Wheat Markets Find New Legs in Australia

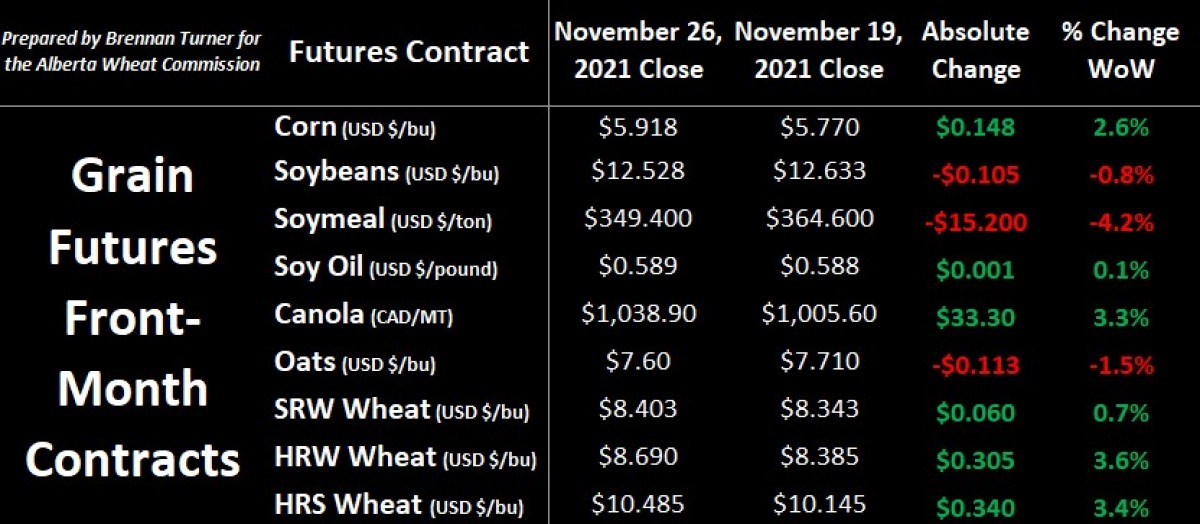

Grain markets were mixed through a U.S. Thanksgiving-shortened trading week, while outside markets sold off, thanks to new COVID-19 variants emerging in Africa that are spooking investors. Heading to the sidelines amidst the uncertainty of the answer behind “will normal ever return?” is logical, but with many market participants away from their screens nursing a food coma or hangover, there’s less liquidity in the market, and so when the selling starts, there’s not a lot of buyers in the game to slow things down. Specific to wheat markets though, Kansas City HRW and Chicago SRW wheat futures both hit new contract highs on weaker crop ratings from the USDA. Minneapolis HRS wheat also came pretty close to topping the $10.50 handle seen earlier in November.

Also supporting wheat markets was activity in Europe and Australia. European wheat futures in Paris hit an all-time high this past week on concerns about the recently-planted Ukrainian winter wheat crop. Output expectations in the Black Sea nation are dropping due to limited precipitation and the likelihood that farmers used less fertilizer, given its record-high value. Meanwhile, the Russian winter wheat crop appears to be in good shape, and if there’s limited winterkill, the Kremlin may tone down its export restrictions and taxes as we get closer to the start of their new crop year, which starts on June 1.

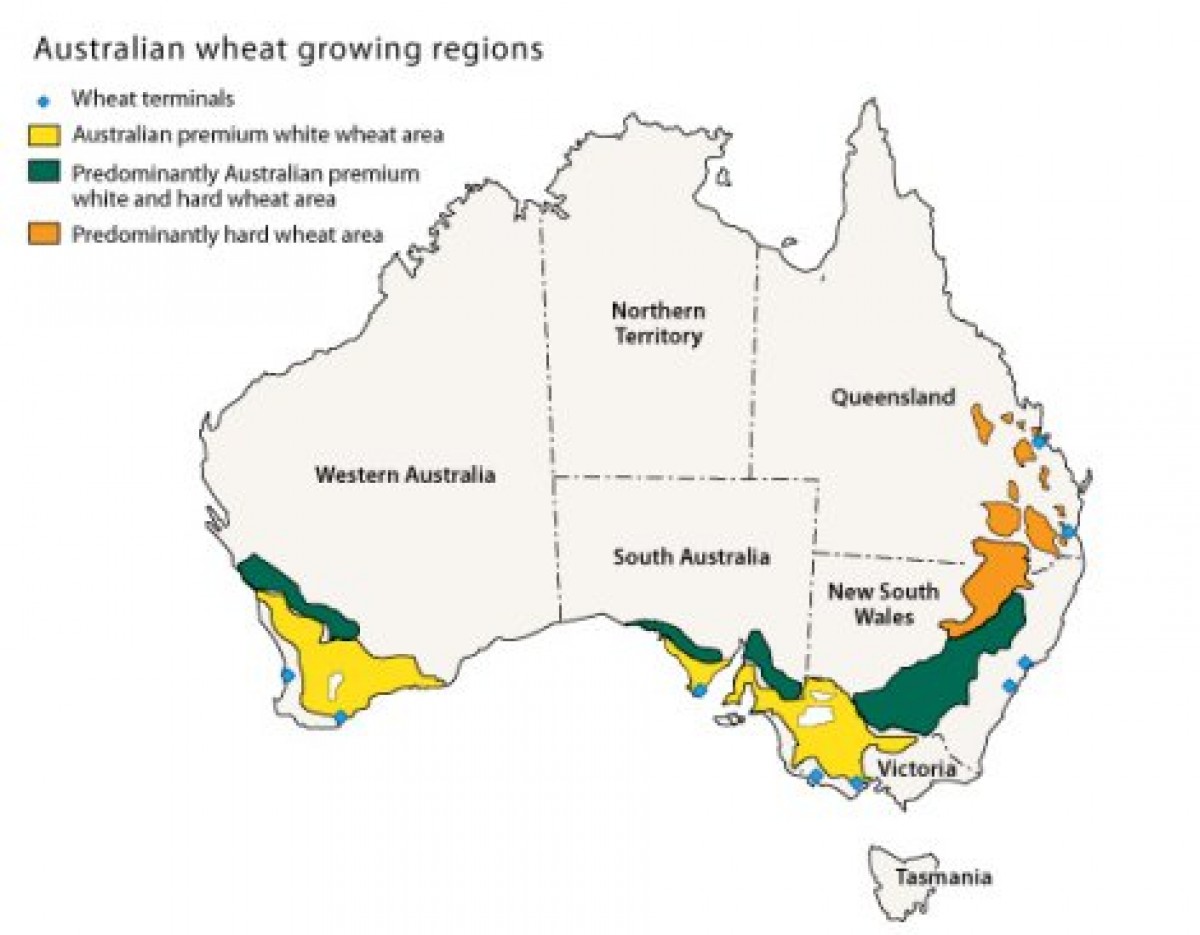

The bigger headline for Canadian wheat players to watch, however, is in Australia, where La Nina-induced heavy rains have persistently fallen along most of the country’s east coast for the past 2 weeks. This is important to note because Eastern Australia is where most of the country’s milling wheat varieties – be it hard or premium white – is grown and this is the wheat that will compete most with Canadian HRS wheat (Heads Up: if you are a HRS wheat farmer, you should remember this fact!).

That said, most of the wheat in Queensland has been taken off, but New South Wales is only about 25% finished, and this is important because there is A LOT of wheat in the region that’s still out and getting rained on (I emphasize “a lot” because, this year, NSW farmers may produce close to 12 MMT, which would be even bigger than Western Australia’s wheat harvest). With more rain expected to fall this coming week, and early sampling suggesting weaker falling numbers and overall lower quality, traders showed their concern as the spread between milling and feed grade wheat widened significantly. Given the smaller crops in North America, Australian exporters were expected to fill the gap for higher quality wheat that international buyers are looking for, but that plan looks a bit doubtful now.

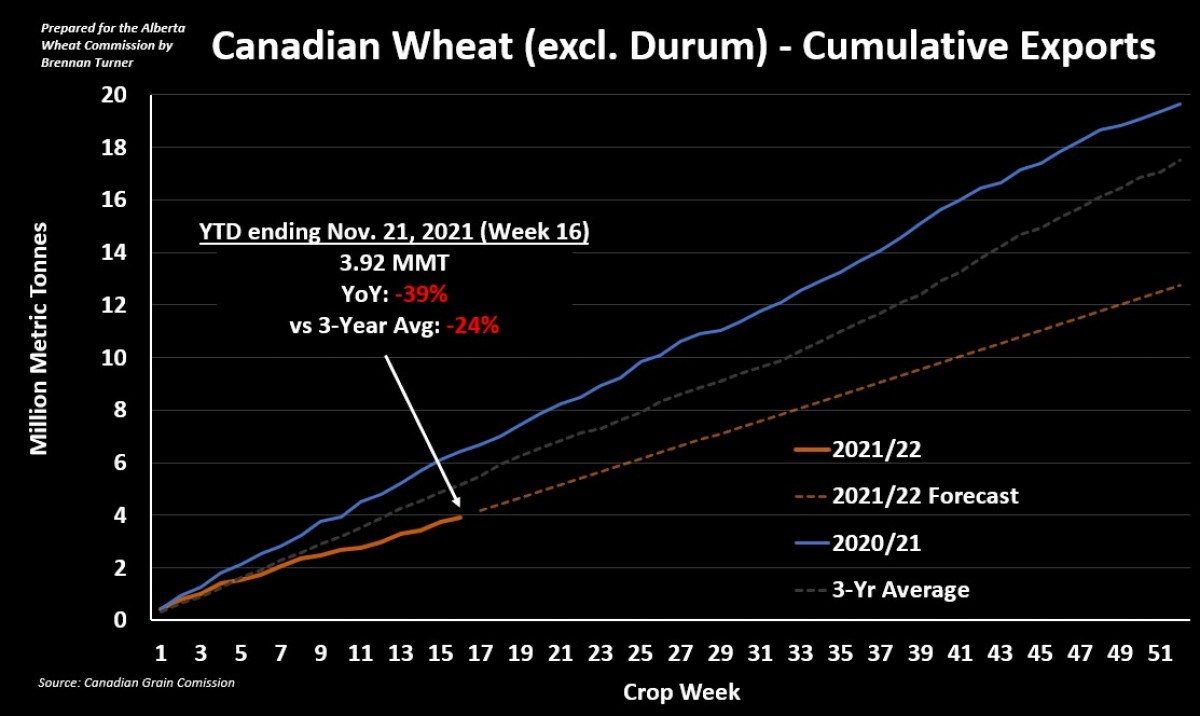

With this in mind, along with the Canadian mudslides from last week, through 16 weeks of the 2021/22 crop year, Canadian non-durum wheat exports are averaging 245,3000 MT a week. This is well below the 2020/21 crop year average of 401,000 MT for the first 16 weeks of the shipping season (albeit, 2020/21 was a record year!), and the 5-year average over the same period of 325,300 MT. For the rest of the crop year (36 weeks), on average, weekly exports have increased by about 2%, to about 353,200. If we were to take this average 2% increase and apply it to this season, that would mean weekly average non-durum wheat exports of 250,400 MT, for a total of just under 13 MMT. Currently, Agriculture Canada is estimating 13 MMT of non-durum wheat exports.

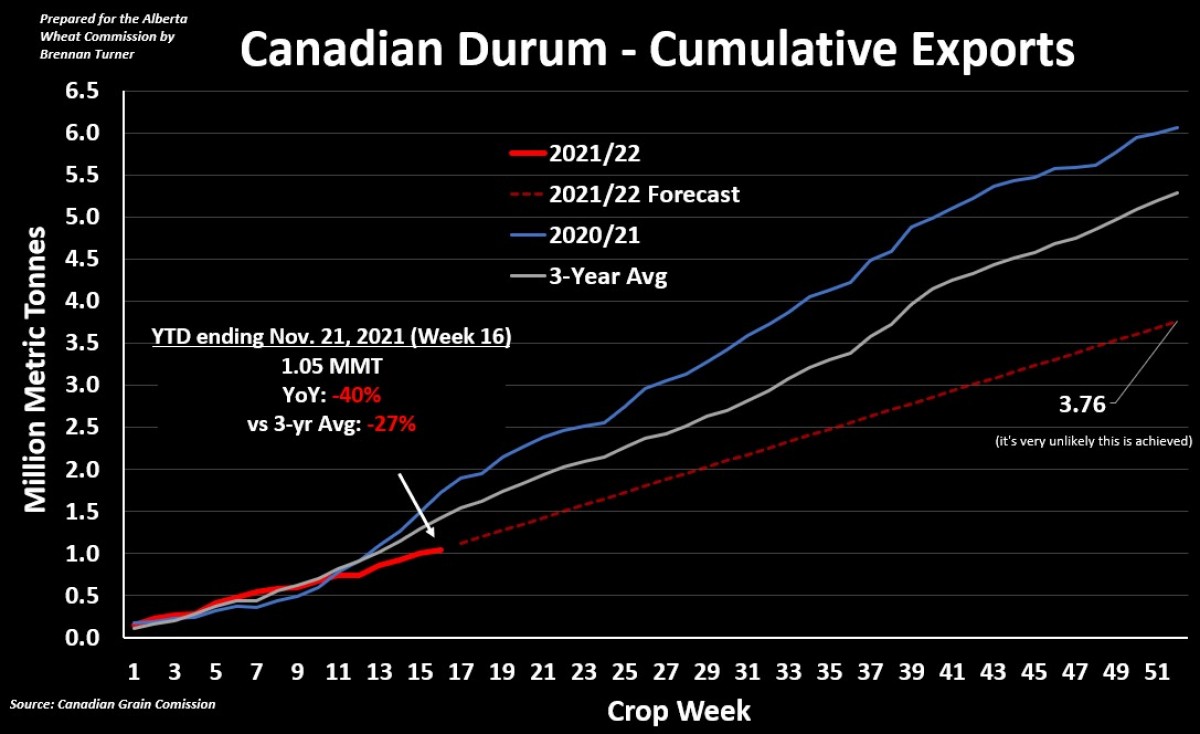

For Canadian durum, weekly exports through Week 16 of 2021/22 have averaged a measly 65,400 MT, well below the last year’s record pace of 107,050 MT and the 5-year average of 80,640 MT. Unlike non-durum wheat exports though, Canadian durum exports tend to increase throughout the rest of the year by more than 15%. This would suggest that the weekly average Canadian durum exports could climb to 75,400 MT for the rest of the year, adding up to a total volume of 3.76 MMT. This seems unrealistic though as we only produced 3.55 MMT of durum in Canada this year, and AAFC’s estimate for exports is 3.1 MMT. Therefore, we’re likely to see some demand rationing over the coming months, which will certainly slow down exports. Translation: prices will start to eventually pull back as demand starts to soften (but I think that’s most likely to start showing in late winter).

Overall, while it looks like ABARES might increase its expectation for the Australian wheat harvest, its quality is certainly going to be up in the air. If all these bullish factors – namely Australian quality, limited North American supplies, and Russian export restrictions – are maintained, and any concerns about the planted 2022 winter wheat crop show up, 2008 price levels could be a reality. As a reminder though, Statistics Canada’s production update on Friday, December 3, or ABARES’ same update on Tuesday, December 7 could set the direction for wheat markets until the spring. All things being equal though, in the near-term, sideways-to-higher prices are more likely than a major significant pullback of 10% or more.

To growth,

Brennan Turner

Founder | Combyne.ag