Setting the Tone for 2023’s Final Weeks

Grain markets found a higher close to reach the midway point of October as the USDA’s mostly bullish WASDE report released Thursday finally provided a catalyst from what many hope are the bottoms. In that report, the USDA lowered average U.S. corn yields by 0.8 from last month to 173 bushels per acre, while soybean yields were lowered by 0.5 to now sit at 49.6 bushels. Both updates were close to the bottom end of the range of pre-report expectations and continue to suggest a tight U.S. soybean balance sheet.

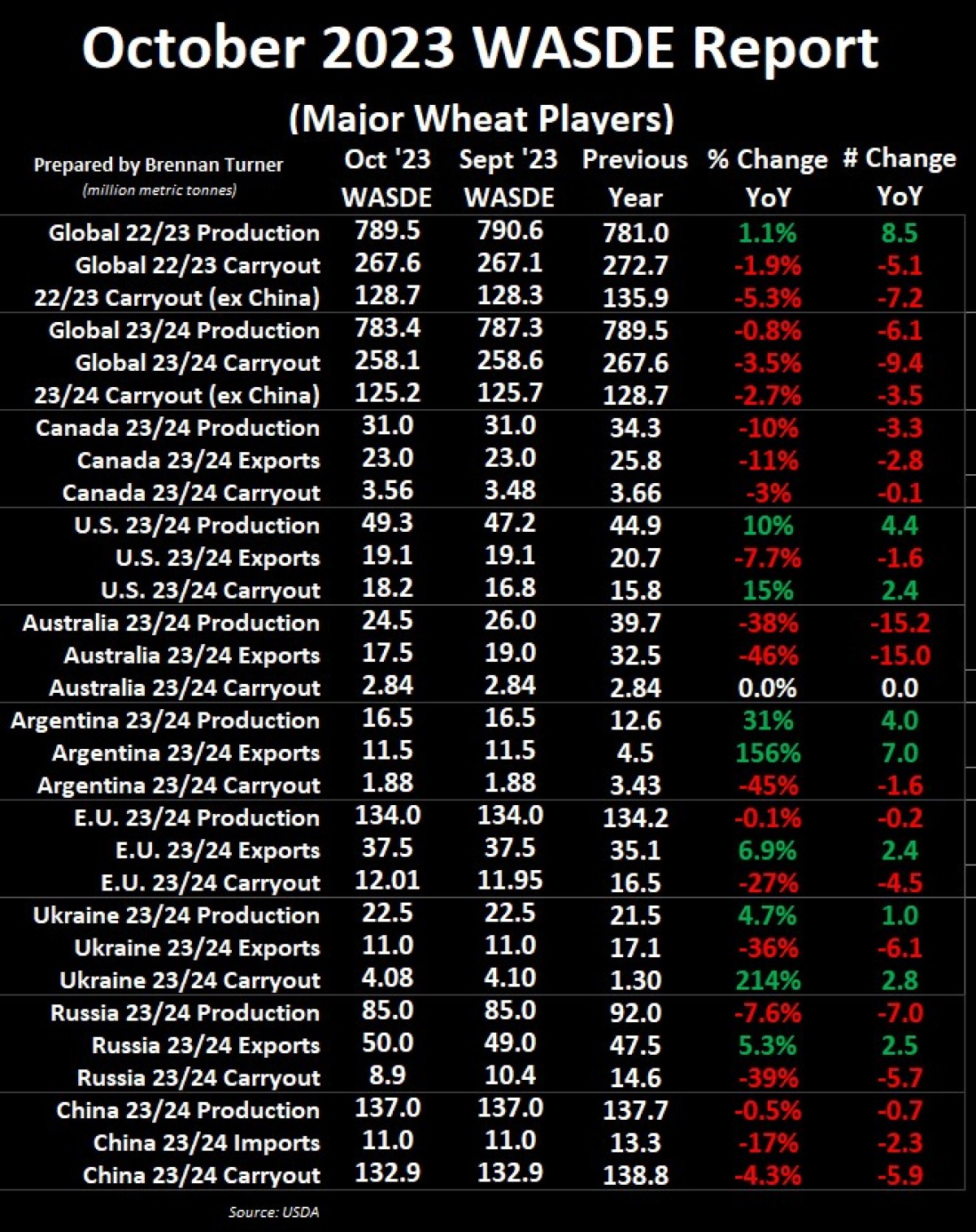

For wheat, the market had already baked in the stronger U.S. wheat production numbers shared in the September 29 Small Grains Report (and as discussed in this column two weeks ago), and so all the focus in this month’s WASDE was on the demand side of the balance sheet. Frankly, while there wasn’t much domestic demand added for U.S. wheat, the bulls ran with a smaller global production number, namely from the Southern Hemisphere. Friday’s trade saw some profit-taking, which took away some momentum, but not all and overall, this October WASDE has likely set the tone for the rest of the calendar year.

Eyeing the higher domestic disappearance seen in the June-August quarter of the 2023/24 U.S. wheat crop year, the UDSA raised American wheat’s feed and residual use by 30M bushels (816,000 MT), but that was it. The number that most were eager to see updated did not change as U.S. wheat exports remain at 700 million bushels (or 19.1 MMT). HRW and SRW wheat saw offsetting 10M bushels (272,000 MT) upgrades and downgrades respectively to both sit at 145M bushels (3.95 MMT) of projected shipments. Similarly, HRS wheat and white wheat exports also offset each other with 10M bushel bump and reductions, respectively, for a total of 225M and 160M bushels each (or 6.1 MMT and 4.35 MMT). Durum exports were kept at 25M bushels (680,000 MT), so the U.S. is now expected to end the 2023/24 crop year with 1.5 MMT more wheat than the September WASDE suggested.

Looking globally, Russia’s old crop, 2022/23 exports were raised yet again this month by 1.5 MMT to now sit at an improbable 47.5 MMT for the total crop year. Accordingly, their 2022/23 ending stocks were lowered by the same amount to now sit at 14.64 MMT, meaning fewer left-over supplies that carry into the current 2023/24 crop year. Combined with the USDA upping their new crop export estimate for Russia by 1 MMT to now sit at an incredible 50 MMT, Russia is expected to end the 2023/24 crop year with less than 9 MMT of wheat, its lowest in five years. On that note, the bulls also bit this week on World Weather Inc.’s report that both Russia and Ukraine need more moisture to help set the recently planted winter wheat properly, but I remember that almost always for winter wheat, whatever happens in the fall and winter is irrelevant to the weather in the spring.

The numbers that had bulls giddy were from the southern hemisphere where the USDA is baking in the drier conditions into their production estimates for Australia. More specifically, Western Australia is experiencing El Nino-induced drier-than-normal conditions, so the country’s total production was lowered by 1.5 MMT to now sit at 24.5 MMT. Australian wheat exports were lowered by the same amount to now sit at 17.5 MMT, which would be nearly half of the 32.5 MMT shipped out last year! Meanwhile, Canada’s wheat harvest was stayed at 31 MMT, and wheat exports at 23 MMT, which seems a bit odd, considering that the USDA usually sticks close to Statistics Canada’s most recent numbers, but that’s not the case here. To be precise, there is now a 1.16 MMT discrepancy in production and 1.7 MMT in exports between what the two government forecasters want us to believe! I’ll dig into this more next week, who’s more likely to be right, and the impact on the Canadian wheat balance sheet.

On that note, Australian and Canadian high-protein wheat tend to compete in the Asian markets, but last week it was U.S. SRW wheat that China purchased for the second straight week. Arguably, the dip that U.S. wheat futures has taken is finally starting to trigger more export business, and perhaps why the USDA didn’t change too much after all in this month’s WASDE for U.S. wheat demand. At the end of the day, however, U.S. wheat exports are forecasted to hit a 52-year low as Russia maintains its King Wheat position in world markets. This comes as U.S. winter wheat farmers have almost finished their fall seeding campaign. S&P Global recently polled U.S. farmers. The survey suggests 36M acres of winter wheat, down about two per cent year-over-year, and likely a reflection of crop insurance minimum guarantees falling $1.45 USD/bushel from last year to $7.34 this year. Combined with wheat seed in relatively short supply (and thereby, expensive), we’re talking about the U.S., Canada, Australia, Argentina, and, if Mother Nature doesn’t help, Ukraine and Russia are all impacted by production shortfalls simultaneously.

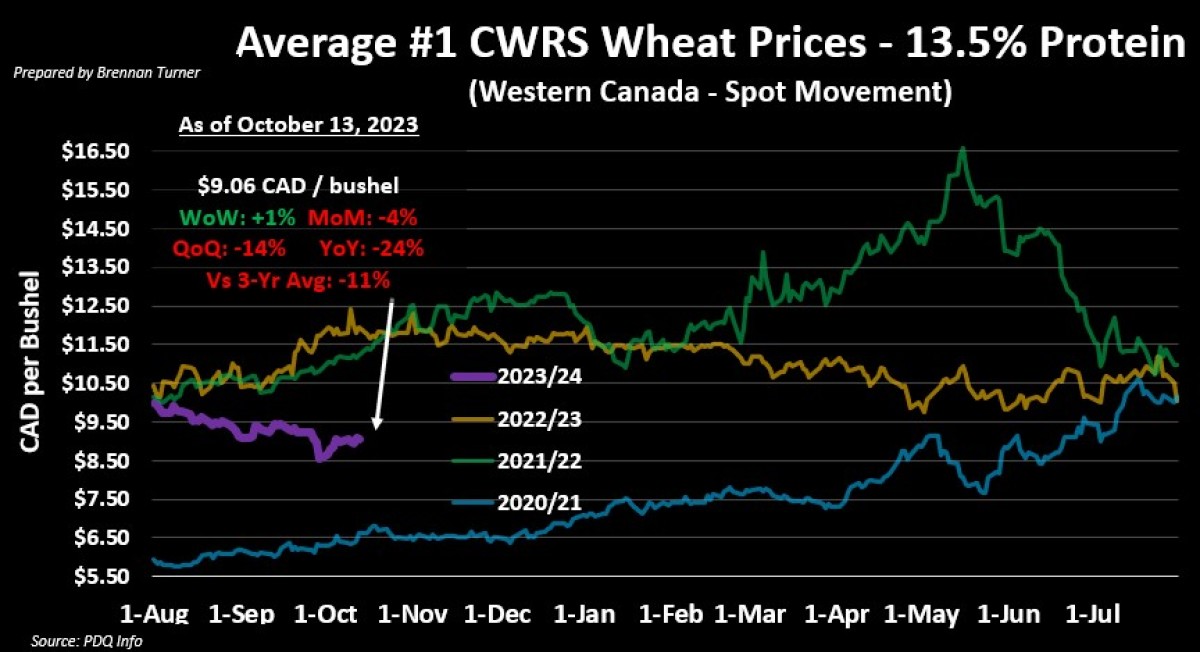

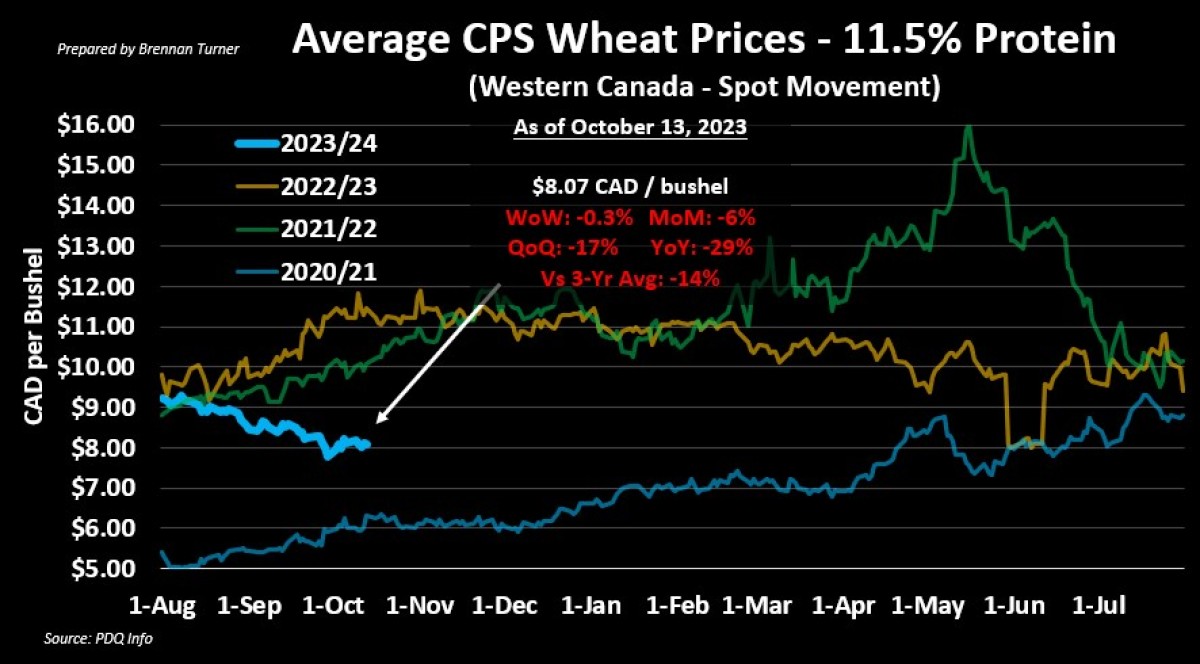

So why are Canadian wheat prices on the cash market sitting at three-year lows? First, Ukraine and Russia haven’t yet experienced any production shortfall, so let’s take that variable off the table for now. Second, with harvest mostly complete everywhere, we’re likely getting off the harvest lows, especially since we know the world’s largest wheat exporters now have tighter balance sheets than previously suspected; this is a healthy foundation to build on as we move into the fall and winter trading months. Third, Canadian cash wheat values have followed the U.S. futures markets lower over the last three months, or arguably six months, since I suggested in March that cash values might be the best we see for the season. That said, the basis hasn’t really helped, as it’s just moved in a roughly $0.50 CAD/bushel range for both CPS and HRS wheat over the same time frame.

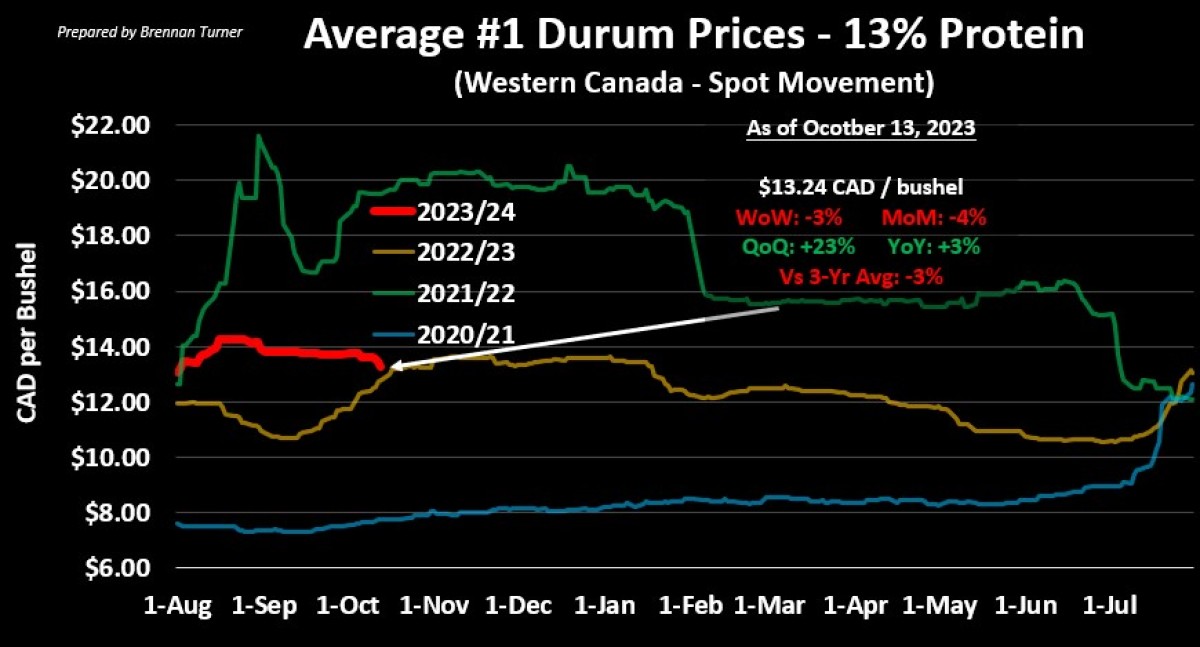

While I’ll also dig into some basis details next week, the market is currently telling us that it’s well supplied. Or perhaps it’s just playing a game of hand-to-mouth, and winter demand could show up early, especially if Australia’s harvest is downgraded. I expect to see double digits again this fall/winter for HRS wheat, but we may be hard-pressed to see the same from CPS wheat, given Russia’s exports and the weaker Kansas City futures that CPS benchmarks off of. Meanwhile, durum continues to be our stoic pillar of the complex, but like the other two wheat classes, I expect some level of price seasonality to kick in over the next four to six weeks to push values higher.

To growth,

Brennan Turner