September 2025

Wheat Outlook

Upside:

- Canadian wheat supplies are on the tighter side this season and next, helped by record exports in 2024/25 and likely strong movement again in 2025/26.

- USDA increased their estimate for US exports, which trimmed the carryout.

- Prairie prices may be trying to carve out a seasonal low.

Downside:

- StatsCan increased their production estimate, and the actual crop size is likely even bigger.

- Production keeps getting revised higher across most of the major wheat exporting countries.

- China’s August wheat imports were just 230,000 tonnes, with the total so far in 2025 at the lowest since 2019.

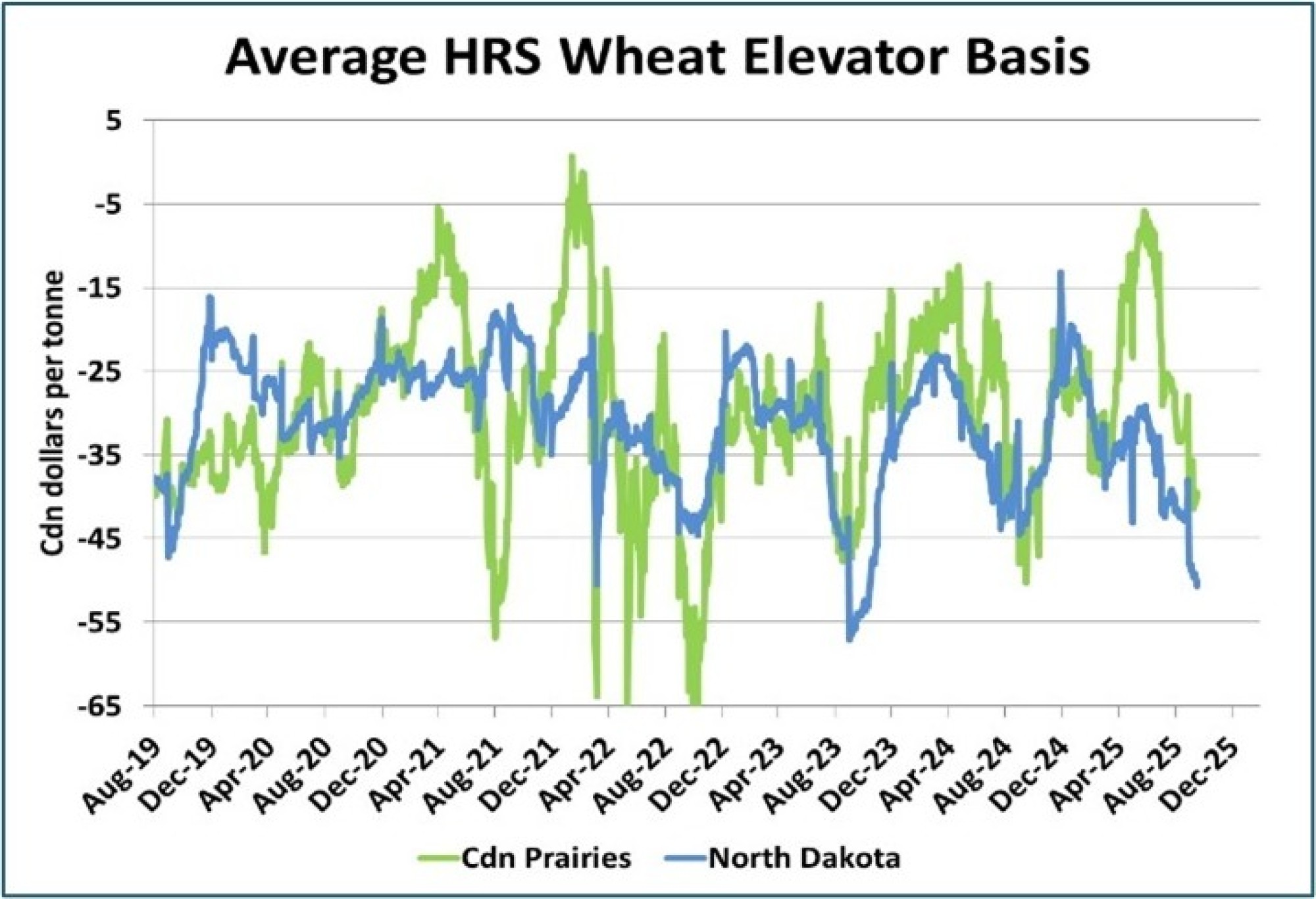

- Basis levels have been weakening in both western Canada and the US.

Key Notes:

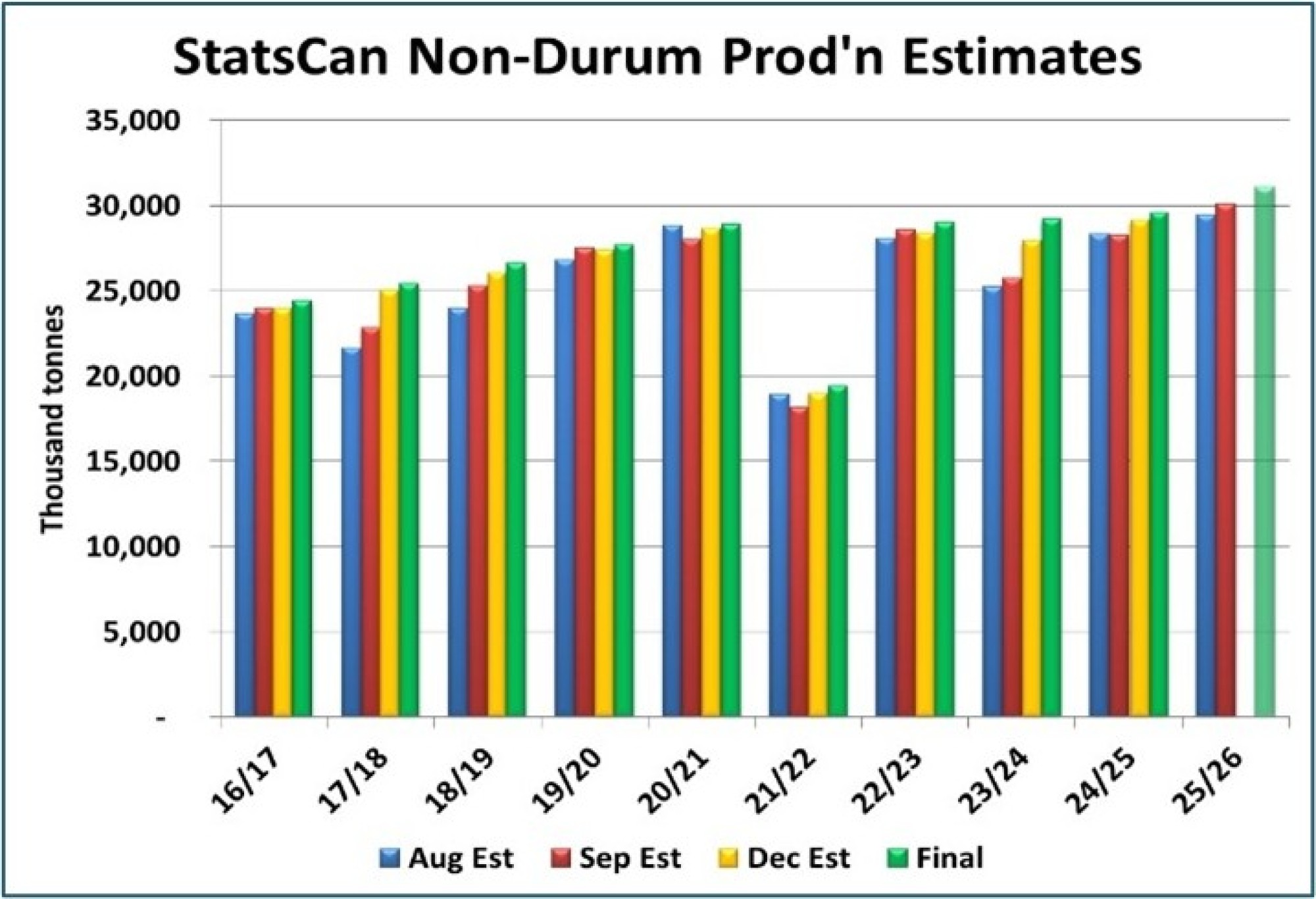

- StatsCan’s latest model-based production estimate showed the spring wheat crop at 26.6 mln tonnes, 600,000 tonnes higher than their August number. Winter wheat production was pegged at 3.5 mln tonnes. This puts total non-durum production at 30.1 mln tonnes. There is a strong tendency for the final StatsCan figure to end up higher than the September number. Our estimate for 2025 non-durum production is 31.1 mln tonnes, 1 mln more than StatsCan, with an upward bias.

- USDA increased the wheat crop for nearly every key country including the EU (up 1.85 mln tonnes to 140.1 mln, vs 122.1 mln last year), Russia (1.5 mln higher to 85.0 mln, vs 81.6 mln in 2024), Canada (added 1.0 mln tonnes to 36.0 mln, which isn’t big enough) and Australia (up 3.5 mln tonnes to 34.5 mln). Production across the major exporters will be the highest in a decade.

- Hard red spring wheat basis levels have pulled back sharply in western Canada and North Dakota as a large crop gets harvested. Western Canada has also seen additional farmer selling as yield expectations increase and bids for some other crops dry up. Unsurprisingly, basis levels tend to bottom out at this time of year and typically show some recovery into late fall and winter.

Bottom Line:

- Local prices may be trying to carve out a bottom as the futures market seems to be finding support and cash bids are helped by some locations posting ‘specials’.

- Stocks in North America and globally are simply too large to allow for any sizeable rebound. This sets up for mostly sideways trade, with perhaps a little more upside into later winter and spring.

Barley Outlook

Upside:

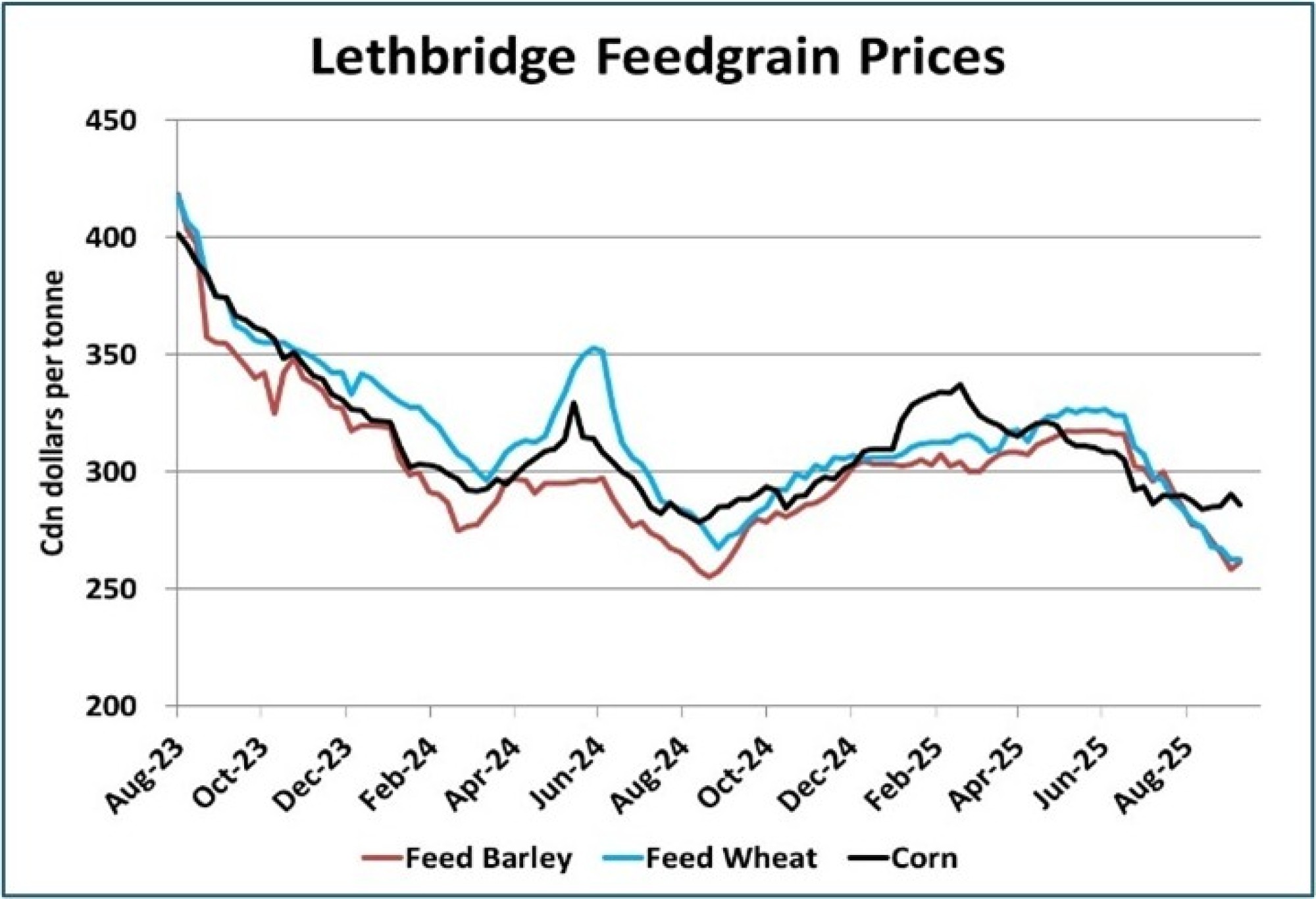

- Lethbridge feed barley prices have dropped well below corn, which could help provide a floor going forward.

- Big early season deliveries may point to good export movement in the coming weeks.

- The seasonal trend turns higher within the next few weeks.

Downside:

- The 2025 Canadian barley crop was nudged up by StatsCan to 8.2 mln tonnes and could go even higher.

- The IGC's global barley crop estimate was raised to 148.5 mln tonnes, 4.9 mln more than last year.

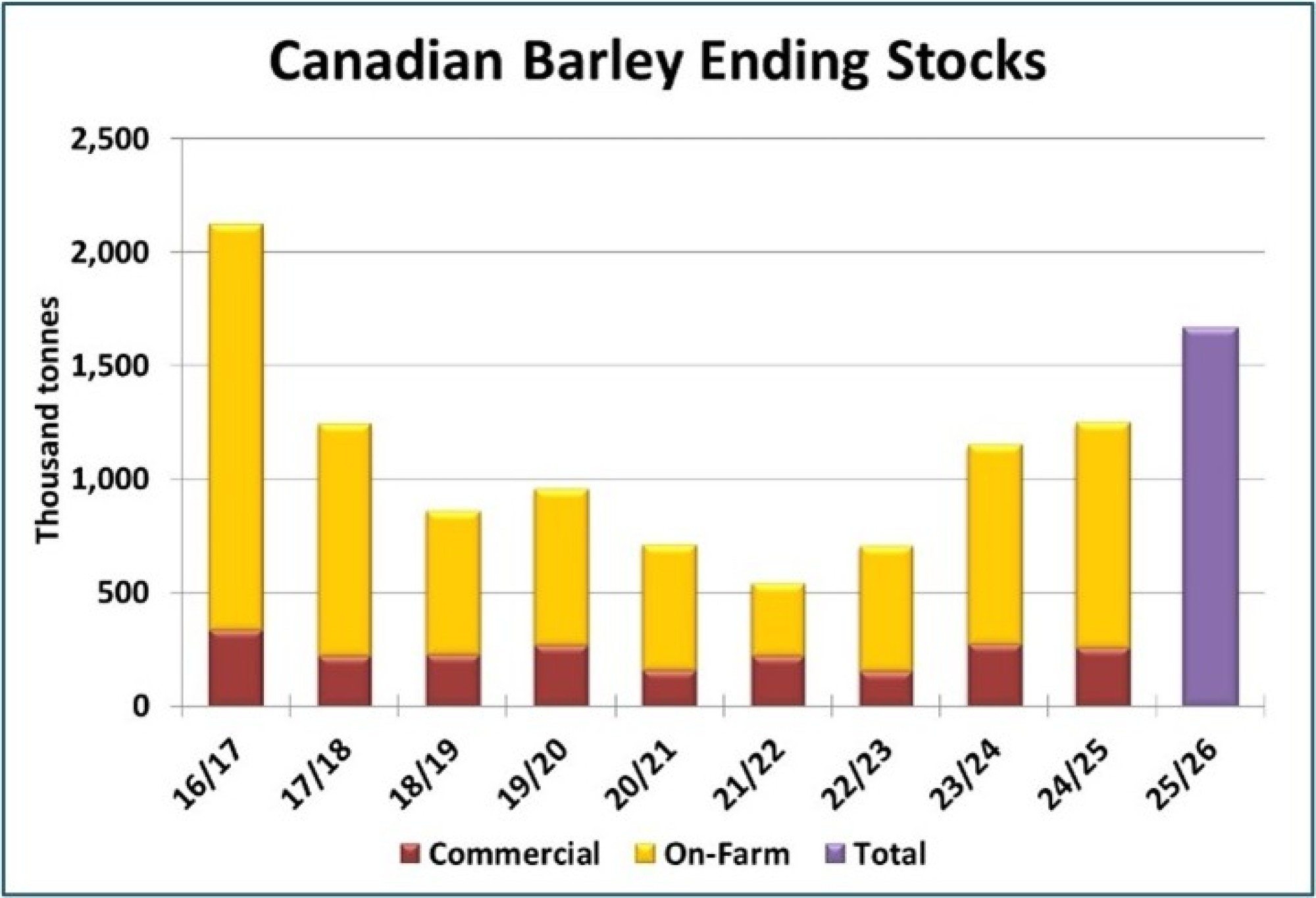

- StatsCan’s July 31st stocks figure came in larger than expected, with the carryout likely building further next season.

- Canadian barley malt exports were the smallest in three years in 2024/25, while domestic use also shows lower demand.

Key Notes:

- StatsCan reported 2024/25 barley ending stocks at 1.25 mln tonnes, the most since 2016/17. Exports ended up at 2.10 mln tonnes, the lowest since 2021/22. StatsCan reported domestic feed use at 5.07 mln tonnes, although that’s a residual calculation, which adjusts for under or overreporting crop production. For 2025/26, ending stocks are forecast to rise further. The 1.43 mln tonnes of stocks are based on StatsCan’s production estimate of 8.23 mln tonnes, which could be revised higher. It also includes an optimistic export forecast of 2.3 mln tonnes, 200,000 tonnes more than 2024/25.

- The IGC’s estimate for 2025/26 global barley production was raised to 148.5 mln tonnes, versus its figure for 2024/25 at 143.6 mln tonnes. A good portion of the increase came from the bigger crop in Australia, with EU barley production also larger than last year by 4.2 mln tonnes. Our estimate of 2025/26 barley production for major exporters is 104.5 mln tonnes, 5.9 mln (6%) larger than a year ago. Exports by the EU could actually decline in 2025/26 due to its shrinking corn crop, which would require more barley to remain in Europe. But that could be offset by more aggressive Australian barley exports, especially into the Chinese market.

- In the benchmark feed region of Lethbridge, feed barley and feed wheat prices are at a substantial $20-25 per tonne discount to corn. As the barley and wheat harvests progress, prices have declined steadily while corn was largely flat. This wider-than-usual spread is discouraging additional imports of US corn and should start to provide a floor for feed barley and feed wheat. In the past week, prices appeared to find some footing, which would fit with the seasonal tendencies.

Bottom Line:

- Price weakness is seasonal with extra pressure from rising crop expectations. The demand side is more critical for the response following the seasonal lows.

- Rising corn prices should encourage more domestic barley feeding and allow prices to move off the harvest lows. That said, there are now larger supplies of other feed-quality cereal grains which will limit the gains.

- A stronger postharvest rally would need increased demand from China, with some short-term opportunities possible before the Australian crop is harvested.

Durum Outlook

Upside:

- The western Canadian durum harvest is lagging the normal pace, with rains causing quality losses.

- Early farmer deliveries are off to a strong start, which could be a positive sign for short-term export demand.

Downside:

- StatsCan raised its 2025 durum crop estimate to 6.54 mln tonnes, slightly less than the previous high in 2020/21.

- The IGC is estimating global durum ending stocks for 2025/26 at 7.5 mln tonnes, up from 6.7 mln last year.

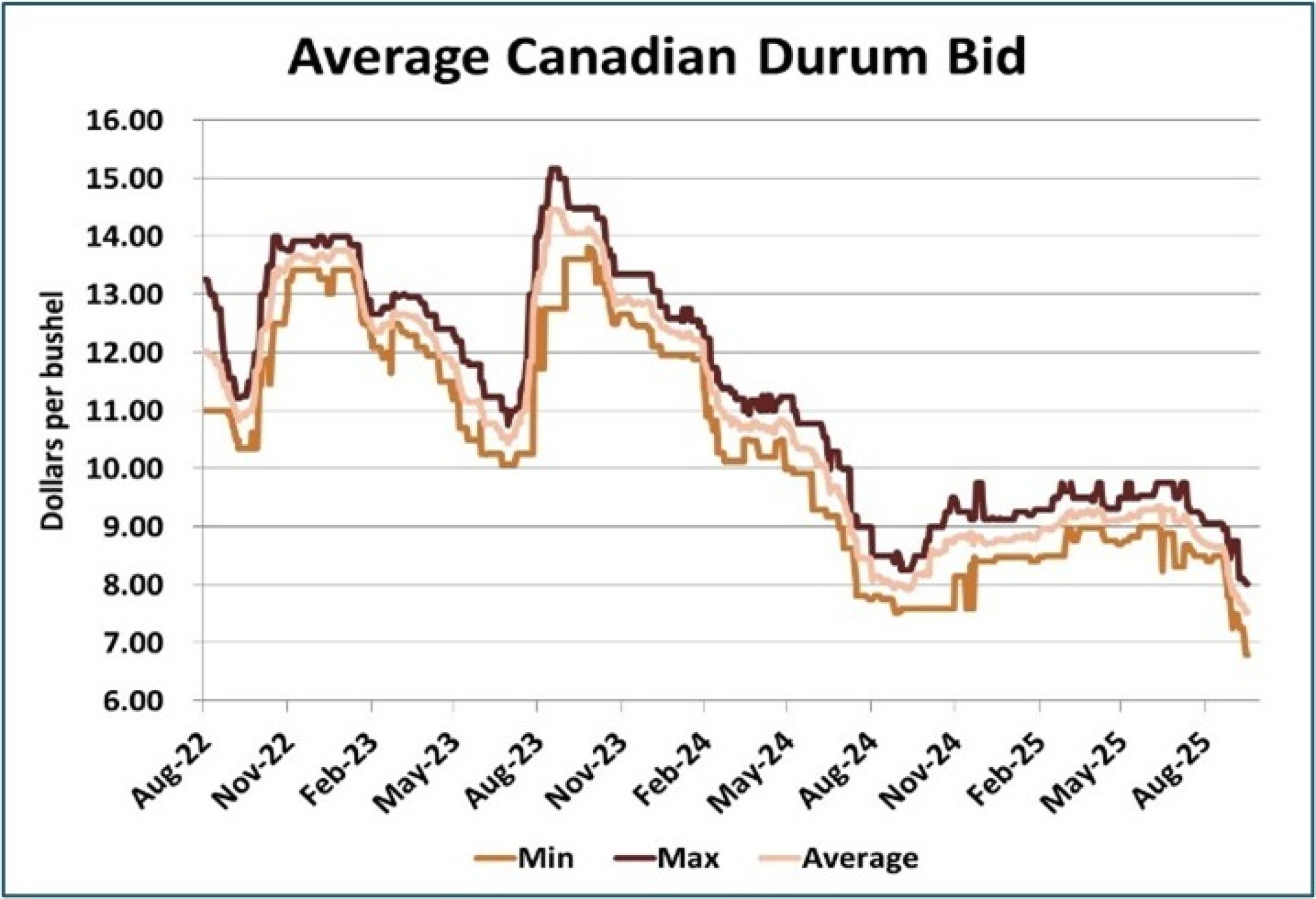

- Elevator bids for durum are continuing to slide and a recovery from the harvest lows will be limited.

- While StatsCan showed very tight July 31st durum stocks, the figure was too low, and the carryout will increase significantly in 2025/26.

Key Notes:

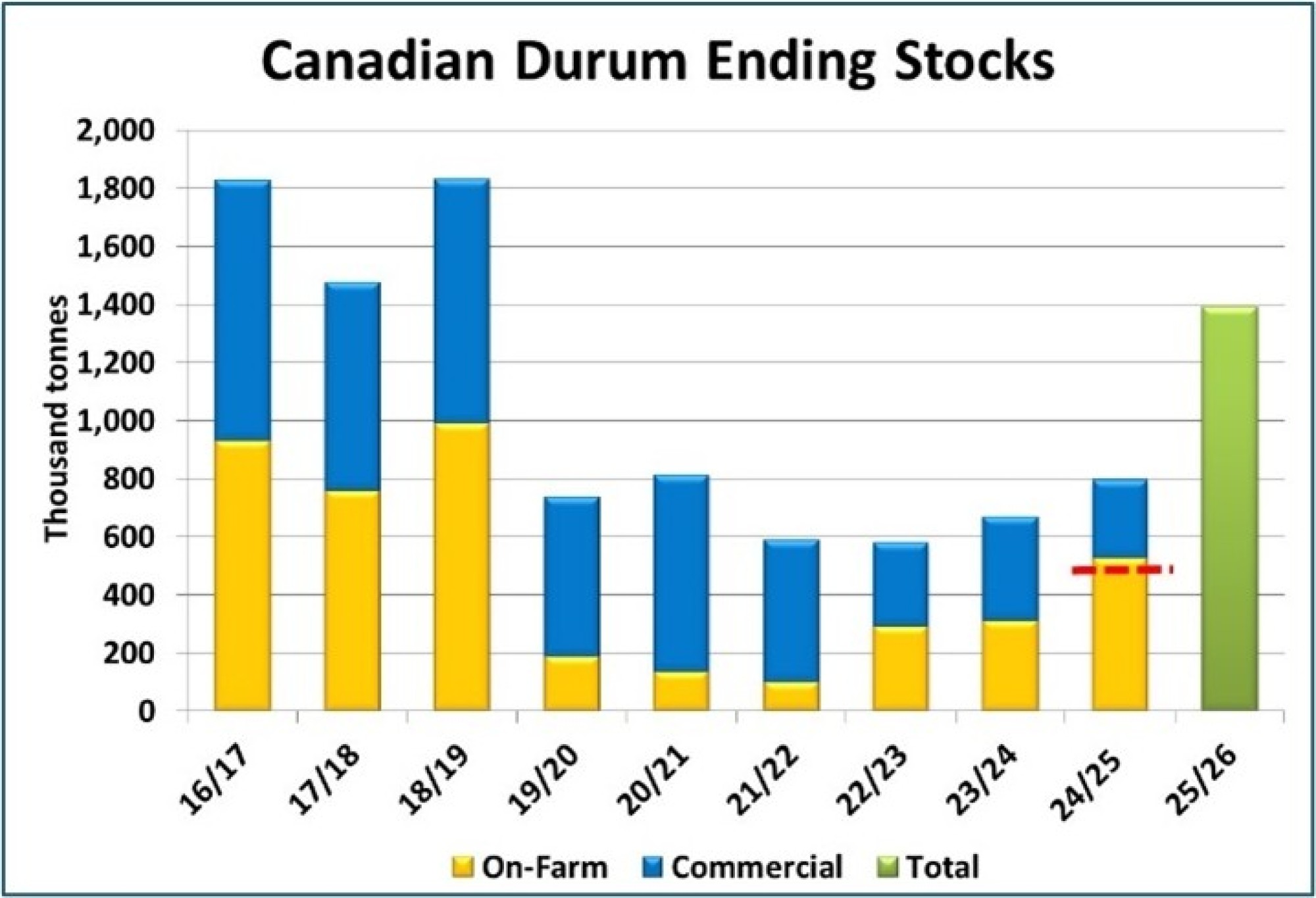

- StatsCan estimated 2024/25 durum ending stocks at 496,000 tonnes, a record low and even smaller than the 2021/22 drought year. This is shown as the red line in the chart below, but that number is clearly too small. Given the record export demand in 2024/25, stocks this low would have restricted the flow of durum and triggered much higher prices. Instead, bids remained mostly flat through the second half of the marketing year. We’ve added 300,000 tonnes to the 2024 durum crop which puts ending stocks closer to 800,000 tonnes. This also raises the supply situation for 2025/26. Even if we adopt StatsCan’s crop estimate of 6.5 mln tonnes (which may be too low), ending stocks will rise beyond 1.3 mln tonnes.

- Elevator bids for durum are continuing to drop in western Canada, even as the harvest moves into its later stages. The average elevator bid has now dipped below last fall’s bottom and there still is some downward momentum. Larger crop expectations are pushing the seasonal bottom later than usual, although we expect the weakness will ease in the next few weeks once farmer selling backs off. Price performance after this fall’s lows are hit could be similar to 2024/25, although the gains could be even more subdued due to quieter export demand.

Bottom Line:

- The 2025 Canadian durum crop is getting larger but is also declining in quality. Some of the lower grades can get blended into export supplies while more tonnes will also slip into the feed channel.

- We’ve nudged up the export estimate slightly but even so, Canadian ending stocks will be larger.

- Without serious production concerns in key importing countries, demand will be down and competitive pricing will be needed to export more tonnes. As a result, we don’t expect meaningful upside after the harvest lows.