Who has Wheat?

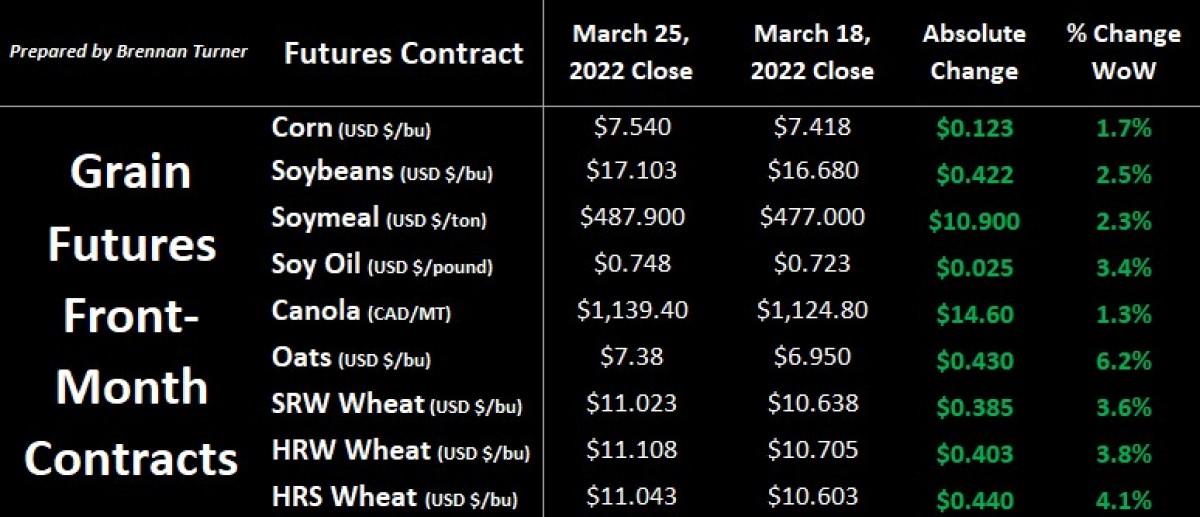

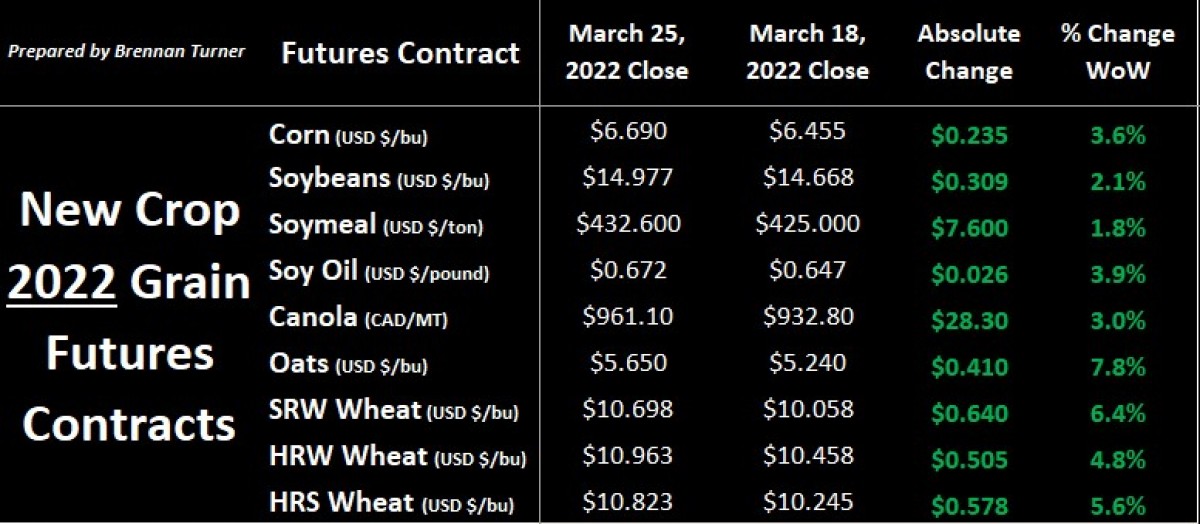

Grain markets found the green again last week, with 2022 new crop pricing leading the charge as traders are starting to focus on the potential of the upcoming growing season, instead of the last few weeks of the current crop year. As the tables below indicate, traders got a little longer on both old and new crop, and for the latter, it comes just a few days before the USDA Prospective Plantings report, released annually on March 31. Also on Thursday, we’ll get the quarterly stocks reports, which usually are associated with large price volatility. As I’ve stated in this column in the past, with drought and war owning the headlines, there is more food production at risk than any other time in the modern farming era, or basically, since World War I upended agricultural production and trade.

This week’s acreage estimates are riding on the coattails of the USDA’s Outlook Forum a month ago in February, where they estimated Plant 2022 in the U.S. would see 92M acres of corn (-1.4M acres year-over-year), 88M acres of soybeans (+800,000 acres), and 48M acres of total wheat (+1.3M acres). For wheat, if the spring area is realized, this would be the largest area planted in the U.S. since the 2016/17 crop year, largely because the winter wheat area seeded last fall of an estimated 34.4M acres would also be the largest area since 2016/17. However, the difference this year is that, as of a week ago, nearly three-quarters of all U.S. winter wheat areas were under some level of drought. Comparably, a year ago at this time, it was just 26%.

Speaking of soil moisture, the eastern half of Kansas finally got some good rains last week with about 2 inches falling across the important wheat-growing region. While the western half only averaged about half an inch, it’s now estimated that Kansas has about 60%-70% normal moisture, and while it is promising, more rainfall will be needed to help yields get close to average. Nonetheless, traders know that, at this point, a below-average winter wheat crop is more likely than unlikely, and that any other disruptions in the wheat market (of which, there are many variables today), could help propel prices even higher.

However, after the sharp reduction in Black Sea exports over the past month, prices are already quite high in Canada and the U.S. and maybe just too expensive to garner significant buying interest. By this time of the U.S. crop year, 99% of the forecasted wheat export program has been contracted, but this year, only 88%, or just under 19.2 MMT, has been signed up so far with about 2 months to go. Further, actual shipments are down 22% year-over-year with a little more than 15.3 MMT sailed, which is about 70% of the full-year target (whereas we’re usually at 76% sailed by this time in the calendar). Some of the slowdowns could also be attributed to rail service disruptions from Union Pacific, NNSF, and Northern Southern.

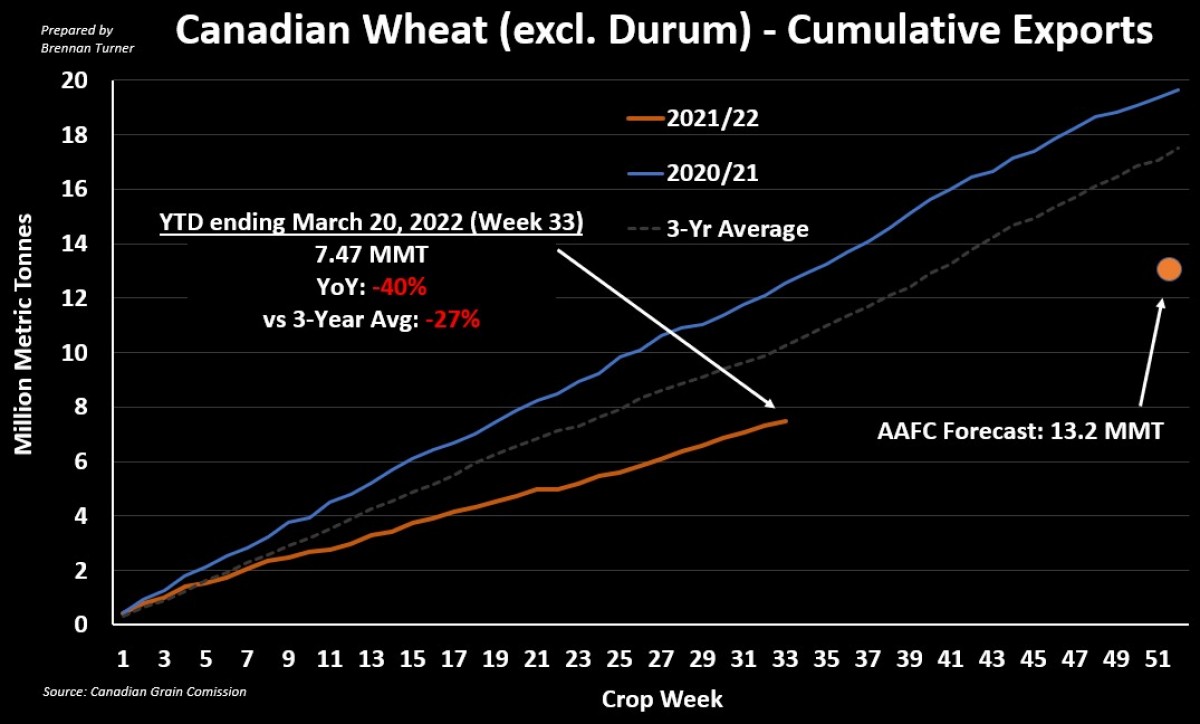

In Canada, the rail service slowdown can be targeted at CP Rail, but its worker impasse only lasted 2 days, so, like the U.S., the slow pace of wheat exports hasn’t just suddenly occurred, but rather has been an ongoing story. Thus, for non-durum wheat exports to hit Agriculture Canada’s export target of 13.2 MMT, Canadian shippers will have to move an average of just over 301,000 MT every week for the last 19 weeks of the Canadian crop year.

For context, the 4-week average of non-durum wheat exports has been 222,000 MT, while the full-year average through the first 33 weeks is a touch under 237,000 MT. The good news is that it’s rumoured Canadian shippers have sold upwards of 50 cargoes of wheat since Russia invaded Ukraine, and with over 1 MMT sitting in port positions, we could still see a surge in export activity in the next couple of months. Supporting this theory is the Great Lakes and St. Lawrence Seaway opening up again after their frozen, winter standstill.

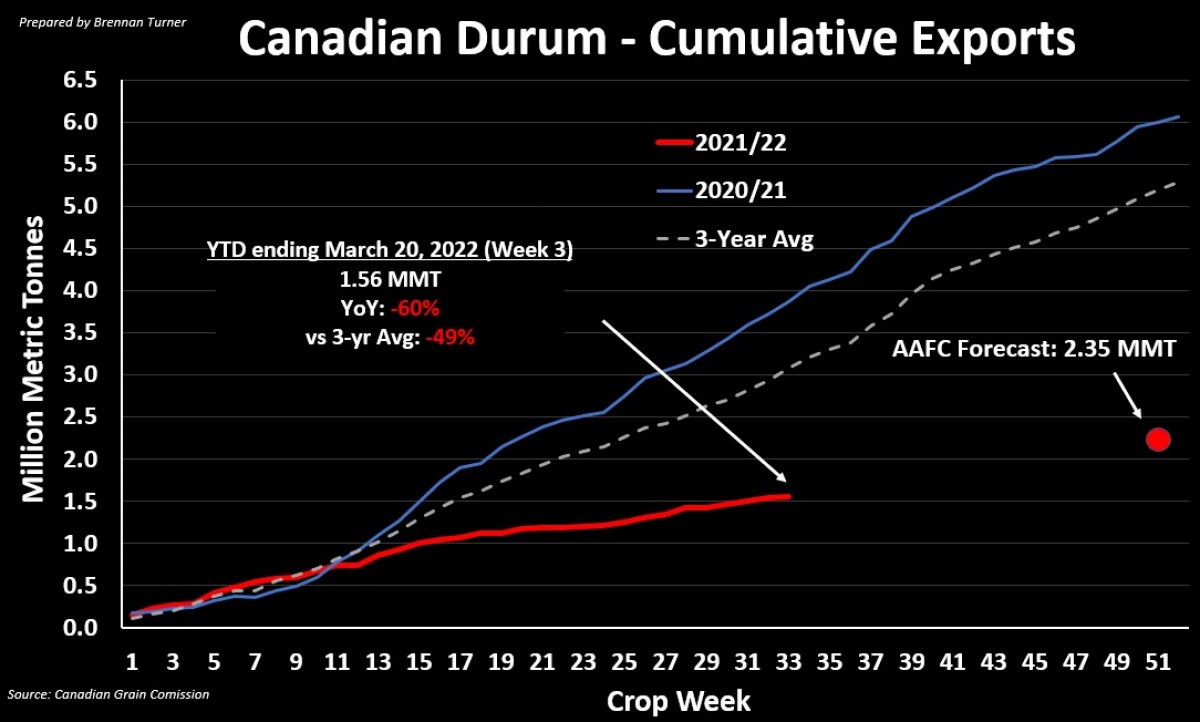

For durum, the export pace is even slower with 46,000 MT seen moved every week so, while the last 4 weeks have seen an average of just 25,400 MT moved out of country. To hit AAFC’s forecast of 2.35 MMT though, we only need to see an average of 26,450 MT moved every week over the next 19 weeks, which seems manageable. Keep in mind though that the Canadian durum balance sheet is extremely tight, and with an expected food crisis in the 2022/23 crop year, might some of these supplies, much of it held by commercials, be sat on until new crop prices converge to where old crop values are?

On the international trade front, Ukraine went from exporting 4–5 MMT of all grains per month to just a couple of 100,000 MT, with APK-Inform estimating last week that just 1 MMT may leave the country, only on the railroad, over the next 3 months. Therein, India is getting a little more wheat export business, thanks to back-to-back record harvests. Despite its wheat usually being traded abroad in the feed category, at these prices, some countries will push to use the lower quality for food purposes. This includes Egypt, which is one of the world’s largest wheat importers and has raised its moisture requirement from 13%-13.5% to allow for some lower quality wheat to be imported. Australia has also had two consecutive record wheat harvests, but basically needs to average 2.7 MMT of exports every month until July, which will be challenged by existing supply chain constraints and port bottlenecks.

All things being equal, it could just be that more international players are trading hand-to-mouth and want to see what’s available in India, Australia, or even the first cuts of the European crop before paying today’s higher wheat prices from the U.S. or Canada. Politicians from the U.S. to Europe are publicly talking about food shortages, and the increasing possibility of food aid programs, or even government intervention. While I’m against the latter, it’s most likely to come in the form of reduced biofuel mandates with more food going into food, instead of being burned for fuel.

The bottom line is that we know we’re going to get less grain production from Ukraine, and definitely fewer exports from them in the 2022/23 crop year. Again, this points to potentially higher prices than what the new crop is offering today. Many international traders know the possibility of this bullish scenario and so, instead of shipping all of their exportable supplies today, they might just hold on to a few extra bushels in case a perfect bullish storm materializes.

To growth,

Brennan Turner

Founder | Combyne Ag