Wheat Diverges with Profit-Taking

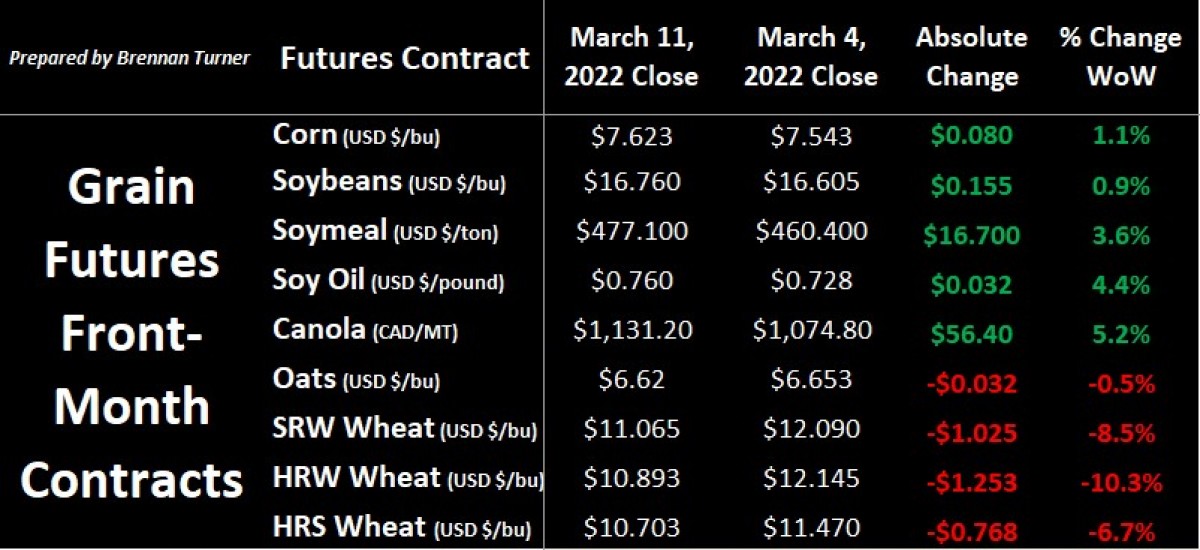

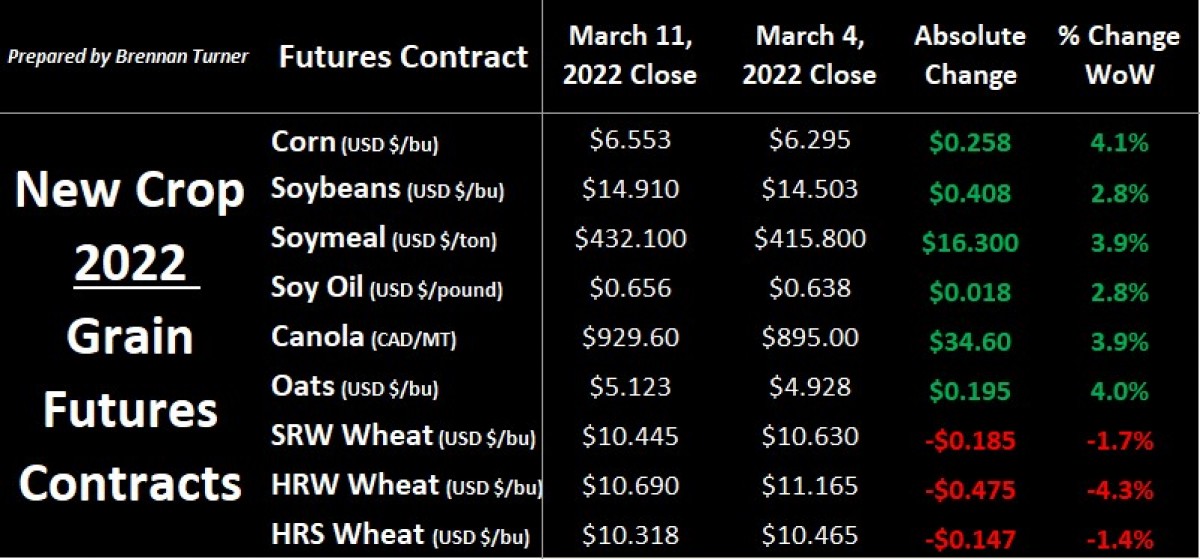

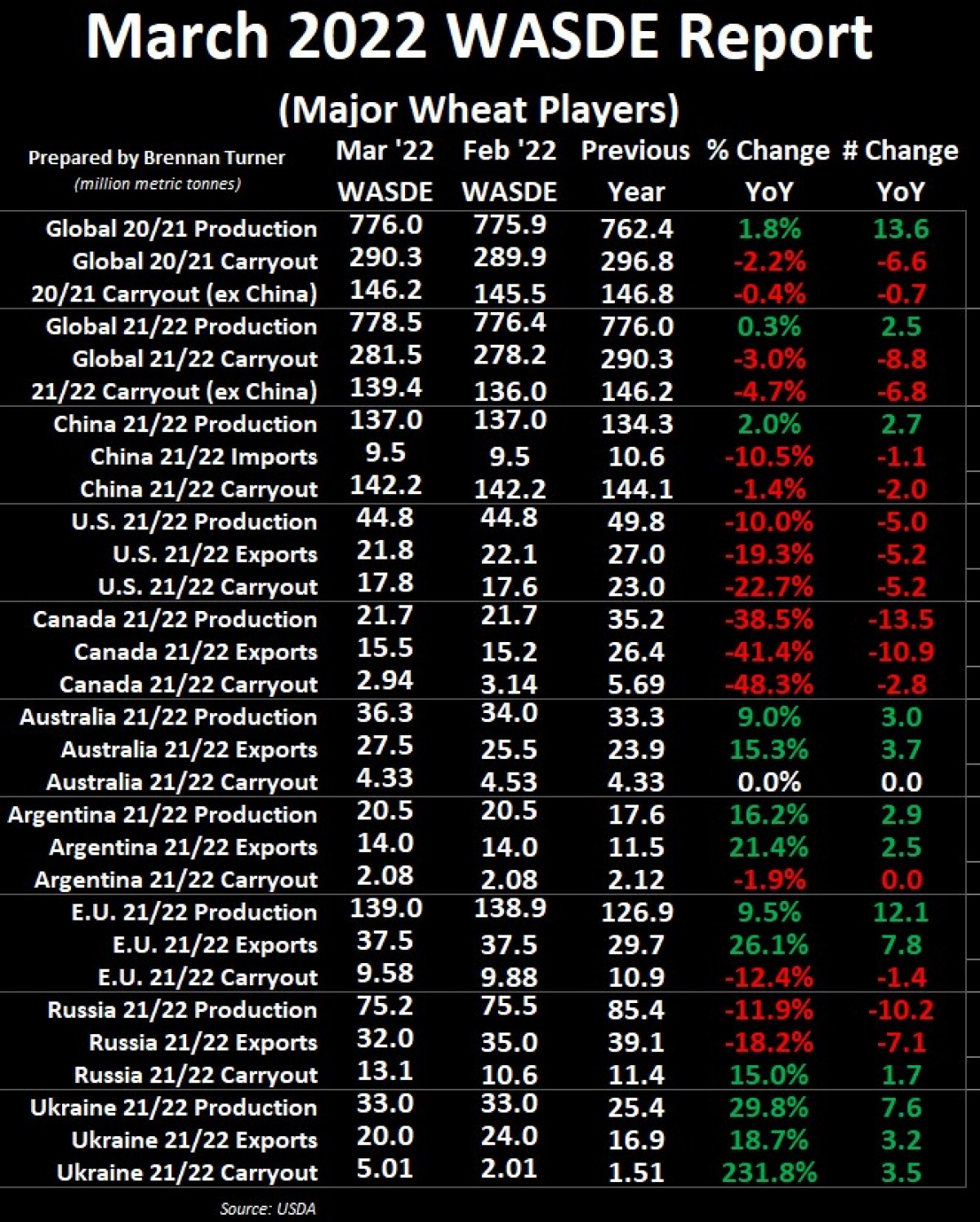

Wheat markets diverged from the rest of the complex as, after two weeks of going limit up on a near-daily basis, liquidity at these extremely high levels became a concern and so some traders took their profits and headed for safety on the sidelines. Old crop wheat futures saw a larger pullback though than new crop contracts, narrowing the price spread between the two harvests. Supporting corn, soybeans, and canola this week was a relatively bullish WASDE report from the USDA which showed smaller production in South America but higher demand offsetting the reduced trade from Ukraine and Russia.

Going into the March WASDE, the market was expecting to see a 5 MMT reduction in Brazil’s soybean harvest, but the USDA was more bullish, dropping the number by 7 MMT down to 127 MMT. There is some buzz that we’ll see further reductions by the USDA to align better with private estimates, but in the near-term, the USDA dropped soybean production by a combined 3.1 MMT in Argentina (-1.5 MMT to 43.5 MMT), Paraguay (-1 MMT to 5.3 MMT), and Uruguay (-600,000 MT to 2 MMT).

As I mentioned in the Wheat Market Insider last week, with Ukraine and Russia accounting for nearly 80% of global sunflower oil exports, trade has basically slowed to a trickle, with demand switching other vegetable oils, namely palm and soy oil, albeit canola and rapeseed oil prices in Europe and North America have hit new record highs this month. Some similar trade dynamics in the rapeseed meal are being seen as well but the tightness in the oilseed balance sheet will be inherently exacerbated by the smaller soybean harvest in Brazil that the USDA admitted to in their March 2022 WASDE report. Many analysts are also anticipating a reduction in biofuel targets in Europe and North America as a reflection of and reaction to this new paradigm of an increasingly tight, global balance sheet.

On that note, the USDA increased corn ethanol use by a little bit, but most analysts believe that ethanol consumption will eventually be revised lower for the 2022/23 crop year as demand inevitably starts to slow because of record high gasoline prices. This will likely push into some of the wheat ethanol markets, an industry that’s gained some momentum in Western Canada the last few years, and a notable demand factor behind the rise in low-protein wheat prices (i.e. CPS or GP).

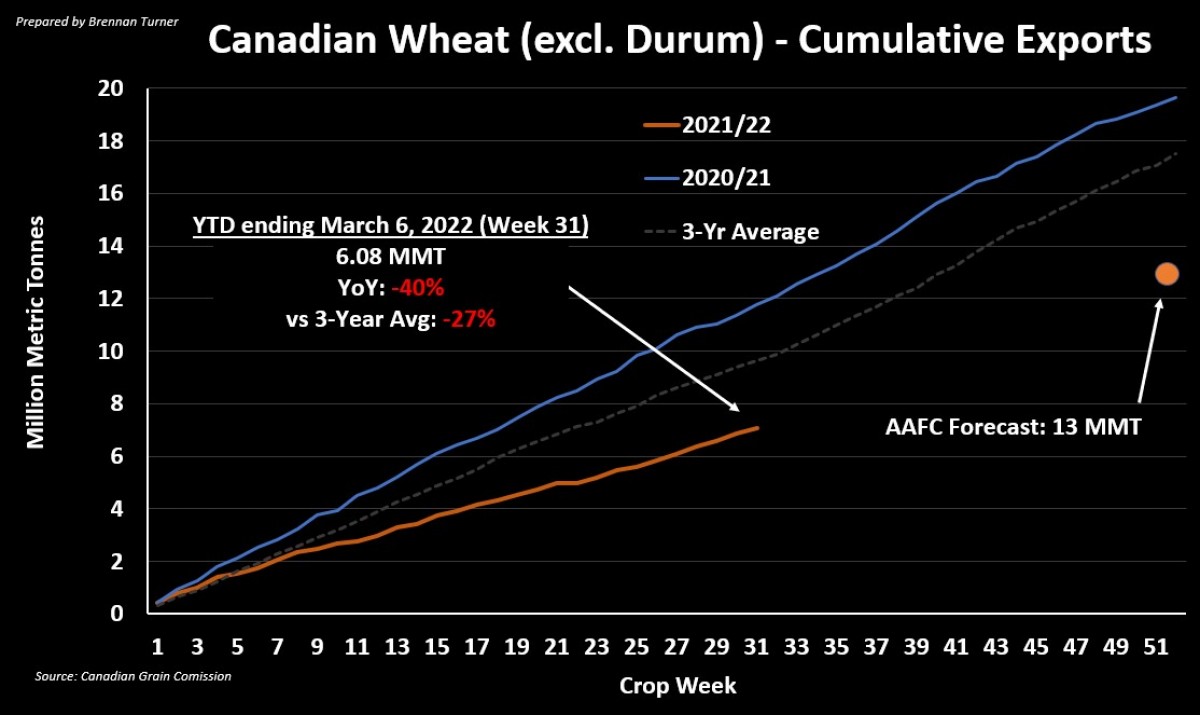

As a reflection of the higher prices though, Canadian producer deliveries of non-durum wheat in Week 31 (first week of March), hit their 2nd-highest this year, with 508,300 MT unloaded. I would expect an elevated pace of delivery to continue, and we’ll likely see it translate into improved Canadian non-durum wheat exports over the coming weeks. Worth noting is that Canadian durum exports remain weak at 1.5 MMT, or almost 50% behind the three-year average, and nearly 60% below the 2020/21 record pace.

Coming back to the WASDE, the USDA cut U.S. HRS wheat imports (likely from Canada) by 5M bushels (or 136,077 MT), while U.S. wheat exports were lowered again this month, this time by 10M bushels, down to 800M (or 21.8 MMT), thanks to smaller than expected sales and shipments of HRW and SRW wheat. Worth noting is that three-quarters of the way through its 2021/22 crop year, total U.S. wheat exports sales are sitting at 18.83 MMT, or 86% of the full-year forecasts, but that’s down about 10% from the seasonal average. In terms of what’s actually shipped, 14.72 MMT in U.S. wheat exports is about 19% behind last year’s pace, and, at 67% of the USDA’s total year forecast, this is a healthy deviation from the 72% seen by this time of the crop year.

Bringing it back to the global level, the USDA matched ABARES updated wheat production number of 36.3 MMT, a new record for the Land Down Under and 2.3 MMT higher than the previous print. Accordingly, Aussie wheat exports were raised by 2 MMT to 27.5 MMT (also a new record), somewhat offsetting the 7 MMT drawdown in Russian and Ukrainian wheat exports. India, which usually isn’t in the wheat exporter news, saw its exports forecast raised by 1.5 MMT to 8.5 MMT, a reflection of the market looking for alternative origins. At the high prices though, it’s expected demand will start to be rationed (at least a little bit).

Now, usually when demand starts to get rationed, prices will pull back, but as I look at the relative strength of new crop futures prices, the trade may be getting more focused on what Harvest 2022 will be able to be produced, let alone exported. As I’ve mentioned in this column the last few weeks, there is a lot of eyes on the lasting drought conditions throughout the North American wheat belt (Texas up to Western Canada). Obviously though, more attention is getting put on Ukraine, which, from a production potential, is being categorized as optimistic in the western half of the country but pessimism in the east, where the war is having the largest impact.

Especially in the east, access to seeds, chemicals, fertilizer, fuel, and labour all remain major impediments to Ukraine’s Harvest 2022 possibilities. Social media conversations and media reports that I’ve read suggest that the Ukrainian winter wheat crop (which accounts for about 95% of total wheat production), could see average yields 15% below average because of limited spring fertilizer top-dressing, or a drop of about 3 – 4 MMT. Further, spring-seeded wheat production could fall by as much as 50%, or about 750,000 MT – 1 MMT. More important, however, is the increasingly-accepted idea that whatever Ukraine produces in the 2022/23 crop year will be hard to export, not just because of the need to meet local demand, but also because Ukraine’s Black Sea ports are now controlled by Russia, whose own international trade is under heavy sanctions.

Accordingly, it’s expected that wheat prices will remain near current levels, if not push higher as we get closer to the North American planting campaign. That said, values will be especially responsive to what may or not may be produced in Ukraine and Russia, let alone exported. Nonetheless, more agricultural companies are expected food crises but are specifically looking at the Middle East and North Africa, as countries like Egypt, Lebanon, Tunisia, and Yemen, are quite dependent on wheat imports from Ukraine and Russia. Complicating global food production will be high prices of fertilizer, let alone its availability, something I suggested a few weeks ago in this column that will be one of the 3 major impacts of the war in Ukraine in the long term.

In the near term, the markets will continue to react to any changes in Ukraine and Russia, be it domestic updates or internationally-imposed sanctions, as well as North and South American weather. Also getting more attention over the next few weeks will be the USDA’s Prospective Plantings report, which will be published on Thursday, March 31. Nonetheless, we should expect volatility and large price changes to continue, which could mean both major pullbacks and acceleration in values in the same week!

To growth,

Brennan Turner

Founder | Combyne