Wheat Prices Rebound on Weather

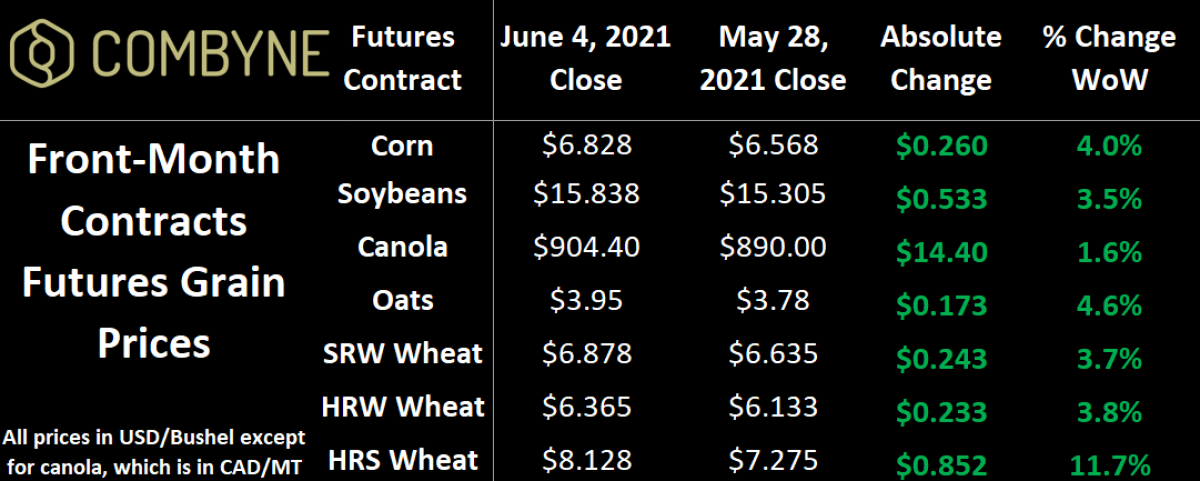

Grain markets heated up again this past week as a shortened trading week (due to the U.S. Memorial Day holiday Monday) and some hotter weather/limited rainfall contributed to the gains. Canola prices continue to be supported by demand for vegetable oils, which was led last week by soybean oil which set a new record price last week, thanks to growing biofuel demand, namely any renewable substitute for conventional diesel. The combination of strong demand across almost all crops and traders' sensitivity to weather is helping prices rebound from the lows seen at the end of May. International wheat traders continue to watch geopolitical happenings, but with a focus on Russia as, with the government there changing their export tax on a weekly basis, it’s complicating the heck out of forward sales.

Before digging into said weather, the June 2021 WASDE report will come out later this week on Thursday, June 10th, and in it, we’ll be looking for lower corn and wheat production numbers out of South America, but higher wheat volumes out of Europe. In South America, expectations for the second-crop safrina corn harvest continue to decline with private estimates for the total harvest ranging between 90 – 95 MMT, versus the USDA’s estimate of 102 MMT in the May WASDE report. The dry conditions have led to lower levels on the ultra-important-for-Argentina Parana River, which has led to limited sailings due to fears of fully-loaded ships running aground (and therefore blocking smaller ships!).

Staying in Argentina, the government there announced a suspension of all beef exports for the next month in their attempt to slow domestic food inflation (same as Russia), which is currently running at about 50%! Most farm groups are understandably up in arms over this and to fight back, are not actively selling cattle to the market as they don’t expect the restrictions to be lifted after just 30 days (in reality, there’s no way you can get 50% inflation under 30 days). While beef farmers will eventually have to sell (there’s an optimum weight for every animal), there’s buzz that Argentine grain farmers can hold out from selling a lot longer than their livestock brethren, and anyways, in doing so, they’re hedging against the continued devaluation of the Argentine peso! This is relevant as Argentine wheat is exported into many other South American countries, but also the Middle East.

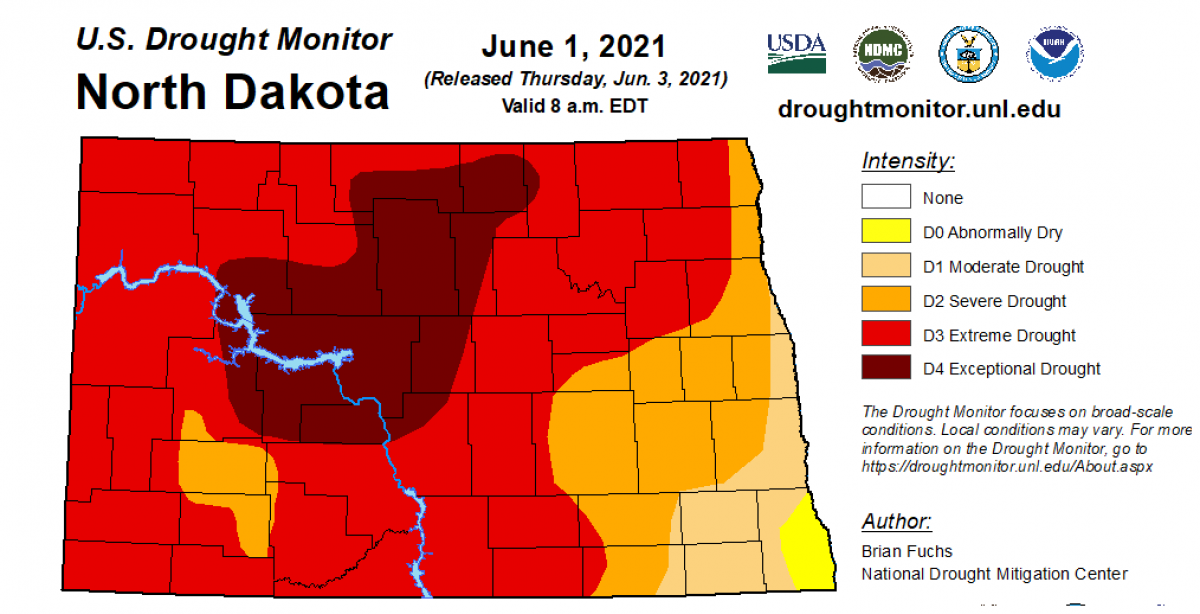

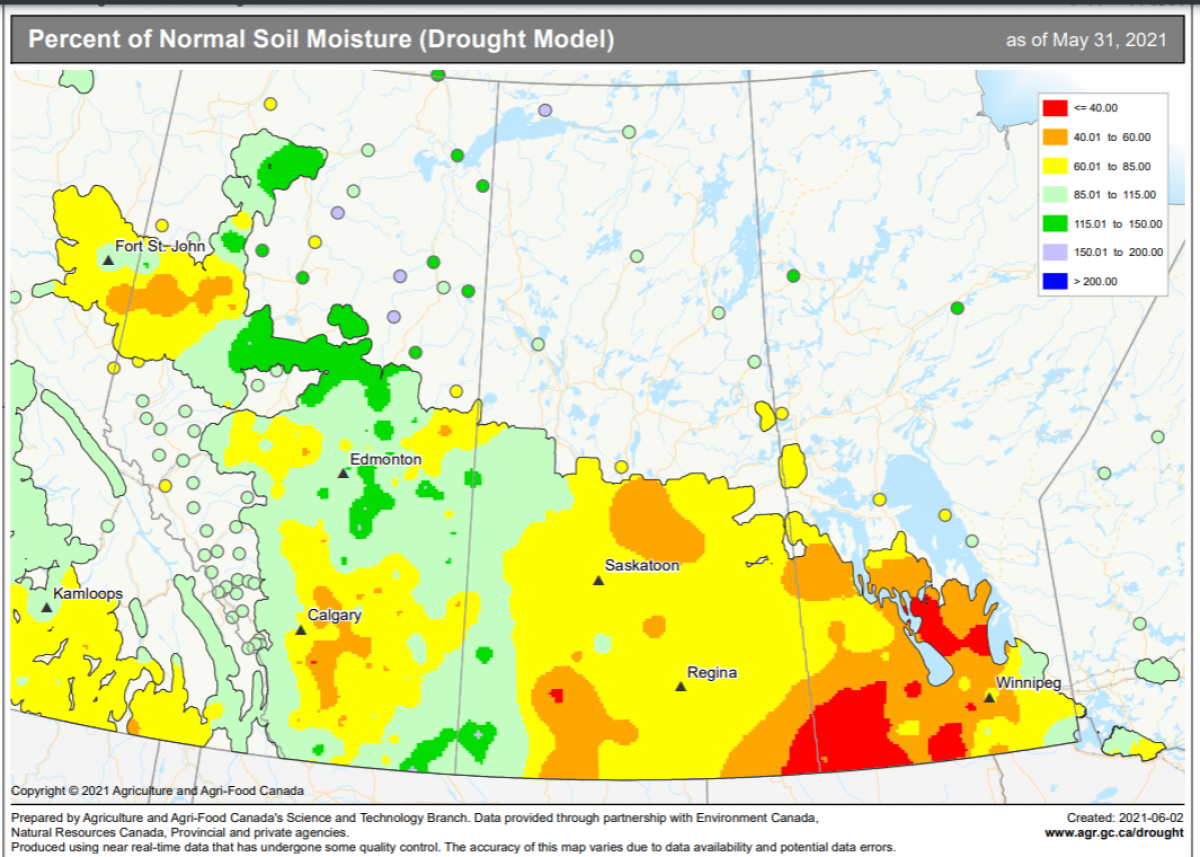

Coming back to North America, HRS wheat prices were clearly the winner last week as less-than-expected rainfall and some hot, hot weather spooked millers and speculators alike. Protein spreads between winter and HRS wheat have been starting to climb, suggesting that the U.S. winter wheat crop’s quality is slightly less than desirable (and as vocalized by the U.S. Wheat Quality Council’s crop tour of Kansas winter wheat a few weeks ago). Therein, as heat and rain forecasts come and go, traders are constantly re-evaluating the potential supply-side scenarios. Arguably, rain events over the next few weeks will be important to HRS wheat and durum growers, especially near the US-Canada border as evidenced by the drought maps below.

Total Farm Marketing out of the U.S. admits a bias to expecting near-record corn prices if Midwest farmers, over the next 2 months, receive that anything below the necessary rainfall. Therein, (and as mentioned in last week’s Wheat Market Insider column), I continue to watch for some weather premiums to creep back into the market, which will be inherently fueled by speculative fund money as long as they continue to see bullish weather forecasts (be it looking at actual maps or just the headlines that the media is printing). Therein, the 3-month outlook from Environment Canada suggests average rainfall for most of the Canadian Prairies, save for southern Alberta and SW Saskatchewan.

To growth,

Brennan Turner

CEO | Combyne Ag