Wheat Around the World

Surprise! WASDE Push Grain Markets Lower

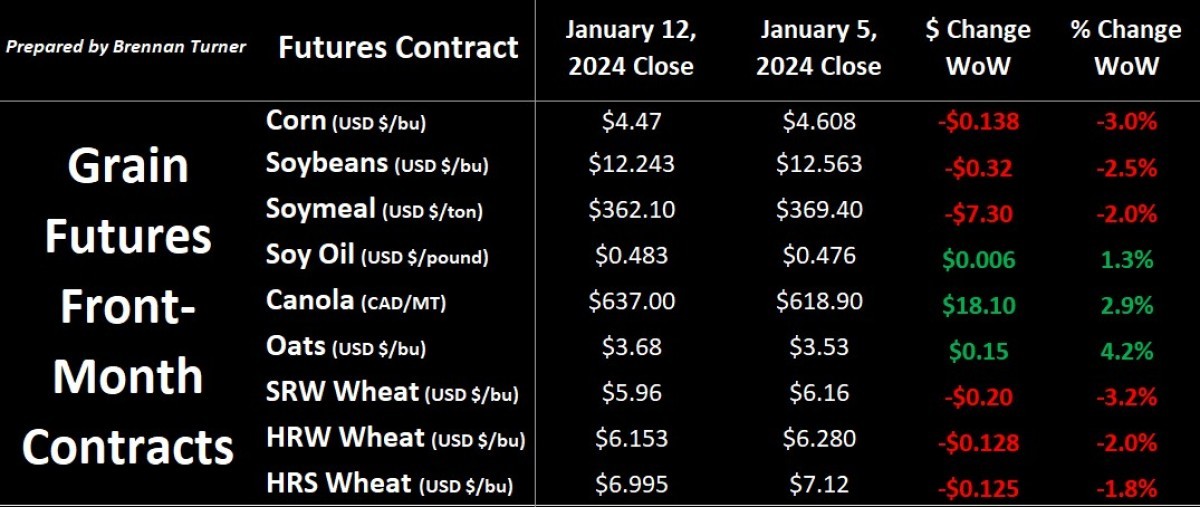

Grain markets were driven lower on Friday as larger-than-expected U.S. Grain balance sheet updates pushed the complex lower. Corn and soybeans hit new contract lows last week as they were pressured by surprise increases to U.S. national yields and smaller-than-expected production cuts in South America. Despite U.S. Winter Wheat acreage estimates coming in nearly 1.5M acres below what the market expected, all wheat futures followed corn and soybeans lower.

In this month’s WASDE report, the United States Department of Agriculture (USDA) pushed average national corn yields up by 2.4 to a new record of 177.3 bushels per acre, one of the most significant updates between the last two reports. The losses likely could’ve been more significant had it not been for harvested acres falling by 600,000, for a total production of more than 15.3 billion bushels, which is also a new record. Average American Soybean yields were increased by 0.7 to 50.6 bushels per acres, a major surprise to the market given that no one was expecting a shift, but harvested acres also dropped by 435,000, softening the blow. The increases were generally attributed to improved farming practices, seed genetics, and even the smoke cover from the Canadian fires this summer, which reduced the impact of the above-average temperatures during the growing season.

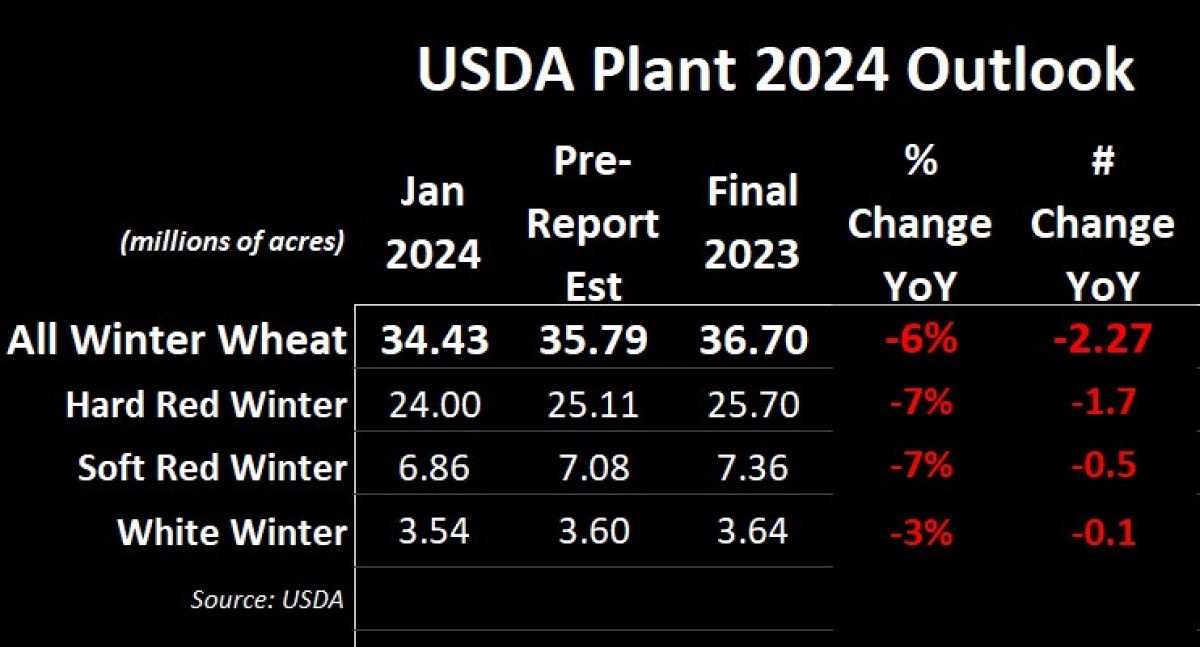

Forecasting Winter Wheat

Digging into the wheat complex, ideal fall temperatures had the market assuming an increase in winter wheat seeded, but the total area fell by almost 2.3M acres year-over, or about a 6 per cent drop. All three winter wheat classes saw a downgrade year-over-year, but the confidence was offset by the reality that more wheat (not including durum) was still available as of December 1. Ironically, only white wheat saw the USDA’s forecast for crop year-ending stocks fall, as total American wheat stocks for the end of 2023/24 were reduced by 300,000 MT to 17.6 MMT. The lower durum inventories are worth noting as we could see more Canadian exports move south, but the USDA did keep its year-end forecast of durum stocks at 17M bushels (or more than 462,000 MT).

Wheat Outlook in the Black Sea

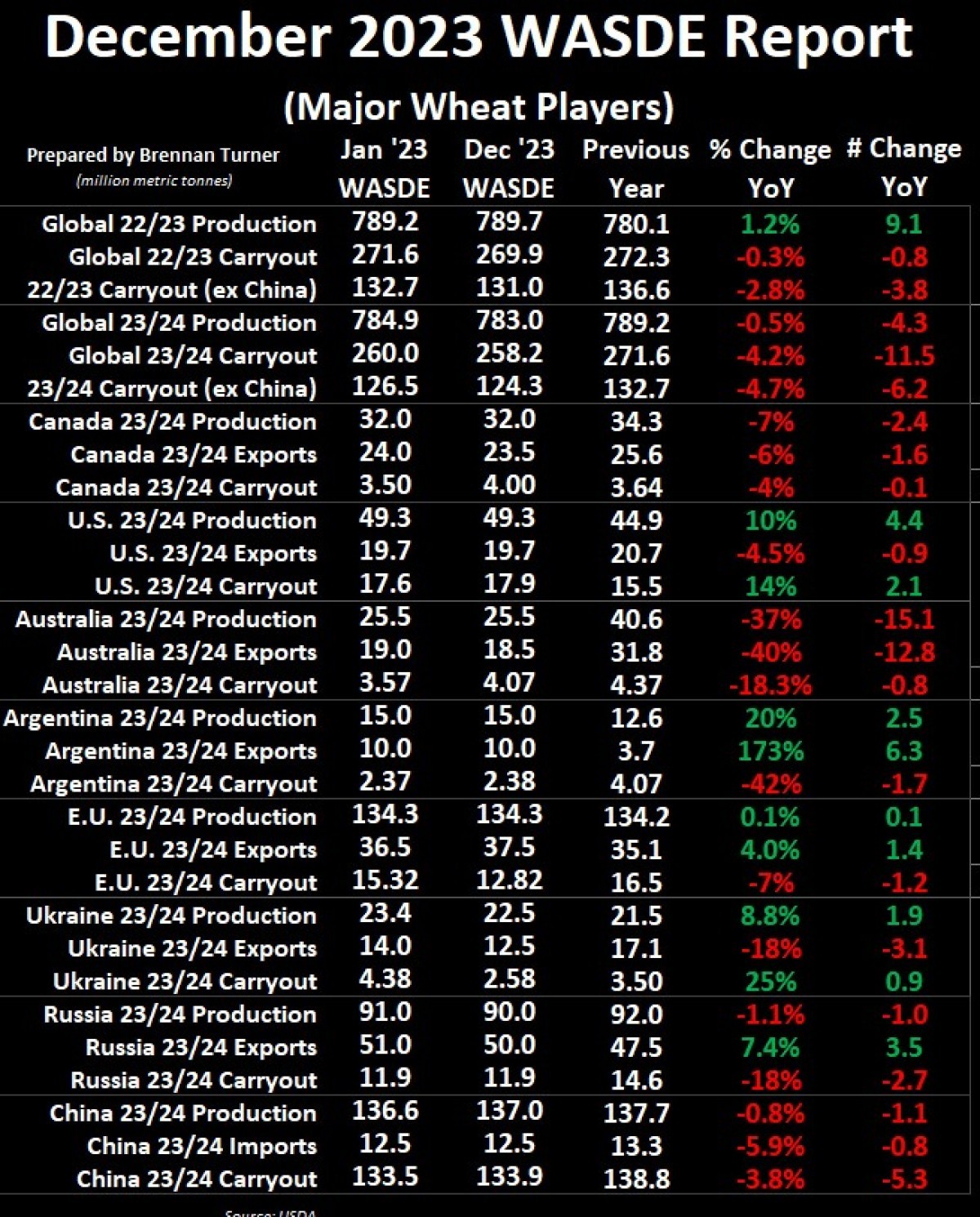

Internationally, observations from in this month’s WASDE Report, surprises came from the Black Sea, starting with Ukraine’s old crop ending stocks climbing 2.2 MMT to a new estimate of 3.5. With the extra carryover and an extra 900,000 MT production, Ukraine’s 2023/24 crop year carryout is now pegged at 4.4 MMT, up 1.8 MMT from the December estimate. Next door, Russia’s wheat harvest was raised by the USDA to 91 MMT, which was fed directly into the export column for a new record of 51 MMT in shipments.

Last week, the Russian government said the total wheat harvest was closer to 92.8 MMT, which was second to only last year’s record completion. Alongside their reporting, Russian Ag Minister Dmitry Patrushev confirmed that the country also produced 1.6 MMT of durum. Given the heavy pace of Russian durum exports this year, while they’ve banned further shipments until May, they expect to produce 2 MMT with forecasts for harvest in 2024. This suggests Russia’s foray into the durum trade this year is not a one-off.

Looking at Argentina, Australia, Canadian and European Union Wheat Production

European Union exports were lowered by 1 MMT, and combined with other demand reductions, ending stocks were raised by 2.5 MMT to 15.3 MMT.

Argentina saw no material changes to its balance sheet, but 500,000 MT raised Australia’s wheat exports to 19 MMT. The Aussie wheat inventories by the end of the current crop year should remain tight, however, at 3.57 MMT, up 500,000 MT from the last WASDE report.

At home, the USDA raised Canadian exports by 500,000 MT, but solid domestic demand lowered total wheat inventories (including durum) to 3.5 MMT, a drop of 500,000 MT month-over-month. I presume these numbers are possibly still slightly high. It’s also worth mentioning that the USDA raised Chinese corn production by almost 12 MMT, which points to fewer feedstuff imports, be it South American or American Corn, American Wheat, or Canadian Wheat and Barley.

At this point, we expect that any rallies will likely be met with farmer selling, which will be compounded by the reality that end users remain reluctant to move beyond any hand-to-mouth coverage. One of those rallies could come in the spring, should El Nino stick around and limit any substantial further snowfalls or spring rain.

Until the calendar flips to March, with the types of bearish headlines seen last week, it’s hard to fathom at what levels the rallies will occur.

I remain committed to making profitable sales in the upcoming weeks versus gambling on the uncertainty of what Mother Nature will provide in the future. That’s not to say I’ll be completely sold in the next few weeks, however I will be more comfortable moving to an 80 per cent sold position in wheat, and closer to 50 per cent in durum.

Finally, this column will be taking a hiatus next week and continue as a bi-weekly publication as we look to revamp the format and include increased barley commentary as part of the broader Alberta Grains organization’s portfolio.

To growth,

Independent Grain Market Analyst