WASDE, Weather and Black Sea Trade Risk

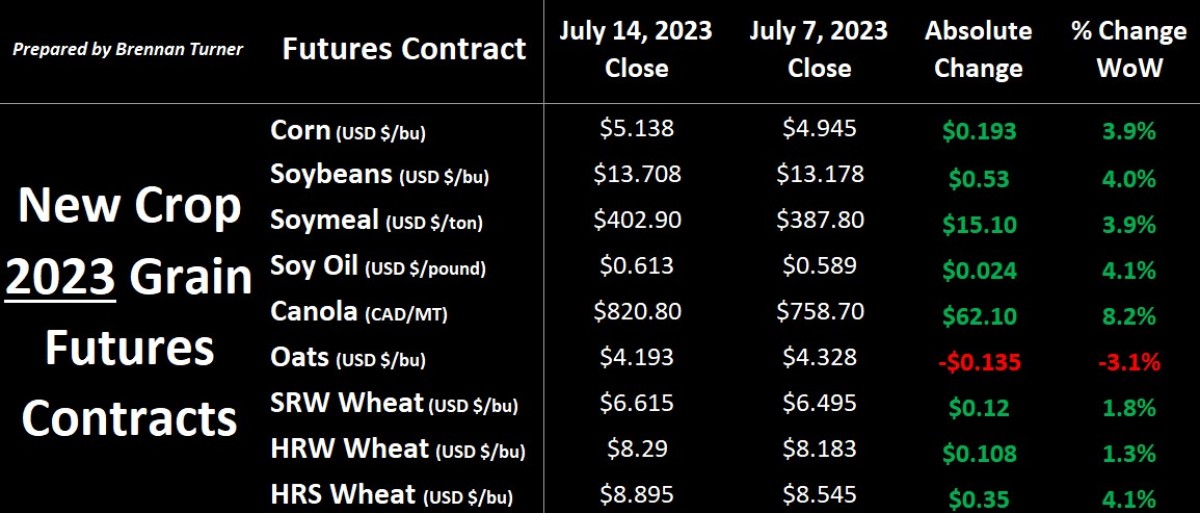

Grain markets added some weather and trade premium to finish the second week of July as subdued USDA estimates gave way to yield concerns and Russia pulling out of the Black Sea Grain Deal. The latter was confirmed by the Kremlin on Monday, July 17th, the date the agreement was set to expire, and so the market is starting to price this in, as it hasn’t really done so until Friday (NOTE: previous agreements have been renewed and risk premiums added before the renewal date were quickly erased so traders may not have been as interested to price in the risk ahead this renewal date). Add in that a bridge connecting the annexed region of Crimea to Russia being blown up over the weekend, and the ongoing drier weather in the U.S. Northern Plains and Canadian Prairies, we’re likely to continue to see volatility to the upside for grain prices in the coming weeks and months.

With the news that Russia is out of the Black Sea Grain Deal, the market is likely to see more corn and wheat short-covering and hedges lifted, which is already helping push values higher at the time of writing. Despite demands by Russia to have its food and fertilizer export needs, as part of the agreement, to finally be recognized, Russia still exported a record amount of wheat in 2022/23. However, the simplicity of trade has been hampered by Western sanctions on logistics, insurance, and payment, the latter exacerbated by Russia’s removal from the SWIFT payment processing infrastructure. The Black Sea Grain Deal allowed safe passage of grain from three Ukrainian ports, but inspections have slowed from the peak of 11 boats per day in October to just over 2 ships each day in June. Similarly, October saw a peak of 4.2 MMT of Ukrainian grain exported to a low of just 1.3 MMT in May (roughly 2 MMT did get exported in June but that was a function of larger boats being loaded, not necessarily more).

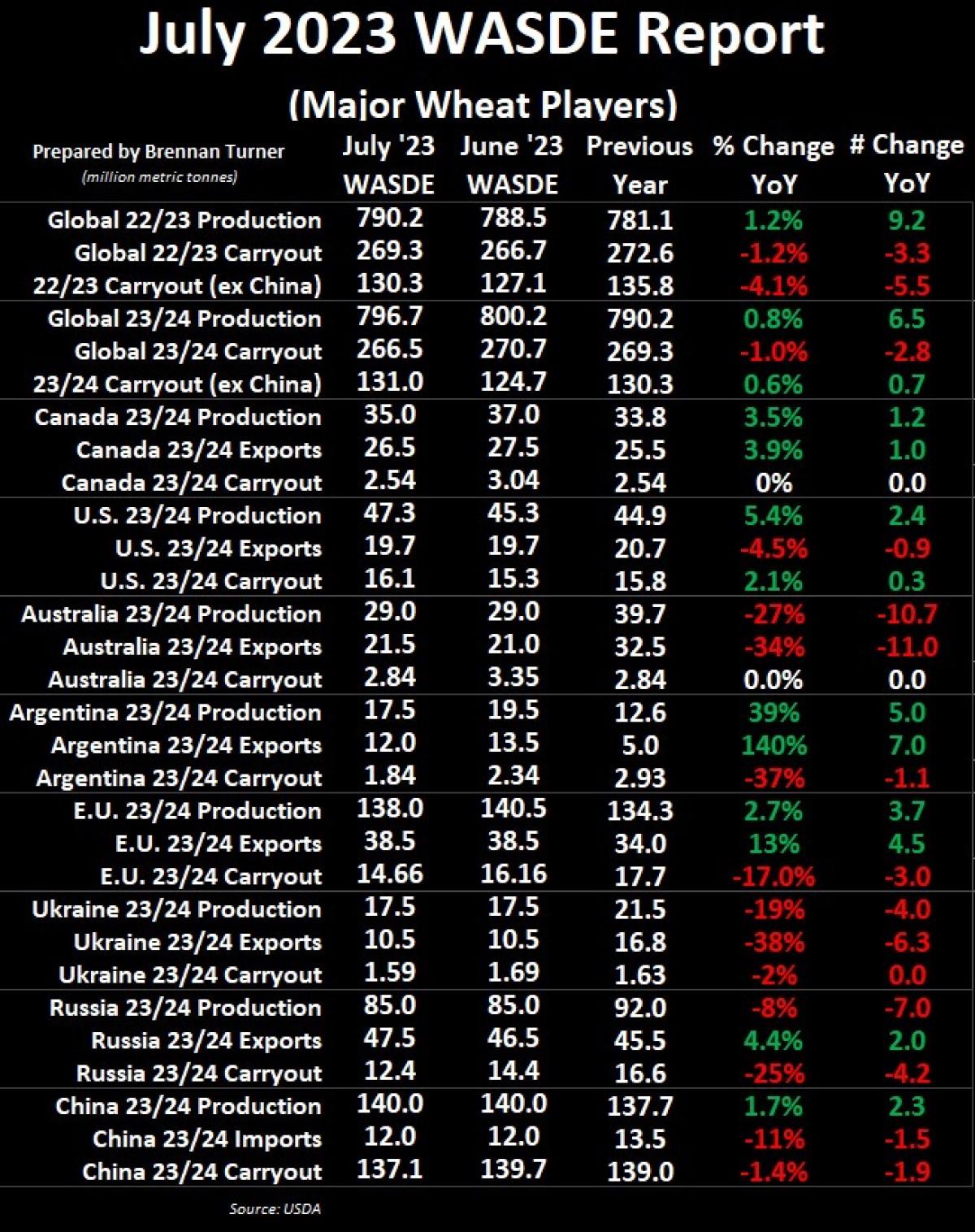

On that note, the USDA likely accounted for some of the expected slowdown in Ukrainian grain exports in their monthly WASDE report, published on Wednesday, July 12th. In it, they pegged Ukraine’s 2023/24 new crop wheat exports at 10.5 MMT, about one-third less than 2022/23’s wheat exports of 16.8 MMT, but this is also a reflection of the fact that Ukraine won’t produce as much as it did last yera. Also in this July WASDE, the USDA lowered their forecast for Canadian, Argentine, and EU production on account of mostly drier growing conditions. For the EU, persistent hot temperatures (35 Celsius and higher) has reduced wheat yield prospects in Spain, France, Italy and Germany for a total production downgrade of 2.5 MMT. In Argentina, a smaller seeded area meant their production forecast was lowered by 2 MMT to 17 MMT, while Canada’s wheat harvest estimate was lowered by the same amount to 35 MMT on account of the drier weather (more on this at the end of the column). From a global summary though, at 266.5 MMT in global inventories to end 2023/24, this would the fourth consecutive year of supply declines.

Thanks to higher harvested acres (+600,000 in the updated June acreage report) and average yields climbing by 1.2 bushels per acre to 46.1 bu/ac, total U.S. wheat production is actually slightly higher than last year. That said, because of a few straight years of drought conditions, U.S. hard red winter (HRW) wheat inventories are likely to be at their lowest level in 16 years, despite the fact that HRW food use demand is likely to the smallest in more than 20 years, and exports are the lowest since record-keeping of wheat demand by class type started all the way back in 1973. As it relates to Canadian wheat, U.S. durum saw the biggest revisions, with production estimated at just 54M bushels (or 1.62 MMT), a decline of 10M bushels or 16% year-over-year. For hard red spring wheat, the balance sheet looks fairly similar to a year ago with 12 MMT produced, and 4.2 MMT in ending stocks. Overall, U.S. total wheat supplies are expected to climb slightly by 300,000 MT to 16.1 MMT.

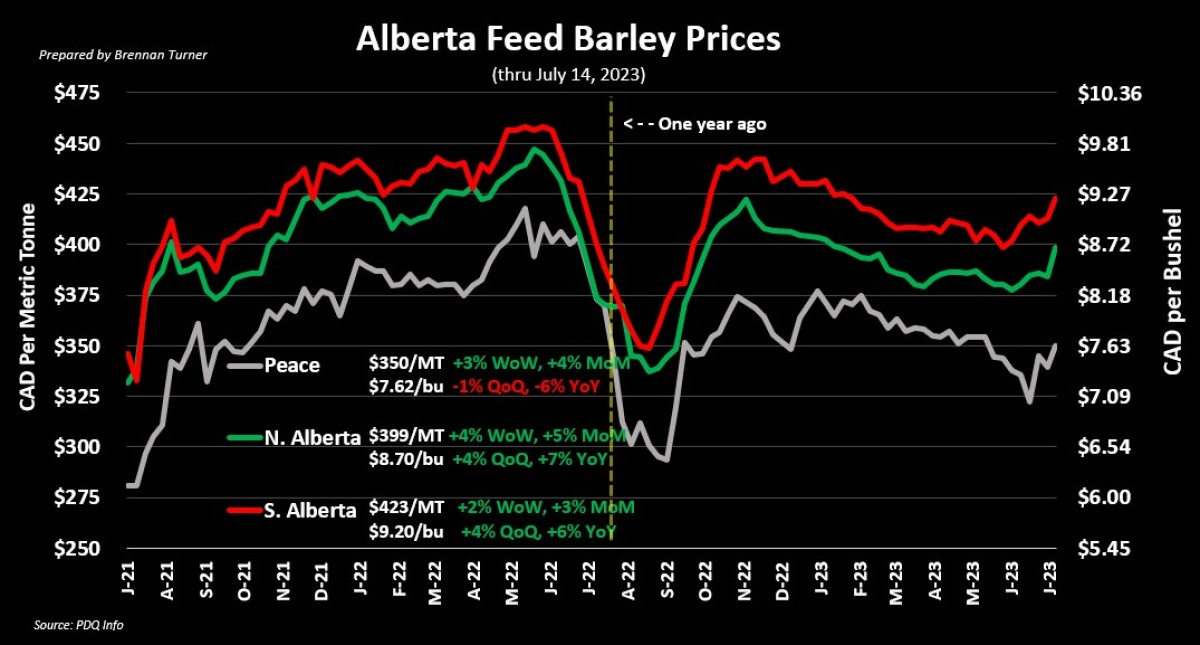

More broadly, since corn dominates the airwaves after reports like the UDSA WASDE, most of the focus is on yield potential and how weather to date is playing a role. In this month’s WASDE, the USDA accounted for the extra 2.1M acres of corn suggested in their June 30 acreage report, but lowered yields by 4 bushels to 177.5 bu/ac, which, if realized, would still be a new record! However, the weather so far in 2023 has mirrored that of 2012, which suggests that the USDA will continue to whittle down yields, which arguably would be front-led by higher weekly closes over the summer. This translates to potentially higher corn prices, theoretically raising all boats in the feed grain category.

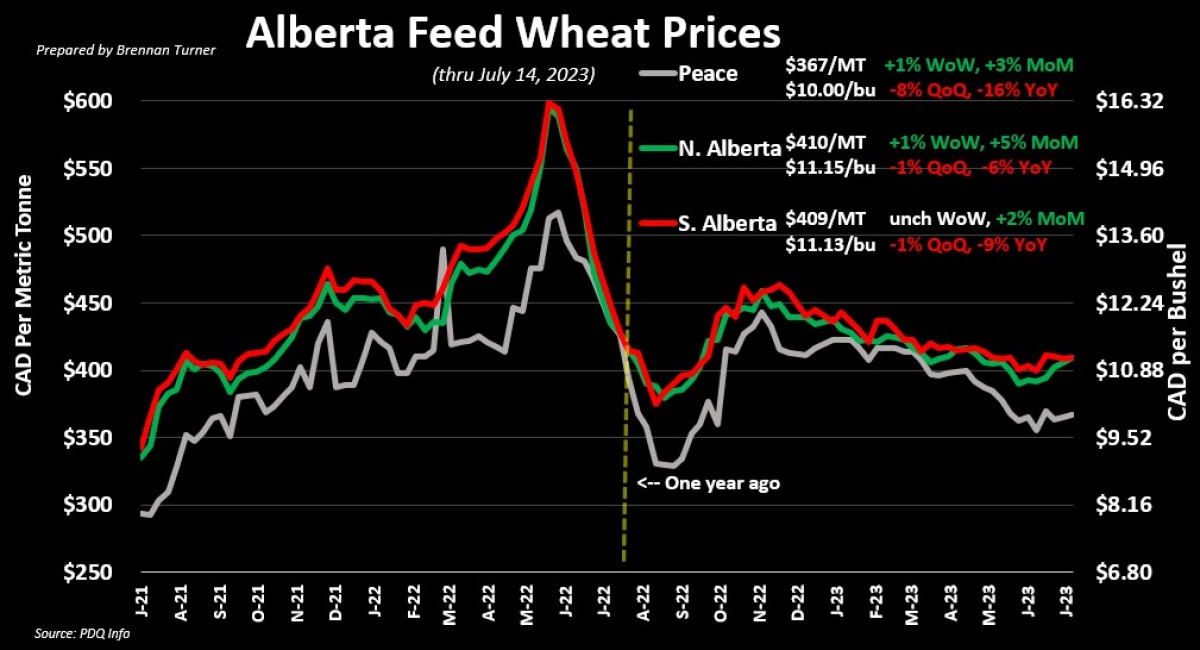

On that note, there’s potentially more Western Canadian crops headed to the feed category because of the lack of good rains in many areas. Drew Learner, from World Weather Inc., is expecting the trend of below normal rainfall and above-average temperatures will continue through the end of July. Even when moisture events do materialize, Drew Lerner predicts that “we will lose all of that moisture in a day or two” because of the persistently hot weather. Thus, we’re starting to see weather risk premiums get added in to a lot of Western Canadian crops’ prices, but especially the feed category, with buyers’ mindsets going from “not concerned” to “need confirmed coverage” in just a few weeks. Therein, referencing the charts below, I would suggest looking at the summer and fall periods from 2 years ago as to when highs were made in the market after the 2021 drought-riddled harvest, and plan sales accordingly around those timeframes.

To growth,

Brennan Turner

Independent Market Analyst