Wheat’s First Plant and Harvest 2022 Estimates

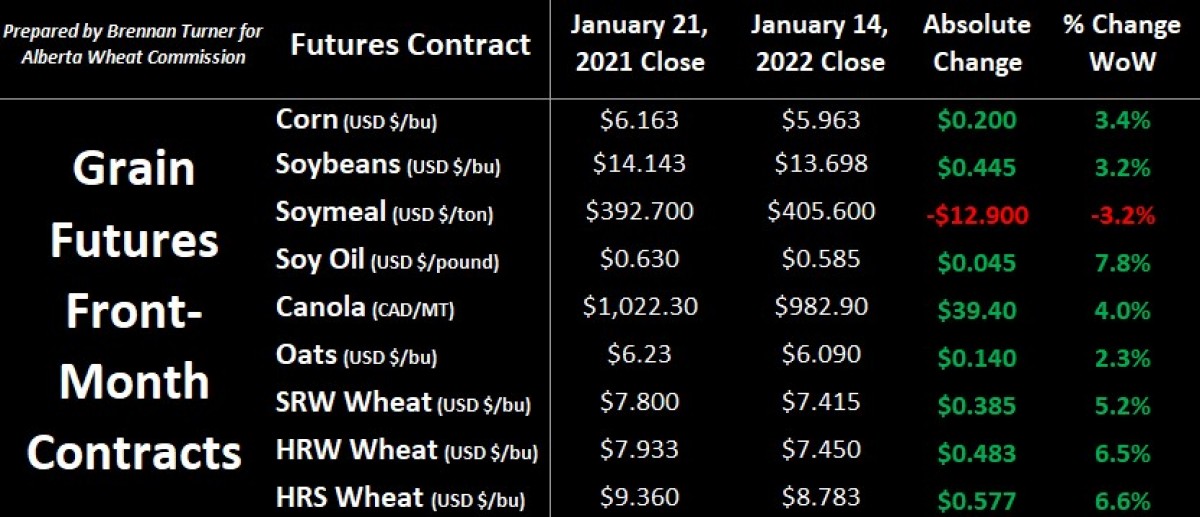

Grain markets found some buyers in the third week of January on the back of strong U.S. export sales, heightened geopolitical risk in Eastern Europe, lower production estimates in South America (which helped corn and soybeans push to their highest levels since June), and inflation concerns. For the last factor, inflation is becoming talked about much more regularly, and so managed money, as they have in the past, tend to channel more dollars into the commodity sector as it can act as a hedge against inflation. Theoretically, this would help slow down or even prevent selling into much lower price levels, but with interest rates sure to trickle higher this year, there’s now some risk in the market as its foundation is going to shift in a major way as central banks dial back their open cheque-book spending.

While negotiations are ongoing between Russia and the West (led by America), Putin has positioned fighter jets in nearby Belarus and camped 106,000 Russian troops – or nearly 40 per cent of the entire Russian army – along the Ukraine-Russia border. Unsurprisingly, the White House admitted this past week that “Russia could launch an attack on Ukraine at any time”. Accordingly, the U.S., U.K., Canada, and other NATO member countries are providing military loans to help Ukraine bring in everything antitank missiles to small arms and ammunition to medical equipment, in addition to sending some special forces to the region. Ultimately, I would estimate the likelihood of a skirmish breaking out at less than 10 per cent, but if it does, I’m in the camp of analysts who think this could help push grain prices higher – notably wheat – by anywhere from 5 per cent to 20 per cent.

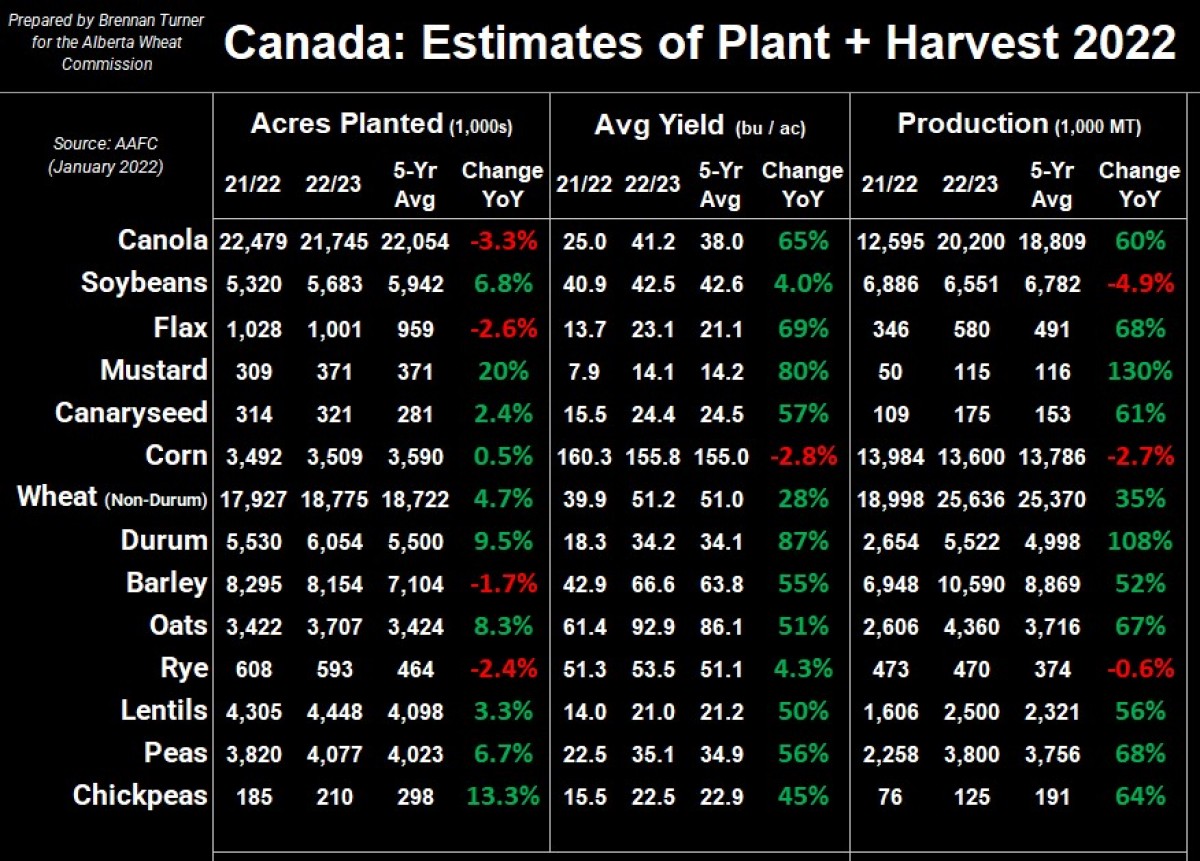

While wheat traders have been mostly focused on the southern hemisphere harvests, the tension between Kiev and Moscow, and January’s WASDE report, Agriculture Canada came out this past Friday with their first estimates of what supply and demand for the 2022/23 crop year could look like. Broadly speaking, the team of analysts at the AAFC is expecting acreage for wheat (including durum), oats, pulses, and specialty crops to increase, while the area planted into oilseeds will mostly decline. While the table below shows how optimistic the Canadian government forecasters are that yields will return to normal (and in some cases, go above normal), myself and others remain very cognizant of the carryover moisture challenges of last year’s drought.

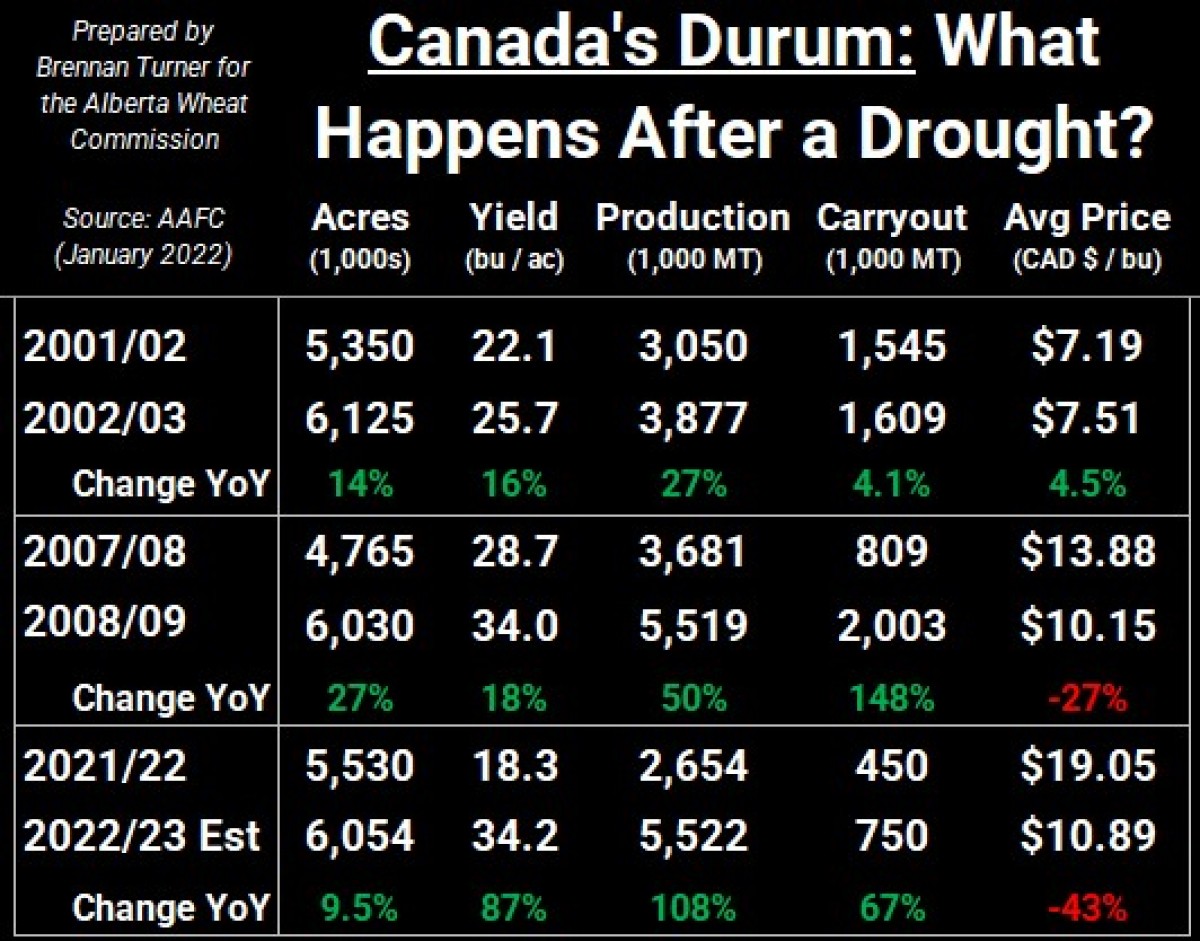

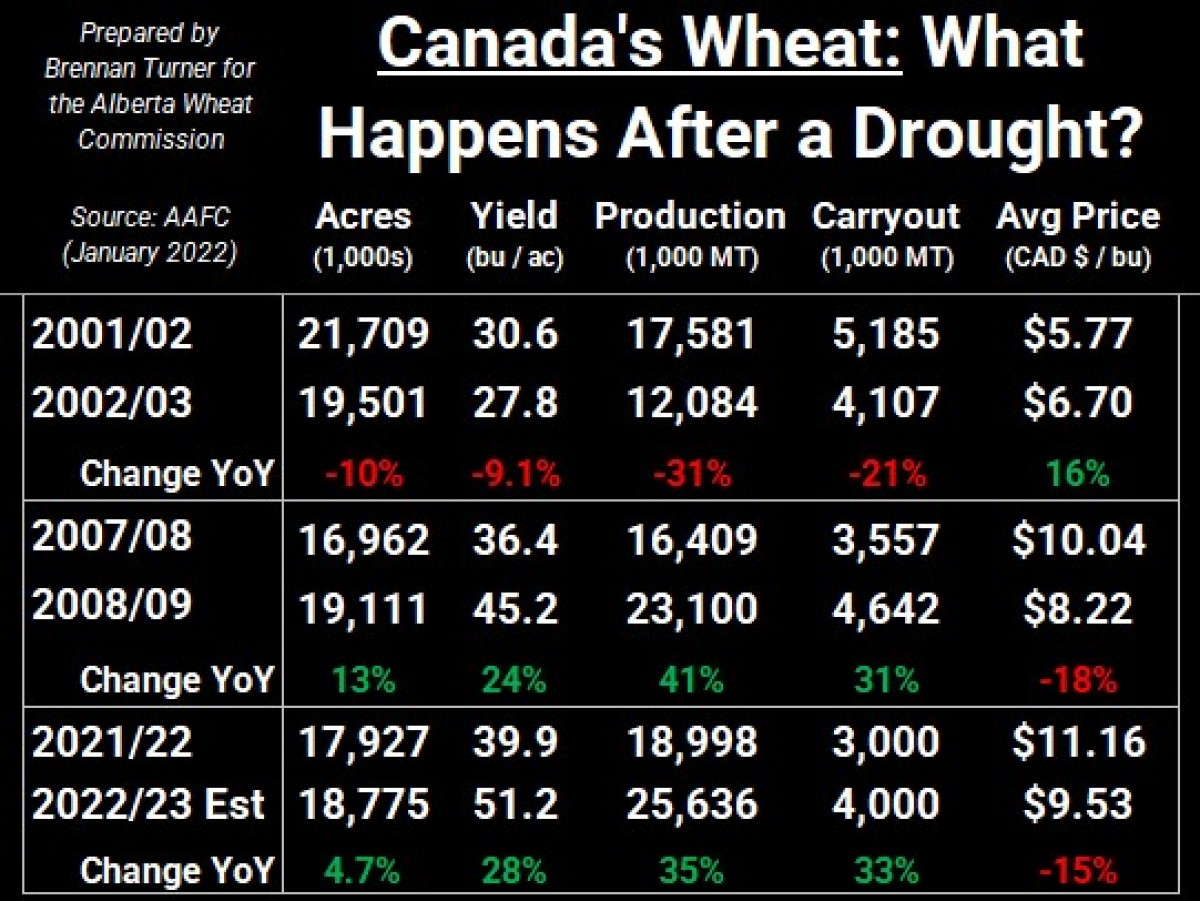

With the drought year preceding us, I asked myself how other crop years performed the year following a drought, and I think the best comparisons in recent memory are in the 2002/03 and 2008/09 crop years (these growing seasons followed droughts in 2001 and 2007, respectively). While acreage increased for most crops in the Plant 2002 and 2008 campaigns, yields and production didn’t materialize as much as one would’ve probably thought. Therein, colour me skeptical that yields – especially for durum – will rebound as much as AAFC is currently forecasting (NOTE: the forecasters have a tough job to begin with, let alone trying to estimate supply and demand the year after a drought when fertilizer prices are at record highs, and ongoing COVID-related supply chain disruptions!).

Thinking more globally, durum stocks carried over from the current crop year into 2022/23 are sitting just above 6 MMT, a drop of 27 per cent year-over-year, mainly thanks to an 80 per cent drop in European inventories, and a 73 per cent reduction in North America. While the winter weather so far in Europe likely points to an average durum harvest in 2022, production from the MENA region (the Middle East / North Africa) is uncertain with drier conditions in the forecast. Thus, soil moisture in North America will likely be directly correlated to durum prices, be it a catalyst to the upside if average rains don’t materialize, or to the downside if the crop’s potential rebounds as much as AAFC is thinking today.

For non-durum wheat, it’s a much more globalized game – it has many more producing regions than durum – and so it isn’t as susceptible to major price swings as durum can be. Nonetheless, tight HRS wheat stocks, similar tight global supplies for high protein wheat, and consistently strong international demand should support Canadian wheat prices. Bottom line: with increased acreage, wheat prices should likely decline a bit as traders focus their attention on a rebound in production, but as previous years show us, Mother Nature still has the final say!

To growth,

Brennan Turner

Founder | Combyne Ag