Wheat Prices Up Nearly 70% Year Over Year

Grain futures were mixed to end the month of July as the impact of hot, dry weather in Western Canada and the U.S. Northern Plains continues to be supportive of wheat prices. Further helping the complex is a lower Russian wheat production estimate from IKAR, who’s now expecting a 78.5 MMT harvest, compared to the USDA’s forecast in the July WASDE of 85 MMT. Meanwhile, corn and soybean conditions in the Cornbelt continue to support a decent crop with conditions not too far behind last year’s record yields of 172 and 50.2 bushels per acre, respectively. In fact, in the July WASDE – which, as a reminder, was already bullish wheat – the USDA has estimated that average U.S. corn and soybean yields could hit new records again at 179.5 and 50.8 bushels per acre, respectively.

For the milling wheat industry, there’s definitely going to be less wheat to go around this year if last week’s U.S. Wheat Quality Council’s spring wheat crop tour is any indication. The tour, which went through various parts of the Dakotas and Minnesota, published an average yield estimate of 29.1 bushels per acre, the lowest number they’ve had since 1993. This smaller yield shouldn’t be much of a surprise for a region that’s experienced much of the same weather as Western Canada, and correspondingly, only 9% of the U.S. spring wheat crop is rated as good-to-excellent (versus 70% G/E a year ago!).

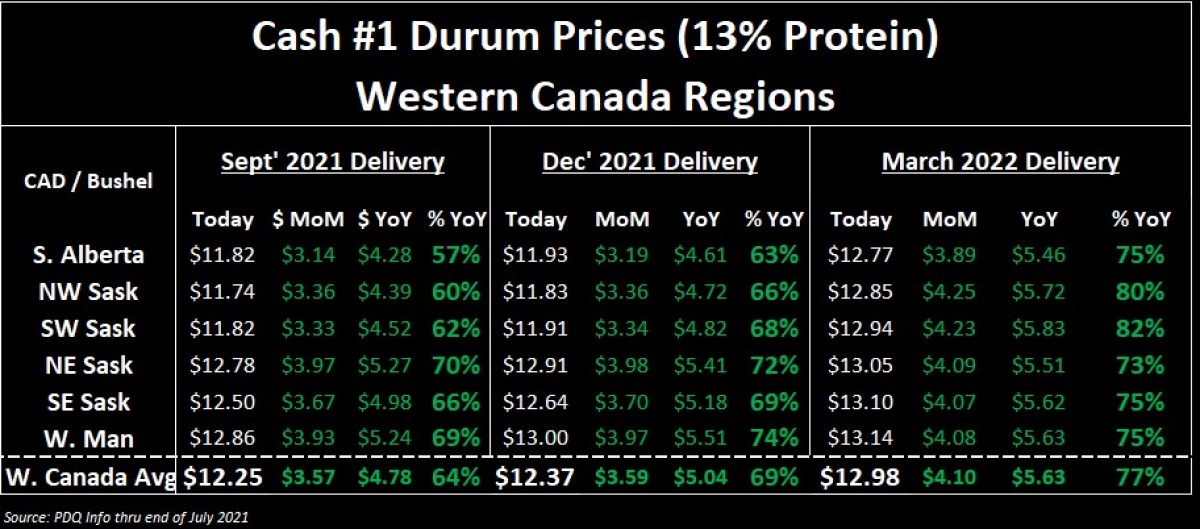

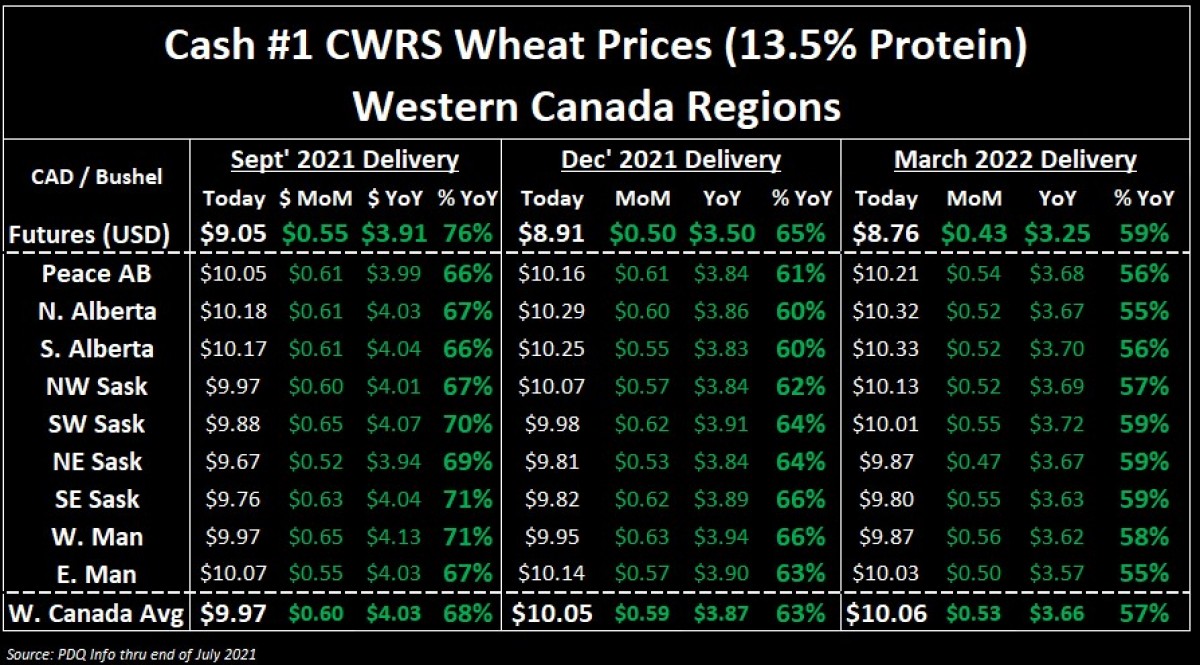

For Canadian wheat, with the start of August, we officially entered the 2021/22 crop year and the 9th anniversary of grain marketing freedom in Canada. It comes at a time that Canadian wheat prices are significantly better than a year ago (as the tables below illustrate), but that’s purely because of the well-known drought conditions. In Saskatchewan, as of the end of July, just 16% and 11% of the spring wheat and durum crops are considered good with 0% of either crop categorized as excellent. In Alberta, just under 22% of both the spring wheat and durum crops are rated as G/E. Unsurprisingly, average dryland spring wheat yields are estimated at 29.5 bu/ac, barely half of the five-year average of 55.6 bu/ac and last year’s 54.2 average yield. If we’re being honest with each other though, average yields could be even lower with all the abandoned acres that are expected.

Therein, with harvest already starting in many areas, the next few weeks could prove to be further pivotal as to where wheat prices go. Regardless of what your farm is able to take off the field in Harvest 2021, cashflow management is going to be incredibly important in the 2021/22 crop year. Accordingly, tracking deferred prices is important to benchmark against when your bills need to be paid, which is something your accountant should be able to help you outline for the next year or so.

For example, if you’re a durum farmer and you have cash receipts from other crops that can satisfy your bills, despite prices literally almost $5 CAD/bushel better than a year ago, you might want to avoid selling right off the combine and instead wait until 1Q2022 (Jan/Feb/March) as it could pay you 50¢ - $1 more per bushel.

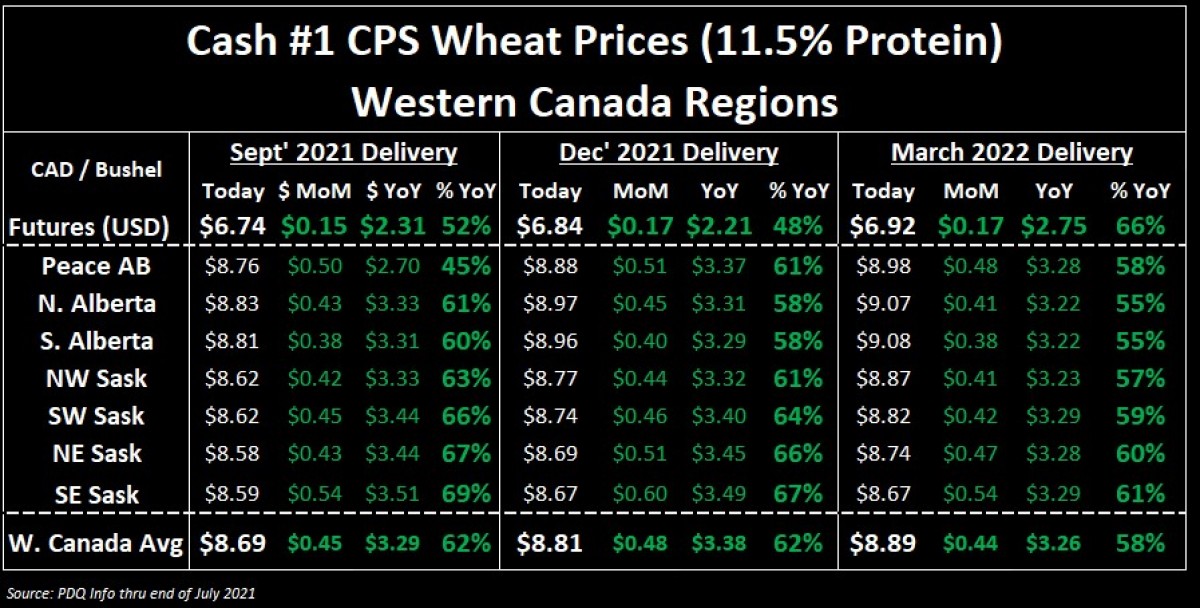

Conversely, the premium for waiting to sell your CPS or HRS wheat is only going to yield you about an extra 10¢/bu for every 3 months of deferred delivery. Regardless of today’s price matrix, I currently expect cash wheat prices to continue to appreciate alongside higher futures values as more about the size of this year’s North American milling wheat harvest is understood. Accordingly, there’s nothing wrong with waiting for these higher prices, but right now, your farm (likely with help from your partners) should work on getting a deep understanding of what you owe and by when, to start mapping out when you’ll need to make sales, deliver, and earn income by.

To growth,

Brennan Turner