WASDE Surprise Yields Verses a Weaker Greenback

Grain markets experienced some major selling this week, mainly after the USDA’s November WASDE report surprised the market with some slightly bigger crops. Specific to corn and soybeans, the USDA raised the average U.S. national yield by 0.4 bushel per acre to 172.3 and 50.2, respectively. The selling might’ve been worse, had it not been for the U.S. Dollar having a terrible week, including its largest two-day loss (percentage-wise) since March 2009, dropping nearly 4% between Thursday and Friday. Inherently, this makes U.S. crops cheaper for international buyers, but the USDA didn’t really acknowledge anything on the U.S. corn export front, which is well behind its normal pace, and therefore also bearish. That said, China walking back on some of its zero-COVID policies helped improve the outlook for demand from the world’s largest consumer of commodities.

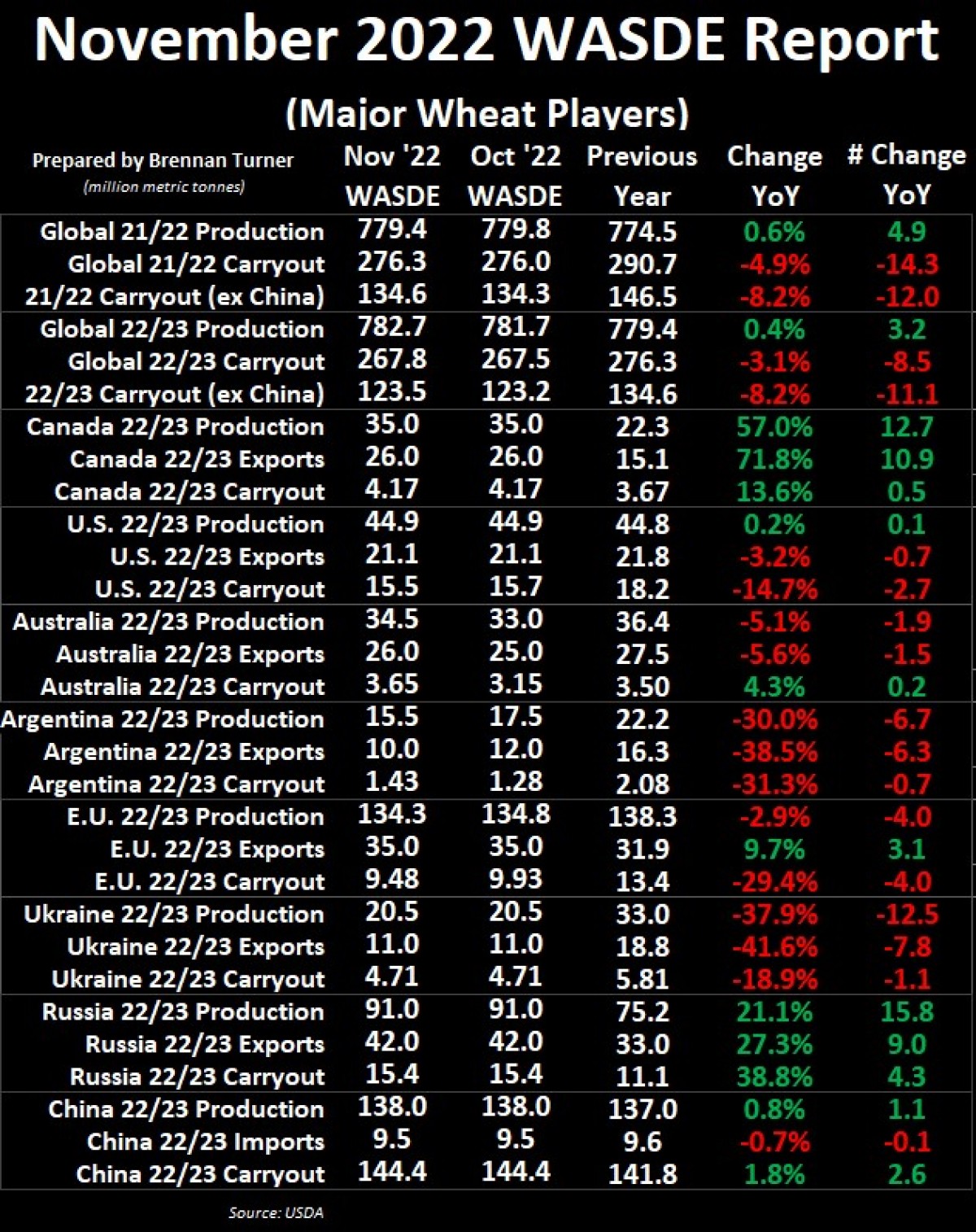

There wasn’t too much changed on the wheat side of things though in the November WASDE report. Only three (3) players saw balance sheet updates this month: Argentina’s crop got downgraded, Australia’s has larger harvest expectations, and the EU’s production was lowered by 500,000 MT. Digging in, the USDA felled Argentina’s wheat harvest estimate by another 2 MMT to 15.5 MMT. This follows local player, Buenos Aires Grains Exchange lowering its outlook last week from 14 MMT down to 12.4 MMT, pointing to late October and early November frosts in southern areas as a main reason. While Argentina’s wheat production forecast was sitting above 20 MMT at the beginning of the year, if these smaller production forecasts are realized, it would be the smallest crop in 7 years. This means less exports, something that other major players will need to make up for. The good news is that the region is expected to get some much needed heavy rains over the next few days, that’ll only help the soybean crop that will be planted soon.

In the Land Down Under, despite a delayed start, Western Australian producers are taking off a record 24 MMT harvest of all grains this season, including 12.6 MMT of wheat. Combines are just starting to hit the fields, and while some late-season rains won’t help quality taken off in all paddocks, it does explain the USDA’s production increase. While Western Australian wheat is lower protein and so doesn’t usually compete with Canadian HRS wheat exports, Eastern Australia’s hard and premium wheat do, but quality remains an issue. Growers in the region are slashing through fields that have been inundated with heavy rains the last few weeks, which is also negatively impacting logistics, and pushing the price for feed grains lower. On the flip side, if you do take off kernels that are dry and of decent protein, the sentiment is “wait-and-see” across the board, so not a lot of milling quality is making it to market yet in the area.

Speaking of wheat making it to market, the agreement between Ukraine, Russia, Turkey, and the U.N. to let food exports pass safely through the Black Sea is set to expire on Saturday, November 19th. Despite Russian military operations retreating out of Kherson last week (the largest regional capital in eastern Ukraine), Moscow is continuing to push back on the grain deal being renewed, demanding some of the sanctions on its own agricultural exports be relaxed. More acutely, Russian companies and shippers don’t have “easy” access to trade financing, insurance, and even ports, and so their own grain and fertilizer shipments are somewhat blocked. One of the biggest sticking points for Putin and Co. in their negotiations in Geneva last week was for major Russian agriculture lender, Rosselkhozbank, be re-connected to the global SWIFT payments system, which they argue would help “stabilize prices” for food and fertilizer.

Ultimately, between the talks in Geneva and the G20 Summit in Bali this week, there’ll likely a lot of rumours swirling, which means more volatility in the markets. Also happening this week is the Alberta Wheat Commission’s regional meetings in Lethbridge, Acme, and Lacombe, where I’ll be and presenting my deeper perspective of grain markets, followed by Westlock, Vegreville, and Rycroft next week. If you’re able to join us in the next 2 weeks, I’d certainly encourage you to do so, as not only will you get my perspective on exactly when I’m looking to time my next sales over the coming months, but you’ll also hear from some other great presenters.

To growth,

Brennan Turner

Founder | Combyne Ag