Market Vantage: Monthly market update from LeftField Commodity Research

Wheat Outlook

Upside:

- CGC data shows non-durum exports continue to run at a record pace.

- USDA is projecting US exports at 900 mln bushels, the highest since 2020/21.

- The MGE March/May futures carry has narrowed since fall, which is a supportive market signal.

Downside:

- CGC delivery data and cash basis levels could be pointing to a seasonal lull in activity going into the end of 2025.

- Production estimates across the major exporters are the highest in over a decade, and keep increasing.

- USDA is forecasting the US carryout at 901 mln bushels, the largest since 2019/20.

- Very early expectations point to combined Russian and Ukrainian production being roughly flat in 2026.

Key Notes:

- StatsCan made a huge upward revision to spring wheat production, now at 29.3 mln tonnes, compared to 26.6 mln in September, and a record by a wide margin. The breakdown by class shows just over 83% of spring wheat production is hard red, which is consistent with the historical average. While this adds to Canadian wheat supplies, export demand has been robust.

- USDA increased production estimates for each of Argentina, Australia, Canada, the EU and Russia. Total 2025/26 production across the major exporters is now the highest in a decade. There may still be more upside in some cases (the Rosario Grain Exchange pegged Argentina's crop at a record 27.7 mln tonnes, vs USDA at 24.0 mln). The changes were expected, but also a reminder that price upside is limited due to big supplies.

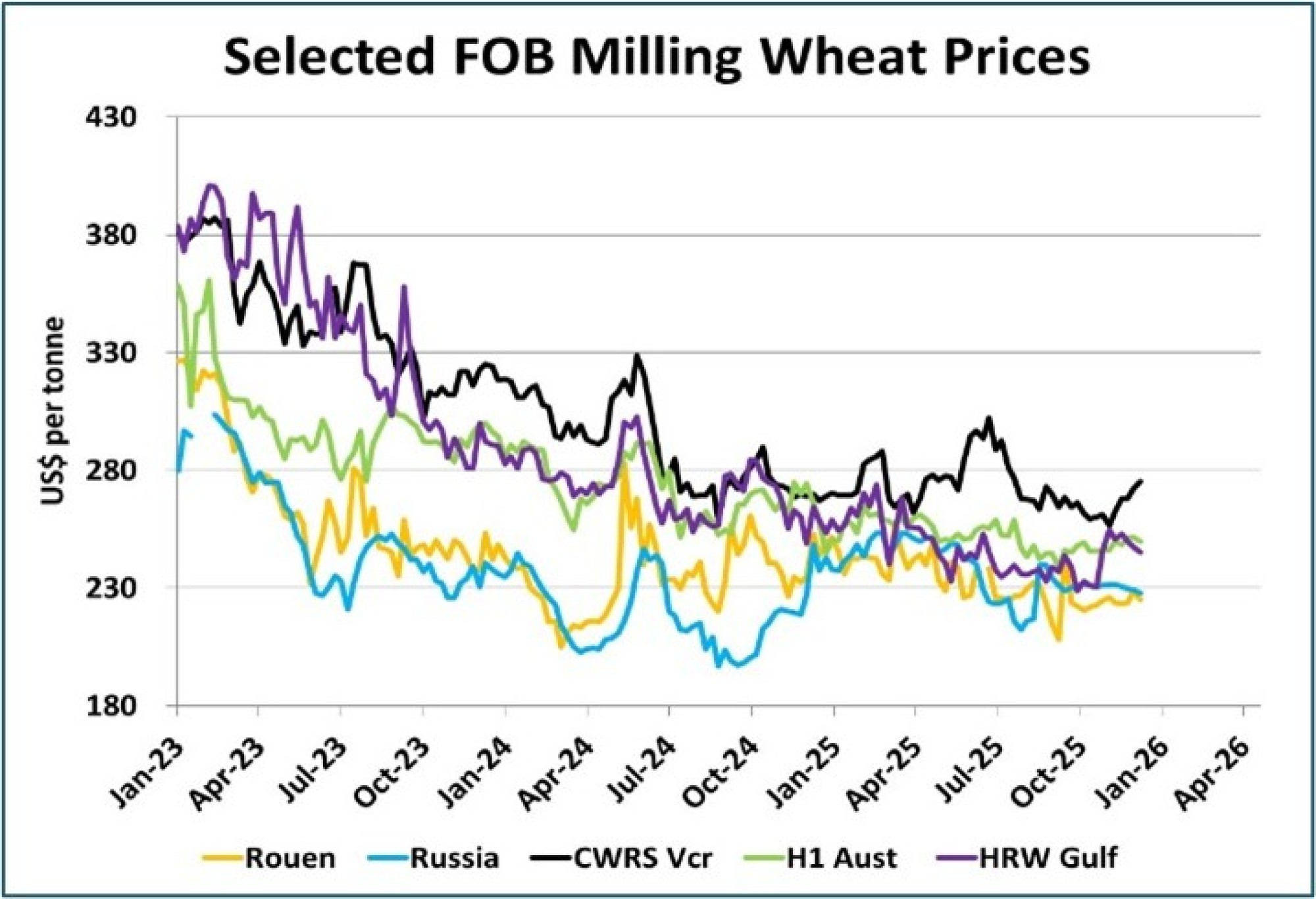

- Global wheat values remain range-bound as large stocks limit the need for prices to move higher. At the same time, this is largely factored in and there are hints of improvement in import demand. The market may see limited movement over the next few months, until attention starts to turn to 2026 production.

Bottom Line:

- The market is likely to remain in a range over the next 4-6 weeks, as big supplies prevent upside potential. But that is already largely priced in, and Canadian export movement has been strong.

- Basis levels have been softening, but that may partially reflect the market going into a quieter time of year. The seasonal price trend is also lackluster until late winter.

Barley Outlook

Upside:

- Even with ongoing gains in bids, FOB prices for Canadian barley are still very competitive globally.

- Barley inventories at Chinese warehouses are reported to be lower, which could suggest increased usage.

Downside:

- The 2025/26 Australian barley crop was estimated this week at 15.7 mln tonnes, a new record.

- Barley exports by the EU have already reached 4.4 mln tonnes, more than double last year's pace.

Key Notes:

- StatsCan’s yield of 79.4 bu/acre was far beyond the previous record of 72.5 bu/acre. The result is a 2025 barley crop of 9.73 mln tonnes, 1.5 mln more than the September number and 1.6 mln tonnes (19%) above last year. This pushes 2025/26 supplies above 11.0 mln tonnes, the most since 2020/21. Even with a large export forecast, this could cause 2025/26 ending stocks to exceed 2.0 mln tonnes, well above 2024/25.

- ABARES raised its 2025 barley crop estimate to 15.7 mln tonnes, adding over a million tonnes to its September estimate. Even though the yield of 3.29 tonnes per hectare (61.1 bu/acre) isn’t quite a record, the combination of an above-average yield and a small increase in acreage pushed 2025 production to a new high. This bigger crop estimate wasn’t a surprise and Aussie barley prices haven’t reacted noticeably. The 2.4 mln tonne increase over last year should allow 2025/26 exports to expand into record territory, with a previous high of 9.16 mln tonnes in 2016/17.

- Despite the larger 2025 barley crop, elevator bids for feed barley have still been able to move seasonally higher, at least for now. Malt barley bids are mostly steady, with domestic maltsters largely covered for the short to medium-term. The current spread between malt and feed barley bids also suggests the feed market hasn’t climbed enough to push malt bids higher.

Bottom Line:

- Despite larger barley crops in most key exporting countries, global prices remain well supported.

- Canadian barley exports have been exceptionally strong, helped by competitive prices, and will help draw down the heavy supplies in the 2025/26 S&D.

- The most likely direction is to follow the seasonal tendency higher, although the gains could be a bit more modest due to the comfortable Canadian stocks.

Durum Outlook

Upside:

- CGC data is showing Canadian durum exports running above average in September and October.

- The first 2026 EU durum crop estimate from Coceral is pointing to a 7% decline on more moderate yields.

Downside:

- Durum ending stocks in key exporters will be up sharply for 2025/26.

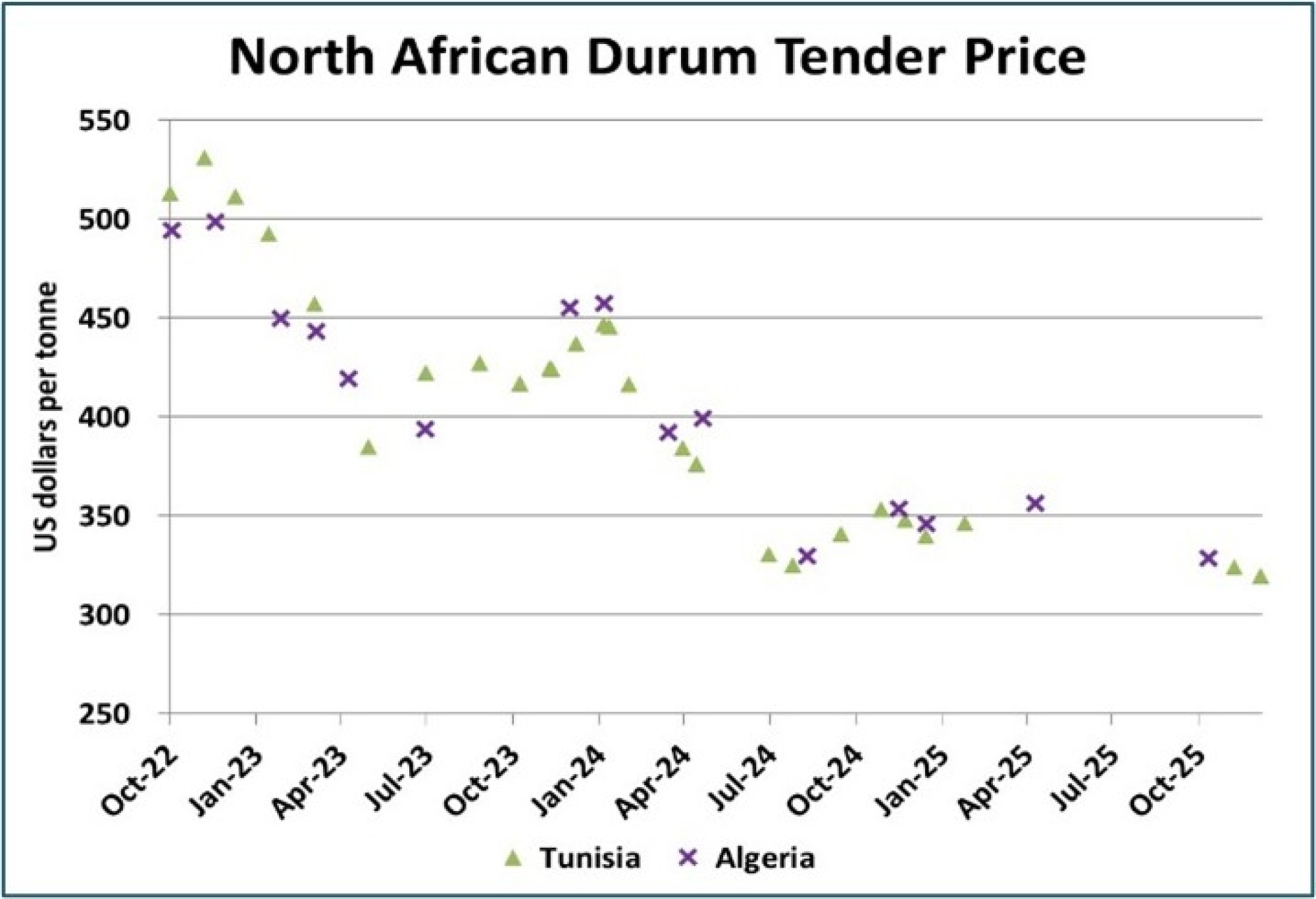

- The latest durum tender from Tunisia was awarded at slightly lower prices than a month ago.

- Durum bids have shown a muted seasonal response, with the index declining in the coming months.

Key Notes:

- StatsCan raised its 2025 durum crop estimate to 7.14 mln tonnes, up from 6.54 mln tonnes in September. This latest production number is 750,000 tonnes (12%) more than StatsCan’s 6.38 mln tonne estimate for last year. This would be the second largest crop on record following 2016/17, but this year’s yield of 40.9 bu/acre is still far below the previous record of 49.5 bu/acre in 2016/17. It’s possible the actual crop is even larger; StatsCan’s final durum estimates in the last four years have averaged 360,000 tonnes more than its December numbers. Based on this new crop estimate (and our prior year revisions), 2025/26 supplies would be 7.94 mln tonnes, also the largest since 2016/17.

- This week, Tunisia issued and awarded another 100,000 tonne durum tender, with shipment in Jan/Feb. The average of the winning tenders was just under US$320 per tonne, down $4-5 from its previous tender a month ago. While the durum for this tender won’t likely be coming from Canada, it would roughly work back to a central prairie bid of $7.60-7.65 per bushel. This latest tender also demonstrates that durum is still very much a buyers’ market.

Bottom Line:

- Movement of durum through the Canadian handling system has been surprisingly strong so far in 2025/26, but that hasn’t been enough to give prices a lift. Farmer deliveries and elevator shipments are running ahead of last year’s pace, but on-farm supplies are also larger.

- Durum remains under pressure from large global supplies and with the closure of the Seaway approaching, Canadian exports could start to slow, especially compared with last year’s heavy midyear volumes.

- The seasonal tendencies for durum bids run steadily lower through the winter and spring and with no supply tightness on the horizon, that would be the most likely direction going forward.