Where to Next?

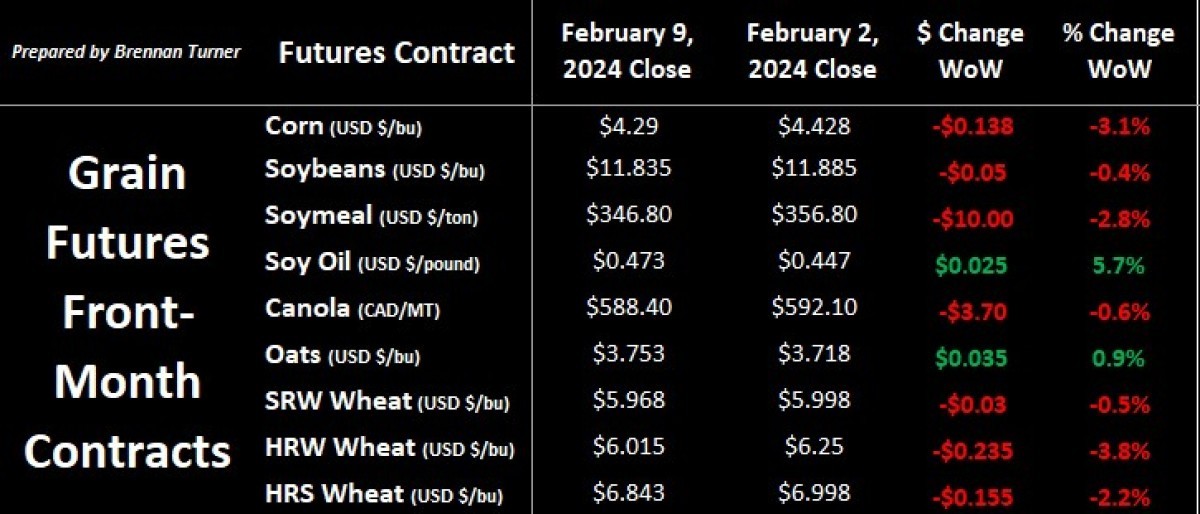

Heavy fund selling last week drove grain prices lower but some short covering helped the wheat complex limit its losses, despite a mostly bearish WASDE report from the UDSA last week. In these higher interest rate environments, grain buyers continue to seem focused on hand-to-mouth, and/or sourcing from cheaper origins like South America or Eastern Europe, and thereby funds remain generally short (read: bearish).

Specific to Canadian wheat, Turkey shipments are pressuring durum prices here at home, whereas international buyers continue to enjoy and buy Canada’s higher quality and protein spring wheat. The broader grain markets are being pressured by South American harvest supplies, but will likely be influenced by this week’s annual USDA Outlook Forum, in which we’ll get some fresh estimates for Plant 2024 acreage, yields, and ending stocks.

Headlines Worth Noting

- With the South American harvest hitting full tilt, and no more weather premiums available for corn and soybeans, farmers there have been heavy sellers off the combine, which has dramatically pressured local basis, and in turn, pushed international grain prices lower.

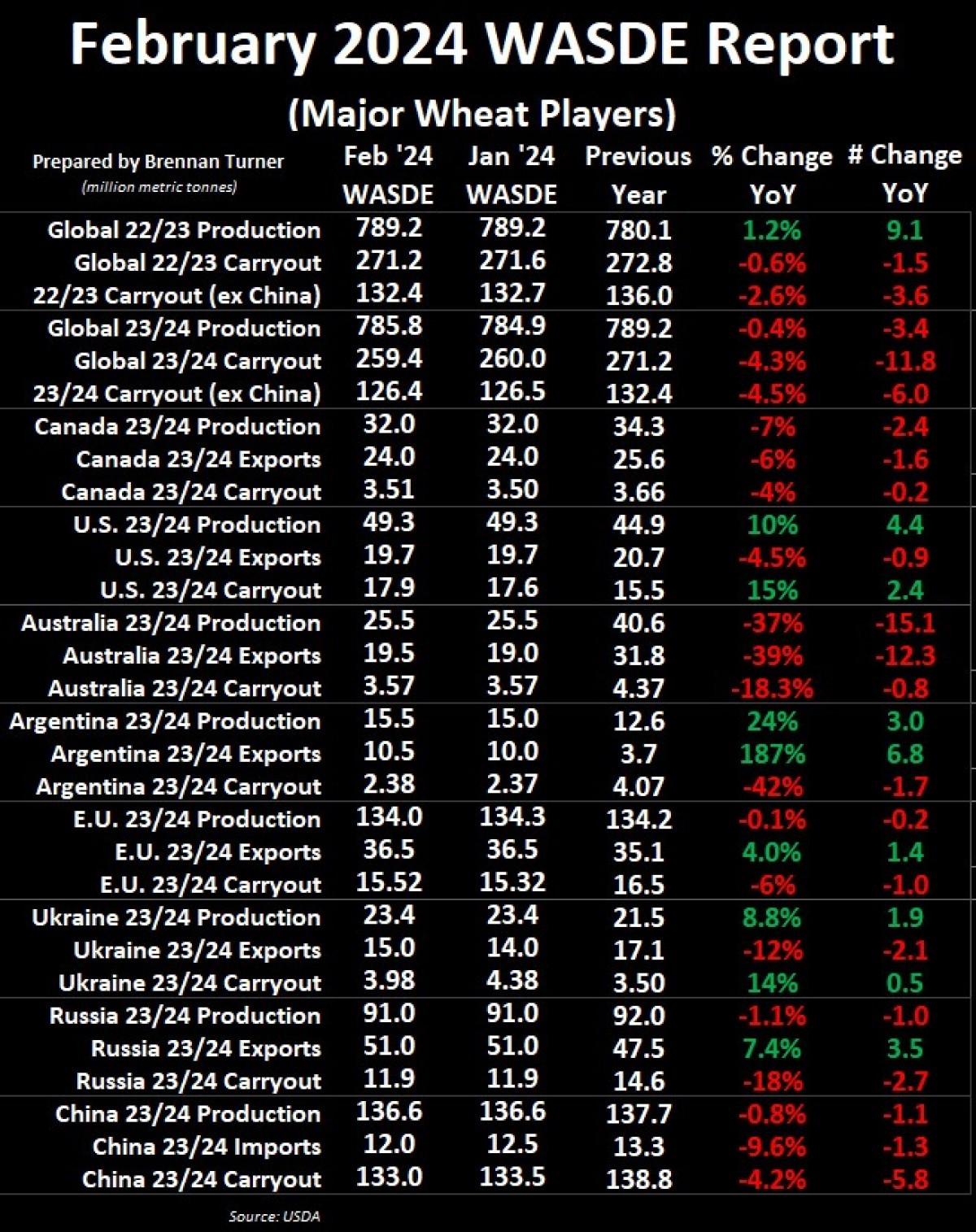

- The USDA’s February WASDE showed production forecasts that remain higher than what local estimates are, which suggests some volatility is likely over the next few weeks.

- Global soybean ending stocks are now estimated to be at record highs.

- European farmers continue to protest in cities and major transportation routes on a mix of government climate policies and trade policy (namely letting cheaper eastern European grain from the likes of Ukraine get imported).

- World Weather, Inc. said it will likely take until 2025 for Canadian Prairie moisture events to improve, and that east-central and southern Alberta, as well as southwestern Saskatchewan are likely to be dry again in 2024 (albeit maybe not as bad as last year).

- The U.S. Drought Monitor map suggests just 17% of American winter wheat-producing regions is in a state of drought, well below the 58% seen at this time a year ago.

More Wheat Competition in February WASDE

- U.S. total wheat inventories were raised by 280,000 MT to 17.9 MMT, which would the 2nd smallest carryout in the last decade.

- U.S. wheat milled in the October-December quarter was the smallest flour grind since reporting began.

- Argentine wheat production was raised by 500,000 MT to 15.5 MMT, which exports raised by the same amount to 10.5 MMT.

- Argentina’s total grain exports in January were up 64% year-over-year, largely because of the new government’s sharp devaluation of the peso currency there and shippers’ aim to avoid realized weaker returns on their contracts.

- Whereas the Canadian wheat balance sheet was unchanged, Australian exports were raised by 500,000 Mt to 19.5 MMT, while Ukraine wheat shipments were raised by a full 1 MMT to 15 MMT.

- The local USDA office in Ukraine thinks wheat exports there could actually climb all the way up to 17.7 MMT in Black Sea transportation remains undisturbed.

- Outside of Russia, inventories held by the world’s largest wheat exports are sitting at 15-year lows, suggesting that Russia’s cheap supply has a hold on price direction.

- Russia is basically exporting about 4 MMT every month, and is now basically considered a full year shipper, whereas just a few years ago, they usually stopped exporting after January

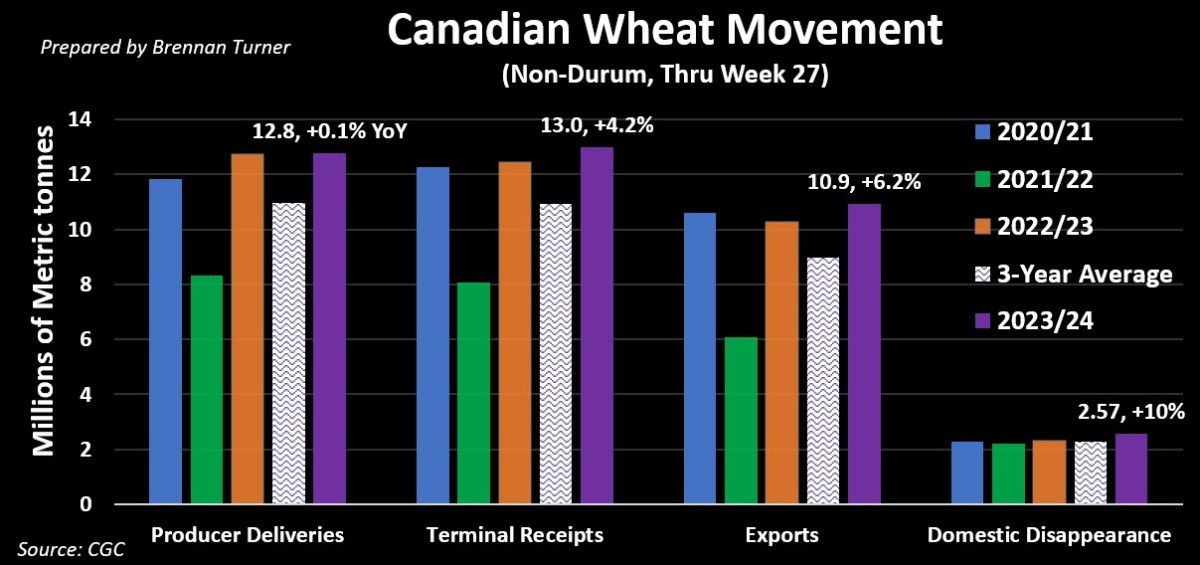

Canadian Wheat Movement is Strong

- International demand for Canadian non-durum wheat remains strong, with nearly 11 MMT shipped out of country through Week 27 of the 2023/24 crop year.

- This averages out to nearly 404,500 MT in weekly shipments, meaning we need to average 363,180 MT for the next ~6 months to hit Agriculture Canada’s forecast of 20 MMT.

- Domestic movement also looks healthy, tracking 10% higher year-over-year with no indication that things are slowing down.

Canadian Wheat (non-durum) stocks through end of December 2023:

- Total: 17.72 MMT (-7% YoY, -6% vs 5-year average)

- Commercial: 3.4 MMT (-1%, +1%)

- On-farm: 14.33 MMT (-8% YoY, -8%)

- Almost a 1.4 MMT decline year-over-year in Alberta farmers’ wheat stocks!

-stocks-total-thru-dec-2023-large-large.jpg)

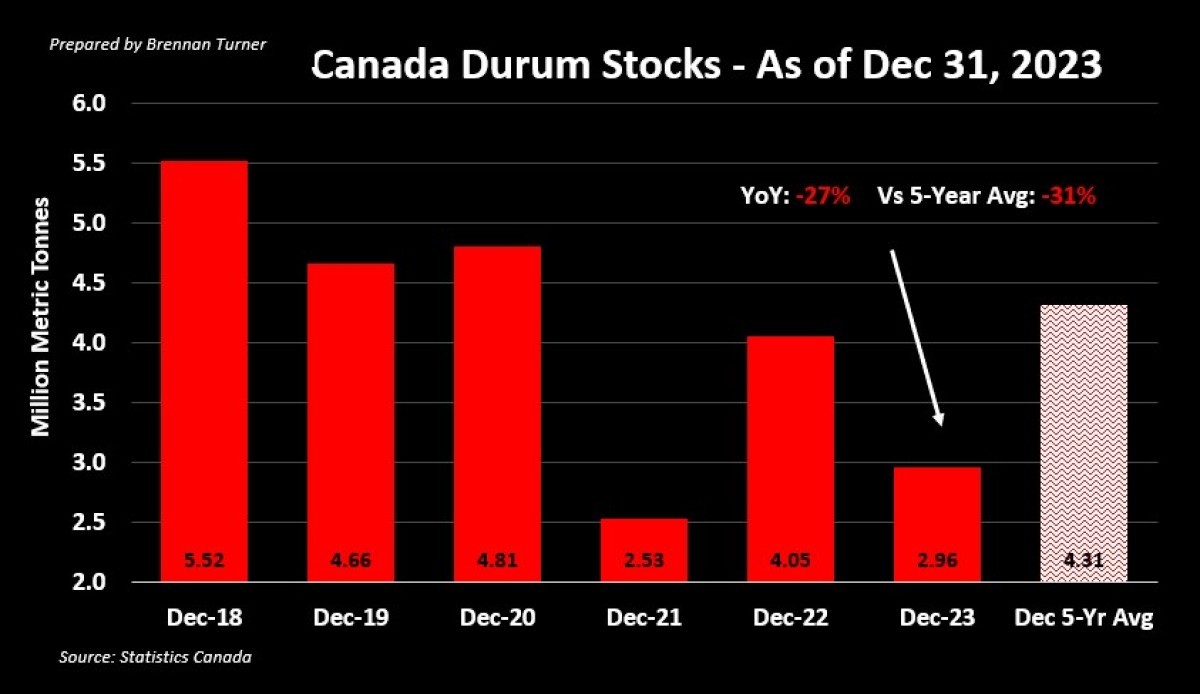

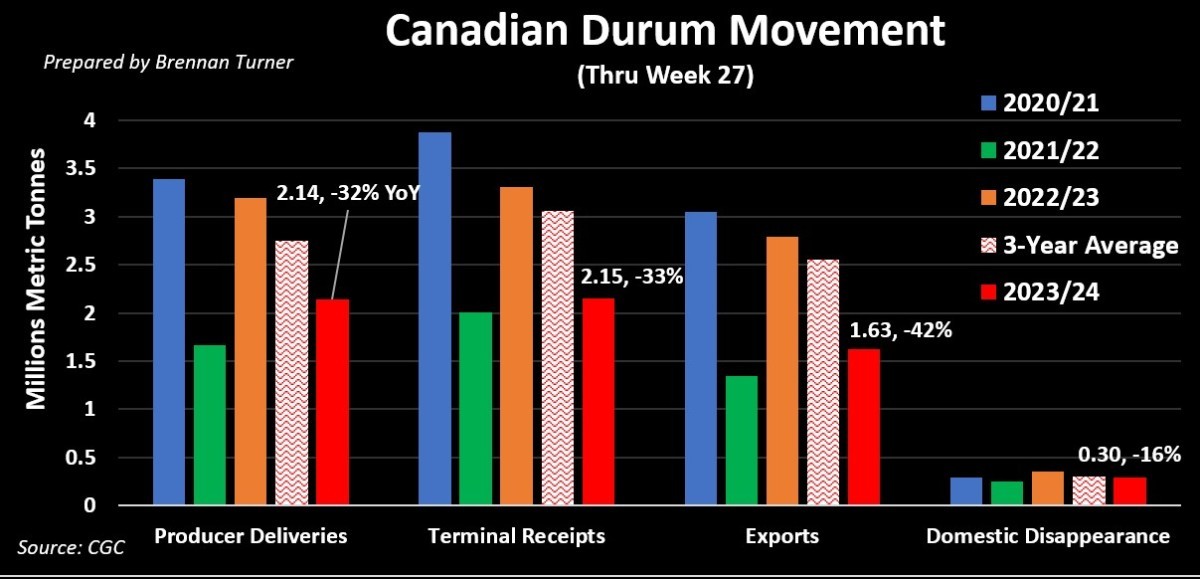

Canadian Durum stocks through end of December 2023:

- Total: 2.96 MMT (-27% YoY, -31% vs 5-year average)

- Commercial: 610,000 MT (-20%, -32%)

- On-farm: 2.35 MMT (-29% YoY, -31%)

- On-farm inventories down nearly 1 MMT year-over-year!

Soft Durum Demand Remains

- The decline in inventories represents both a story of lower production and softer demand.

- More talking heads and buyers believer we won’t be able to hit AAFC’s full crop year target of 3.2 MMT in exports.

- However, with a weekly average of 60,300 MT through Week 27 of 2023/24, we need to average a little under 63,000 MT to hit this forecast.

- Italy and Spain remain fairly dry but Turkish and Kazakh durum providing ample supply to European and North African buyers.

- In the first two-thirds of the EU crop year (which starts June 1), Europe has bought nearly 230,000 MT from Kazakshtan, or 10 times what it bought from them the same time a year ago.

- Canada’s share of the EU durum import market has dropped to less than 20% from over 70% a year ago.

- Private firm, Arvalis, says that, because of mixed conditions and late seeding, France’s durum 2024 harvest could be even smaller than last year’s 1.28 (which was its smallest since 1997).

- From a timing standpoint, we need to be aware that new-crop supplies will be available from Mexico in late April and late May for European options.

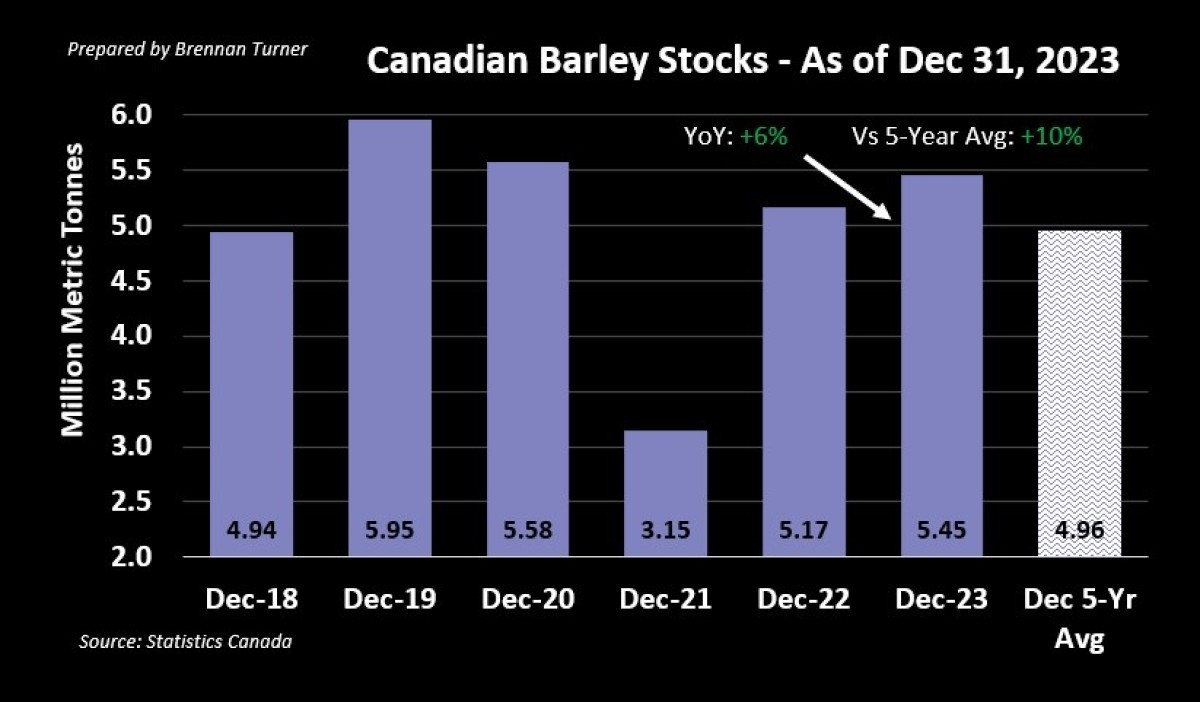

Canadian Barley stocks through end of December 2023:

- Total: 5.45 MMT (+6% YoY, +10% vs 5-year average)

- Commercial: 418,000 MT (+11% , +11%)

- On-farm: 5.04 MMT (+5% YoY, +10%)

- Higher on-farm stocks in Saskatchewan and, to a lesser extent, Manitoba, made up for downgrades everywhere else

- The higher inventories reflect both the weaker domestic and international demand.

- We know cheap corn has been displacing feed barley, both here in Canada and internationally.

- Domestic use of barley in the quarter is estimated to have dropped nearly 17% to just 2.9 MMT.

To growth,

Brennan Turner

Independent Grain Markets Analyst