Ho-Hum Start to 2024 Grain Futures

Grain markets were lower for the first week of trading in 2024. Selling by managed money in a quiet trading week pressured the complex. March corn futures made fresh lows on Friday, thanks to a marketing year low in weekly exports. Soybean futures were pressured by fresh rains in the dry central and northern areas of Brazil. Canola followed the soybean weakness but was also impacted by lower soy oil and European rapeseed trading. Winter wheat futures hit a multi-week low on Thursday before rebounding on Friday. This was attributed to rumours that China is looking for U.S. wheat (I’m a bit pessimistic, given the current values, but Chicago Wheat was trading lower again to start this week). Despite ongoing attacks in the Red Sea by Yemen-based rebels, there does not seem to be much risk premium being added to North American grain values.

If you haven’t yet had a chance to do so, it’s worth revisiting the 2023 wheat market recap from before the holidays, as well as the 2024 wheat market outlook shared last week. In those two columns, there are plenty of data to help give a visual perspective on where things have been and where they are going in the wheat complex. We will also get some fresh updates this Friday in the USDA’s January WASDE installment, which is set to bring final U.S. yield and production numbers. Market participants will also be looking for updated production numbers from Brazil and Argentina, as well as any updates to the European Union and Russian wheat balance sheets.

Staying in South America, Argentina’s wheat harvest is about 80 per cent complete. The government recently estimated the country’s wheat harvest at 15.1 MMT. Comparing this to the UDSA’s current projection of 15 MMT, the Buenos Aires Grain Exchange’s forecast of 14.7 MMT, and the Rosario Grain Exchange’s expectation of 14.5 MMT, Argentina is proving to be active in the export market. There are a few moving parts to this equation as newly elected President Javier Milei has introduced fresh currency and export policies aimed at incentivizing increased production and exports.

To execute this, the Argentinean government must come up with some cash and has increased the export tax on wheat from 12 per cent to 15 per cent. This leads to exporters taking out these licenses sooner rather than later (hence the sentiment of increased shipping activity over the next few months). While local farmers are opposed to higher export taxes, the goal of the new Argentine government is to eliminate the taxes, as the last time this happened, seeded wheat acres jumped by more than 50 per cent.

In other international wheat headlines, Egyptian farmers have planted about 20 per cent more wheat compared to this time a year ago. Depending on the growing conditions, this could reduce dependence on international purchases (primarily from Russia). Meanwhile, India’s wheat inventories at the start of 2024 are sitting just below 16.5 MMT, its lowest volume since 2017. This could be an interesting market to watch, but again, it will depend on how the current winter growing season evolves. Similarly, the Minneapolis Grain Exchange estimated total spring wheat stocks in America to start at 16.85M bushels in 2024, or just under 460,000 MT. This is down more than six per cent year-over-year.

Speaking of U.S. Wheat, with solid winter precipitation, the winter wheat crop in Colorado and Oklahoma has ballooned above 60 per cent rated good-to-excellent (G/E). Similarly, winter wheat G/E ratings in Kansas and Texas have also improved but remain below 50 per cent. As a reminder, winter condition readings should be taken lightly, as it’s the growing conditions from mid-March forward that tend to correlate to production numbers.

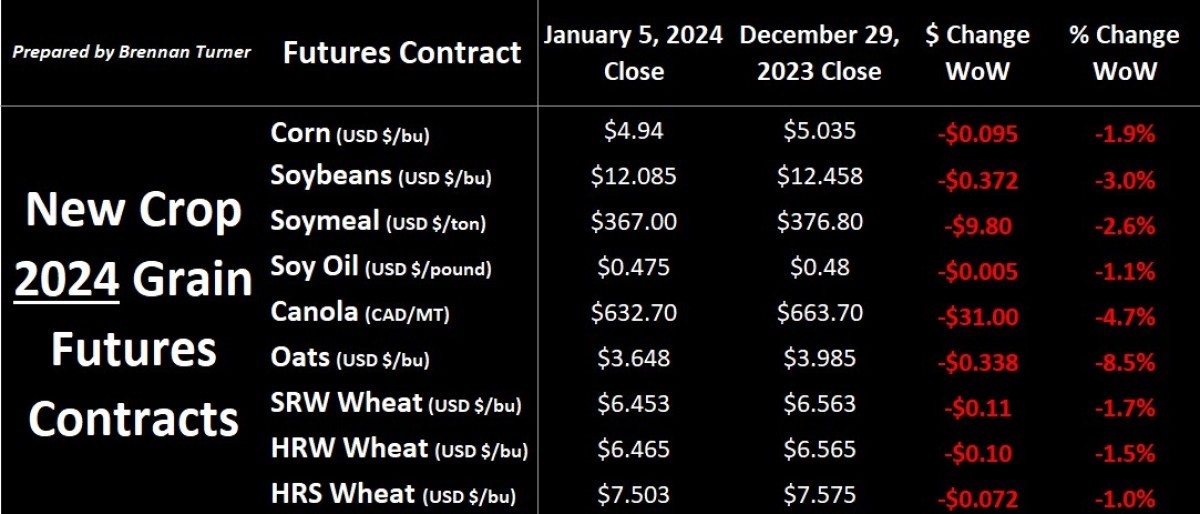

On that note, most talking heads are looking at Chicago Soft Red Winter as the driver that could push the wheat complex higher. This is largely because funds have covered a significant portion of their short positions, and a bottom has seemingly been found around the $6 USD / handle (at the time of writing, the front-month contract was at a level below what was significantly comfortable). We will need to see more export demand for U.S. Wheat to help drive momentum in not just Chicago futures, but all three of the U.S. Wheat trading boards. A supply shock from the USDA on Friday in the corn and/or soybean market could surprise us, but between the more favourable weather in Brazil and weaker U.S. exports, it’s been a ho-hum start to 2024 grain futures.

To growth,

Brennan Turner

Independent Grain Market Analyst