August 2025

Wheat Outlook

Upside

- Canadian exports were record-high in 2024/25.

- CGC showed low visible supplies for week 52, affirming a tight Canadian non-durum carryout going into 2025/26.

- USDA reported small US hard red spring acres, although they also forecast a strong yield.

- Funds have built a sizeable, short position in wheat.

Downside:

- Global supplies are adequate relative to demand, particularly with a heavy US corn market.

- The seasonal trend for CWRS bids points lower for a few more weeks before a rebound might be expected.

- Australia’s wheat exports are ahead of last year and may be even higher again next season.

Key Notes:

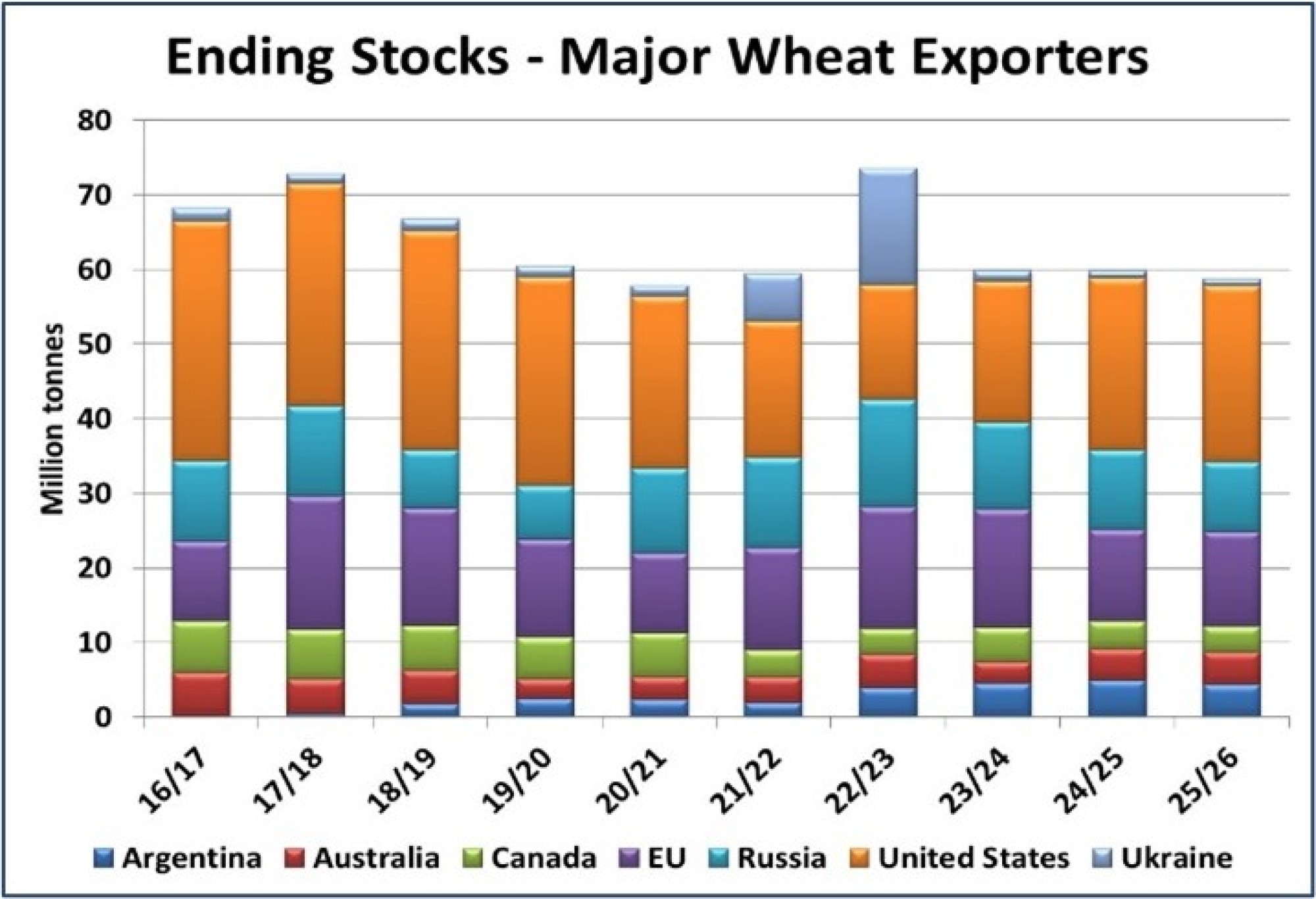

- USDA made few changes to the global figures in their last report. Ending stocks across the major wheat exporters are forecast to be down a bit, to just below 60 mln tonnes and the lowest since 2020/21. World wheat stocks are not heavy and there are some quality issues with the Black Sea and (potentially) North American hard red spring crops. At the same time, supplies will be adequate to meet demand, particularly as a heavy corn market eats into wheat usage from livestock feeding.

- CGC showed week 52 non-durum visible supplies at 1.87 mln tonnes. This is the second lowest ever, behind only the 2021/22 season, and compared to a 5-year average of 2.18 mln tonnes. Supplies are tight going into the 2025/26 crop year.

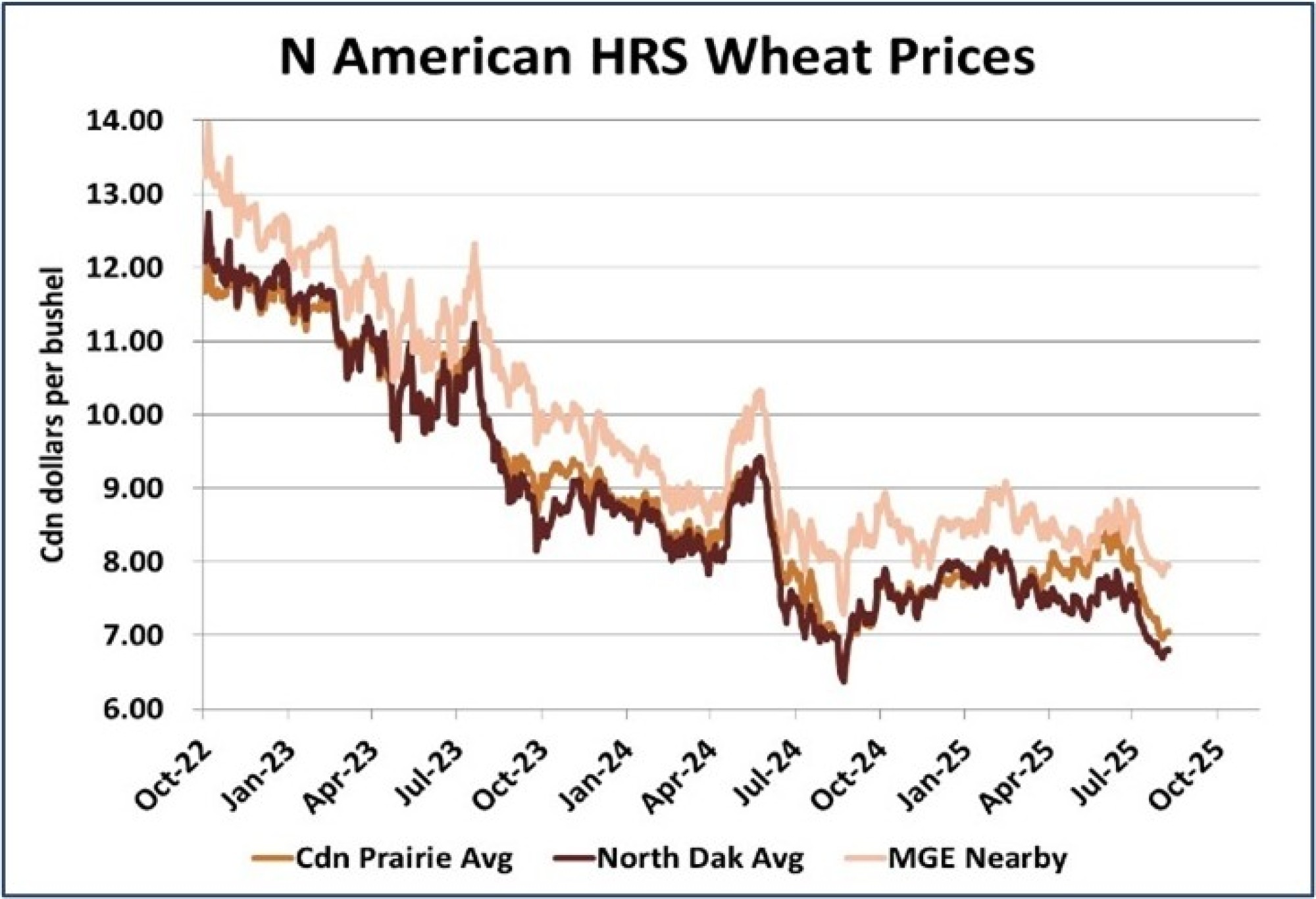

- Hard red spring wheat prices have been trending lower in western Canada and the US. This reflects improving yield prospects and a lackluster global market. It’s also a normal pattern at this time of year. CWRS bids have tracked seasonal trends fairly closely this year, which suggests the market may be within a few weeks of finding a typical harvest low.

Bottom Line:

- There is potential for more softness in the short-term, although there are reasons why the market may be close to finding a bottom (global harvest getting into the later stages, wheat stocks are not particularly heavy, funds hold a big short position, normal seasonal patterns). Even so, we don’t see aggressive upside, even when values catch a rebound.

- It’s possible that hard red spring may gain some relative value within the wheat complex, although that will be influenced by the quality of the western Canadian crop.

Barley Outlook

Upside:

- USDA reported a near record US barley yield, but this doesn't fit with the below-average crop ratings.

- USDA is forecasting largely steady barley imports in 2025/26 including to China, Canada's main destination.

- The drop in Canadian barley bids is making Vancouver barley prices more attractive for importers.

Downside:

- Our estimate of the 2025 Canadian barley crop is 8.2 mln tonnes, unchanged from last year despite fewer acres.

- StatsCan reported June barley exports at 133,000 tonnes, below the average for the month and less than last year.

- Domestic feeding of barley could be reduced this year due to increased availability of US corn.

- The Australian barley crop could reach 14 mln tonnes, with increases in acreage and yields.

Key Notes:

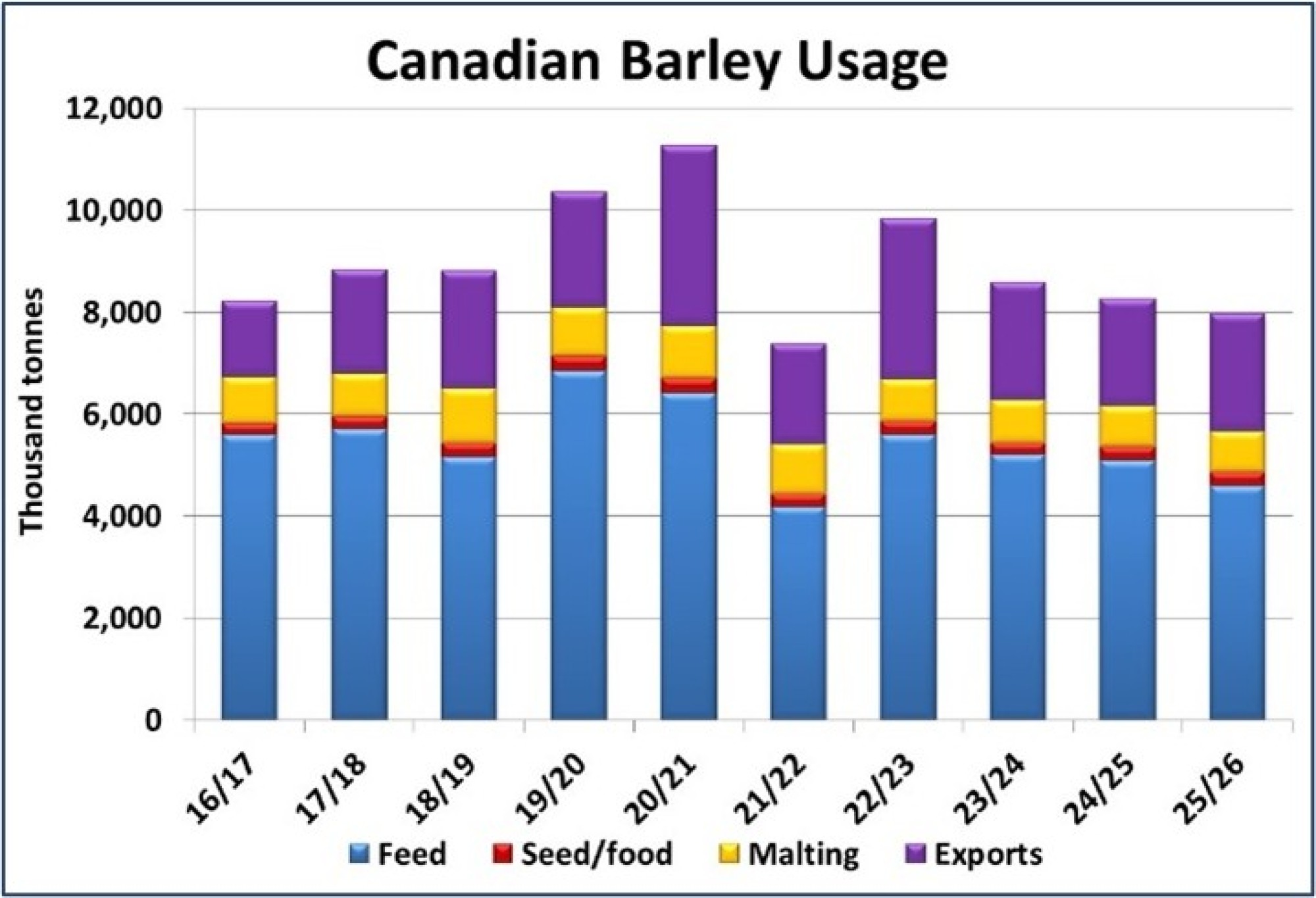

Even before USDA’s big corn crop estimate, we were already hearing reports of more US corn moving into western Canada. Cheaper US corn has been an issue for a while and is the reason we pegged 2025/26 barley feed use at 4.6 mln tonnes, down from the 5-year average of 5.3 mln tonnes. While we still don’t have a firm estimate of the 2025 Canadian barley crop size, there’s a good chance production will be around 8.2 mln tonnes, up slightly from last year despite 4% fewer acres. If the export program doesn’t expand enough to offset reduced domestic feeding, 2025/26 ending stocks will grow. Currently, we’re estimating ending stocks at 1.40 mln tonnes, up from 1.09 mln for 2024/25.

- Favorable conditions in Australia are increasing barley production expectations in the country. The last ABARES figure was 12.8 mln tonnes, but higher estimates for both seeded area and yield could point to a crop size closer to 14.1 mln tonnes. This means increased export potential for Australia, particularly into China.

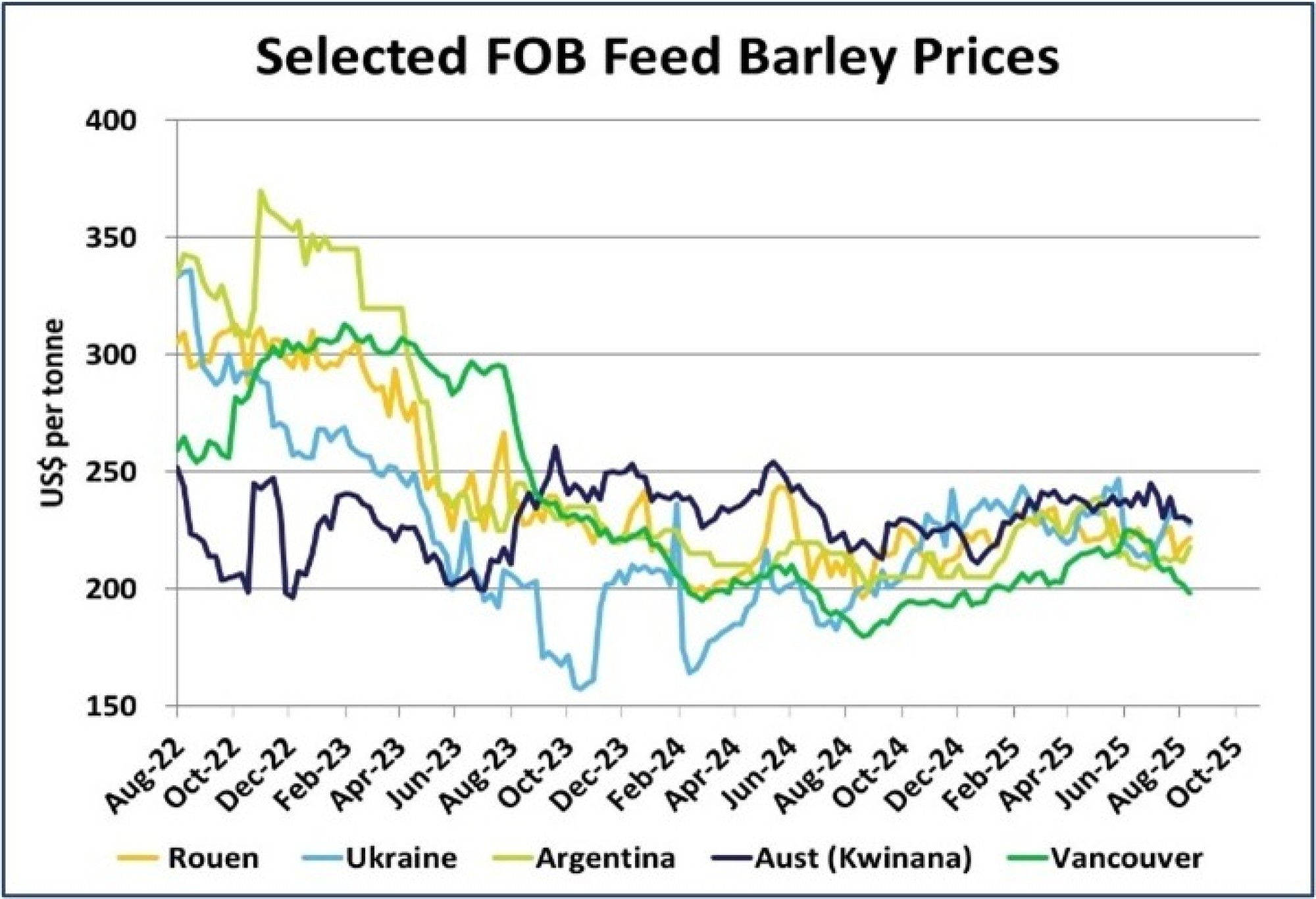

- Feed barley prices from key exporters have been realigning in recent weeks. After dropping in early summer, Ukraine prices bounced back, partly due to concerns about its corn crop and feed supplies. Prices in Argentina and Australia also dropped. Meanwhile, prices in France have been steadier. Canadian barley has become the bargain, with our FOB Vancouver price (calculated from Alberta elevator bids) dropping below other origins and heading lower. This move could help spur more export sales for the critical fall shipping season.

Bottom Line:

- On its own, the Canadian barley outlook for 2025/26 is well-balanced. The difficulty for barley prices is the prospect of very heavy US corn supplies and the easy movement of corn into western Canada. This will cap domestic feed barley prices and limit the upside off the harvest lows.

- It also increases reliance on the export market. Currently, Canadian export prices are attractive and should enable strong fall movement, but Australian barley is still dominant.

- Harvest weather will set the tone for malt barley bids, but the wider malt premium recently has room to shrink.

Durum Outlook

Upside:

- USDA raised its 2025 durum yield estimate, but that's contrary to crop ratings in the northern plains.

- Morocco imported 195,000 tonnes of durum in June, a record for the month.

- Durum prices in Europe ticked slightly higher this week but remain in a long-term sideways trend.

Downside:

- Prospects for Canadian durum exports could be quieter in 2025/26 and allow ending stocks to rise.

- We’ve raised our 2025 durum yield estimate to 34.4 bu/acre, resulting in a 5.87 mln tonne crop.

- The IGC is forecasting another year of modest global durum ending stocks, but its estimate is questionable.

Key Notes:

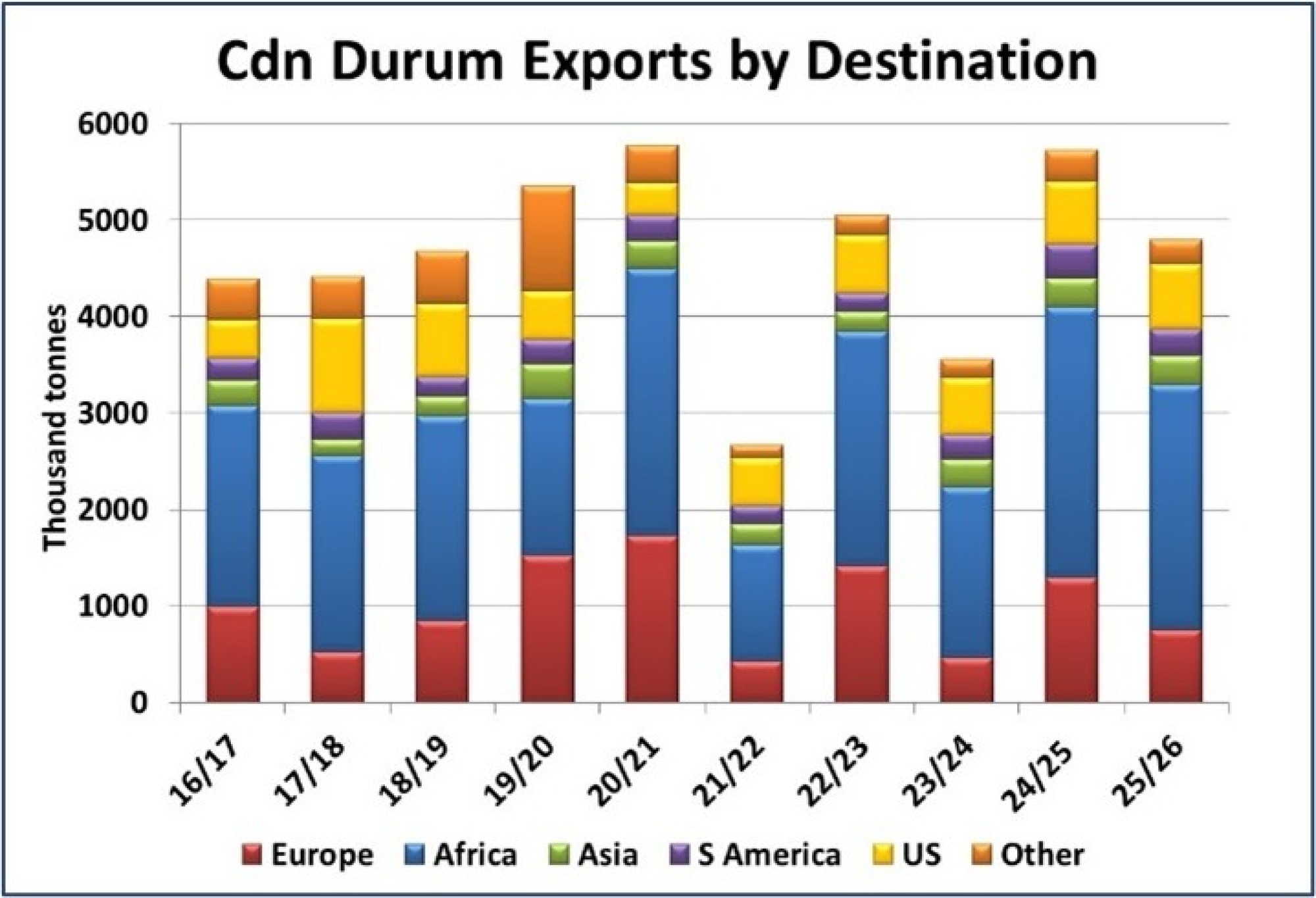

- Ongoing rain events in southern Saskatchewan are raising questions about 2025 durum quality, but it’s too soon to draw conclusions. As long as things don’t get much worse, we’re still expecting solid yields and production of 5.87 mln tonnes, with a slight upward bias. When combined with an old-crop carryover of 735,000 tonnes, a 4.8 mln tonne export program is certainly in scope and supplies are large enough to ship even more. That said, our outlook is for quieter demand from several key destinations. European imports will be lower due to its bigger 2025 crop, which also makes the EU a larger export competitor. Russian and Kazakh durum could also be a bigger factor in 2025/26, depending on harvest weather, which could reduce the amount of Canadian durum going into North Africa. If 2025/26 Canadian exports end up close to 4.8 mln tonnes, ending stocks would increase to the 1.15-1.20 mln tonne range.

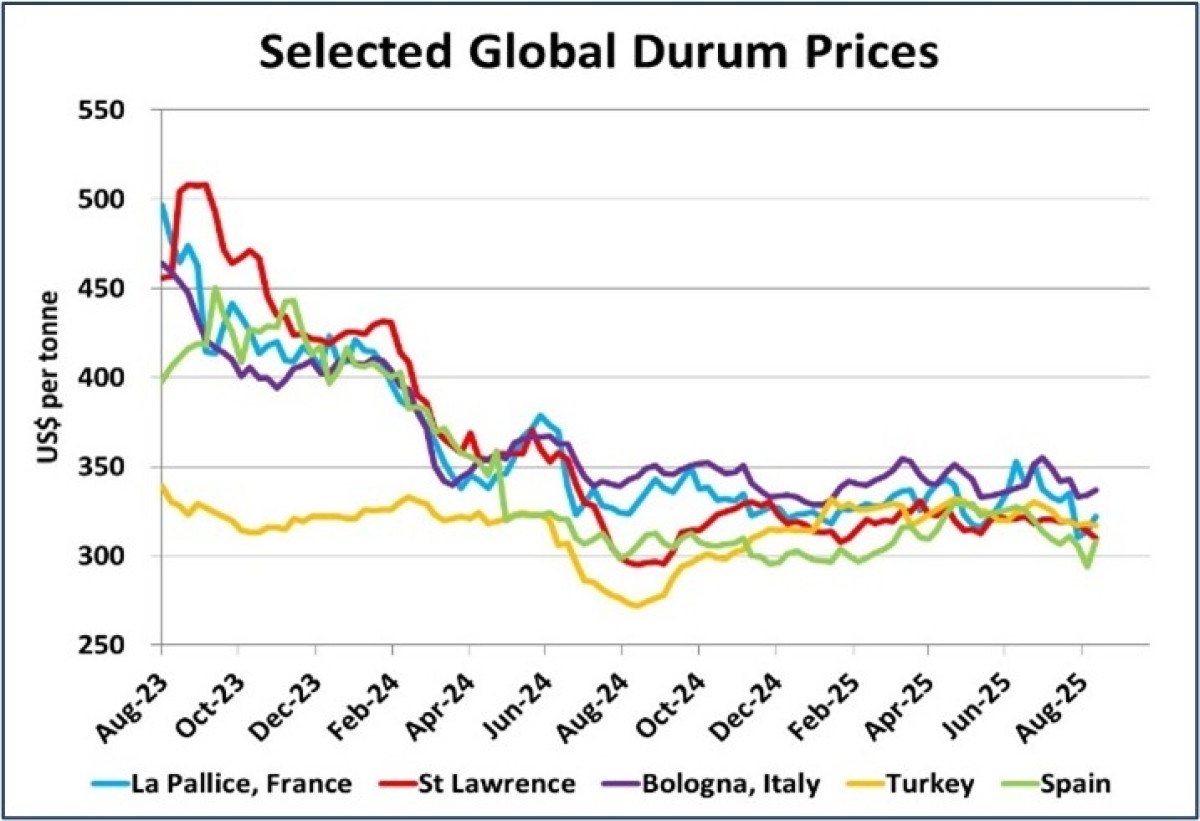

- Global durum markets aren’t showing meaningful signs of strength, although prices in some locations, particularly Europe, have come off earlier lows. A small bounce could be a signal that the seasonal declines in the EU are over. That said, the market is still locked in a long-term sideways direction that’s been in place since the 2024 harvest. Canadian durum prices quoted in the St. Lawrence are edging lower, as the North American harvest is just getting underway.

Bottom Line:

- There’s a little more uncertainty creeping into the Canadian durum market, with questions about crop quality, but it’s too soon to draw any real conclusions. Based on current conditions, Canadian supplies should be more than enough to meet export demand, which could be quieter in 2025/26. Increased competition from other exporters is also a concern.

- Prices are getting closer to finding a seasonal bottom but when it does occur, the recovery from the harvest lows isn’t expected to be all that impressive.