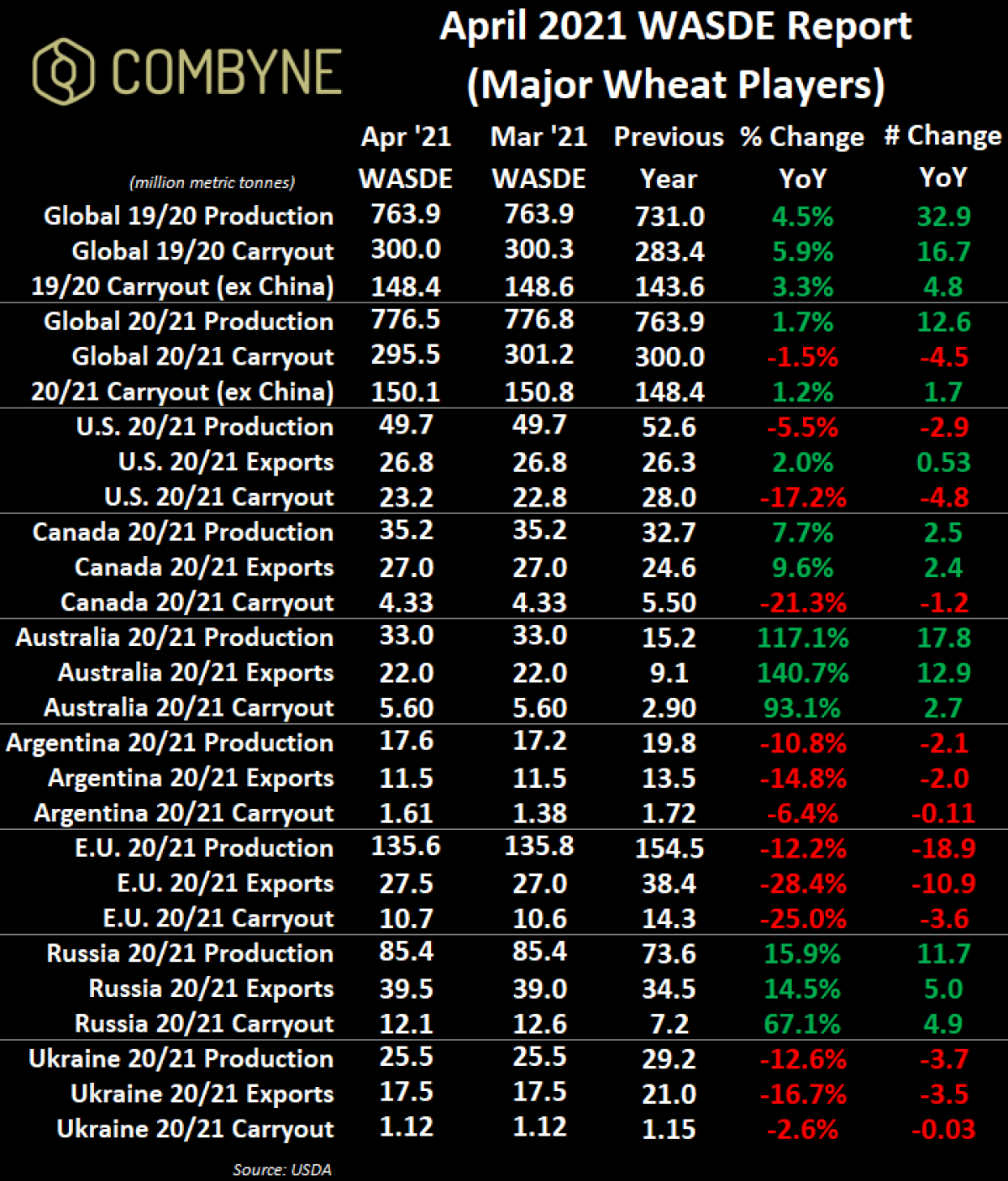

The USDA published its monthly WASDE report on Friday, April 9th, and for the first time in a very long time, global wheat ending stocks actually fell, which supported prices across the complex. Also helping wheat markets are ongoing drought conditions as well as a tighter U.S. corn carryout. The latter helped corn prices go higher, and with higher corn prices and less of it to go around, the thinking is that more wheat could get substituted into feed rations, both domestically and abroad. One asterisk that could weigh on corn prices is how the South American corn harvest materializes, with a lot of attention on Brazil’s second-crop safrinha output.

Digging into the WASDE, global wheat carryout for the 2020/21 crop year was felled by 5.7 MMT to stand at 295.5 MMT, which was well below the market’s average guesstimate of 301.3 MMT. Worth noting is that, since the USDA started estimating for the current crop year back in May 2020, this is their first forecast of global wheat inventories dropping below 300 MMT, down from a high of 321.5 MMT in the October WASDE. The decline of global wheat stocks is largely a reflection of the strong demand the cereal has had globally since the northern hemisphere harvest wrapped up in the fall.

The good news is that, with a tighter carry out, this means that traders are potentially a bit more on edge as to how this year’s crop performs. Starting down south, the Argentine Ag Ministry is estimating that wheat acres for the 2021/22 new crop year will climb 4% year-over-year to 17.3M acres. They also estimated that total wheat exports in 2021/22 from Argentina to top 14 MMT, a material improvement over the current 11.5 MMT estimated by the USDA for 2020/21.

Heading northeast to Europe, 87% of the French soft wheat crop is considered to be in good-to-excellent condition, matching the five-year average, but well above the 63% seen at this time a year ago. In the Black Sea, Russian and Ukraine spring wheat seeding is fairly delayed by the extended winter / wet spring conditions. The delay in Russia is about 10 – 14 days behind while in Ukraine, it’s nearly a month behind the average schedule. However, keep in mind that the large, large majority of wheat production out of these countries is in the form of winter wheat. Therein, state weather forecasters in Ukraine recently pegged 98% of the winter wheat crop there in good condition.

In Russia, winter wheat crop conditions are also looking fairly healthy, which is part of the reason we’ve seen Russian wheat prices drop for 5 consecutive weeks before leveling out this week. The other factor driving Russian wheat prices lower is weaker demand, as the wheat export tax in Russia pushes international buyers elsewhere. While this mirrors the action in the wheat futures market, since the beginning of March, Russian wheat prices for 12.5% protein at Black Sea port locations have fallen about 15% to $245 USD/MT (or about $6.67 USD and $8.34 CAD per bushel if converting metrics tonnes into bushels).

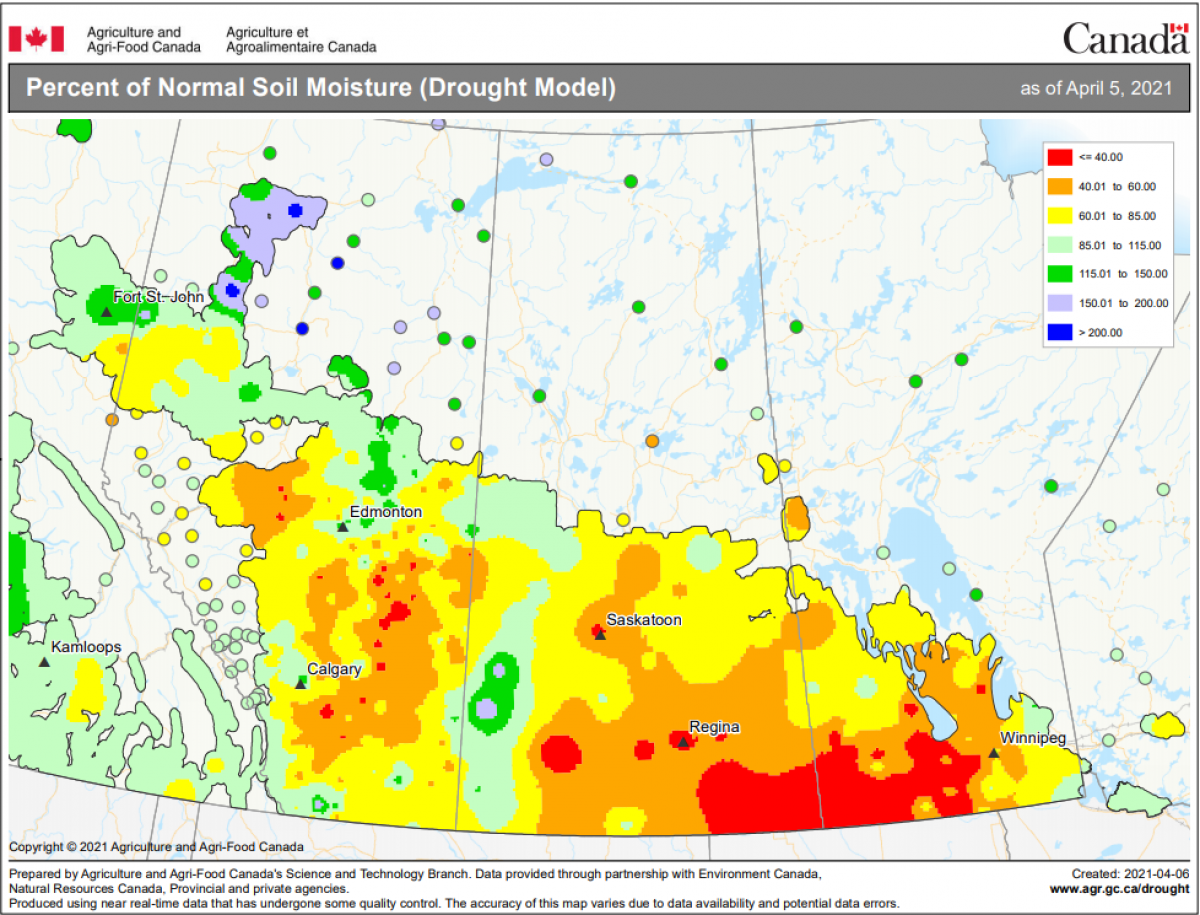

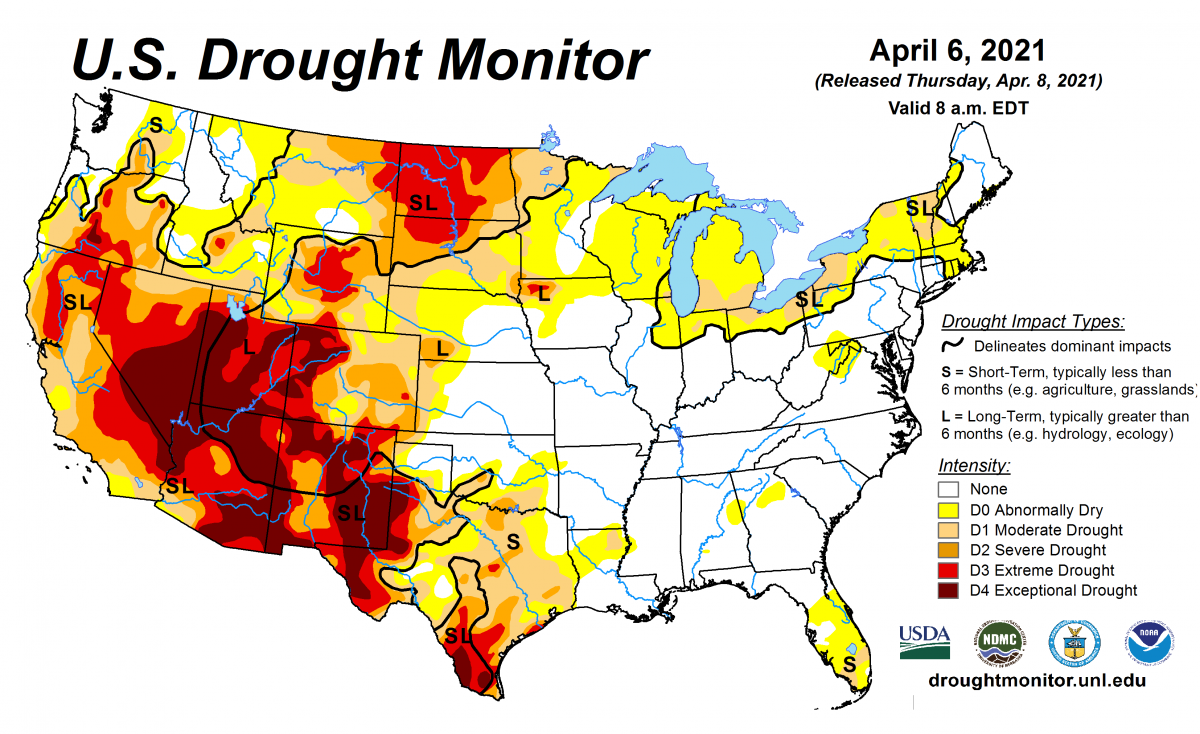

Coming home, there are quite a few voices talking about the dry conditions in the U.S. Northern Plains and Western Canada. While the soil moisture map below (as a percentage of the normal) is as of April 5th, many parts of the Canadian prairies received a healthy dump of snow (and some rain) over the weekend and to start the week. As the moisture is quite welcome, it will likely satisfy a lot of concerns for another month, two, or even until Canada Day (as some farmers told me).

However, 70% of North Dakota is now classified as being in “extreme drought”, up from 47% the previous week. Further quantifying the situation, almost 60% of the state’s topsoil moisture reserves rated as “very short”, 1/3 as short, and only 8% as “adequate. With this in mind, the state is forecasted to see some moisture events this week, which is why HRS wheat futures in Minneapolis have pulled back a bit to start this week.

Overall, the dry conditions are being given more attention to, and therein, creates more volatility. With less wheat to go around globally heading into the 2021/22 crop year, traders are cognizant of the importance of this year’s production, and thus, again volatility is likely. Thus, I’d encourage you to check out our innovative Target Offers functionality on Combyne, to set a target price AND freight that up to 10 of your buyers can trigger.

To growth,

Brennan Turner

CEO | Combyne Ag