November 2025

Wheat Outlook

Upside:

- Even with record farmer deliveries, commercial inventories are drawn down by heavy export movement.

- Calculated FOB wheat prices at the west coast are moving higher, with country bids narrowing the gap.

- MGE futures are showing signs of carving out a bottom.

- US exports are off to a good start, with USDA projecting 2025/26 shipments to be the highest in 5 years.

- China has reportedly been showing buying interest.

Downside:

- USDA increased US wheat stocks in their last update, as well as production for most of the major exporters.

- The Canadian crop is record-large, with our estimate 1.5 mln tonnes higher than StatsCan.

- The seasonal trend for CWRS bids tends to level off late in the calendar year.

Key Notes:

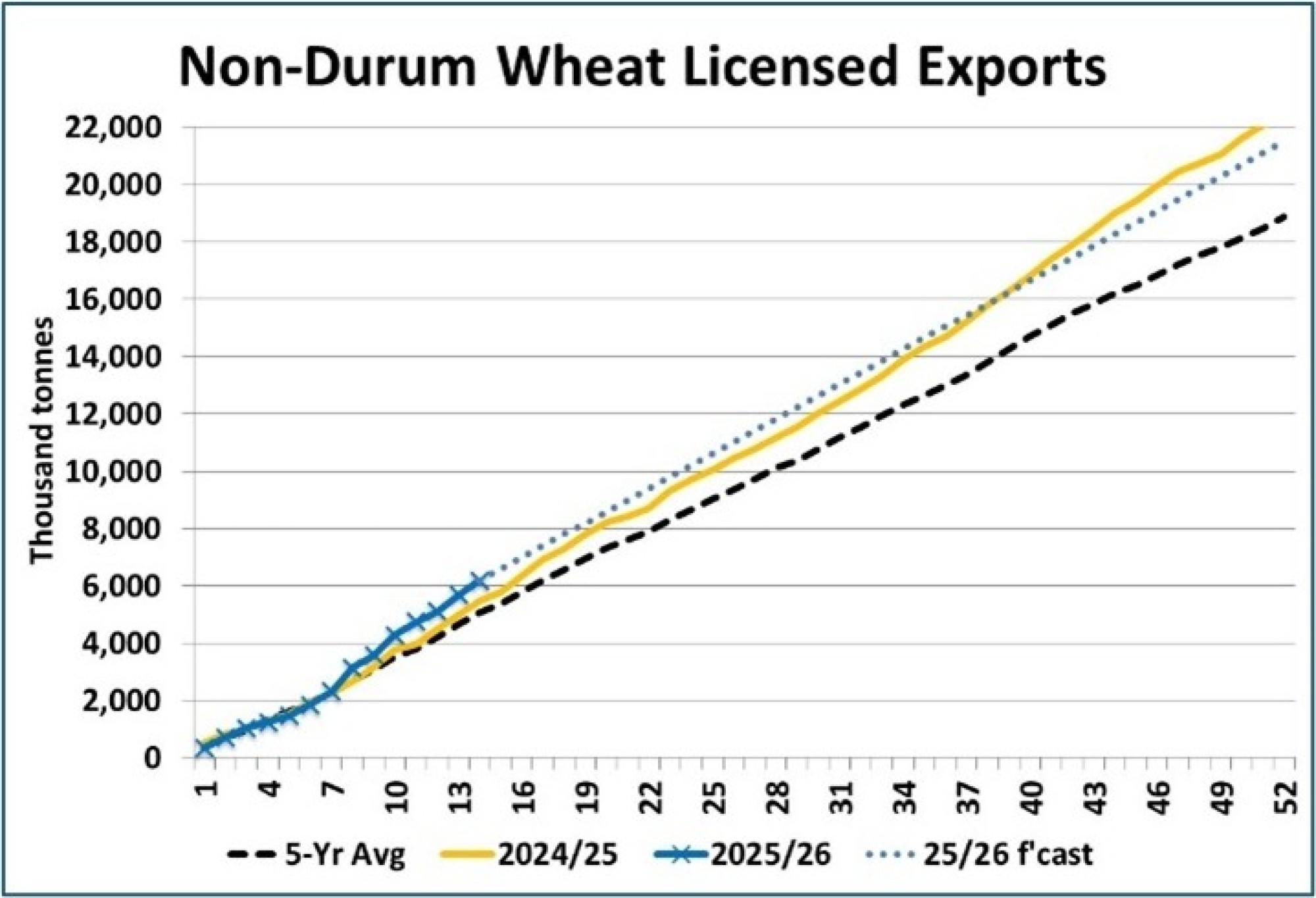

- CGC shows total non-durum exports as of week 14 are a record 6.18 mln tonnes. Terminal stocks sit at around 1.15 mln tonnes and farmer deliveries remain strong, pointing to additional solid exports in the weeks ahead. Our current non-durum export forecast for 2025/26 is 22.4 mln tonnes. The robust early movement means an upward revision to the outlook may be needed, although Canada will also face more competition into key Asian markets as the large Australian crop comes off.

- USDA increased the US wheat carryout in their latest update to 901 mln bushels, the highest since 2019/20, as it incorporated data from the September 30th Small Grains Summary. This included higher stocks for each class of non-durum wheat. Production was also increased for nearly all major exporting countries, affirming comfortable wheat supplies globally.

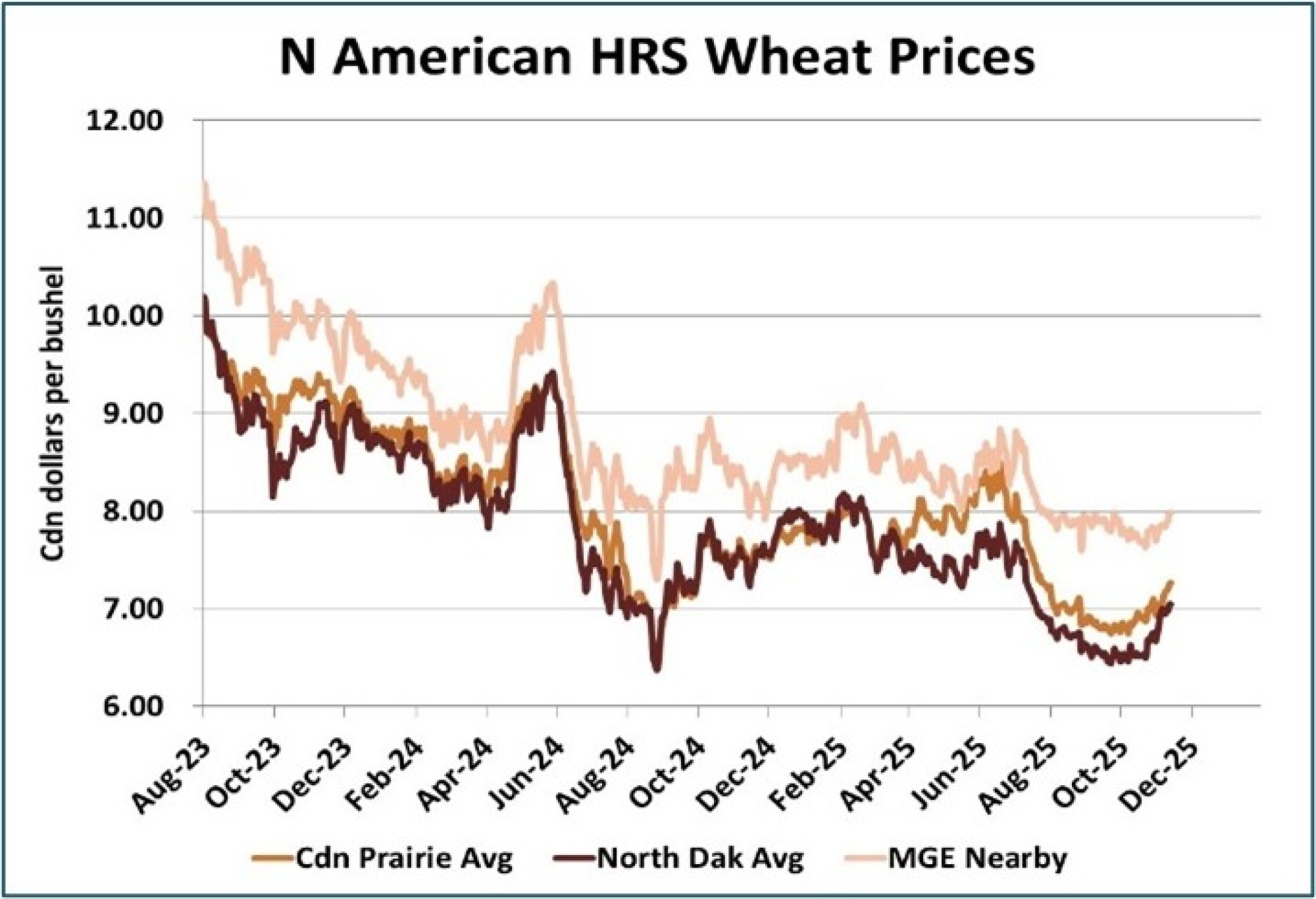

- Hard red spring prices continue to move higher in western Canada, North Dakota and the futures market, helped by strong early season exports. Global wheat supplies are too large to allow for significant upside, but the trend for hard red spring wheat remains steady-to-modestly firmer on the back of good demand.

Bottom Line:

- The USDA numbers weren’t friendly, but also not surprising, which kept the price pullback brief.

- Record movement of Canadian wheat is supporting basis levels and local bids.

- A sideways-to-modestly firmer outlook is justified given the strong exports and shifting overall price trend, but supplies are too large in North America and globally to allow for any aggressive upside.

Barley Outlook

Upside:

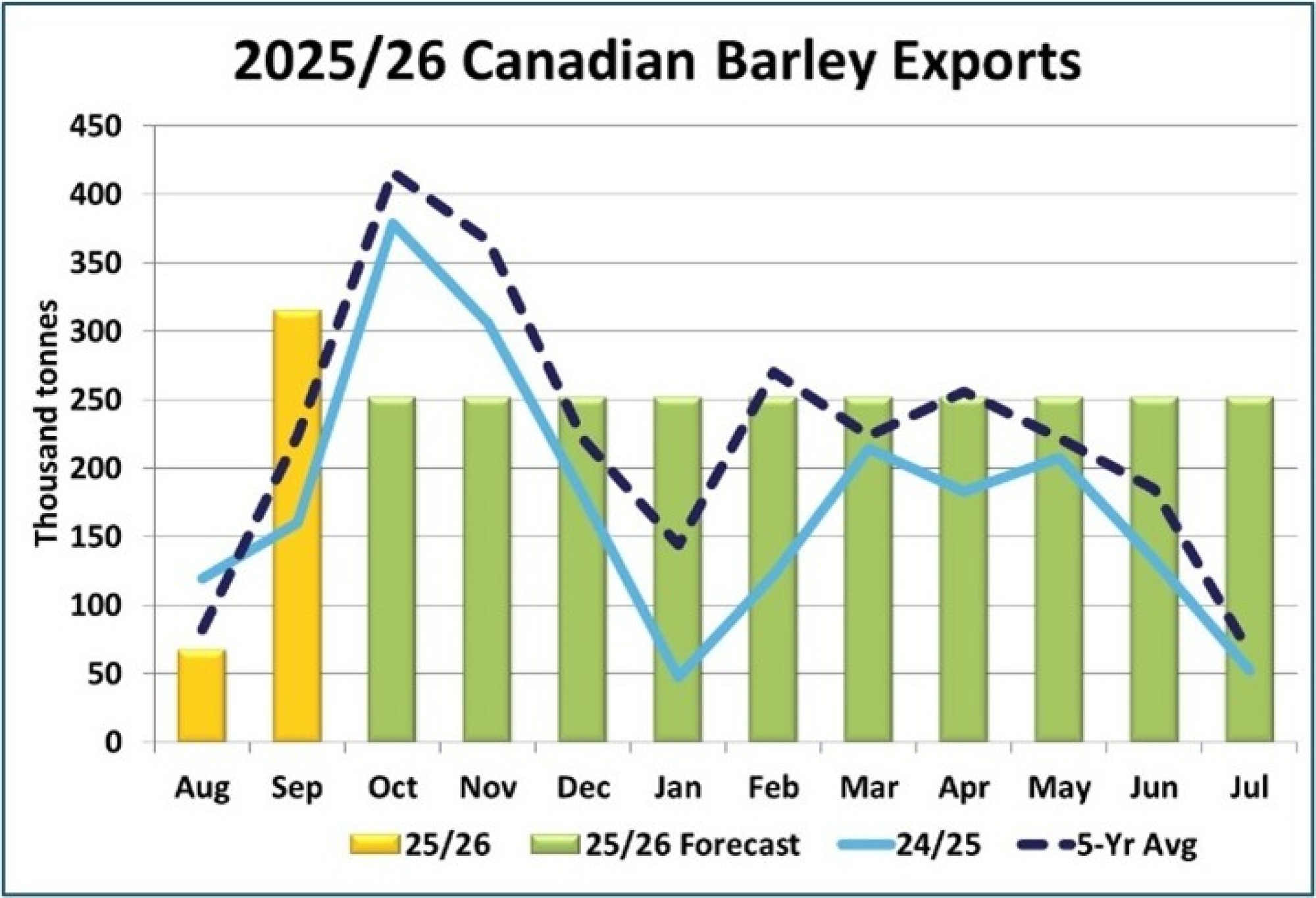

- September barley exports reported by the CGC were a solid 315,000 tonnes, including a vessel to Saudi Arabia.

- Elevator bids for feed barley are showing modest gains, in line with the seasonal tendency.

- Feed barley and feed wheat are still at a sizable discount to corn in southern Alberta, limiting interest in corn.

Downside:

- CGC's weekly data shows barley movement is slowing down after a record start for 2025/26.

- Australian barley exports declined to 310,000 tonnes in September, but a record is possible for 2025/26.

- Chinese barley inventories are rising as large import volumes are arriving from Canada and elsewhere.

Key Notes:

- CGC monthly data shows strong September barley exports of 315,400 tonnes. That’s nearly double from a year ago and well above the 5-year average for the month of 224,000 tonnes. Of note was the 71,800 tonnes destined for Saudi Arabia, the first barley shipped to that country since 2016/17. This is a welcome development as it signals a broader demand for Canadian barley. Our full-year export forecast is an aggressive 2.9 mln tonnes, which would require an average of 252,000 tonnes per month. The CGC weekly data indicates October barley exports at close to 650,000 tonnes.

- Inventories of barley at Chinese ports rose sharply in September, supported by 1.2 mln tonnes of imports that month, which included shipments from Canada. Inventories are up a bit more in late October, at 1.18 mln tonnes, the highest since February, indicating big imports that month as well. We expect China’s inventory may rise further as Australian barley starts showing up in China, which could dampen its demand from Canada.

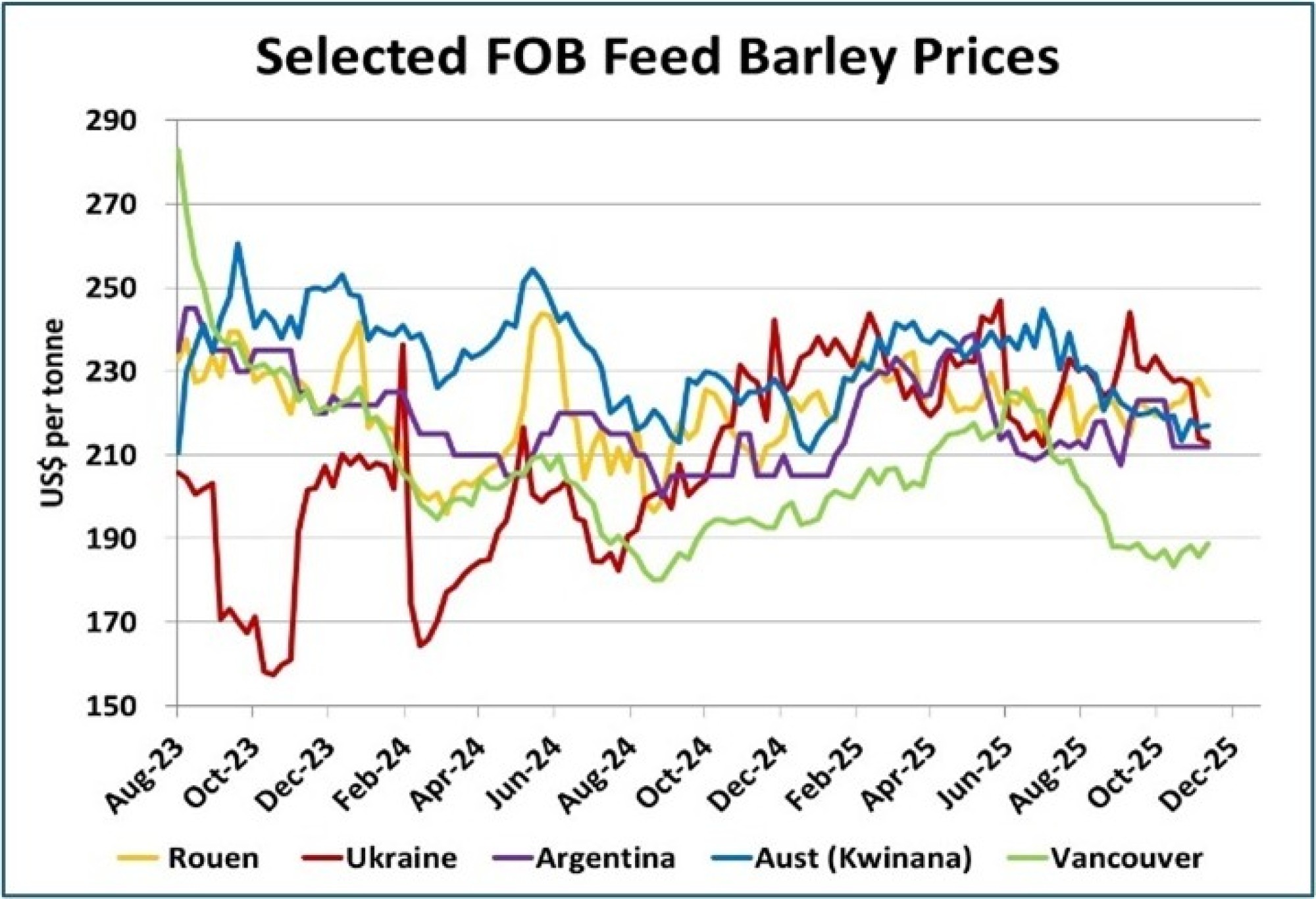

- Clearly, low barley prices in western Canada and at west coast terminals are doing their job of encouraging exports, with a record pace so far in 2025/26. One key question is whether Chinese buyers will shift to Australia once its 2025/26 harvest is available. Australian barley prices have been declining but remain at a sizable premium to Canada, which should still position Canadian barley favorably.

Bottom Line:

- Despite the larger barley supplies in Canada (and export competitors like Australia), Canadian bids have been able to firm up a bit. In part, that’s because Canadian barley is still a bargain compared to other origins.

- The sale to the Saudis is positive as it adds another source of demand besides China and Japan and could help Canada hit a larger export target for 2025/26. As such, it raises the likelihood that barley prices will continue to follow the seasonal tendency higher.

- The record export pace hasn’t given local bids a real boost but has kept this year’s harvest low from dropping further. Prices are starting to edge higher seasonally but larger production from the key global players will keep China well supplied and limit upside potential.

- It appears Canadian maltsters have most of their needs covered, which will keep that portion of the market on the quiet side.

Durum Outlook

Upside:

- CGC reported 255,000 tonnes of durum exports in September, above the average and last year’s total.

- Shipments of durum from country elevators so far in 2025/26 are running ahead of last year.

- Country durum bids are edging higher while the east coast is firmer and Vancouver is flat.

Downside:

- The recent durum tender from Tunisia came in a bit below Algeria's October tender, signaling a flat market.

- Total usage of Canadian durum is forecast to be lower in 2025/26, with reduced exports but higher feed use.

- Canadian durum exports to the US this year are at the slowest pace since 2021/22.

Key Notes:

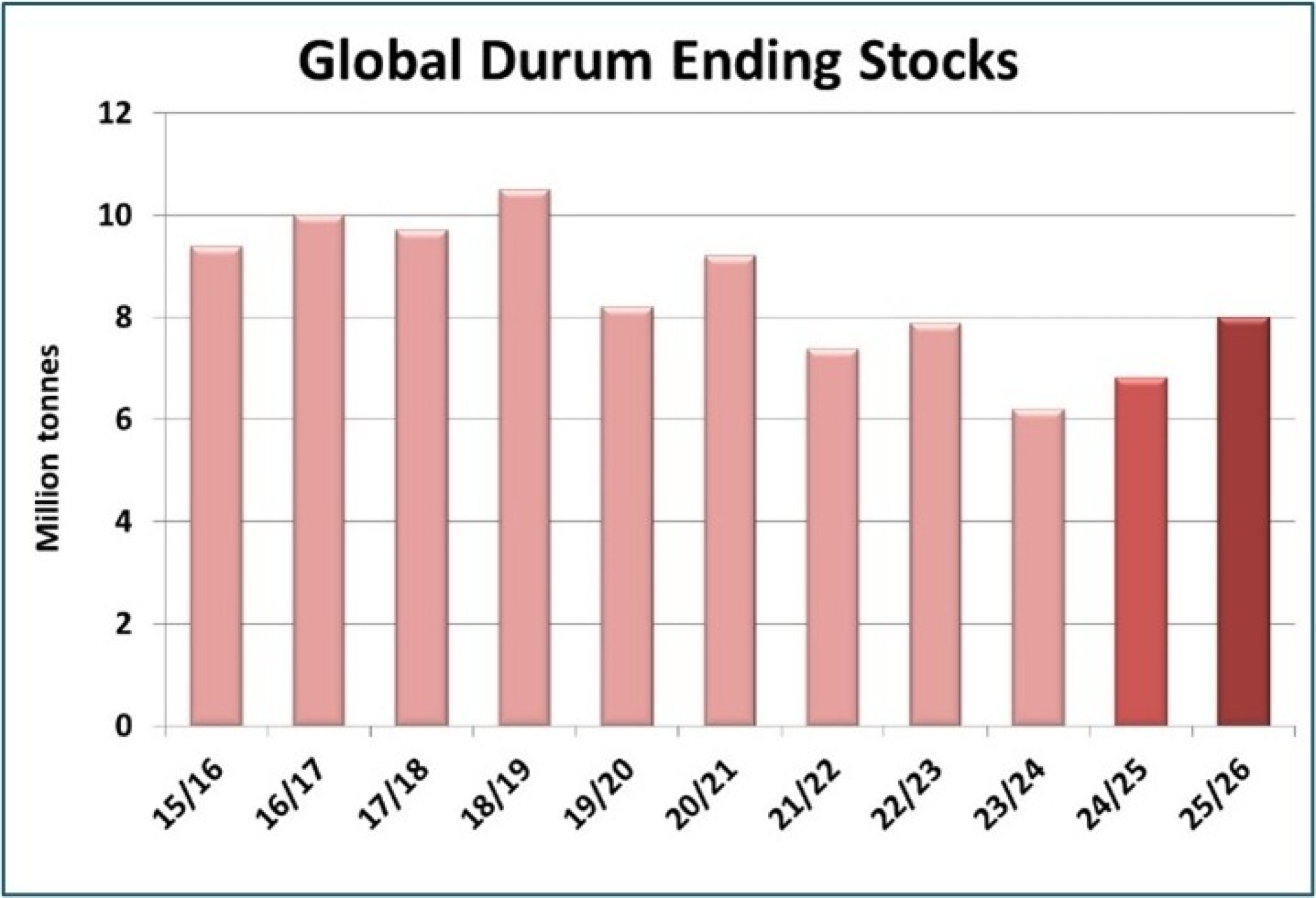

- The latest IGC report increased global durum ending stocks for 2025/26 to 8.0 mln tonnes. That’s up from its previous estimate of 7.50 mln and last year at 6.84 mln tonnes. The IGC is still using the Canadian production estimate from StatsCan at 6.54 mln tonnes, while the crop is likely over 7.0 mln tonnes, which would add even more to the stocks total. Even with its Canadian crop estimate, the IGC’s supply numbers mean the durum market will struggle to post meaningful gains this year.

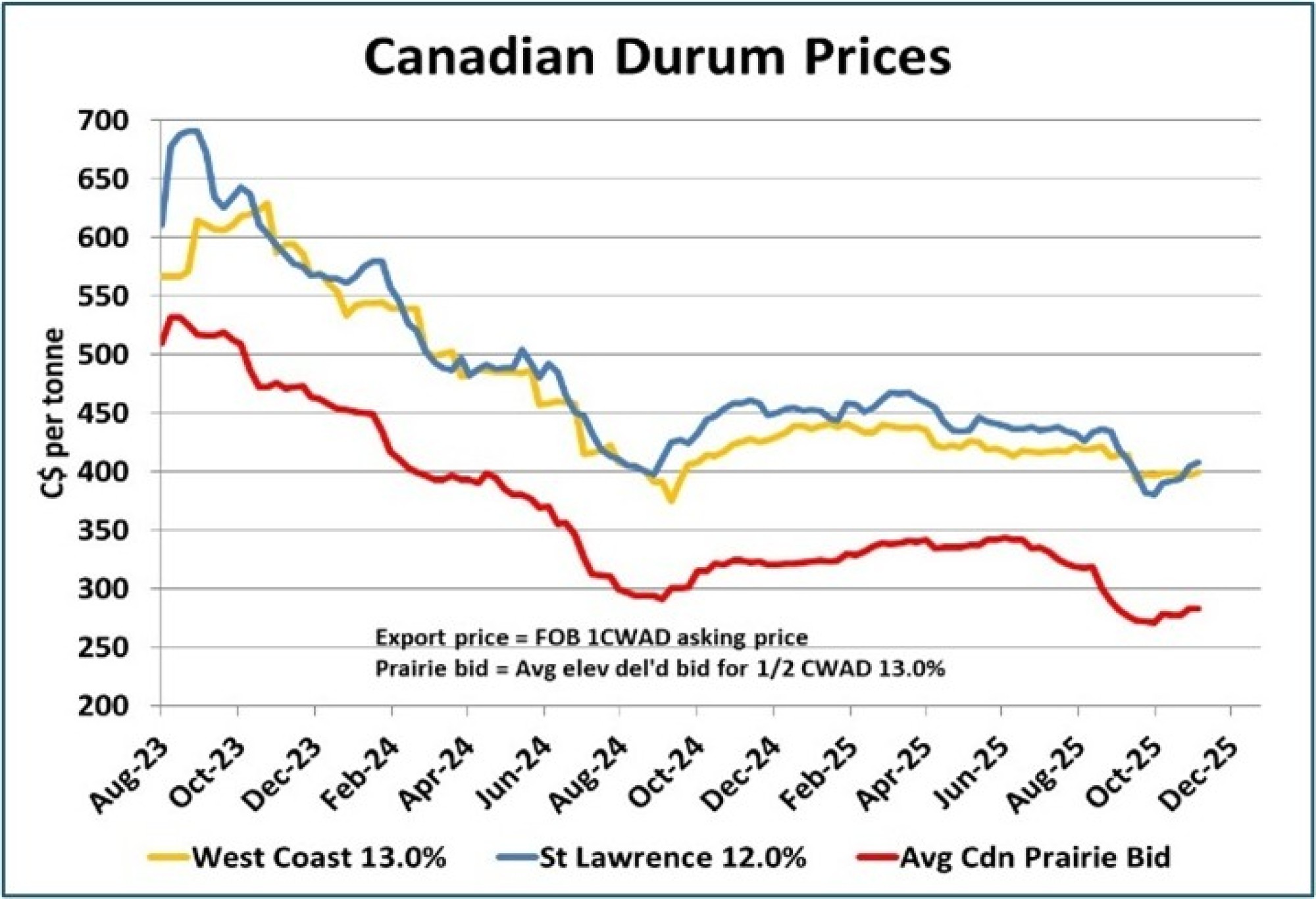

- The average durum bid in western Canada has edged slightly higher from the harvest lows. There seems to have been a stronger recovery in St. Lawrence offer prices while west coast offers are essentially flat. In all locations, durum prices are still at the bottom end of the range from most of 2024/25. Seasonal highs for durum bids tend to show up in mid-November with spring rallies quite infrequent.

Bottom Line:

- Global durum stocks are more comfortable in 2025/26, which has resulted in a limited response in bids despite solid Canadian export movement so far. Even with some quality concerns, there’s plenty of 1-3 CWAD to meet export demand.

- The recent Tunisian import tender demonstrates the soft price environment isn’t just a Canadian situation. Buyers are expected to remain “unmotivated” into 2026 while downside risk will be limited by farmers’ unwillingness to sell at lower prices, resulting in a largely flat price outlook.