Wishful Weather

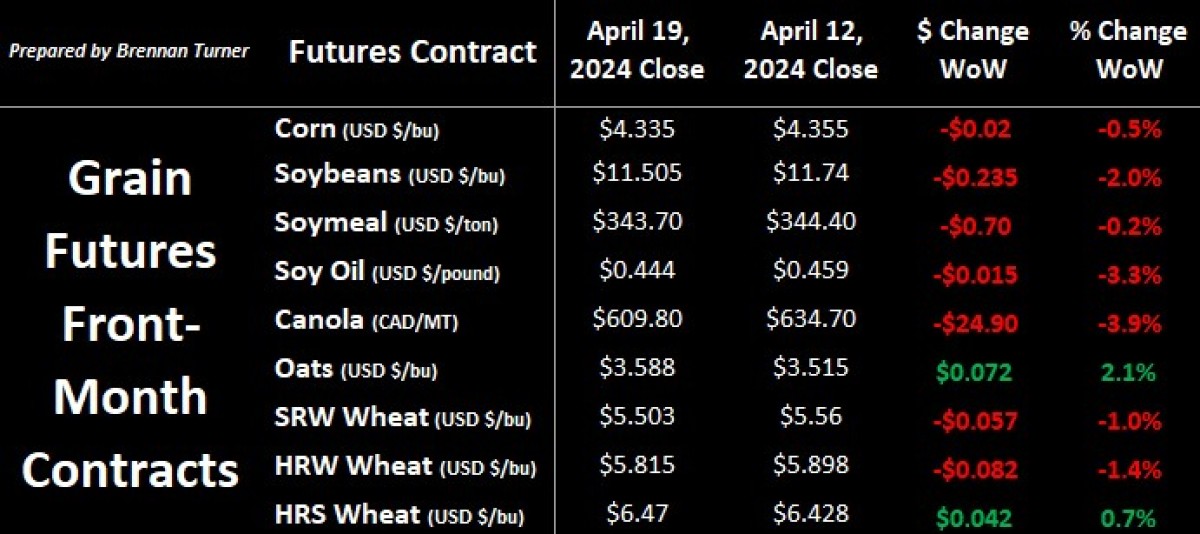

Grain markets ended last week mostly in the red with a higher Friday close thanks to short-covering on weather and increased tensions between Israel and Iran. While Middle East unrest may be considered noise, it’s hard to read any grain markets commentary without some mention of the growing season’s weather forecast. The “why” is that, without any bullish news catalyzing better grain prices, including this month’s WASDE, it’s likely that Mother Nature is the only thing left in the tickle trunk of factors that could drive higher values. One other macro factor I’m watching is the potential for a late May strike of CP and CN rail engineers and conductors, as well as CP rail traffic controllers, which the Western Grain Elevators Associations says would basically halt grain movement in Canada.

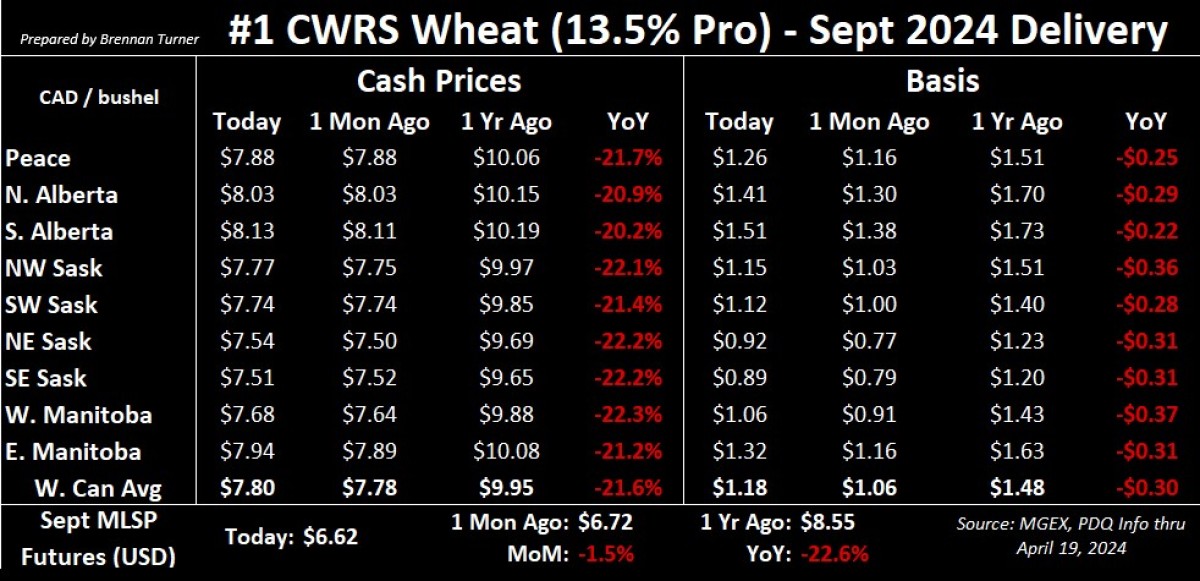

This is where a disciplined grain marketing plan comes into place. As you’ll read below, cash markets are starting to balance out. While the moves have been relatively subtle in the short term, a good marketing plan usually involves some long-term thinking. For wheat crops, this might include buying call options to hedge against 2024 new crop contracts already signed, while put options can help provide protection for those unprotected new crop bushels.

Uneventful WASDE

- South American government and private estimates continue to be much lower than the USDA. One example is the Rosario Grain Exchange making a more than 10 per cent, or 6.5 MMT, downgrade of the Argentine corn crop due to leafhoppers, which spread in hot and dry conditions.

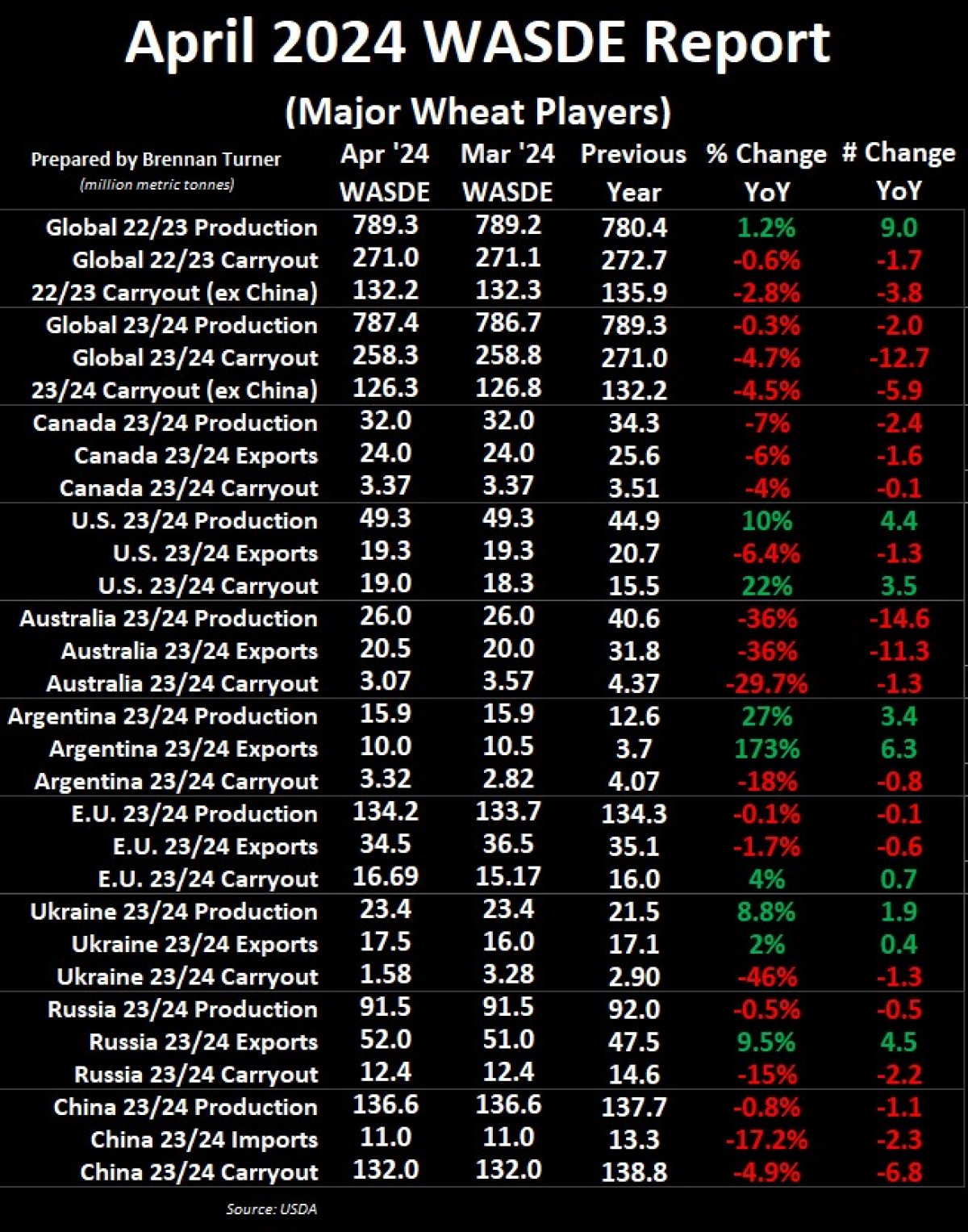

- In the wheat world, Russia’s 2023/24 wheat exports were raised by 1 MMT to now sit at 52 MMT as exports continue to be robust as the 2023/24 season nears its end.

- Ukraine 2023/24 wheat exports were also raised by 1.5 MMT as operations in the Black Sea are expanding.

- The flipside is that the EU is losing wheat export business to Russia and Ukraine, and so their new crop exports were lowered by 2 MMT to 34.5 MMT.

- For the U.S. wheat balance sheet, feed and residual use was lowered mainly in HRS wheat and durum, adding up to larger stocks, which are now sitting 22 per cent higher year-over-year at 15.5 MMT

- The next WASDE report, out on Friday, May 10, will include the first forecasts of the 2024/25 crop year. Depending on what the weather is doing by then, it could be a volatile trading day!

Where’s the Weather Premium?

- Is there any chance of a weather market this year? The most aggressive comment I heard last week was that if there are no weather issues this year, then the market will likely show a low-to-mid $3 handle for corn futures.

- There are some soil moisture concerns already in quite a few areas of North America, including the Western Corn Belt, both Southern and Northern Plains and Western Canada. Southern regions of Russia and North Africa could also use some moisture as wheat crops there finish up over the next one to two months.

- The latest U.S. Drought Monitor report shows that 53 per cent of Kansas, the largest wheat-producing state, is in some level of drought. This is up from 29 per cent the week prior, but below the 80 per cent seen at this time a year ago.

- A consistent theme across many meteorologists is above-average temperatures this growing season as we transition from El Nino to La Nina. This includes World Weather Inc., which has been looking at 18-year lunar cycles over the last century and a bit, and two of the six years included he driest summers in North American history (1934 and 1988).

- Drew Lerner specifically thinks that June/July could be the hottest in the Corn Belt, which is exactly when most corn crops there will be pollinating.

- Specific to Canada, Lerner says Manitoba and southeast Saskatchewan could be the driest regions this growing season, whereas areas north of the Trans-Canada highway in western Saskatchewan and Alberta could get adequate rainfall.

- Outside of North America, India is likely going receive normal monsoon rains this summer, but the government there continues to fight against food price inflation amidst their one-and-a-half-month-long federal election, which began last week.

- There are also a few pockets of concern here and there, but even though southern regions of Russia could use some moisture, Argus bumped their 2024/25 wheat harvest forecast by 2.1 MMT to 92.1 MMT.

Durum Demand, Competition Remains High

- With rumours that Russian durum acreage doubled this year, the Russian Ministry of Agriculture is estimating 1.8 – 2 MMT of durum production in 2024/25, with at least 1 MMT of exports.

- Compare this to 2023/24’s Russian durum harvest of 1.3 MMT and exports estimated by Strategie Grains at 800,000 MT, the latter of which would be a 60 per cent bump year-over-year.

- A new import tariff by the EU of $217 USD / MT could push Russian durum exports instead to North Africa and Turkey

- It’s hard to think that Turkey will need any more durum though as the USDA’s foreign office there says that, thanks to timely and above-average rains, the country could product 4.4 MMT of durum in 2024/25, which would be a 10 per cent jump year-over-year.

- Considering some private estimates are pegging it even higher at 4.7 MMT, the USDA believes that Turkey’s durum exports in 2024/25 could be as high as 2 MMT (a 33 per cent increase year-over-year).

- More broadly, while the global harvest of durum will rebound by 10 per cent to 34.6 MMT, demand will exceed production by 2.6 million tonnes, according to the International Grains Council.

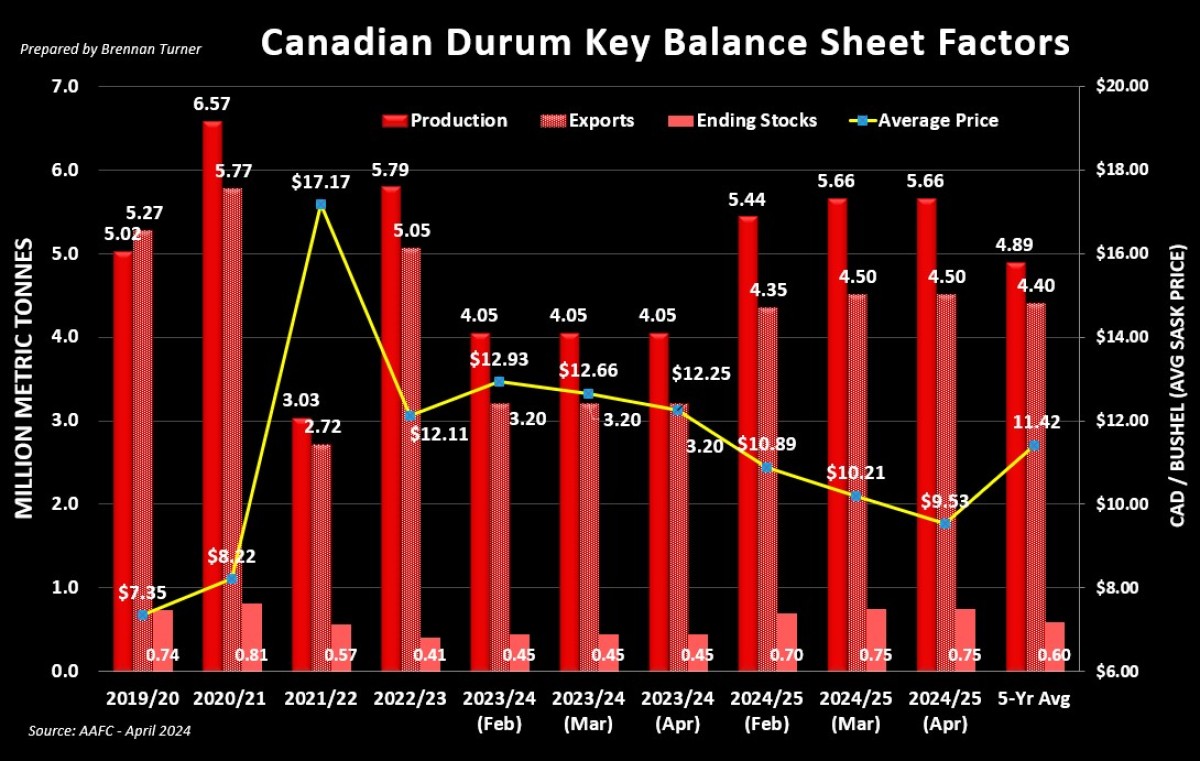

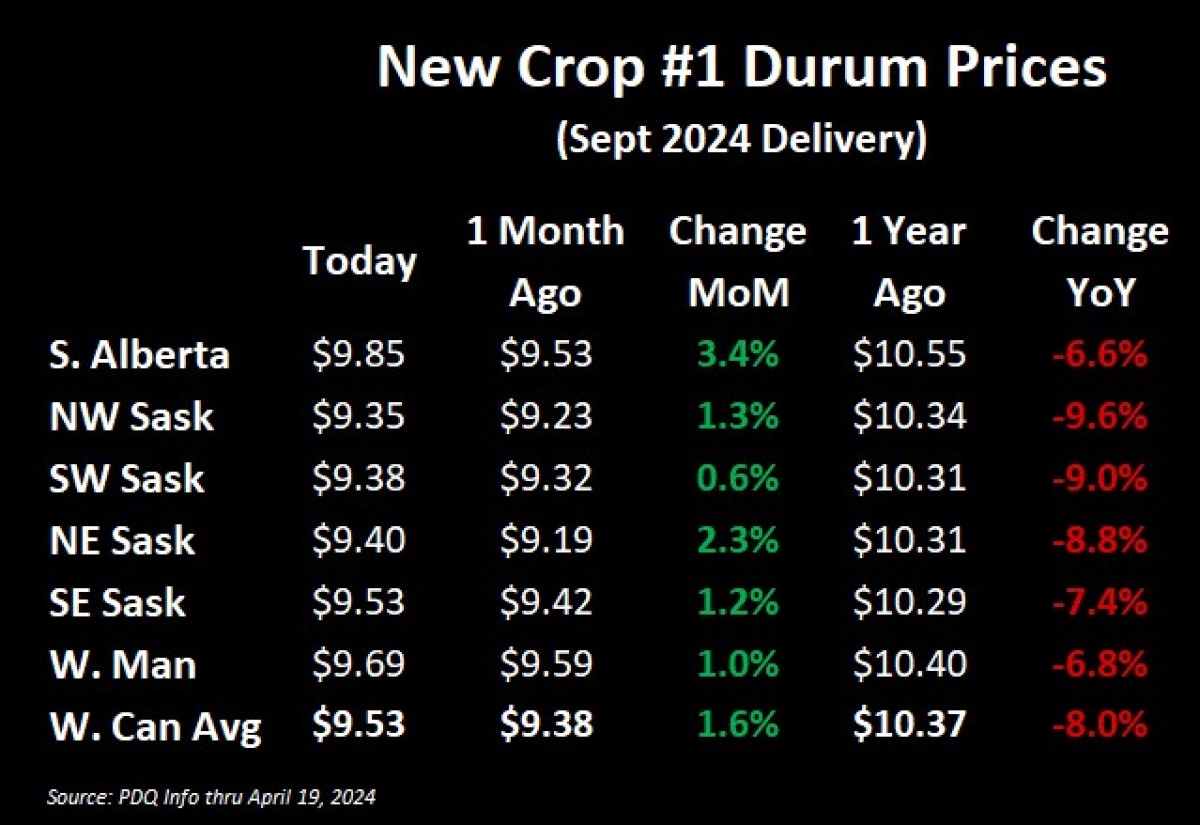

- In their April supply and demand report, Agriculture Canada, is starting to recognize this international competition by lowering their average price forecast to $9.53 CAD/bushel, the lowest since 2020/21.

- New crop 2024 prices have inched higher over the last month but remains below the double-digit mark that we’ve become accustomed to over the last few years.

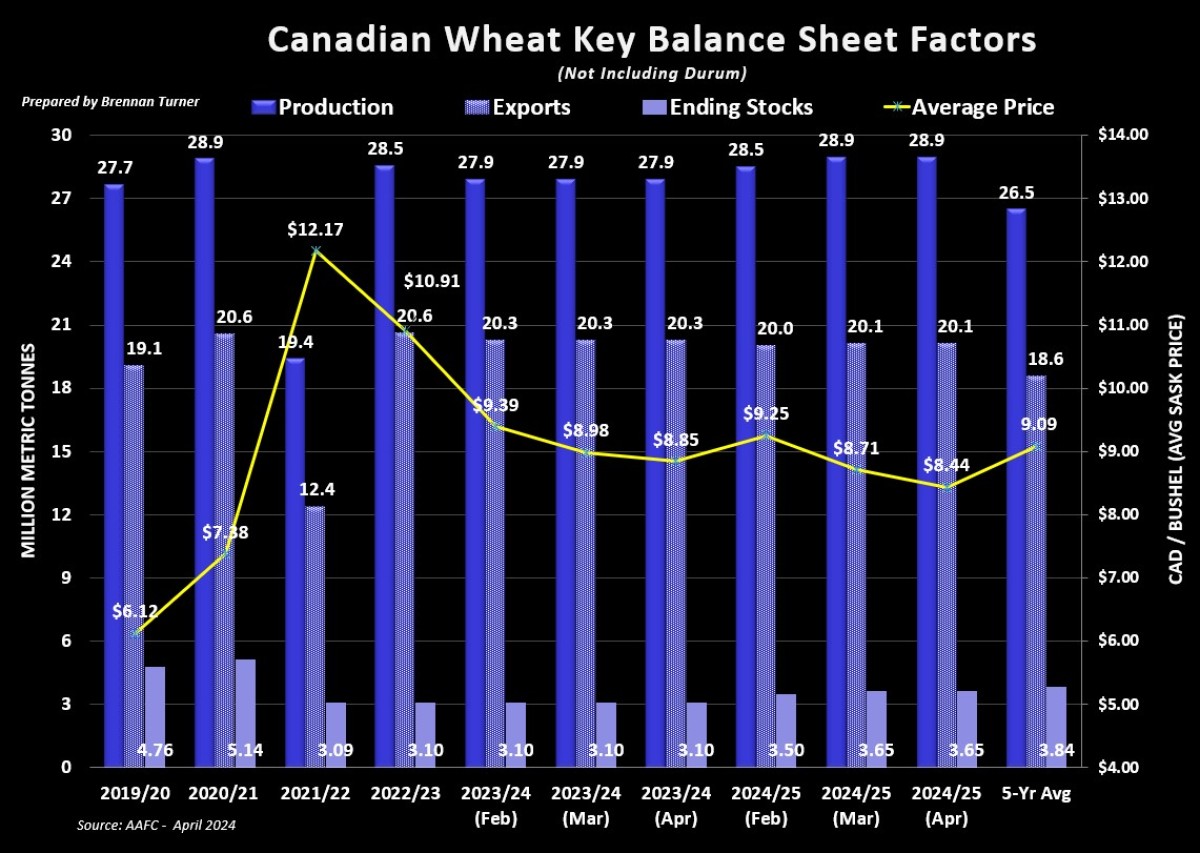

AAFC Lowers Wheat Prices

- Agriculture Canada did the same thing for the non-durum wheat balance sheet, only changing their price forecast, dropping it to the lowest point since 2020/21 at under $8.50/bushel.

- The port of Thunder Bay is already open, making it the earliest start to their shipping season since 2008.

- Feed prices have started to stabilize a bit, but coverage remains fairly strong. I expect mostly hand-to-mouth buying over the next few months (save for new crop coverage).

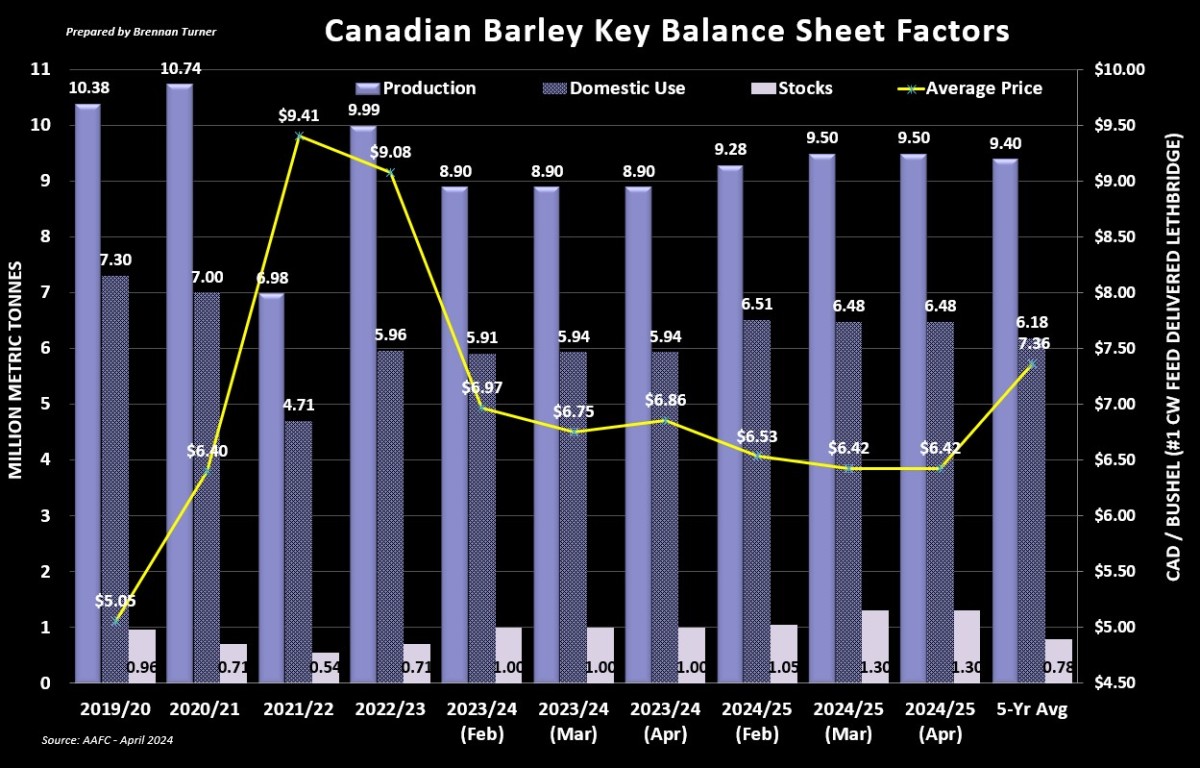

Less Barley Acres in 2024/2025

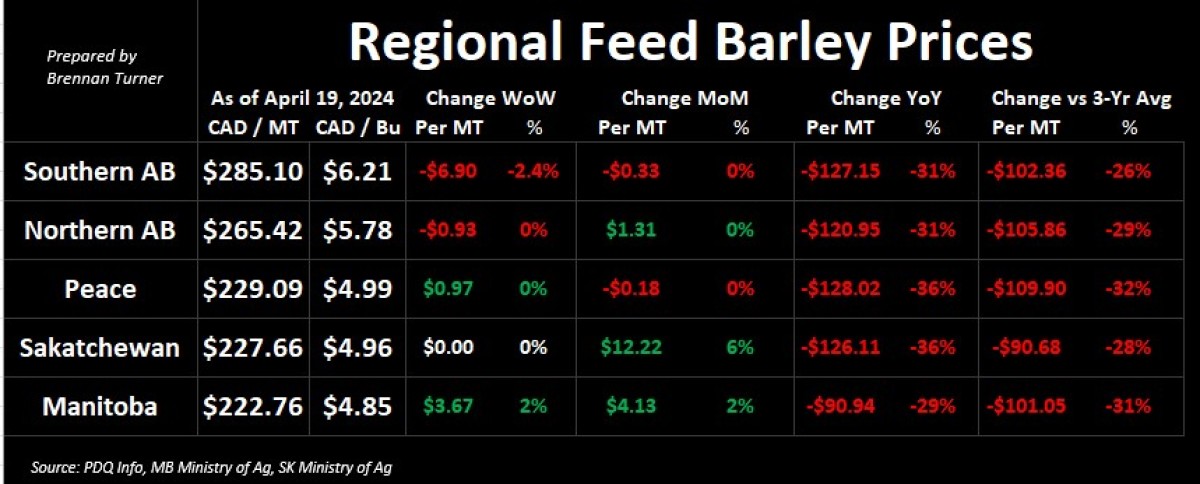

- That same hand-to-mouth buying applies to feed barley, and similarly, prices have stabilized, but with all signs pointing to more supply and tempered demand in 2024/25, there could be more downside yet.

- Old and new crop feed barley prices are trading similarly around the $6 CAD/bushel handle for delivery into the Lethbridge area.

- U.S. corn imports are likely going to temper down a bit, unless those $3 USD/bushel corn handles mentioned above start to materialize, which would pressure values even further.

- Agriculture Canada didn’t change anything except slightly higher prices for old crops in this month’s update.

- As feed and malt barley prices have declined over the past three months, private industry Plant 2024 acreage estimates are hovering around 6.6M – 6.8M acres, below the survey-based estimate of 7.1M from Statistics Canada.

- Expectations in 2024/25 are also for weaker demand, both domestically (due to corn substitutions and weaker demand in the U.S. for beer) and internationally (due to competition from Australia in the Chinese market).

- Internationally, thanks to plentiful rains on the east coast of Australia, private estimates are for an 11.1 MMT crop, which would be slightly larger than last year’s haul.

- Europe, especially France, has some wetness issues and malt barley prices have rallied a bit on quality concerns, which may spill over into Canada assuming the quality issues are realized.

To growth,

Brennan Turner

Independent Grain Market Analyst