October 2025

Wheat Outlook

Upside:

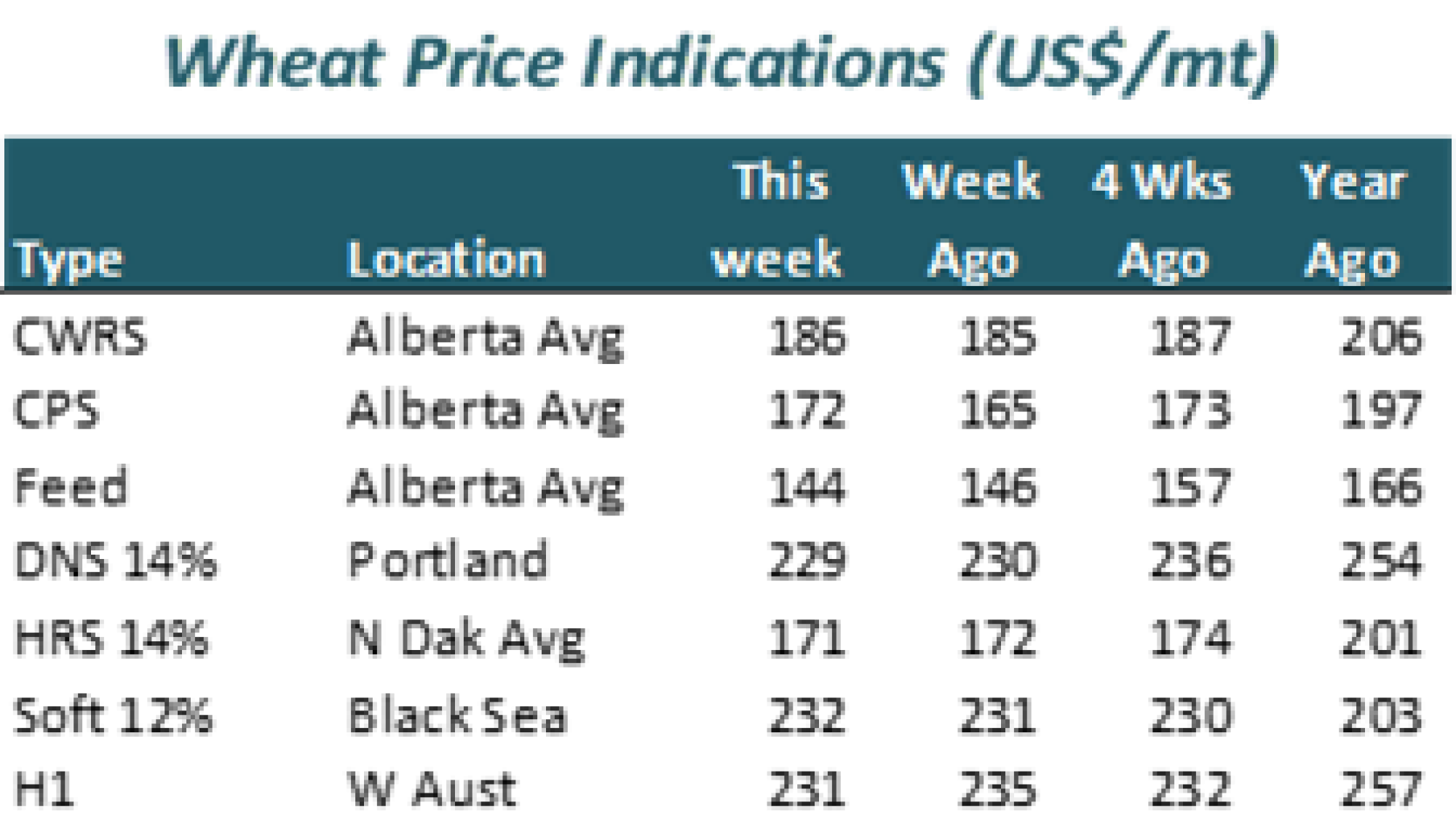

- Hard red spring basis levels are firming in Canada and the northern US. This may help cash bids carve out a seasonal low even if futures markets remain soft.

- CGC shows Canadian non-durum exports are off to a record start, which is encouraging elevator premiums.

- Funds are holding a sizable short position.

Downside:

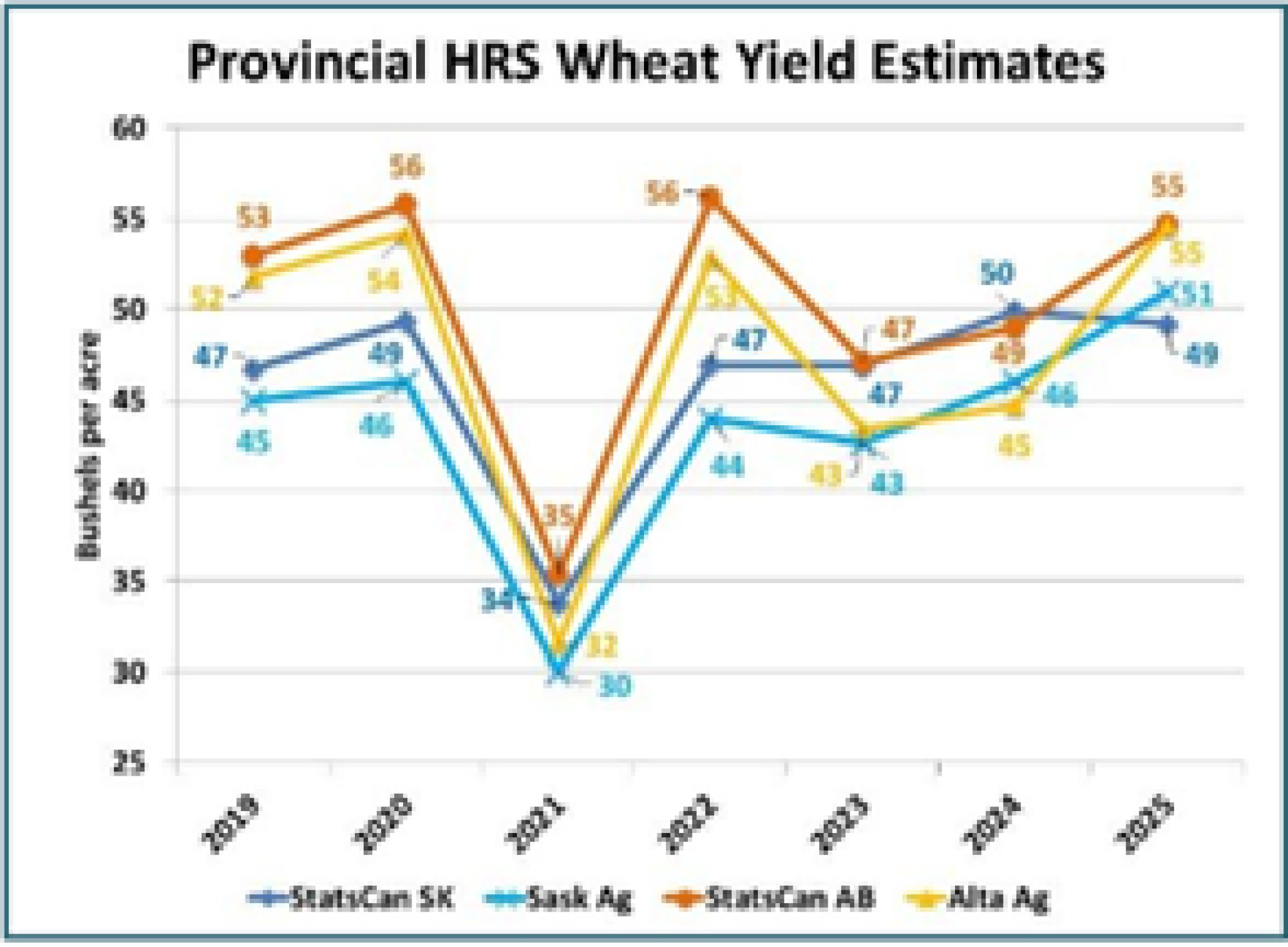

- Estimates for the Canadian crop are increasing, with our forecast at least 1.5 mln tonnes higher than StatsCan.

- USDA showed the US wheat crop at 1.99 bln bushels, the highest since 2016.

- EU exports are running at the slowest pace in a decade, despite a big increase in production. Ukraine’s exports are also lagging.

- Conditions in Australia and Argentina are favorable.

Key Notes:

- Sask Ag’s spring wheat yield estimate is 51.0 bu/acre. This compares to the last StatsCan provincial spring wheat yield of 49.2 bu. The final StatsCan number tends to be roughly 3+ bu higher than the provincial number, suggesting the Saskatchewan crop is larger than currently reported. A similar comparison implies another 1.5 bu/acre is needed for Alberta as well. We are estimating Canadian spring wheat production at 28.1 mln tonnes, 1.5 mln above the StatsCan figure.

- USDA’s Small Grains Summary showed US all wheat production at 1.99 bln bushels, the highest since 2016. Most of the annual increase came from hard red winter wheat, although soft red winter and spring wheat were up as well. Hard red spring production was shown at 458 mln bushels, up slightly from earlier estimates, but the lowest in three years.

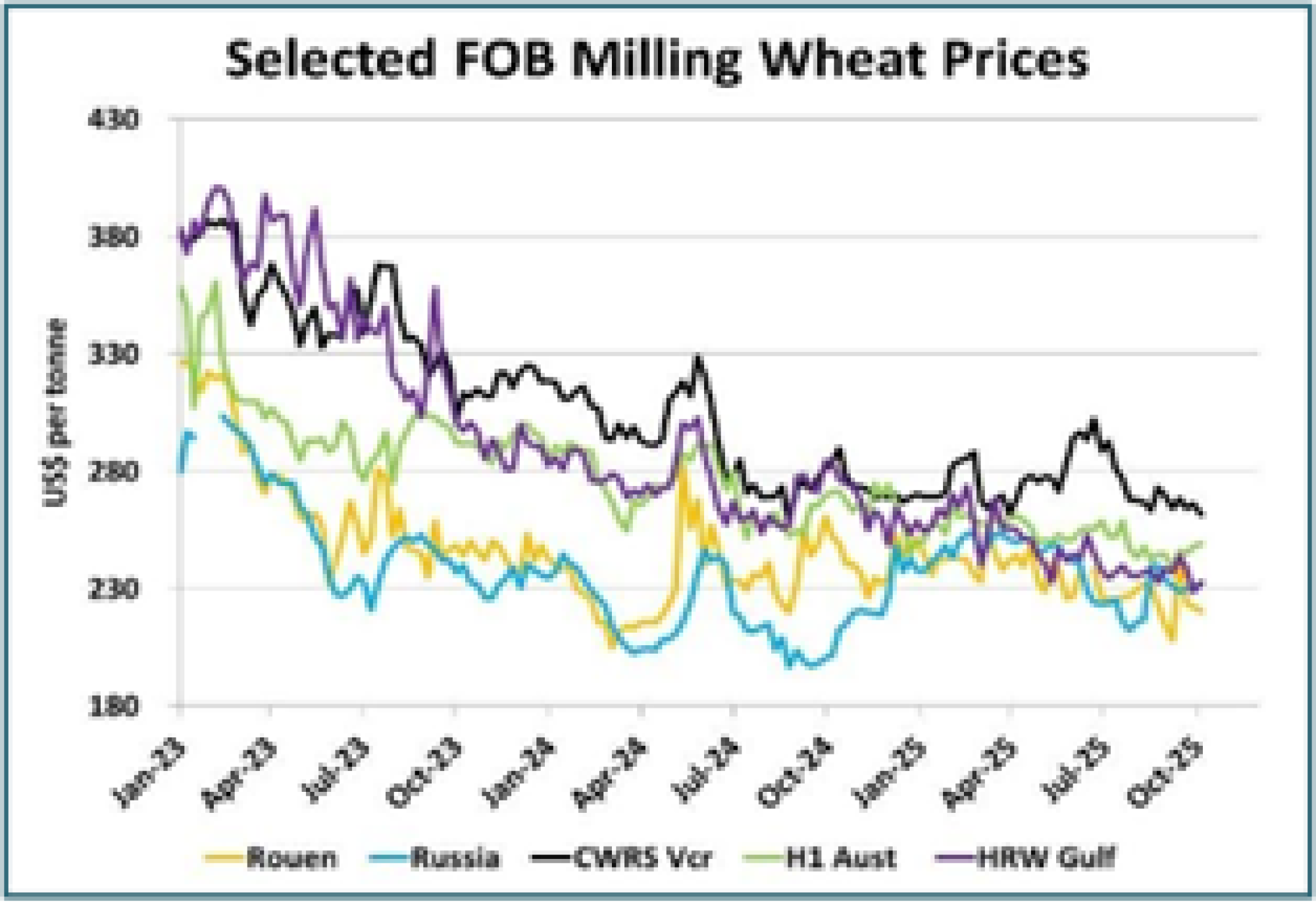

- Global prices continue to drift sideways-to-lower. Some pressure has eased now that the Northern Hemisphere harvest has passed, although crops were large across most of the major exporters, while favorable conditions in Australia and Argentina are setting up for strong Southern Hemisphere production.

Bottom Line:

- The trend of soft futures values and a stable cash market continues. Basis levels are doing the work of allowing elevator bids to find support, helped by strong exports.

- Rising estimates for wheat crops across virtually every key exporter will limit gains over the coming months, at least until attention starts to shift to the 2026 outlook.

- The market may be setting up for a period of sideways-to-slightly-firmer trade until later winter or early spring.

Barley Outlook

Upside:

- Barley shipments from country elevators increased sharply recently, suggesting strong export movement. This is helping elevator bids to recover from the seasonal lows.

- Australian barley exports slowed in August, prior to the 2025 harvest, but will pick up in the coming months.

- The USDA posted a record US barley yield in 2025, but production was still down 3% from last year.

Downside:

- Canadian barley exports were 68,000 tonnes in August, below average for the month.

- Yield estimates from provincial crop reports suggest a larger Canadian barley crop, around 8.7 mln tonnes.

- Feed barley elevator bids have levelled off recently and started to show some recovery, but US barley is still at a large discount.

Key Notes:

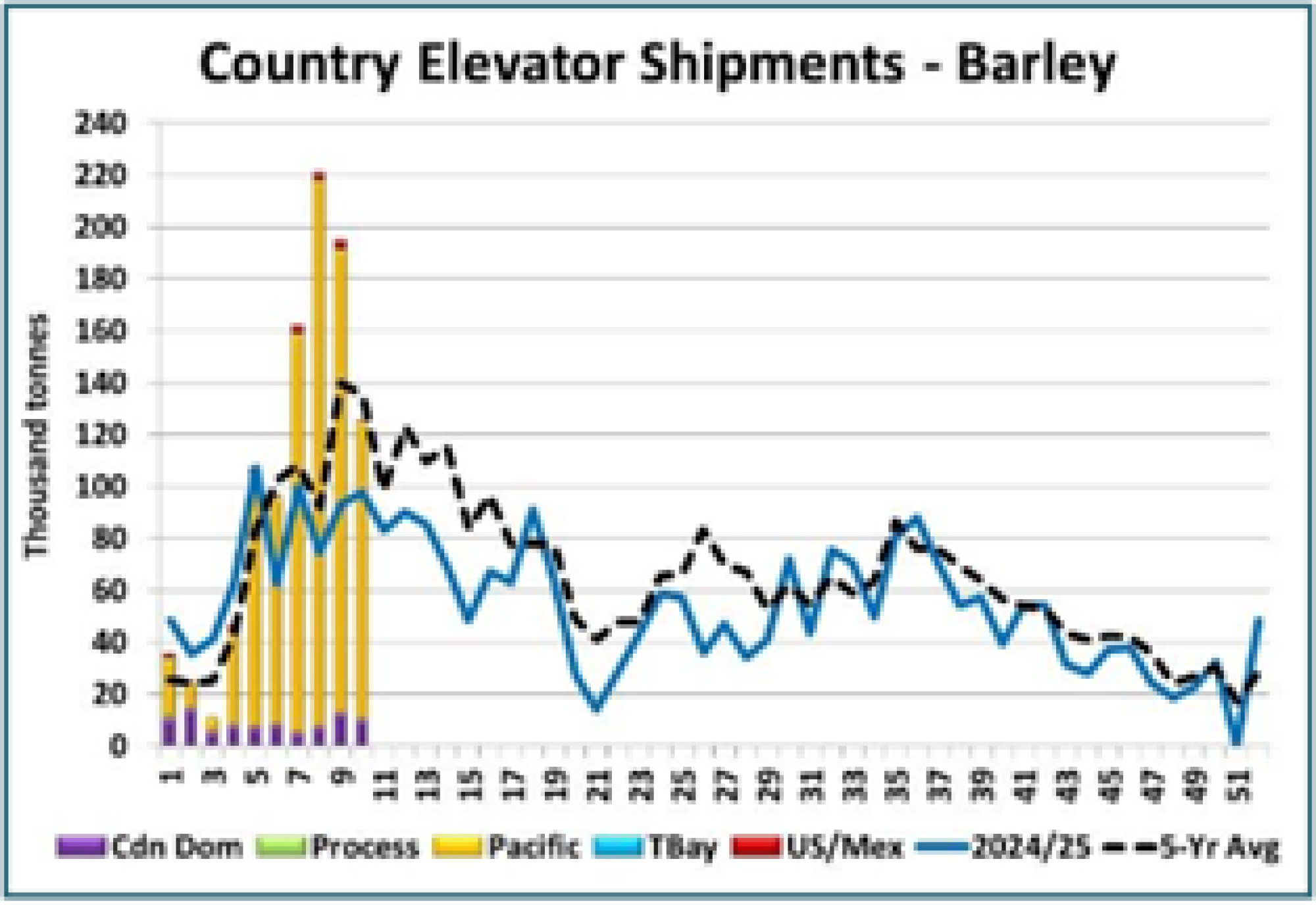

- Barley movement has picked up sharply in recent weeks, with shipments out of country elevators rising well above average. As of week 10, 995,000 tonnes have been shipped out, 270,000 tonnes more than last year and well ahead of the 5-year average of 772,000 tonnes. Exports have picked up in the last 2-3 weeks and are now above both last year and the 5-year average pace. Farmer deliveries of barley into the elevator system are also at a multi-year high so far and stocks at terminal elevators are also well above average, both signals of continuing improvement in the export pace.

- Alberta Ag issued a preliminary grade breakdown for 2025 barley, with 31% as malt grade, 61% as 1CW and 8% 2CW or lower, slightly better than the 10-year average. That’s also better than the grades reported by Sask Ag at 24%, 68% and 8% respectively. If we apply these percentages against StatsCan production estimates, it would mean 2.31 mln tonnes of malt quality (up 9% from last year), 5.26 mln tonnes (up 34%) of 1CW and 650,000 tonnes (down 63%) of 2CW or lower.

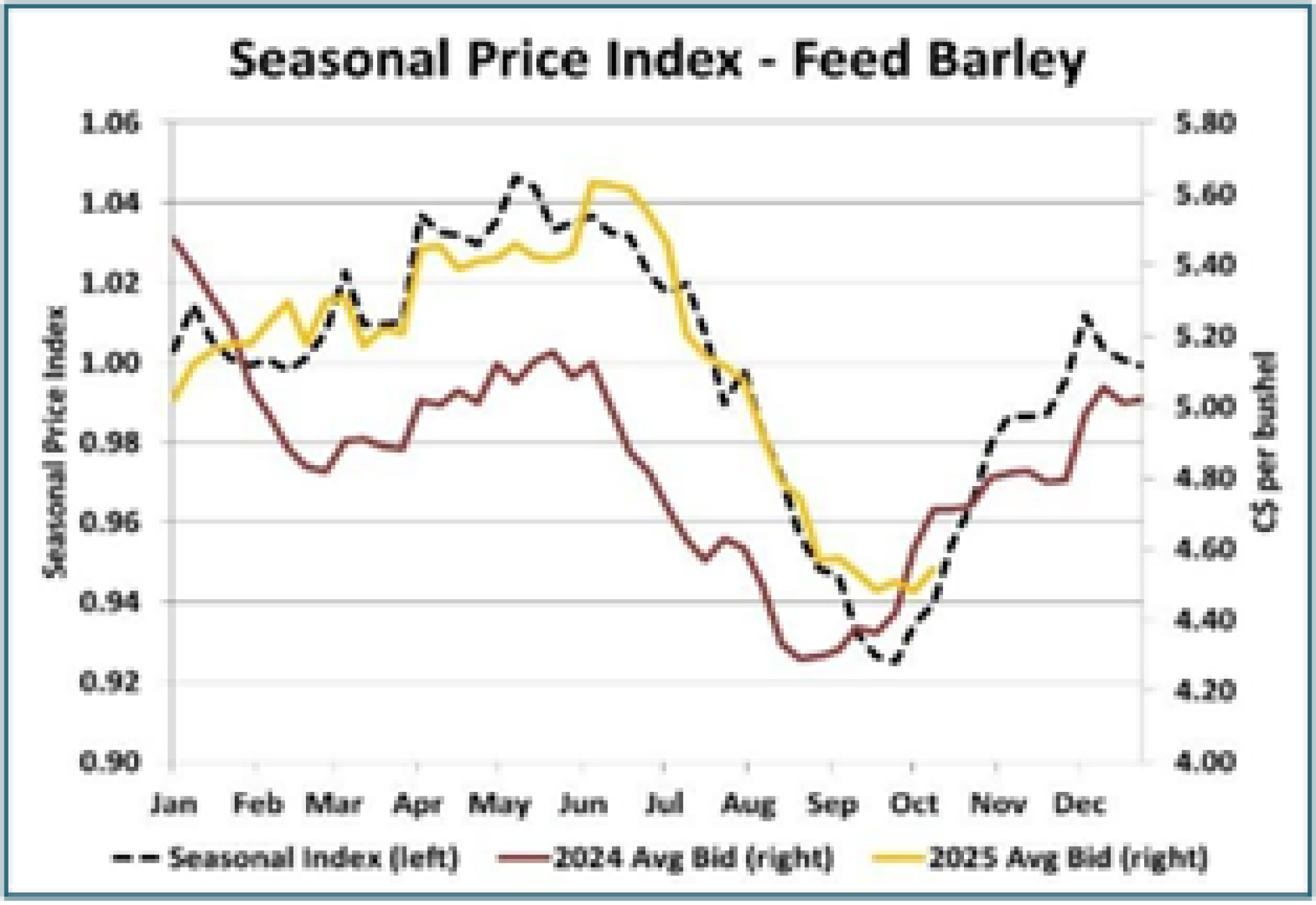

- Despite the increase in the 2025 Canadian barley crop, seasonal price tendencies still seem to be developing. Compared to 2024 at 8.1 mln tonnes, StatsCan reported the 2025 crop at 8.2 mln tonnes, with our estimate at 8.7 mln and others at 9.0 mln or higher. Even so, this year’s seasonal bottom for the average feed barley elevator bid is about 20 cents higher than last year and the postharvest recovery looks like it’s underway. Some of the early support in 2025/26 feed barley is likely coming from the stronger export pull but even so, we’re expecting only a modest rally from the lows.

Bottom Line:

- There’s plenty of barley in western Canada but even so, bids are starting to edge higher from the harvest lows.

- To keep bids firm, exports will need to continue running at a solid pace, which will become a greater challenge once the next Australian harvest becomes available.

Durum Outlook

Upside:

- The movement in western Canada has picked up sharply in recent weeks, suggesting stronger exports ahead.

- Prices for Canadian durum have dropped more than other locations and are supporting export sales.

- The quality profile for the 2025 durum crop will mean adequate supplies of all export grades.

- Durum bids in Canada and the northern US have levelled off now that harvest pressure is easing.

Downside:

- Sask Ag raised its durum yield estimate to 41 bu/acre, which would push the 2025 crop above 7.0 mln tonnes.

- Canadian durum exports were a disappointing 136,000 tonnes in August, but it's too early to be concerned.

- USDA's 2025 durum crop estimate was 86 mln bushels, up 8% from last year, and could mean fewer imports.

Key Notes:

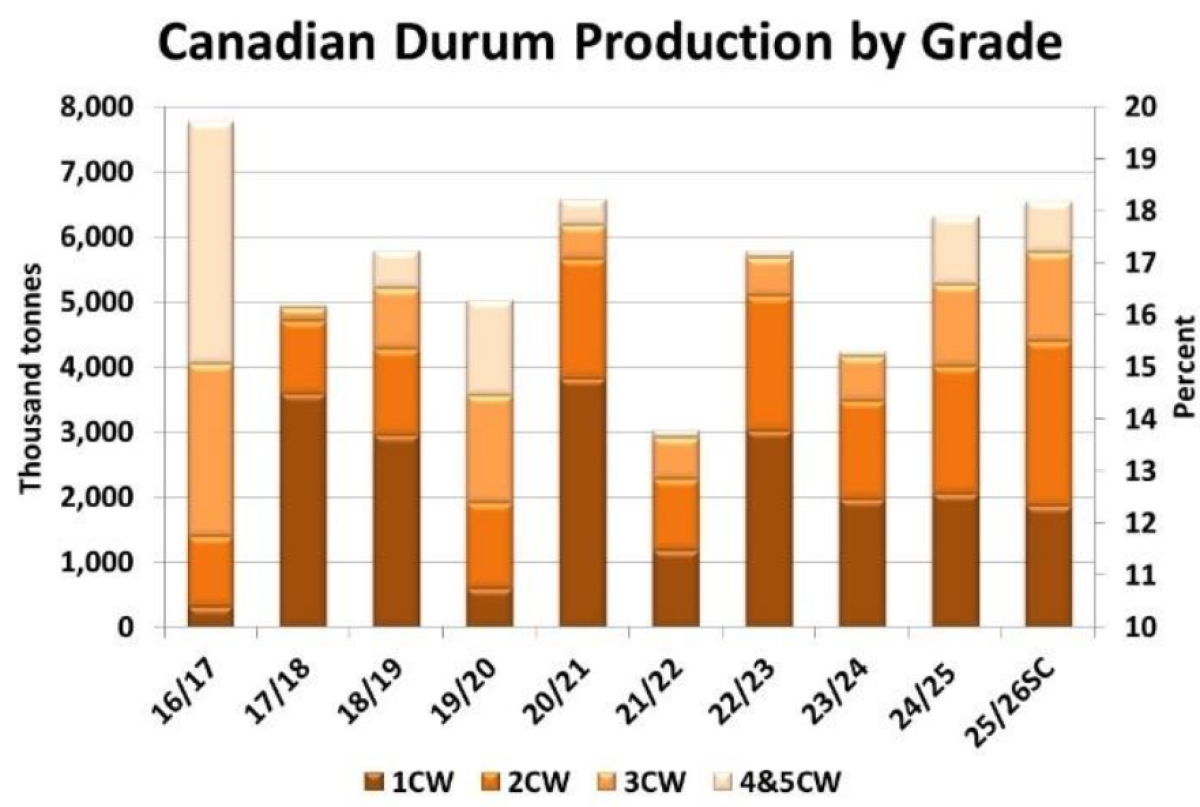

- The Alberta Ag crop report’s estimate of the grade breakdown for durum was considerably better than Sask Ag’s estimate. That’s not a surprise as much of the southern Alberta harvest occurred under dry conditions while parts of southern Saskatchewan were hit by rain. Alberta Ag reported 48% of the durum as 1CW, 24% as 2CW, 13% as 3CW, with the remaining 15% lower. That compares to Sask Ag at 23%, 43%, 23% and 11% respectively. When compared to StatsCan’s production estimates for the two provinces, it works out to 1.86 mln tonnes of 1CWAD, 2.54 mln tonnes of 2CWAD, 1.36 mln tonnes of 3CWAD and 780,000 tonnes as 4&5CWAD. It’s possible the final grade profile will be a bit worse, but we’re also forecasting a larger 2025 durum crop.

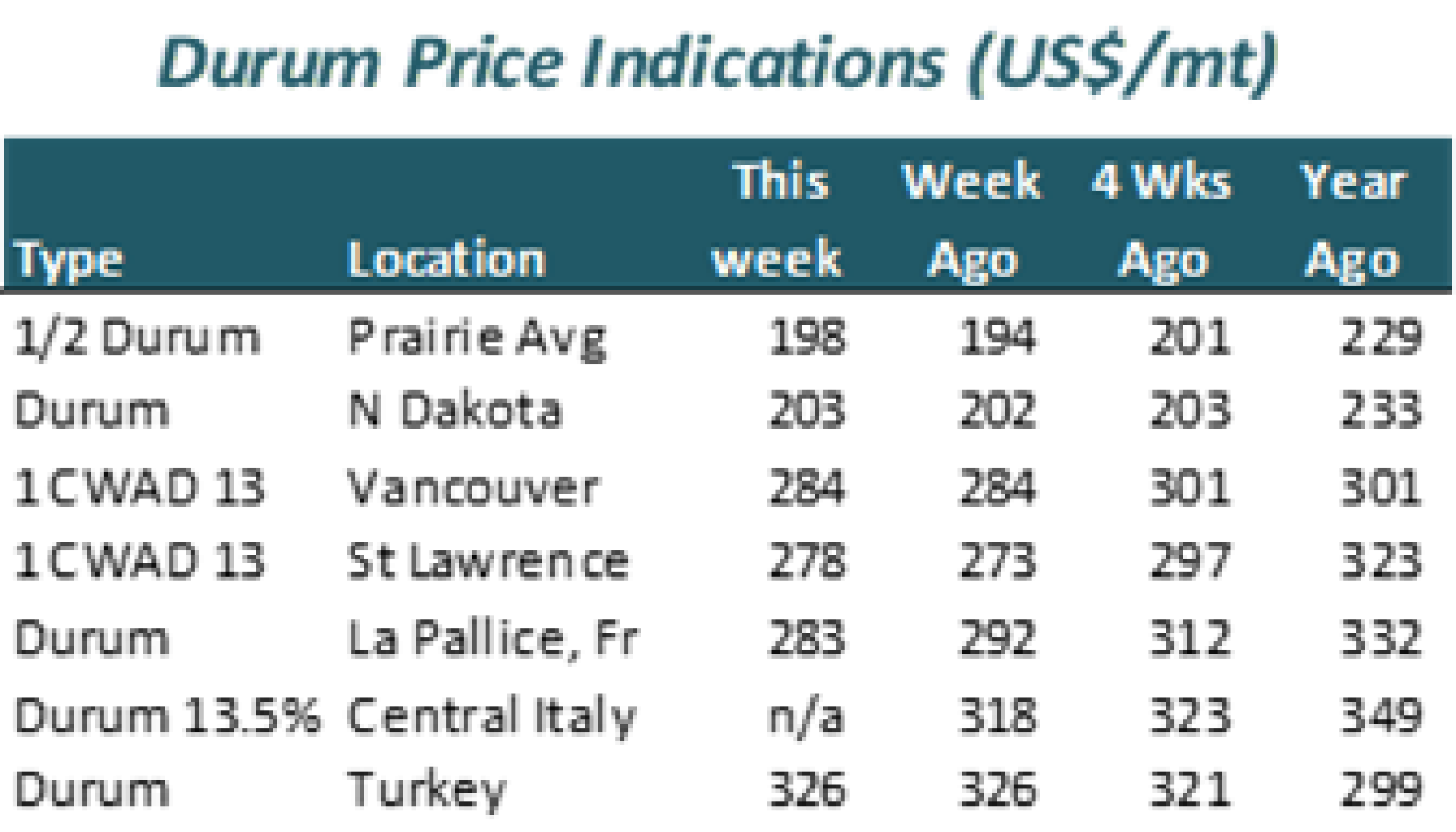

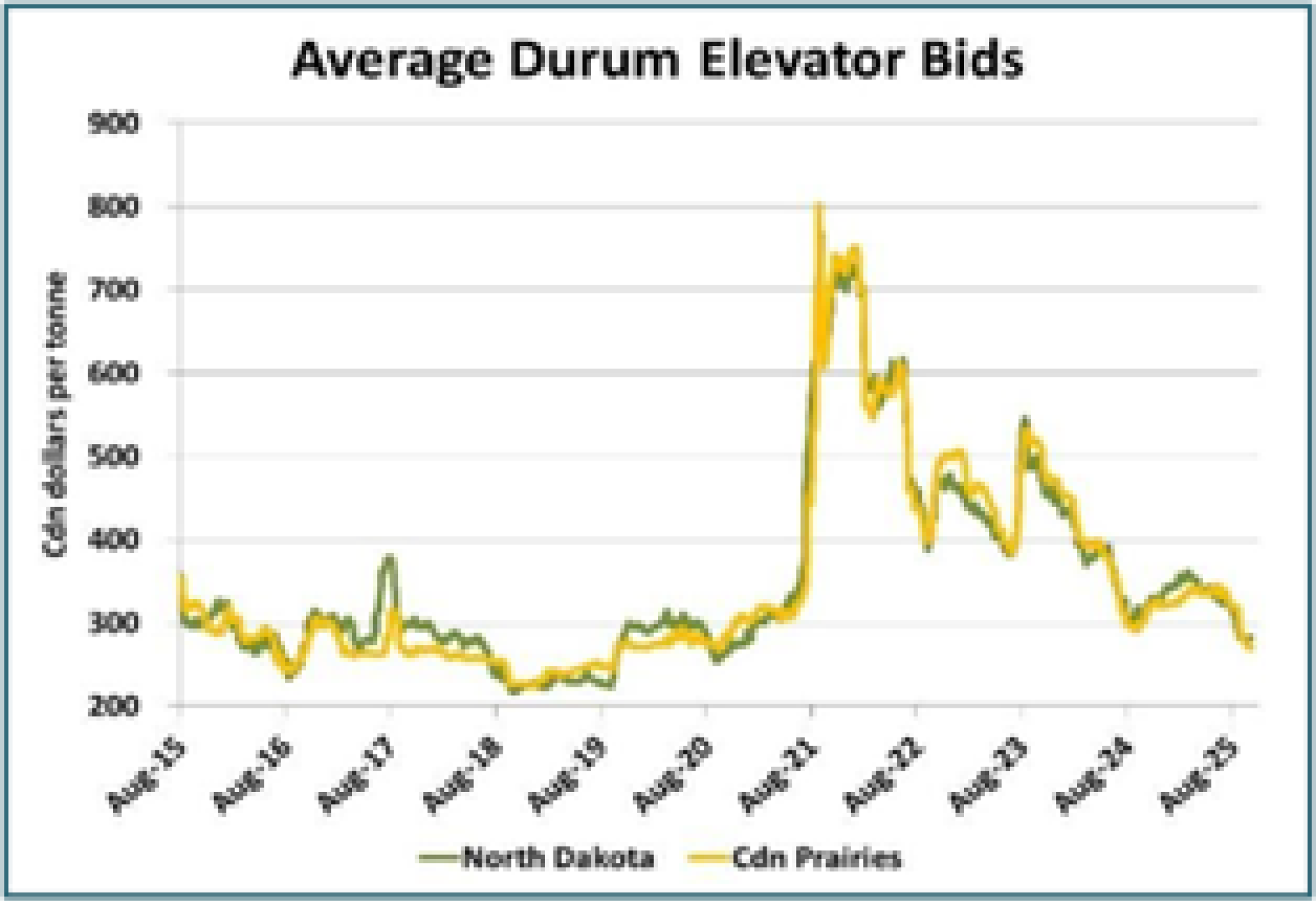

- The normal summer declines in durum bids appear to have levelled off in both Canada and the northern US, suggesting the seasonal lows are now in. That said, the lows for an average bid in the C$275-280 per tonne range are now back to the levels last seen prior to the 2021/22 drought year. If those prior years of low prices are any indication, bids could struggle to push above C$300 per tonne in 2025/26, but it’s still early.

Bottom Line:

- There’s no question that Canadian durum supplies will be considerably larger in 2025/26 and those stocks are weighing on bids. At the same time, overall global durum demand will be quieter, which makes matching last year’s record export pace a serious challenge.

- That said, Canadian prices seemed to have gotten overdone the downside, which could allow a small recovery, now that the durum crop has been binned. But gains will be limited and met by steady farmer selling.

- The next significant market event would be the status of winter durum crops in the EU, Türkiye and Mexico, but it’s too soon for any meaningful forecasts.