Volatility Engaged

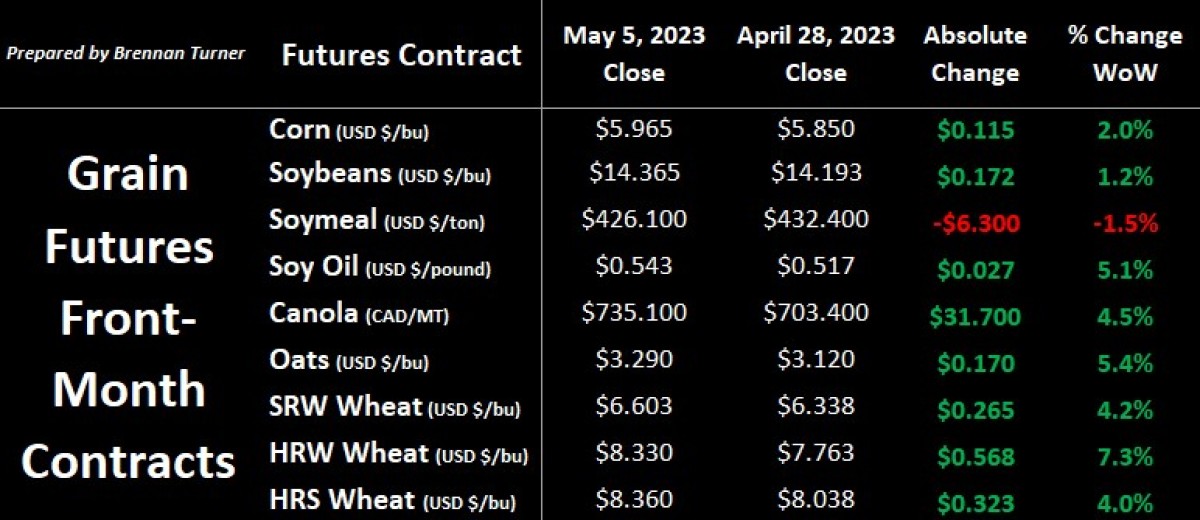

Grain markets started out the first few days of May trending lower before reversing mid-week and closing higher thanks to renewed planting and geopolitical premiums, along with some bargain buying. Last week started out slow as the complex was under pressure due to helpful rains and plenty of bearish headlines (read: fears of global recession, U.S. bank failures, weak U.S. grain export sales, etc.). However, grain futures springboarded higher on Wednesday, led by the wheat complex, after a drone strike at the Kremlin in Moscow renewed fears about the Black Sea Grain Corridor Deal not being renewed on May 18. Overall, despite the bearish undertones, the move higher to finish the week of trading has many thinking that the Plant 2023 lows are in ahead of Friday’s May WASDE report from the USDA.

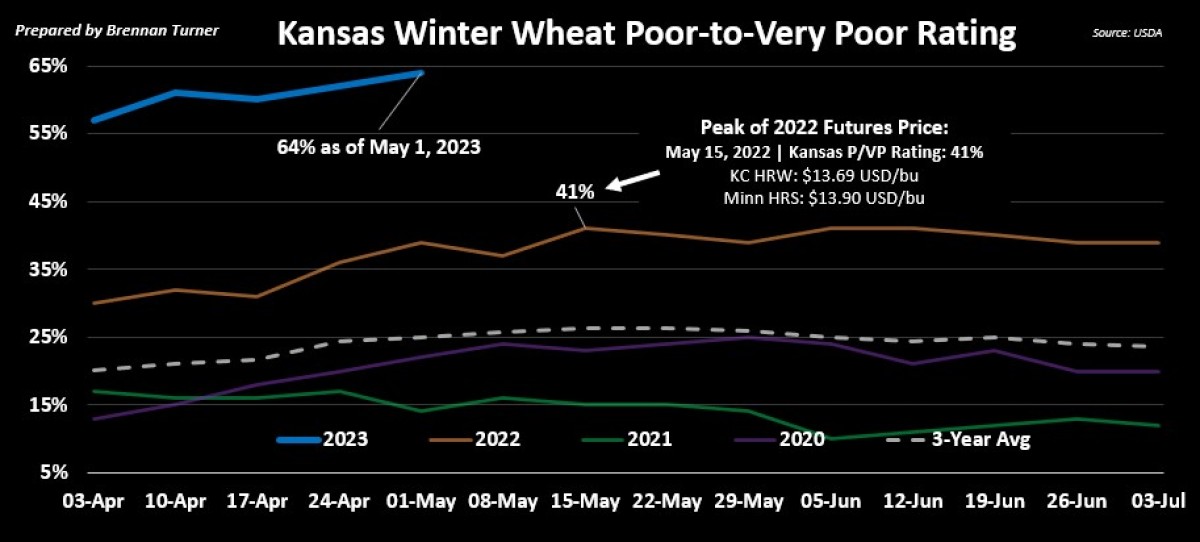

In the U.S. Southern Plains, the April rains were too spotty and/or too late for many fields, especially in Oklahoma where last week’s USDA crop progress report showed 61 per cent of the Sooner State’s winter wheat fields are in Poor-to-Very Poor condition, nearly triple the three-year average for this time of year of 23 per cent P/VP. With just nine per cent of Oklahoma’s winter wheat field rated Good-to-Excellent (three-year average is 45 per cent), last week’s crop tour through the state suggests an average yield of 22 - 25 bu/ac from 2.1M – 2.2M acres harvested, for a projected total haul of somewhere between 1.1 and 1.48 MMT. On the top end of the range, this would still be a 16 per cent drop in production year-over-year, while on the low end, this would be the smallest winter wheat harvest in Oklahoma since 2014, and possibly the worst since 1955’s 650,000 MT harvest when 3M acres were combined with an average yield of just eight bushels per acre.

Ultimately, the rebound this week in wheat futures was warranted in my opinion, given the 16 per cent tumble seen by Kansas City HRW wheat contracts over the last two weeks of April after some decent rains fell mid-month. Now though, it looks like the market is starting to realize the moisture was too late or too little and U.S. winter wheat production looks more than likely to fall below last year’s 14.45 MMT total. Moreover, in Kansas, the state responsible for nearly half of all American HRW wheat production, the harvest will certainly be below last year’s 6.64 MMT according to the Kansas Wheat Commission, which will host their own crop tour May 15 – 18 (there’s that date again, May 18).

Looking abroad, most eyes in the wheat market are on Ukraine, as boat movement slowed right down last week thanks to slower Russian inspections, with just six ships with Ukrainian grain leaving the Black Sea, well below the peak of 55 in one week last September. Argus Media believes that if Russia does not renew the deal on May 18, the world would stand to lose about 10 MMT of wheat exports from Ukraine in the 2023/24 crop year. While this would be generally supportive of higher prices, ample supplies remain available from Canada, Australia, the EU, and (ironically) Russia, with each country’s wheat exports likely climbing 2 – 4 MMT from current forecasts.

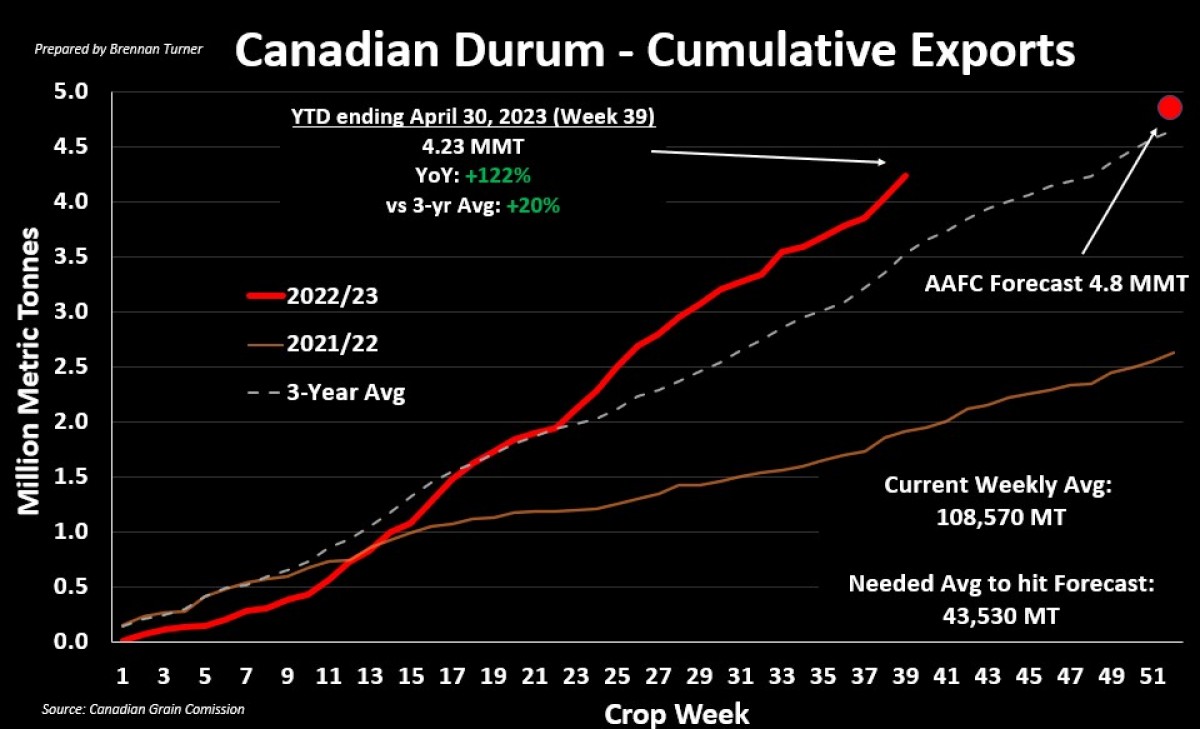

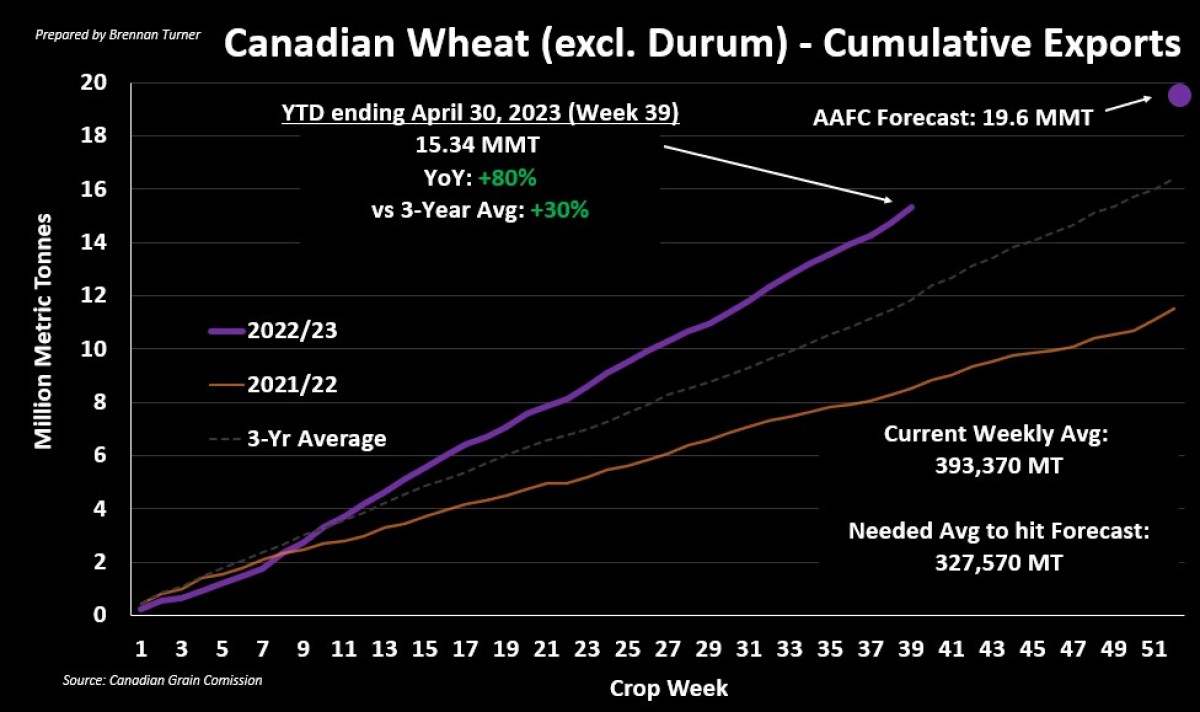

Therein, the pace of Canadian wheat exports continues to be impressive, and there could be more heading across the Atlantic to Europe and North Africa as they deal with the fallout of slower Black Sea trading activity and drier weather in southern regions. More specifically, the EU Commission lowered its 2022/23 old crop exports by 1 MMT to 31 MMT, while also trimming its Harvest 2023 estimate by 700,000 MT to 130.2 MMT, thanks to the persistent drought in Spain. This includes a reduction in Spanish durum yields, which is why the EU Commission raised durum imports for 2023/24 to 2.3 MMT, slightly above the 5-year average of 2.08 MMT. While durum values have fallen thanks to new crop supplies from Mexico, and the broader pullback in wheat prices, Europe continues to be a strong destination for Canadian durum with nearly three quarters of the bloc’s durum imports so far in 2022/23 coming from the Great White North.

Overall, as the charts above show, Canadian wheat exports are performing very well and it’s very likely we’ll hit the full-year targets. Therein, the market’s focus is starting to switch over to new crop potential and most farmers that I’ve been talking to across the Canadian Prairies are now into the fields, joining a few 100,000 other operators in the U.S. who will likely be going full-tilt this week with the warmer weather in the forecast. That said, the market seems to be fairly content with the pace of planting thus far of corn and soybeans, but U.S. spring wheat acres drilled in were at just 12 per cent last week, 10 points back of the average. Therefore, with each day and week in May that passes, farmers in the region may be less inclined to plant the cereal and instead opt for Prevent Plant (AKA government conservation payments AND the option for additional pasture-grazing money). There is a possibility, however, that these fewer acres have already been priced into today’s futures values, but most talking heads agree that the complex is oversold at this point, and any covering of the near-record short position will likely catapult values higher (and quickly, meaning more volatility).

To growth,

Brennan Turner

Independent Grain Market Analyst