WASDE Love for Wheat?

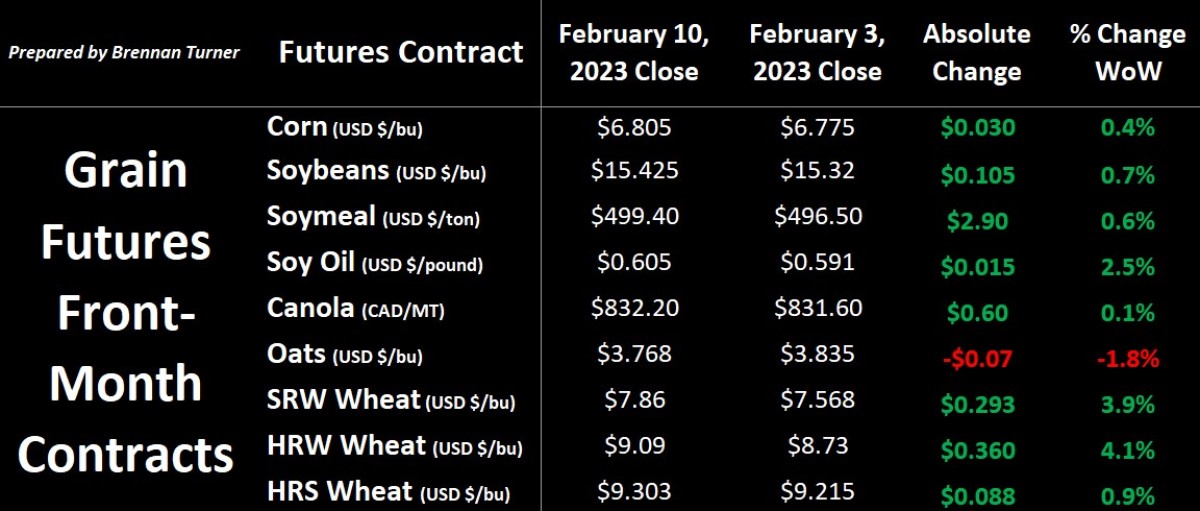

Grain markets found love ahead of Valentine’s Day as a neutral-to-bullish February WASDE report helped the complex end the week in the green. Gains were also made on almost every 2023 new crop contract, albeit they were not as strong as the front-month futures. The wheat complex made most of its move on Friday as tensions continue to rise in the Black Sea about escalating military activities, and the impact that this would have on not just export activity, but also spring planting initiatives. Amidst some speculation of short-covering, Chicago SRW wheat prices saw their highest one-day climb since October 31st, and the highest close since the beginning of 2023. Other factors being watched in the wheat market include winterkill numbers for the U.S. winter wheat crop thanks to the surprisingly cold February weather, and, despite higher production globally, smaller inventories of higher quality milling wheat.

Despite the reality they are well behind last year’s export sales AND shipments, the USDA didn’t change their forecast for American corn exports in this month’s WASDE, which was surprising to most. The thinking is that things might pick up, thanks to the smaller crop in Argentina, which the USDA felled by 5 MMT to 47 MMT. Next door, the USDA didn’t change their Brazilian corn crop estimate despite, because of harvest rains, Brazilian farmers are behind in getting their second, safrinha corn crop planted. This could be concerning as, the longer the delay, the more likely the crop will be in its pollination period during the driest / hottest time of the year (read: not good for yields). On the soybean side of things, the USDA kept the Brazilian harvest at a record 153 MMT, but dropped Argentina’s harvest by 4.5 MMT to 41 MMT. For comparison, local analysts, Buenos Aires and Rosario Grain Exchanges are currently estimating an Argentine soybean crop of 38 MMT and 34.5 MMT, respectively, so maybe there’s more cuts the USDA will make.

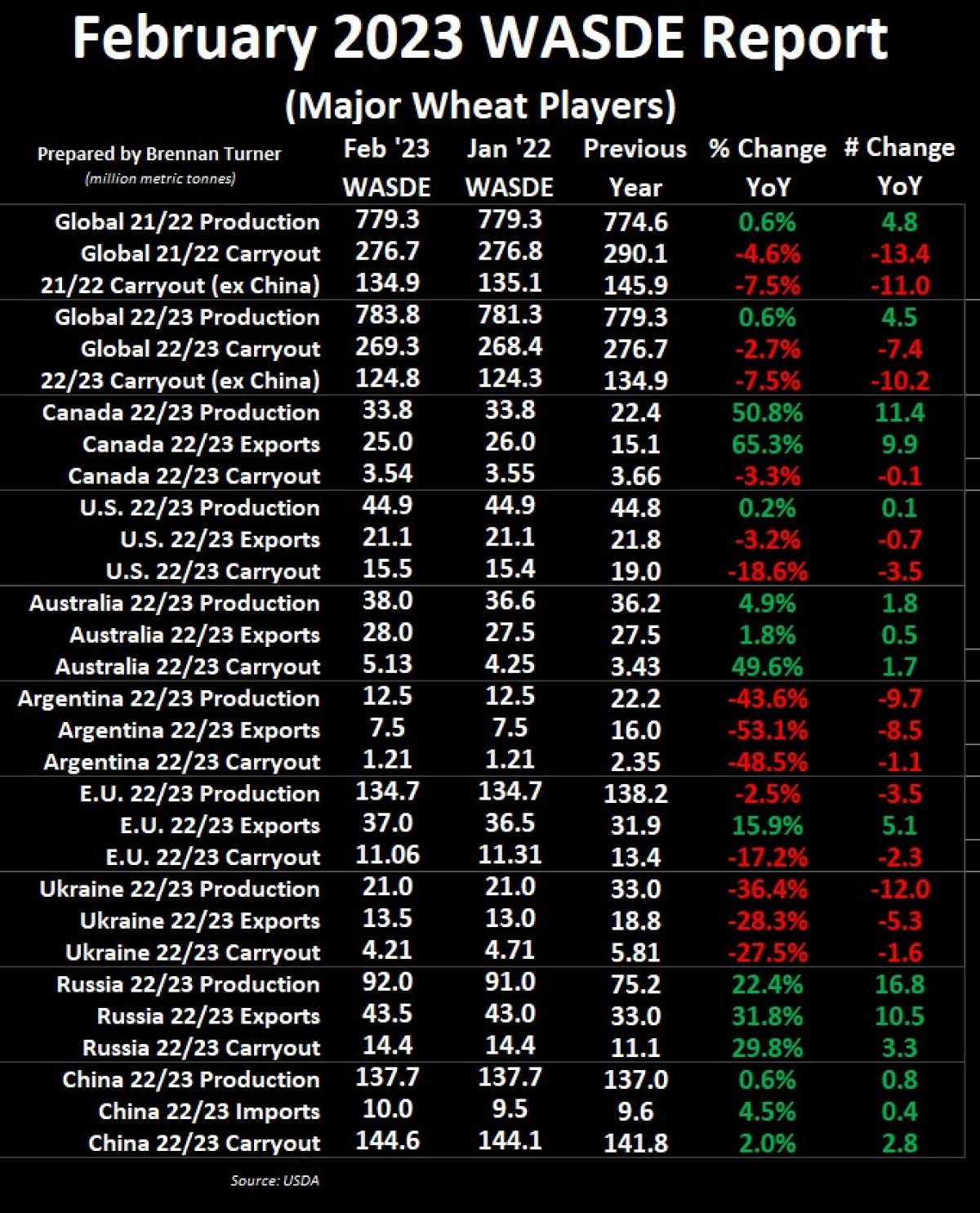

Coming over to the wheat side of the WASDE, the USDA was actually a bit bearish, thanks to production increases in Australia and Russia, but that was offset by some higher trade and feed use in Canada and the EU. In the Land Down Undaa, the Aussie wheat harvest was raised by 1.4 MMT to 38 MMT, which matched local estimates and confirmed the 3rd straight year of a new record for wheat output by the country. Australian wheat exports were also raised by 500,000 MT to sit at 28 MMT, which would also be a new record. EU and Ukrainian exports were also raised by 500,000 MT each, the latter of which was surprising for me to see (more on why below). In Russia, 2022/23 wheat production was raised to 92 MMT, which is still below what many other analysts believe was a 100 MMT crop, but the USDA did acknowledge the improved rate of exports, so increased their shipments by 500,000 MT to 43.5 MMT.

Overall, global wheat ending stocks remain the lowest since 2016/17 and depending what happens in Ukraine in the next few months, could continue to drop lower. The Ukrainian Ministry of Agriculture said last week, that about 97% of the 2022/23 wheat crop had been harvested, bringing in 20.2 MMT, which is slightly below the USDA’s estimate of 21 MMT. Similarly, 93% of Ukraine’s corn crop has been cut, for a total haul of 26.4 MMT, which is, again, slightly below the USDA’s 27 MMT forecast. Going forward though, production expectations in Ukraine are up in the air with everything from shortages of labour and crop inputs to trying to run equipment on nearly $10 CAD/litre diesel is creating challenges for farmers across the country.

Coming home, the USDA lowered Canadian total wheat exports (including durum) by 1 MMT to 25 MMT, but offset this by raising domestic feed use by the same amount to keep carryout at 3.54 MMT. In contrast, Agriculture Canada believes we’ll ship out just under 24 MMT of wheat in 2022/23, so does the USDA need to come down, or does AAFC need to come up? With 10.3 MMT of non-durum wheat and 2.8 MMT of durum already sailed through Week 27, things are tracking well above the average and it’s likely we’ll end up somewhere between 24 and 25 MMT. The only thing I could see slowing Canada’s wheat shipments down though in the last 5.5 months of the 2022/23 season is if either the U.S. Dollar suddenly weakened and American exports rallied, or demand started to soften because of high prices. In my opinion, the former is very unlikely, but we might see a slowdown as we get closer to the Plant 2023 campaign, with buyers getting even more hand-to-mouth. As usual these days though, any slowdown of grain movement from Ukraine could quickly make prices less important than just ensuring supply.

To growth,

Brennan Turner

Independent Grain Market Analyst