Welcome to Wheat Marketing in 2023 to 2024

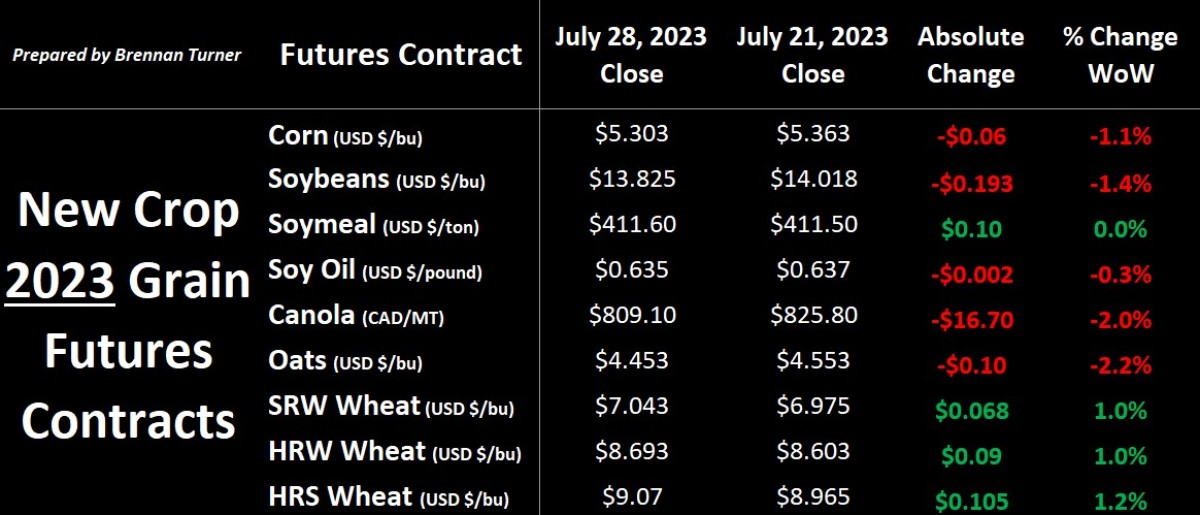

Grain markets started the last full trading week of July with the bulls firmly in the driver seat, thanks to dryness concerns and Russia targeting Ukrainian shipping infrastructure. While Chicago SRW wheat went limit up for nearly two straight days and most of the complex following, the strength couldn’t last the week, with selling seen Wednesday through Friday. Part of the bearish strength was from the NOAA’s forecast for up to an inch of rain for most Midwest and Northern Plains, despite some triple-digit temperatures in some U.S. production areas last week and through the weekend.

Even though a lot of uncertainty remains in the Black Sea, uncompetitive U.S. grain prices, and thereby, limited international demand also helped drive futures down. I don’t think there will be any peace talks soon in the Black Sea, unlike many analysts who are talking about it. It would only happen if the financial and logistical sanctions on Russia are relaxed, with the Kremlin this week declaring a new declaration that international buyers can open special Russian currency accounts to pay for Russian goods in roubles.

In other international news, the EU cut their soft wheat output by 2.5 MMT to 126.4 MMT, with Agritel suggesting that France, the EU’s largest producer, will see a 34.8 MMT wheat harvest. This is slightly above average, but Agritel said “a total lack of rain from mid-May to mid-June strongly reduced the production potential…in the northern two-thirds of the country” leading to a loss of 2 – 3 MMT. For reference, the French Ag Ministry suggested a 35 MMT wheat harvest earlier in the July. On the flipside of the equator, healthy rains in Argentina have radically reduced the drought situation there and the recently seeded wheat crop is looking better than a year ago.

That is probably frustrating to hear if you’re a farmer in many parts of North America this year. While cooler nighttime temperatures are likely helping avoid disaster, as of last week, 59 per cent of American corn, 53 per cent of soybeans, and 43 per cent of the spring wheat fields are in an area of drought, up a few points for each, week-over-week, with analysts expecting another increase this week. From a crop rating standpoint, 49 per cent of the spring wheat crop was rated good-to-excellent (G/E), down two points on the week and nearly 20 per cent points below last year’s rating. That said, the U.S. Wheat Quality Council’s annual spring wheat crop tour last week suggested an average HRS yield of 47.4 bu/ac in North Dakota, which is slightly above the USDA’s estimate for state, and durum yields of 43.9, which is way above the USDA’s forecast of 34 bu/ac.

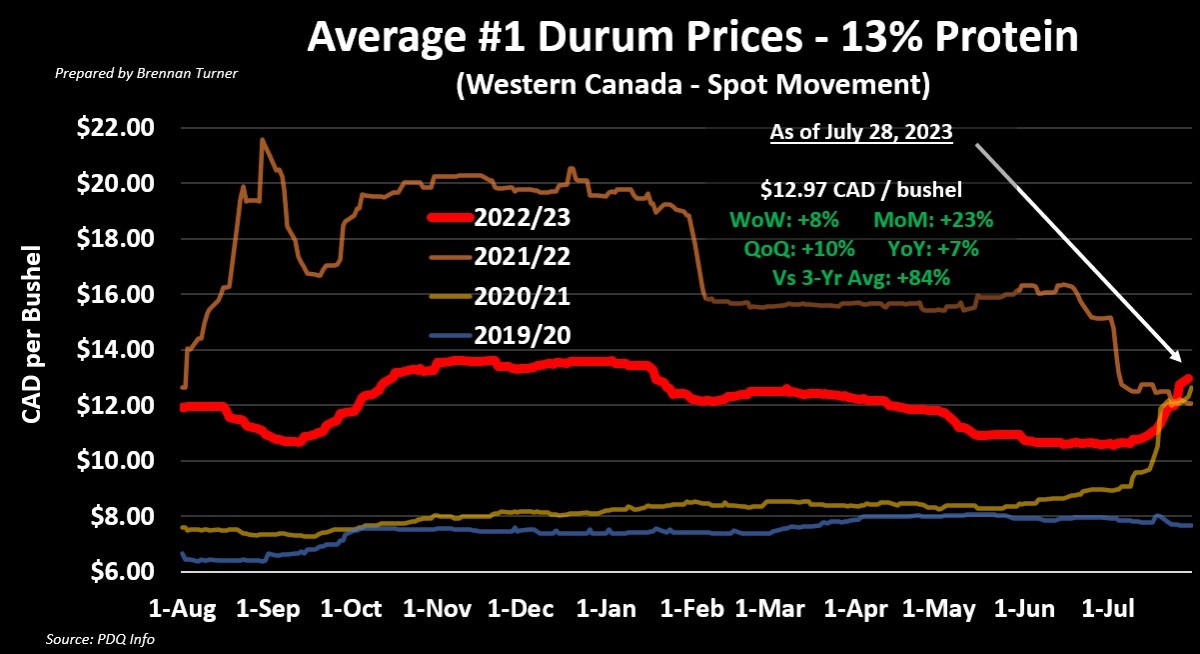

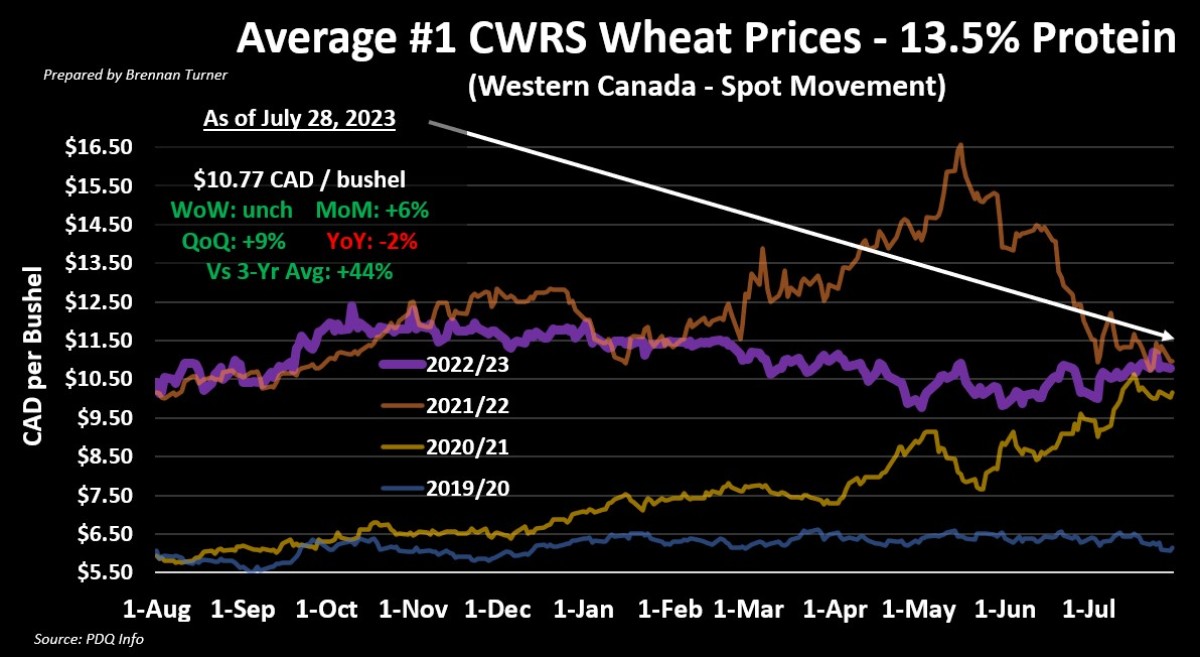

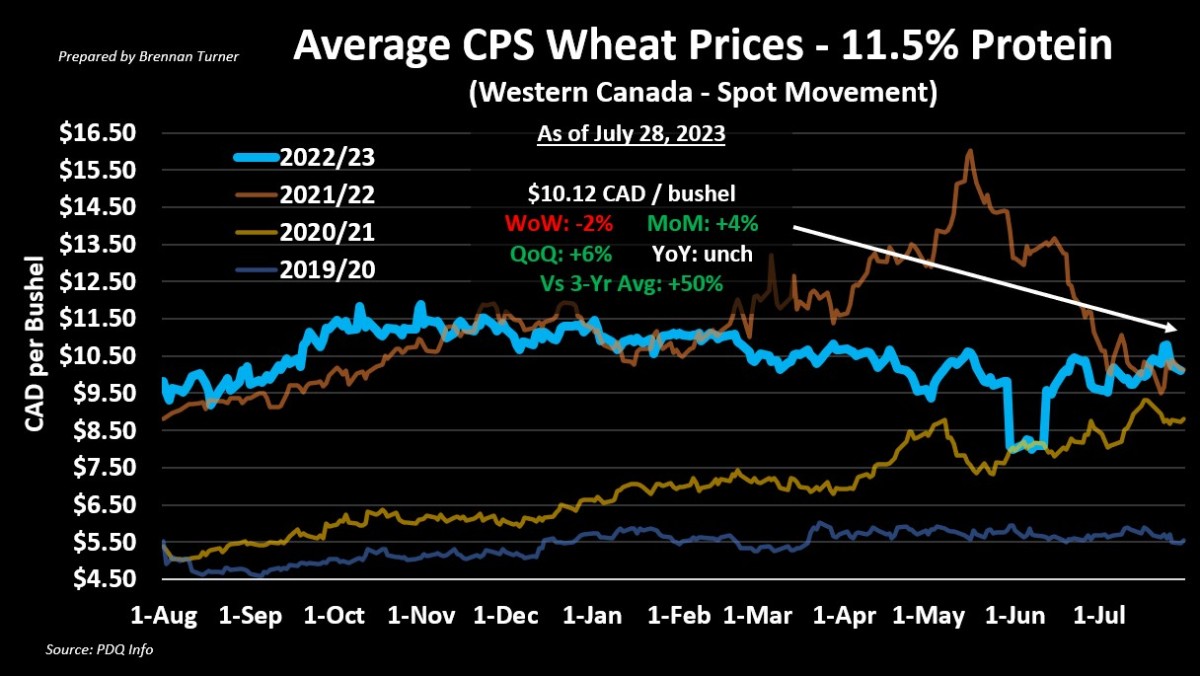

For Western Canada, my estimate is that at least 80 per cent of the Western Canadian spring wheat crop is facing some level of drought right now. In Manitoba, the large majority of the spring wheat crop there is rated good, with only excellent crop rated in NW corner of the province. Saskatchewan’s spring wheat crop rating last week saw 35 per cent of spring wheat rated G/E, down 15 points on the week, while durum dropped 10 points week-over-week to just 16 per cent rated G/E. In Alberta, 45 per cent of the spring wheat crop is rated G/E, while just 30 per cent of durum fields are in G/E shape, both a healthy clip better than the same time in 2021, when just 22 per cent of both Alberta’s spring wheat and durum crops were considered to be G/E.

Therein, while the comparisons to 2021 and even 2012 are there, we’re still a few weeks away from the yield monitors validating the concerns and that’s why I think we’re not yet seeing a price swing like we saw in 2021. As we officially flip the crop year into 2023/24 this week, I’m looking at the start of the 2021/22 crop year (the orange line in each of the charts below) for potential indications of best times to sell in the spot market. However, with some weather premium taken off the table, we may see more technical selling this week until there’s some risk built back into the trade ahead of the next WASDE report, out on Friday, August 11. That said, as futures could pull back, we might see basis widening for Canadian Prairie crops to reflect a flat to possibly higher cash price.

To growth,

Brennan Turner

Independent Grain Markets Analyst