May 2025

Wheat Outlook

Upside:

- Canada continues to export at a robust, pace, drawing down supplies.

- There are indications that low prices may be uncovering some demand, including from China.

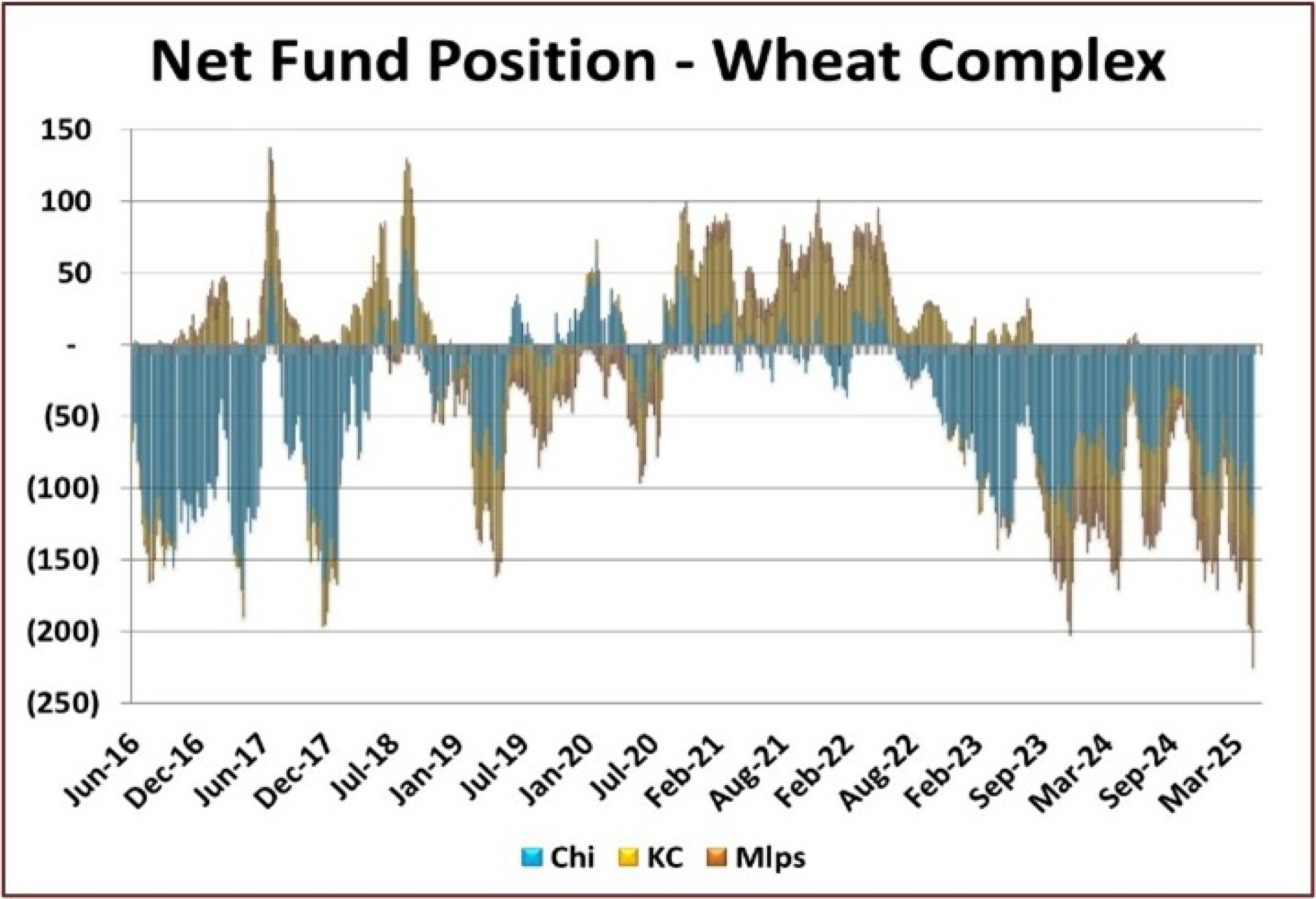

- Funds are heavily short the wheat complex, which means eventual buying when positions get covered.

Downside:

- USDA is projected US winter wheat production to be the largest since 2016. US ending stocks are estimated to be the highest since 2019/20.

- While there are areas of dryness to watch, combined exports from Russia, Ukraine and the EU will likely be higher in 2025/26.

Key Notes:

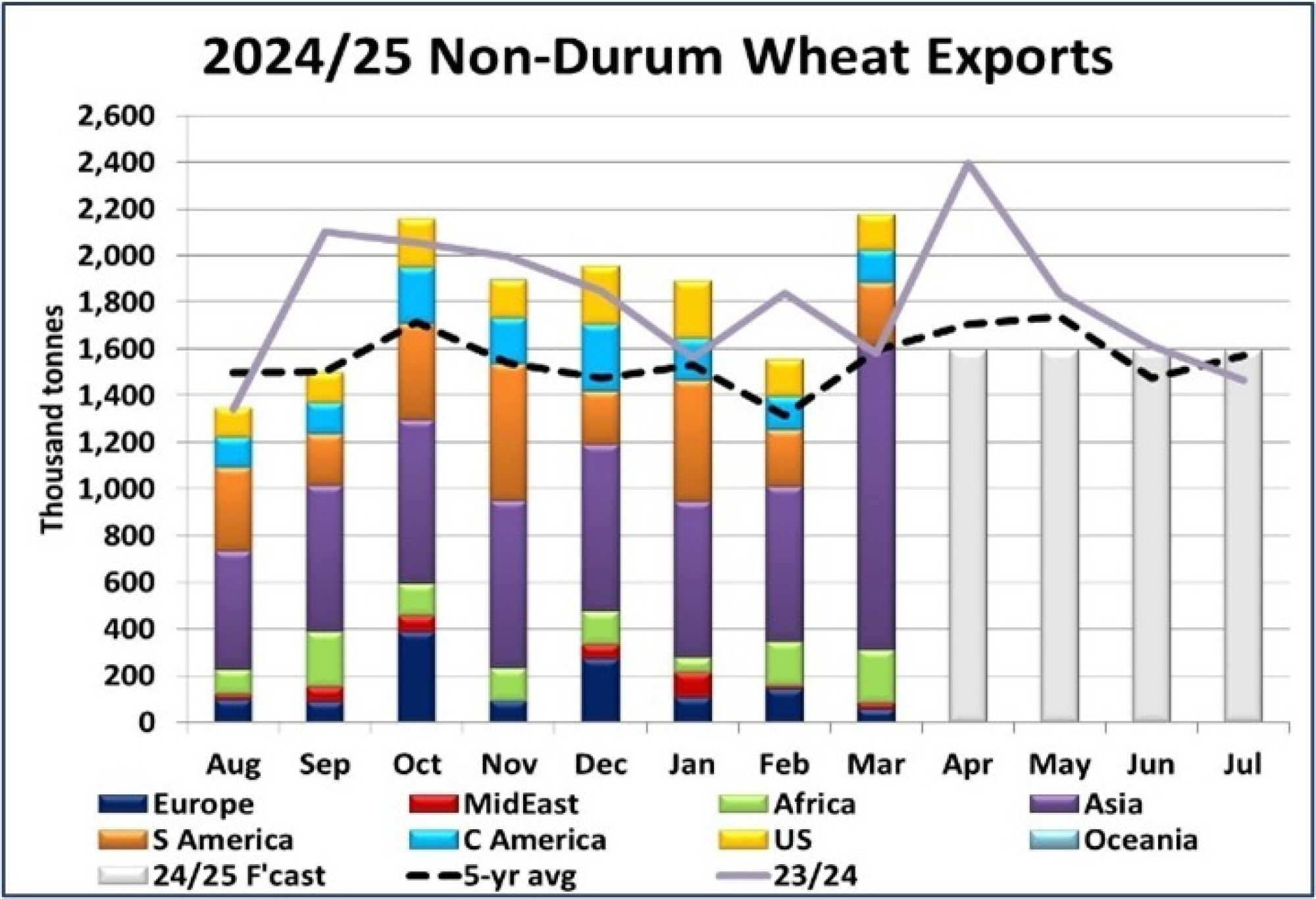

- StatsCan reported March non-durum exports at 2.17 mln tonnes, the highest in nearly a year and close to a record for any month. Total shipments so far are 14.48 mln tonnes, 150,000 tonnes ahead of last year, which ended up a record. Of note is that nearly 400,000 tonnes went to China in March. Australia shipped another 290,000 tonnes, which together points to much improved buying from China compared to previous very slow months.

- USDA’s initial 2025/26 global figures point to a similar setup to this past year. Production across the major exporters is forecast to be higher, but this may be offset by stronger exports, with ending stocks near unchanged and at a fairly tight level. Russian and Ukrainian exports may roughly match last year, while EU shipments could be up by 8 mln tonnes due to larger production.

- Funds continue to hold a huge net short position in the wheat complex, at 225,429 contracts. The setup is such that a bullish trigger could result in aggressive short covering, which may allow for a meaningful rally. At the same time, that kind of move is not inevitable, and history has shown funds can maintain a sizeable short position in wheat for an extended period, making the timing of any potential buying difficult to predict.

Bottom Line:

- Prices may find support at current levels for several reasons (low prices uncovering export demand, US wheat getting cheap relative to other exporters and compared to corn, funds heavily short, much bearish news already priced in).

- Even if values can stabilize, a lack of weather threats means a material rally will be difficult to achieve.

- Old-crop CWRS bids may start to become a little more vulnerable in the weeks ahead.

Barley Outlook

Upside:

- The CGC has shown strong barley exports in recent weeks, with signs of steady movement in Q4 of 2024/25.

- China has continued to be a steady importer from Canada and other suppliers.

- Global feed barley values have been steady-to-higher, and Canada remains competitively priced.

Downside:

- Very dry conditions in parts of Australia may be causing farmers there to shift acreage to barley.

- The USDA is projecting record yields for the 2025 US barley crop, resulting in larger 2025/26 ending stocks.

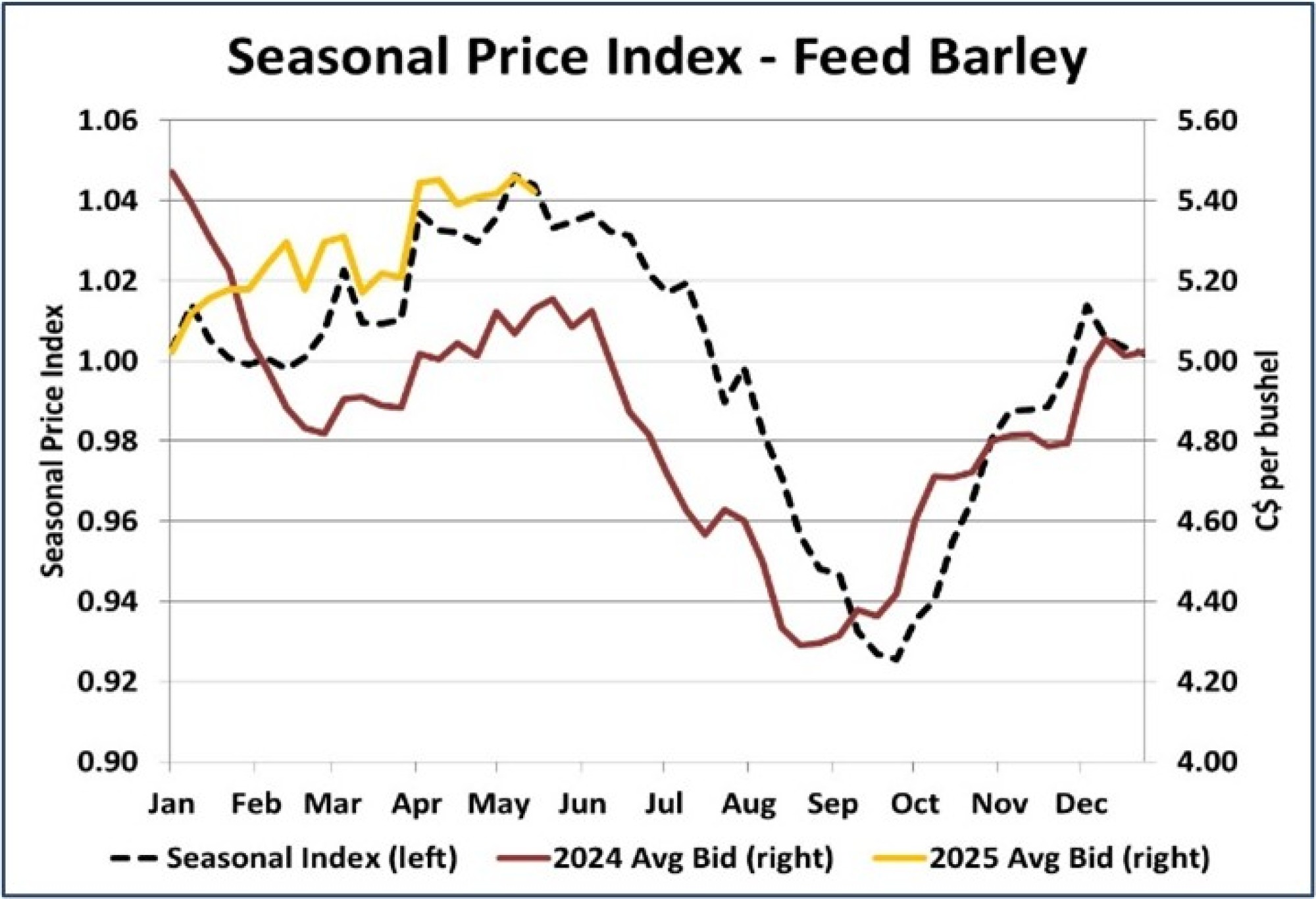

- Canadian feed barley prices are following the seasonal index, which is about to start declining from its peak.

Key Notes:

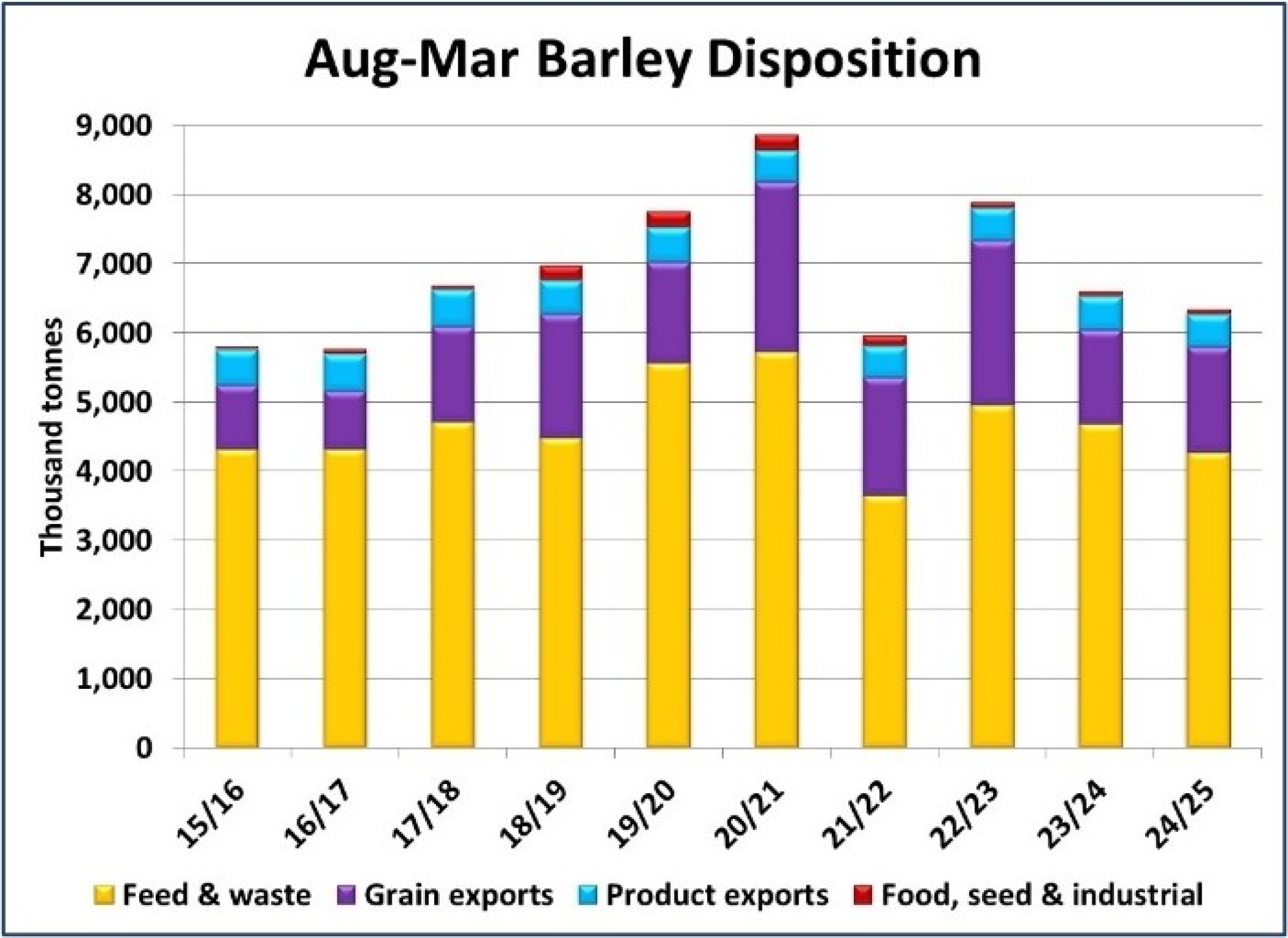

- StatsCan reported March 31st barley stocks at 3.07 mln tonnes, almost identical to last year. Because feed/waste is the largest category in Canada’s barley S&D but StatsCan doesn’t actually measure that usage (it’s calculated residually), there’s more “wiggle room” for under or over reporting of barley supplies. For example, StatsCan showed Aug-Mar barley feed use at 4.27 mln tonnes, 400,000 tonnes less than last year and feed use of wheat is reported lower by 600,000 tonnes. At the same time, western Canadian corn imports for Aug-Mar were 1.12 mln tonnes less than last year. In total, that would mean over 2.0 mln tonnes less grain was used for livestock feed in western Canada, which makes these StatsCan usage estimates less credible.

- Dry conditions across parts of Australia are expected to cause acreage shifts out of crops like canola and into barley. Earlier, it appeared 2025/26 barley area would be roughly unchanged from ABARES’ 2024/25 area of 4.62 mln hectares, but seeded area could rise to 4.9 mln hectares or higher.

- While there has been solid export demand for Canadian barley in recent weeks, elevator bids are still following the seasonal pattern closely. The index for feed barley bids peaks right about now and without some unusual market conditions, there’s little reason for barley prices to ignore the seasonal tendencies. Canadian barley supplies are relatively well-balanced and early conditions for the 2025 crop are mostly favorable. In addition, barley crops in the EU and Ukraine will be harvested in a few weeks and hit the export market.

Bottom Line:

- Solid export movement in recent weeks has been keeping barley prices supported but demand isn’t large enough to push the market even higher.

- Fresh barley supplies from other exporters will hit the market soon, and rain across western Canada is providing positive early conditions.

- As a result, there’s nothing to indicate barley prices will avoid the lower seasonal tendency. The recovery from the seasonal lows in fall could be modest if global and Canadian production are up, with corn prices also under pressure.

- New-crop malt barley interest is also quiet and malt premiums are unlikely to firm up noticeably.

Durum Outlook

Upside:

- Canadian durum exports have been strong in recent weeks.

Downside:

- Durum exports by the US have been very slow in 2024/25, causing a buildup in supplies.

- European durum imports have continued at a steady pace but will be far short of earlier expectations.

- Durum prices in key markets have been flat in 2024/25 and are now slipping toward the bottom of the range.

Key Notes:

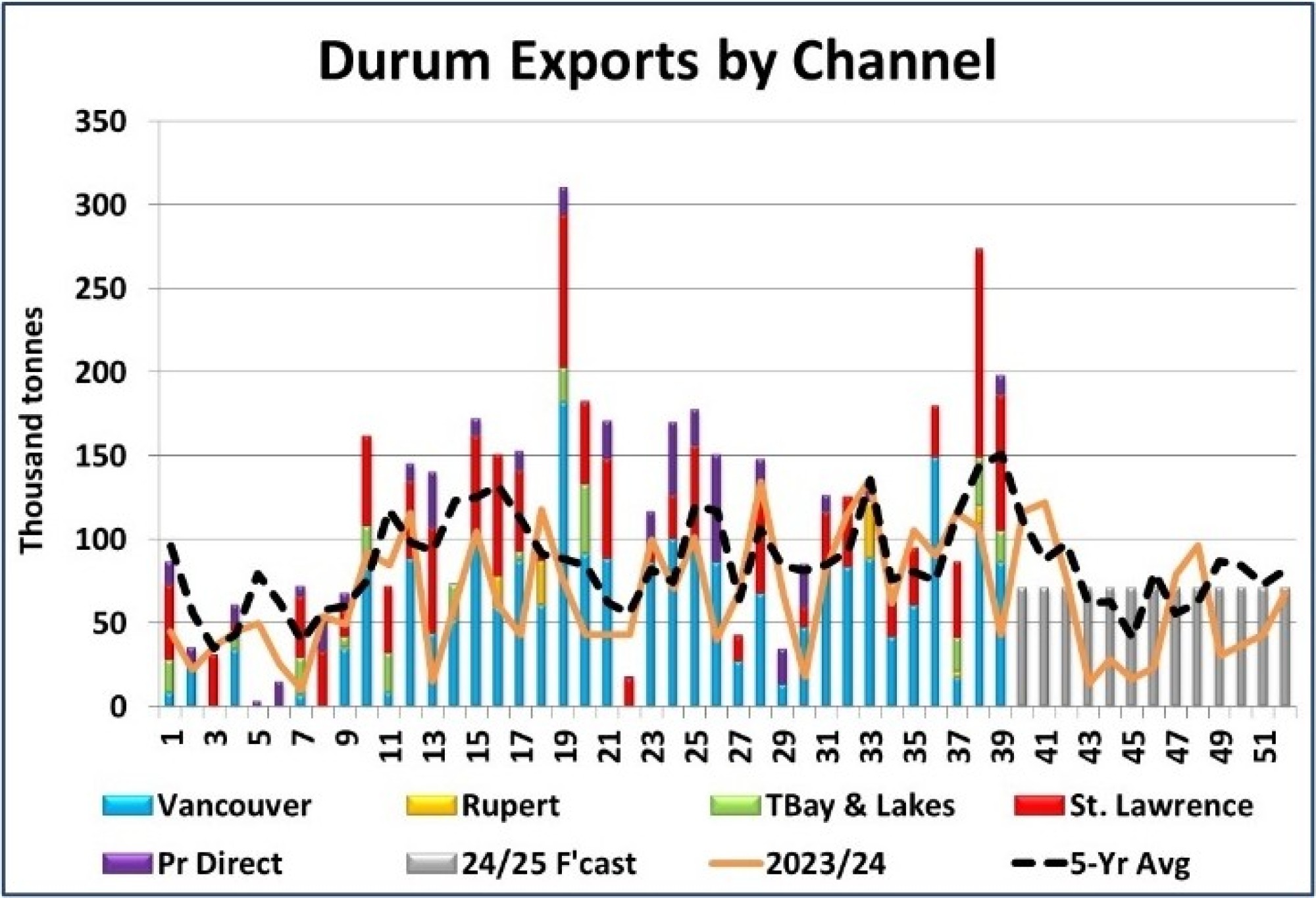

- The CGC showed very strong exports in weeks 38 and 39, pushing the year-to-date total to 4.48 mln tonnes, far ahead of last year at 2.71 mln and the 5-year average of 3.51 mln tonnes. Export volumes will likely slow in the coming weeks, as farmer deliveries decline later in the season and country elevator stocks drop as they normally do at this time of the year. That said, lower stocks also mean there’s less of a supply cushion for late-season shipments, which could trigger a short-term bump in bids, not unusual at this time of year.

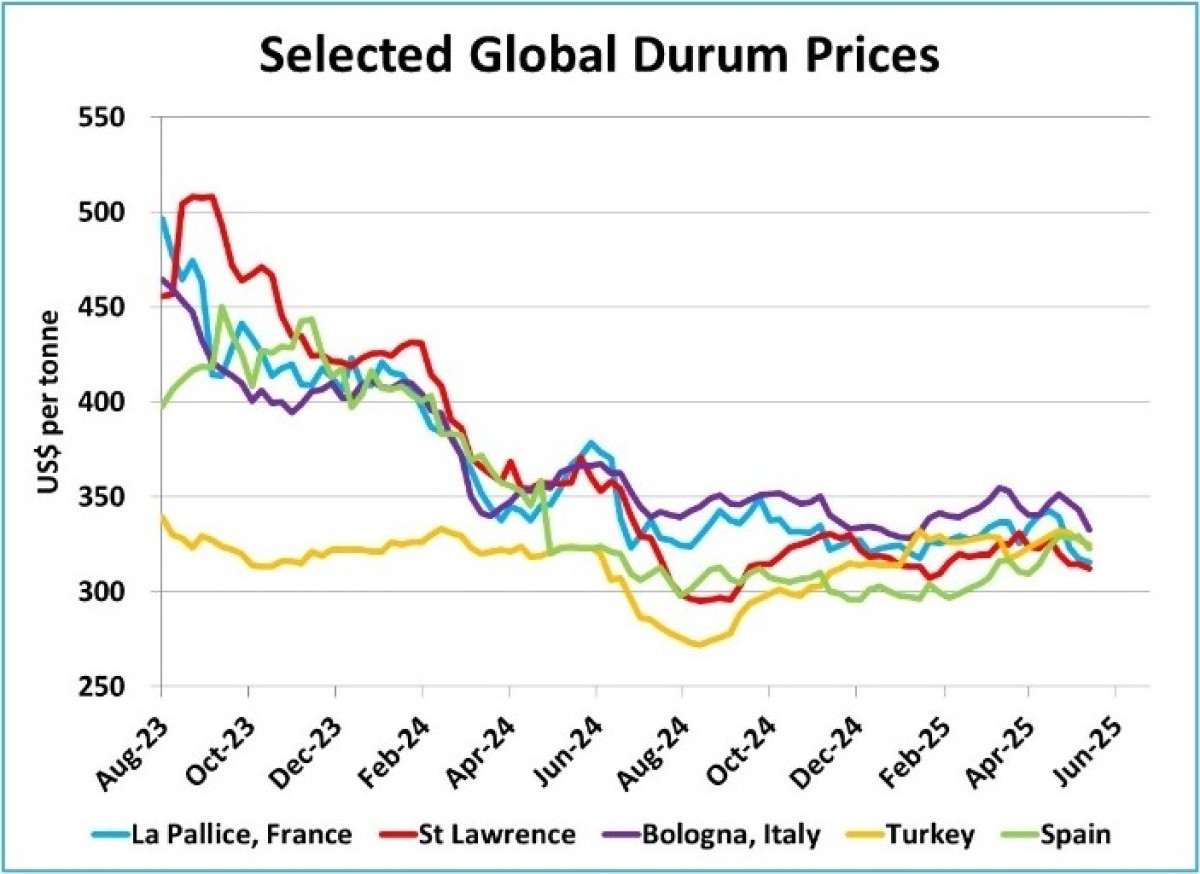

- Durum prices in key markets have spent most of 2024/25 in a narrow sideways range. While that direction is still holding, prices in all locations have been shifting toward the lower end of the range in the last 2-3 weeks. With the North African harvest now beginning, the European harvest expected to start in a few weeks and the North American crop getting planted under mostly favorable conditions, it’s difficult to see what would cause the market to turn higher at this point.

Bottom Line:

- Durum production is expected to rise in Europe and North Africa, with the early harvest already underway. This could mean lower demand for Canadian durum, although Turkish output is still in question.

- Canadian durum exports have been strong, which is drawing down supplies. At the same time, farmer selling has been quite steady without forcing more aggressive bids, signaling that on-farm stocks aren’t running low yet. Supplies will be drawn down by the end of the marketing year but by then, export demand will have started to slow down. As such, prices are expected to be steady to lower, in line with seasonal tendencies.

- Keep in mind, the seasonal bottom for durum tends to already show up in early July. The strength of the fall recovery will be determined by yield outcomes in Canada.