Weather Beats Dull June WASDE

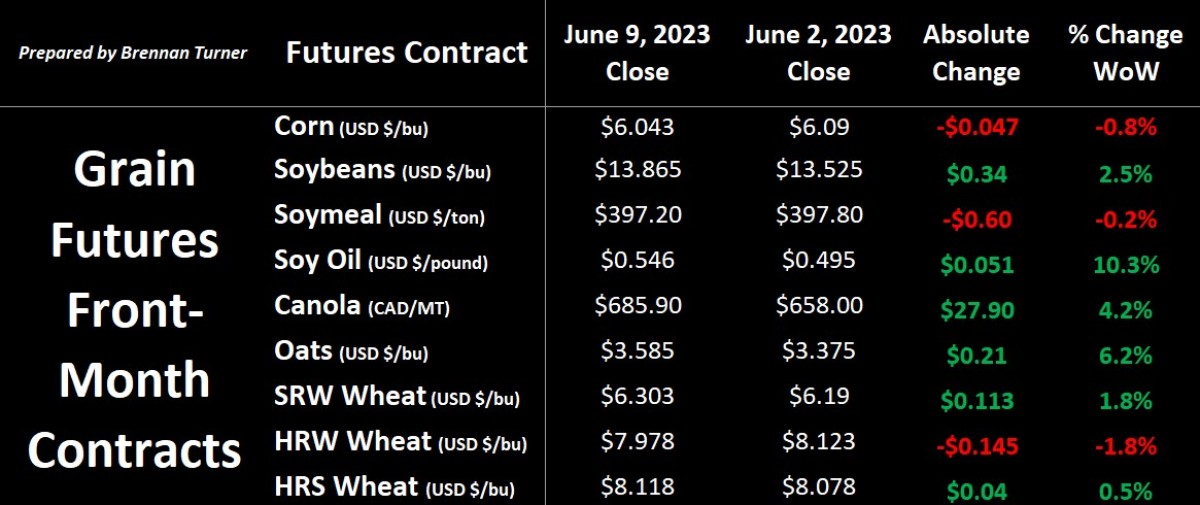

Grain markets were mostly green in the first week of June as a relatively neutral monthly WASDE report quickly gave way to weather trade again. Corn and HRW wheat were the losers for the week because of weaker demand for the former and a slight upgrade in yield projections for the latter supported the bearish pressure. Despite this, the market didn’t turn dramatically lower, suggesting that a weather premium is still being baked into current prices. That said, with the relatively benign conditions across the Canadian Prairies, we have seen more impact on cash prices than what the futures markets are suggesting (more on this at the end of this week’s column). Also worth noting is that the NOAA officially declared the arrival of El Nino last week, and so, staying with this weather theme, more focus will be on if the weather patterns change, the rains disappoint, and, thereby, if we’re trending closer to 2012 or, conversely, another big year of production. Nonetheless, we should still be cognizant that crop conditions today don’t correlate very well with final yields and that there is some demand destruction for U.S. exports, which will be felt on the futures board (eventually).

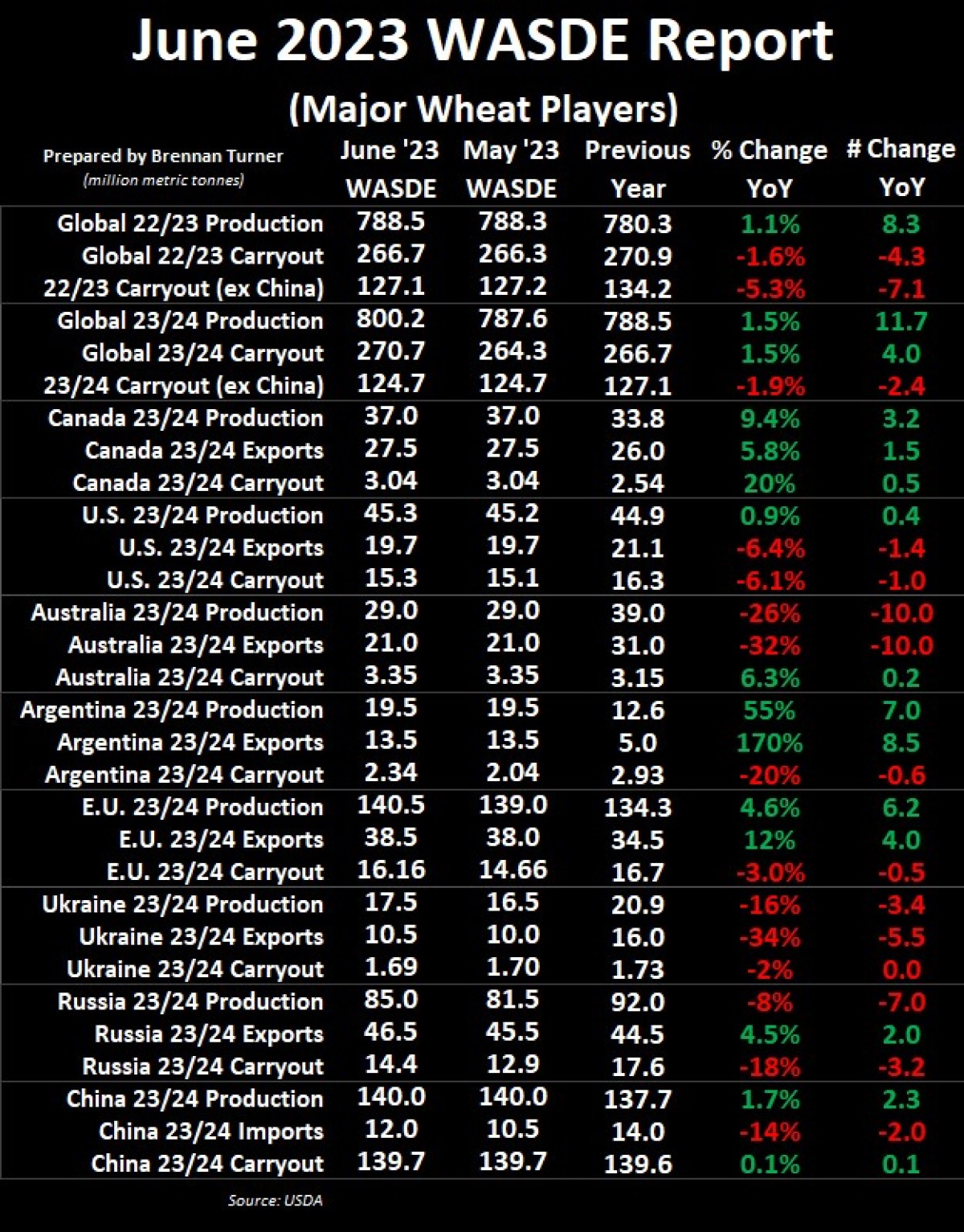

Staying with the WASDE, going into the USDA’s print last Friday, most market participants were expecting a snore fest from the USDA, as the major in-season update is in July after plugging in the June 30 Acreage and Stocks report numbers. Thereafter, U.S. yields aren’t usually changed dramatically until the August report so let’s remember that it’s still the first half of June but again, it’s unlikely that the market is trading, for example, the full 181.5 bu/ U.S. corn yield the USDA is forecasting. The U.S. wheat balance sheet was relatively unchanged with just HRW ending stocks lowered by 5M bushels on exports being raised by the same amount, while white wheat inventories were raised by 5M bushels on account of lower exports by the same amount. In next month’s July WASDE report, we’ll get the USDA’s first official estimates of the 2023/24 U.S. wheat balance sheet, but with the all-wheat yield increased to just under 45 bushels per acre, this is still below last year.

Looking abroad, bigger crops in Russia, Ukraine, India, and the EU, Black Sea, and India were printed in the June WASDE compared to last month, by 3.5 MMT, 1 MMT, 2.5 MMT, and 1.5 MMT respectively. The Black Sea and EU got upgraded on the more favourable spring growing conditions they’ve experienced, but we should be aware that India is unlikely to export much of what they grow as they look to replenish inventories. Ukraine’s numbers are likely to change (shocker) as there’s no way the USDA accounted for the Kakhovka Hydroelectric Station getting blown up last week. This is important for Canadian farmers because this dam supplied water for 31 irrigation systems across nearly 1.5M acres in Ukraine, which is usually responsible for about four per cent of all Ukrainian grain, oilseed, and pulse crop production. Without the water, many talking heads believe the land will recline back to desert-like conditions and best guesstimates are it will take at least three years to rebuild the dam. Finally, the USDA also recognized the heavy May rains in China’s major wheat-producing provinces, increasing their feed use number while also increasing imports by 1.5 MMT to 12 MMT. Otherwise, like most of the June WASDE report, there weren’t many changes to the wheat balance sheet.

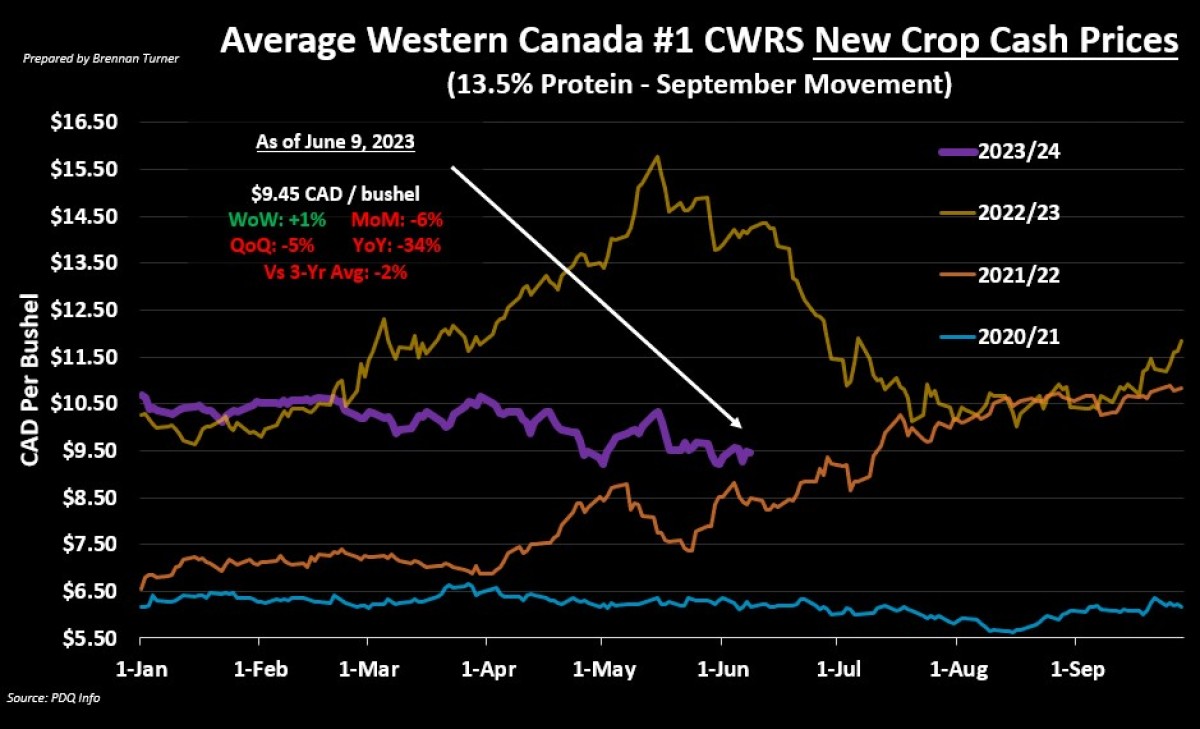

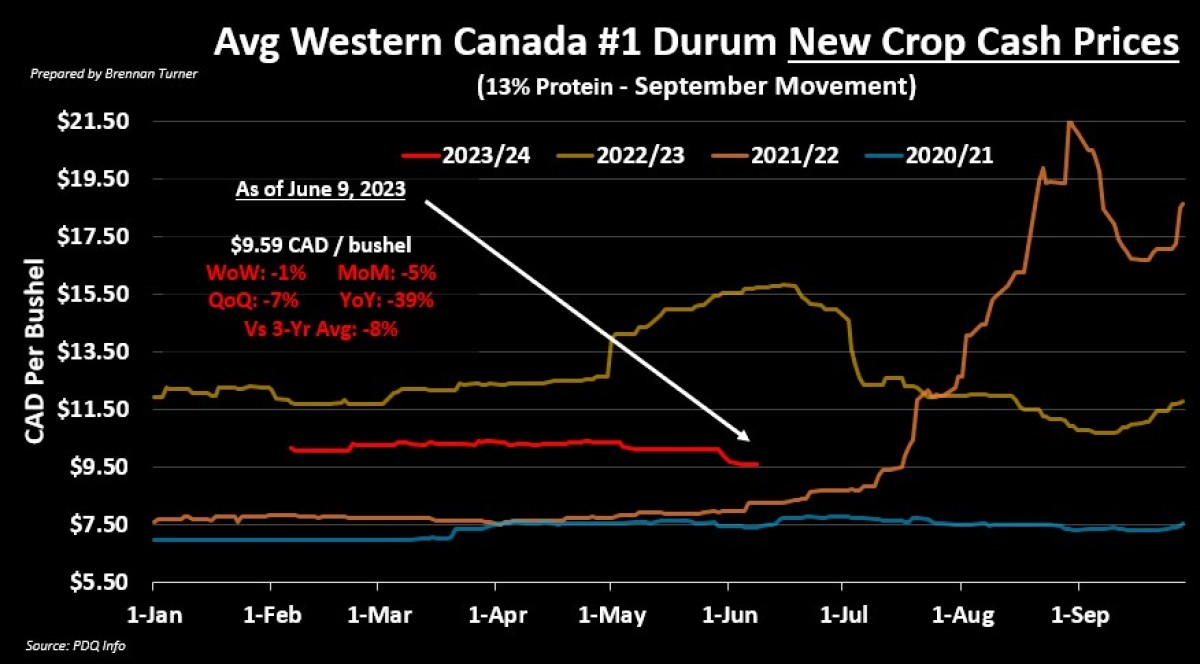

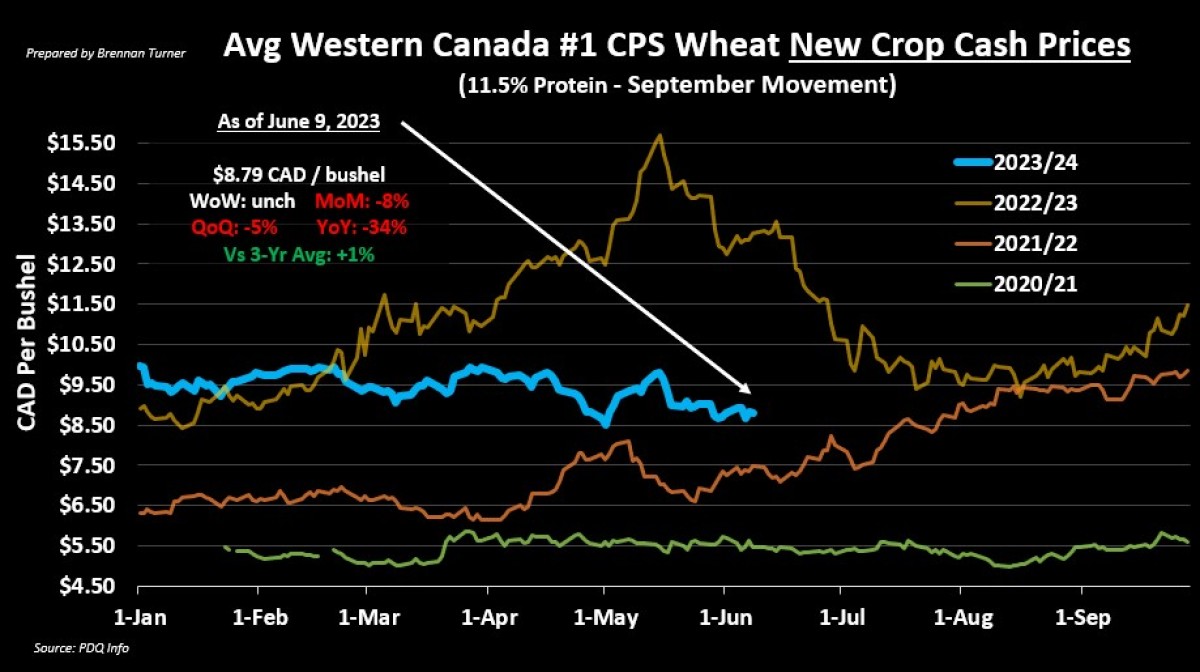

Coming back home, with the wheat crop planted and decent moisture and heat to help get things going, new crop values are started to pull back for all three major types we track. For HRS and CPS wheat, we’re well below last year’s highs at this time, and, in my opinion, could be tracking more like the 2020/21 price activity in the charts below. Why? Well, despite the decent demand, supplies are become more validated with each passing week, and as such, production risk premium starts to fade from the market. For durum, average Western Canadian new crop cash prices fell below $10 CAD/bushel which, again, feels like 2020/21, but I’m cognizant of the usual downturn anyways in durum markets during the growing season (drought years aside!). All things being equal, I would expect more of this sideways-to-lower trading in the cash markets until the fall, save for any major changes to the war in the Black Sea or China’s real wheat import needs!

To growth,

Brennan Turner

Independent Grain Market Analyst