Black Sea, Summer Heat Fuels Rally

Grain markets had a very strong week through July 21 as weather and Black Sea risk premiums were added all week until some profit-taking on Friday. With Russia officially not renewing the Black Sea Grain Deal on Monday, July 17, it started a new era for how they will approach Ukrainian ports and ship activity in the Black Sea going forward. They started by attacking grain-handling port infrastructure for four straight days and explicitly stating that they will treat any vessel headed for Ukraine as a potential transporter of military goods (instead of i.e. grain).

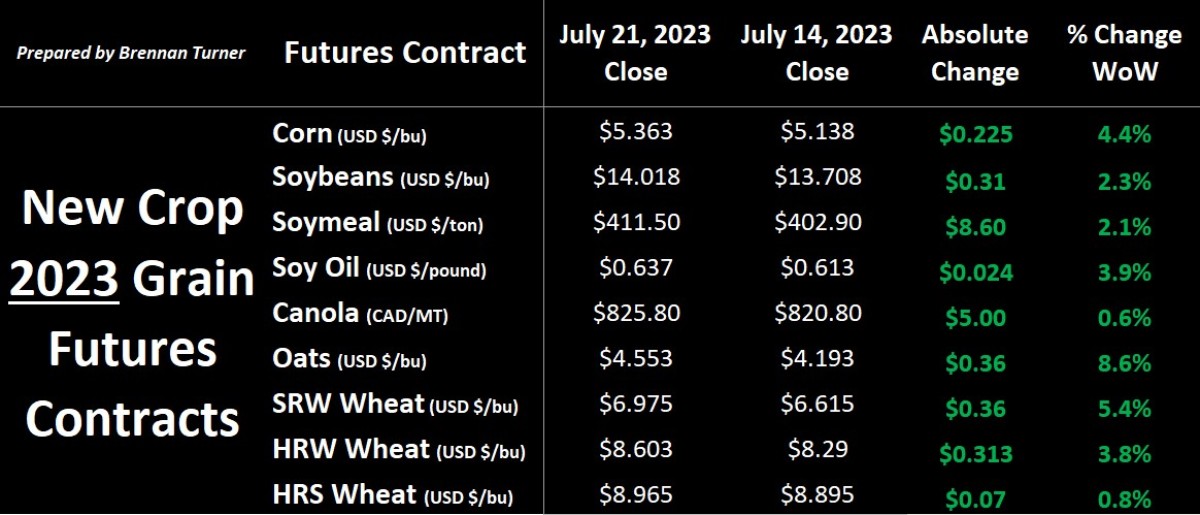

On top of this, the 10-day forecast suggests extended hot weather with close to or above 100 degrees Fahrenheit showing up in almost every growing region in North America, which would likely nullify any helpful rains these areas have received in the past week. As a result of the weather and war, the wheat complex had a very strong week, with Chicago SRW wheat futures actually seeing their best weekly performance since late February 2022 when Russia invaded Ukraine. As war premiums continue to be added to start this week, the U.S. Wheat Quality Council‘s spring wheat and durum crop tour will also be on wheat traders’ minds this week.

Staying in the Black Sea, even though Ukraine has offered up a half a billion dollars to insurance companies to incentivize them to provide coverage for ships carrying Ukrainian grain, Russia’s aggressive military stance is certainly disincentivizing ship owners and insurance companies to do business in the region. Thereby, instead of 60,000 MT boats transporting grain from Ukrainian ports, it sounds like most product will start flowing through Danube River ports, which can handle a max of about 15,000 MT vessels and has the capacity to move up to 2.5 MMT of grain and oilseeds every month. Nonetheless, over the weekend, in addition to attacking Odessa ports, Russia destroyed a grain storage facility at a Danube port, basically verifying that Russia is set on impeding Ukrainian grain flows.

In addition to Russia’s efforts, the EU has banned Ukrainian grain from moving through neighbouring countries Bulgaria, Hungary, Poland, Romania, and Slovakia until mid-September. These five nations have already called on EU lawmakers to extend this policy until the end of the 2023 calendar year as a larger harvest in eastern Europe is already going to tax grain handling infrastructure in the region. Thus, it is looking increasingly difficult for Ukraine to get its farmers’ harvest to market, and that impacts the market both today, but also likely a year from now.

As nearby global wheat and corn prices climb because of the trade risk premiums being added, Ukrainian grain prices will likely fall to offset the higher risk of moving the product. This, according to the International Food Policy Research Institute think tank, will likely lead to an even smaller 2024 corn and wheat harvest in the war-torn country because of inability to pay for increasingly expensive crop inputs. All of the above in mind, Ukraine’s role as a major supplier of foodstuffs to the global market is looking increasingly diminished.

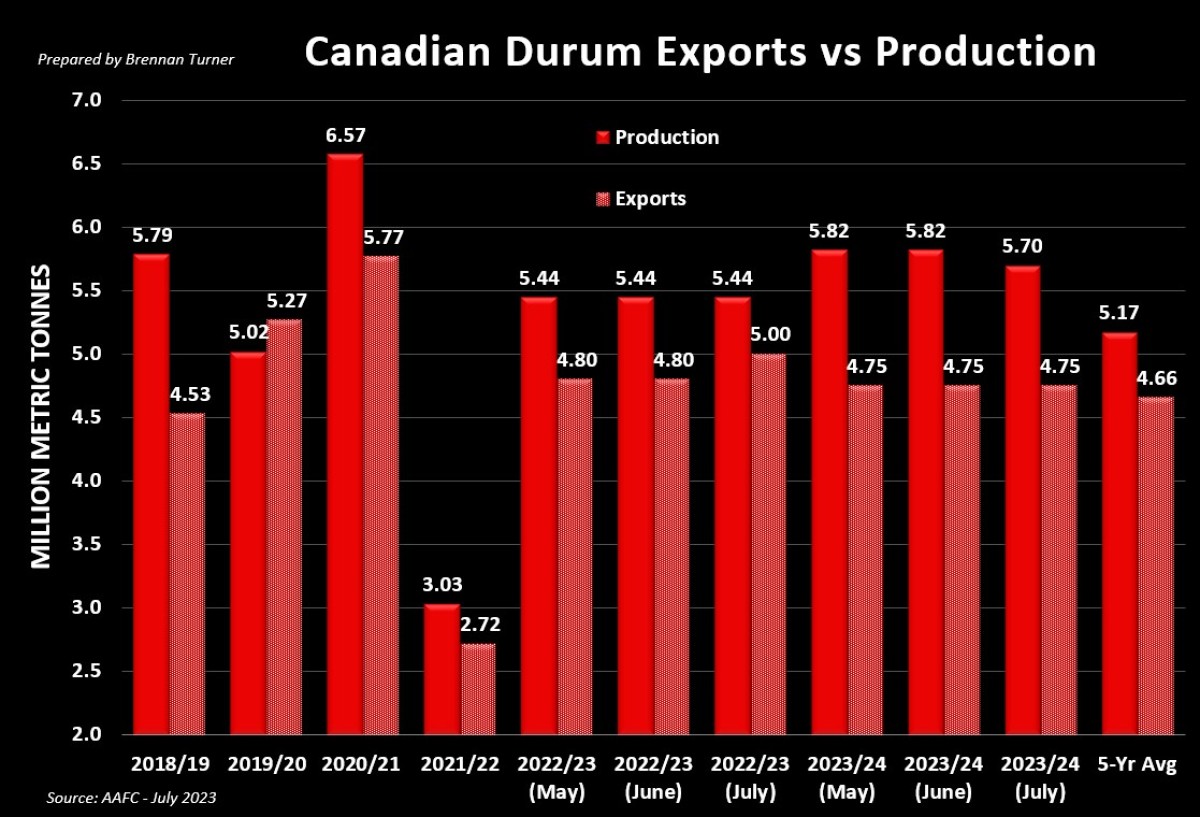

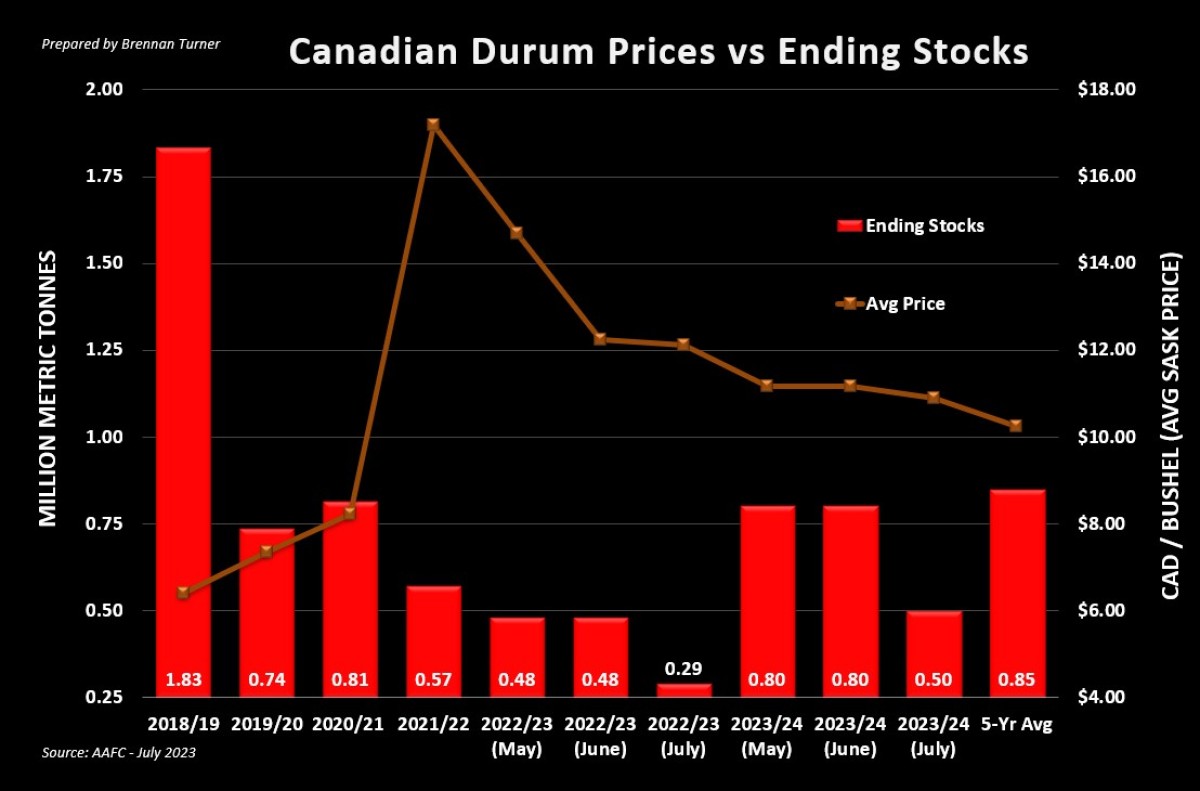

That essentially means other countries, like Canada, are in a position to pick up the slack. Fresh off a new west coast port workers agreement, Agriculture Canada came out with its updated supply and demand tables last week, continuing to show strong demand for Canadian wheat. Old crop 2023/23 durum exports were raised by 200,000 MT to 5 MMT total with shipments to Italy and North African countries alone up roughly 2.1 MMT year-over-year. The increased volume means that Canada will likely end the 2023/23 crop year with just 290,000 MT of old crop to carry over into the new crop year, which would be a new record low.

Surprisingly, despite the clear drought situation in Western Canada, AAFC only reduced their durum yield forecast by 0.6 to 35.4 bushels per acre (bu/ac). Looking back at their estimates in the drought-riddled Harvest 2021, Agriculture Canada dropped its durum yield forecast by nearly 13 bushels to 27 bu/ac in their August report from the July one, before settling at a final yield tally of 20.2 bu/ac. For context, following a recent crop tour, Glacier Media’s MarketFarms is expecting an average durum yield of 26 bu/ac this year so it's reasonable to expect a sizable downgrade next month from the government.

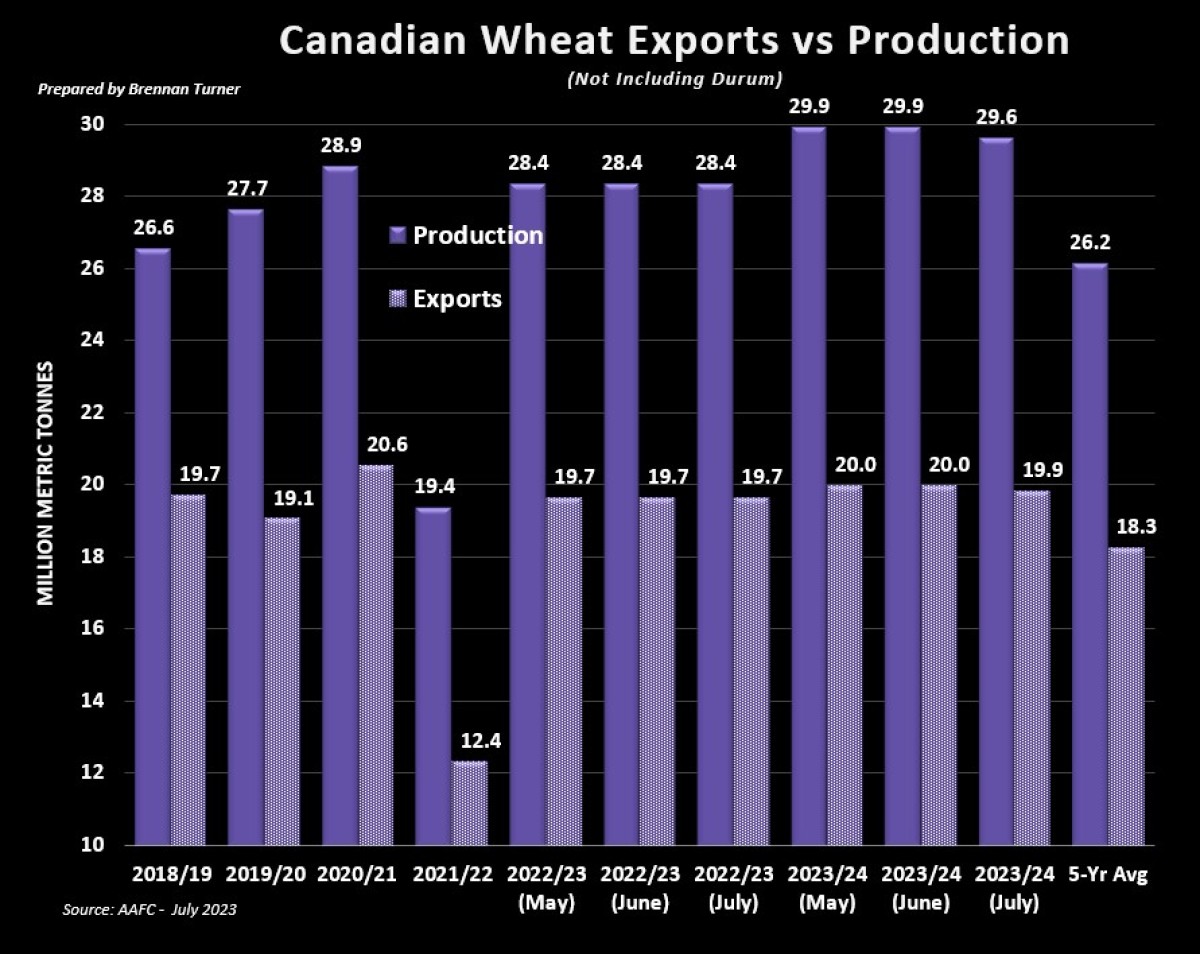

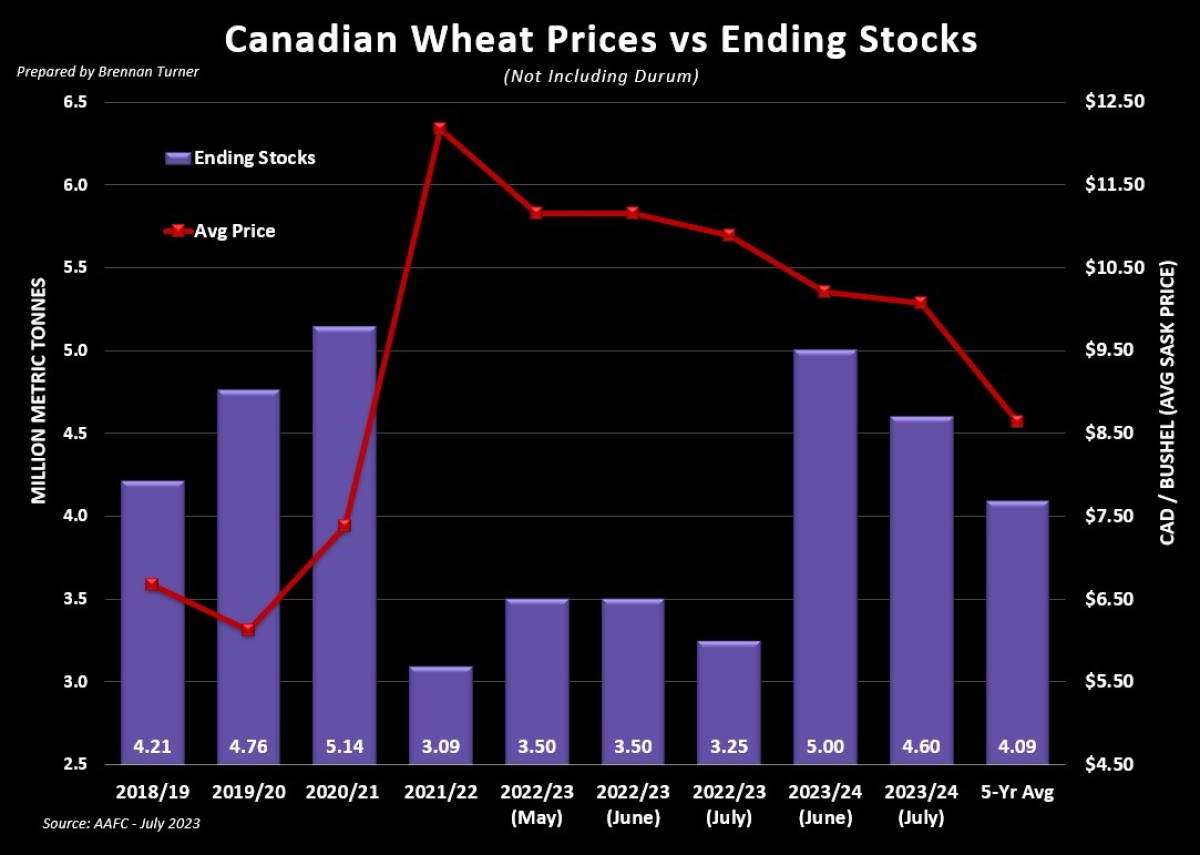

For non-durum wheat, that same crop tour by MarketsFarms suggests an average spring wheat yield of 44 bu/ac, which would be an 11 per cent drop year-over-year. Meanwhile, Agriculture Canada subtly reduced average wheat yields, again setting things up for a major reduction in their August print. However, they did acknowledge that if production is smaller than expected, prices should rise, thereby negatively impacting Canadian wheat’s competitiveness in a global market and reducing export business. With the incredibly strong 2022/23 exports campaign though, the forecasted ending stocks of 3.25 MMT is precariously close to that of the 2021/22 drought year, which saw just 3.1 MMT carry over into the next crop year. Ultimately, Canadian wheat yield and production expectations will need to reflect reality, and with limited inventory coming over from the 2022/23 crop year – which ends July 31 – wheat prices are going to eventually reflect this reality of limited supply to go around.

Those yield reductions though will likely depend on weather over the next three to six weeks. While Alberta didn’t put out a crop report last week, Saskatchewan’s showed that just 26 per cent of durum and 50 per cent of spring wheat is rated as good-to-excellent (G/E). Frankly, this is much better than the same week in 2021, which saw just 11 per cent of durum and 16 per cent of spring wheat rated good, with nothing whatsoever categorized as “excellent”. With more hot weather hitting North America this week, there’s going to be more volatility in the markets, likely to the upside, but the NOAA has indicated that their expecting August weather to turn wetter and cooler, which may help American soybeans, but it’d likely be too late for any material benefit to corn yields.

To growth,

Brennan Turner

Independent Grain Market Analyst